The advent of cryptocurrencies has brought an unusual opportunity to the world. It has brought equality to the financial market. A person living in Mumbai has the same access to the market as someone in New York.

The only needful common factor is the internet. This ease and access has enabled people who might not fit through the qualification required in traditional systems to find a place of expression.

This opportunity has brought its drawbacks also. Lots of cryptocurrency projects have started with high hopes and have fallen significantly short of the goal. There have also been lots of scams, hacking, and theft. Decentralized Autonomous Organizations have faced severe tests, many of which resulted in hard forks.

And today, many people are confused more than ever about how to join the crypto revolution.

Cryptocurrency Investing Strategies

There are many strategies to approach the crypto market.

The worst strategy is having no strategy. The second-worst strategy is to keep changing strategy based on sentiment and feeling. Anybody can suddenly get lucky in the crypto market and make significant gains, but it takes someone with a well-thought out strategy to be able to replicate that success.

Many have been fooled by a false sense of expertise because they made some profit in their first set of trades. Encouraged by this, they went in with more funds and began to lose. In panic and fear, they sold at a loss with regret.

Investing in cryptocurrency can be a good thing, but doing it without a strategy can cause heartache when unfriendly trends show up.

The cryptocurrency market is known for its volatility. While volatility creates the opportunity to make fast money, it carries the possibility of losing funds with the same speed.

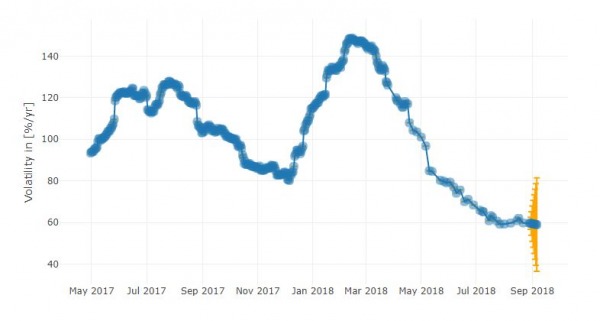

A cryptocurrency volatility index by Sifr Data (consisting of BTC, ETH, LTC, XRP, DASH, and XMR) from May 2017 to August 2018 is shown below:

Crypto day trading is definitely not for everybody, but everybody can build a strong and well-diversified crypto portfolio.

There are a number of profitable strategies to choose from when dealing in the crypto market. The real task is not picking the right strategy; rather, it is sticking to the strategy when it seems it is not working.

3 Key Elements For a Well-Diversified Crypto Portfolio

There are 3 elements of consideration in building a well-diversified crypto portfolio: timing, distribution, and coin choice.

Timing gives the understanding of what to do when the market is up, down, and flat. The simple wisdom is to buy when the market is down, and sell when high. Good timing is not about predicting the market. Rather, it is about accepting where the market currently is (and making decisions based on that).

Distribution gives the understanding of the percentage of the total funds to invest in each coin, while coin choice gives the understanding of what to buy.

The rest of this article will focus on coin choice — however, the success of this template is significantly dependent on good timing and distribution.

According to the legendary trader Paul Tudor Jones, investors shouldn’t be focused on making money, rather they should be focused on protecting what they have and not losing it. In this interview, he expressed this philosophy clearly.

With respect to this, a well-diversified crypto portfolio is one that is structured with the focus of not losing money.

This template for a well-diversified cryptocurrency portfolio is made up of 5 types of coins (as well as our pick for each category). These coins offer 5 different functions in token performance that can keep you hedged against different levels of market performance.

5 Coins to Hold to Build A Well-Diversified Cryptocurrency Portfolio

1. The Market Leader – Bitcoin

Bitcoin is the market leader of the cryptocurrency world. It is not just the first cryptocurrency, but it is the largest in market cap by a significant margin. It has a total supply of 21 million with over 17 million already in circulation.

Bitcoin is included in this portfolio template because it is the leader of the crypto market. Any crypto bull run that does not involve Bitcoin often ends up as a false run.

The percentage of Bitcoin in a portfolio following this template should be substantial (perhaps 30-60%). This is because mainstream adoption will most certainly happen first to Bitcoin before any other coin.

