Imagine turning $500 into a six-figure retirement fund. Forget the Wolf of Wall Street, this is a valid possibility in the crypto world for anyone with skill, patience and discipline. Last year’s growth in cryptocurrency was nothing short of surreal, and 2018 looks set to be bigger. Day trading cryptocurrency could be an unbelievably profitable venture for those who put in the work and remember the golden rules of trading.

Think trading stocks, but better. Why? Tiny commissions, markets open 24/7, simpler charts, and more accessibility. You can start trading with $5 and if this year is anything like 2017, you could virtually turn that into any number you want.

If you’re thinking about day trading, let’s dive in and get the low-down on how it’s done. This article walks you through a step-by-step guide to getting started with day trading cryptocurrency.

But first…

Is Day Trading Cryptocurrency Right For You?

You might be licking your lips at the thought of getting a slice of the $550+ billion global crypto pie, with many the prices of many cryptocurrencies exploding across the board in the past year.

There are a number of ways to profit from cryptocurrency, but day trading is most likely the fastest. Day trading involving speculating on the price of currencies, and then buying and selling them within the course of a day to make a profit.

Yes, you can make a fortune day trading crypto, with many traders turning three figures into five, six or seven in a matter of months.

Why? The market is outrageously volatile, and that means two things:

- You can MAKE a lot of money.

- You can LOSE a lot of money.

Bearing this in mind…

The (Significant) Risks of Day Trading

You might be dreaming of the feel of the steering wheel of your first Ferrari right now but before getting started on your first trade, you should come to terms with the proven risks associated with day trading:

Capital Loss

Research shows that more than 80% of day traders fail in their first year. Almost all day traders suffer BIG losses when starting out, and few actually move on to start making profits. Why? Because they lack the education, experience, insight and have no risk management systems. You wouldn’t sit your grandma down at her first game of Texas Hold’em and expect her to clean up, would you?

Psychological Addiction

Trading can be enthralling, exciting, and simply make you feel alive. The thought of earning $100,000 at the click of a button can do that to people. It can give you a dopamine hit and a rush just like narcotics, and unless you have a natural ability to avoid addiction, your brain may well soon depend on these ‘highs’ generated by wins. Not only can this erase your bank balance and put you into debt, it can erode the fabric of your life as you damage and destroy relationships with friends and family.

High Stress and Big Time Committment

Let’s get this straight: day trading is a full-time job. You’re not going to be popping onto your laptop every few hours in between martinis by the pool; this is an occupation that requires constant attention. Stress will be a reality and unless you pay constant attention to price movements, you risk losing your money.

False Information

The cryptocurrency market is outrageously speculative right now and just about everyone has an opinion on how prices will move, or the value of a coin. Trades made on the basis of false information can lead to big losses, and this is something every new trader will be exposed to.

You will see all sorts of conflicting information when trawling through Reddit, Steemit and Twitter. Take everything with a grain of salt; find trustworthy sources and connect people with experience successfully trading the markets.

How to Manage the Risks of Day Trading

NEVER Trade with Money You Can’t Afford to Lose

With many coins disappearing as fast as they emerge and a good helping of scams being run in the crypto world, the possibility of losing money is as real as Trump’s presidency. Ensuring you have enough money to live will increase your confidence, relaxing in the knowledge you have your bases covered if you blow your whole account balance.

Educate Yourself

Trading is a skill that must be acquired, crafted, and honed through training and education. Before making your first trades, immerse yourself in reputable sources of information and consider connecting with a mentor such as someone with a proven track record of success.

Get Experience

Once you have some basic theoretical knowledge, you are ready to start putting theory into practice, without risk. Signing up to a demo brokerage account allows you to make trades in real-time, but with fake cryptocurrency. Sure, you might as well be trading Monopoly money, but this is a risk-free way of gaining valuable experience as a day trader. You will quickly develop strategies; seeing what wins and loses will prepare you to start winning on the (real) market.

Manage Your Own Risks

You ought to know that no trader wins 100% of the time. In fact, many successful traders win 60% of trades – this is an acceptable figure. To hold on to your wins and minimize your losses, you will need to put in place systems that guarantee this (see the Stop Losses and Take Profits section below).

If these risks haven’t scared you from the thought of trading cryptos, let’s get into the meat of it.

Related: 6 Questions to Ask Before Investing in Crypto

10 Steps To Day Trade Cryptocurrency

Step 1: Learn About Blockchain

Yawn, I know. Perhaps you’re just out to make a quick buck day trading, but if you want to make sensible investments and leverage them in your favor, you need to understand the value that causes their growth. You wouldn’t buy into a company you know nothing about, would you?

Few people in the world claim to fully understand cryptocurrencies right now, and even fewer can wrap their heads around the finer details of blockchain technology. You might have never even heard of the term, but it’s important to understand that blockchain is the technology that underpins the growth of cryptocurrencies.

Do your homework on blockchain. Even if you just glance the surface of what blockchain is and what it can do, you’ll already have a major advantage over the majority of investors. This will give you a leg-up, helping you identify profitable trades and promising investments faster and more accurately.

Related: What is Blockchain Technology?

Step 2: Learn Which Currencies to Trade

With 1200+ coins on the market and counting, you’re probably feeling a little befuddled as to which coins to trade.