2. The Stable Coin – USD Tether

Tether is a cryptocurrency pegged to the US Dollar. 1 USDT is always equal to US$1.

This is because the Tether company says every coin is backed up with the actual value of USD. More USDT can be added into the circulation by increasing the amount of actual USD in the company’s account.

Tether is included in this portfolio template because it will give you an edge over crypto bear markets. It is important that a significant portion of the portfolio is in Tether so that when the market drops, other crypto coins can be bought cheaply. Tether bags should be filled in a bull run and be gradually emptied as the market dips.

The percentage of Tether in a well-diversified portfolio depends on the market state; up and growing in a bull market (can be up to 60%) and steadily reducing in a bear market (can go as low as 15%). However, it should never be emptied out.

Some other examples of stable coins include TrueUSD, Dai, and the Gemini dollar.

3. The Passive Income Token – NEO

NEO is a popular project in the crypto market mainly because of its 2-coin system. It is a platform just like Ethereum, but the gas fees for transactions are paid in another cryptocurrency known as GAS. The NEO coin represents a stake in the NEO network.

NEO is included in this template because it pays GAS to its hodlers. A coin that pays passive income is very important in a long-term portfolio. This unique feature of getting paid for holding on to the coin is desirable to make the portfolio well-diversified.

If nothing else, the GAS payment will make up for the trading fees. And it is a good way to make gains in a flat market.

The percentage size of the passive income token depends on the size of the portfolio. For large portfolios (>500 BTC), 5% can be a suitable a amount, depending on the state of the market. In other cases, the proportion can be as high as 25%.

4. The Trading Hedge – BNB

BNB is the ERC-20 exchange token of the Binance crypto exchange.

Anyone trading on the Binance platform is given a 25% discount (through its second year) on fees when paying with the Binance token. Also, holding 500BNB or more increases the referral bonus to 40% from 20%. More can be learned about Binance and BNB in this overview of Binance’s first year of operation.

An exchange coin is included in this portfolio template because it has an indifferent relationship with other cryptocurrencies. As long as people continue to trade on the associated exchange, the trading will dictate the state of the coin above all else.

Generally, exchange coins are less likely to be affected by general crypto sentiment. In an analysis of the cryptocurrency market in Q2 2018, exchange coins suffered considerably less than all other cryptocurrencies (except stable coins). This unique quality makes an exchange coin a must-have in a well-diversified portfolio.

BNB is the token of (arguably) the largest crypto exchange by trade volume, making it a wise choice in this category. The size of this type of coin in the portfolio should hover around 10-20%.

5. The Future Speculation – ICON

ICON is one of the blockchain projects focusing on the interoperability of blockchains. In a future world where there are numerous blockchains, there would be a need for each of them to communicate with one another. This problem is what the Icon project anticipates and creates a solution for.

This category of the portfolio template is based on speculation, and ICON was chosen based on its future potential — it is perhaps a coin that could give hodlers a 100x return. An insight into the potential of ICON is discussed in this article.

However, any coin could be substituted in this category, based on your individual belief and assessment of what a coin’s potential growth could be in the future.

Keep in mind, this category should have the least percentage in the portfolio (4-10%) because it carries considerable risk and does not offer any unique edge.

Conclusion

This 5-coin template is just a starting point to provide you with some ideas on how to build a well-diversified portfolio. The reasons behind each choice are shared so that you can replace any of the mentioned coins with an appropriate replacement as you wish.

However, care must be taken not to be self-deceptive by putting a coin in the wrong category. For example, TrueUSD can be used to replace USD Tether. But it would be unwise to replace NEO (in this template) with Litecoin. Litecoin doesn’t have the same properties as NEO (that is, the ability to earn passive income), and as such it belongs in another category.

The purpose of this portfolio template is to make you better equipped to create a solid, well-diversified cryptocurrency portfolio that minimizes losses.

Disclaimer: This is not intended to be financial or investment advice. Before making any kind of investment, it is always important to do your own research and never invest money you cannot afford to lose.

Related: Slush Fund Strategy: Why You Should Reserve 10% Of Your Portfolio For Experiments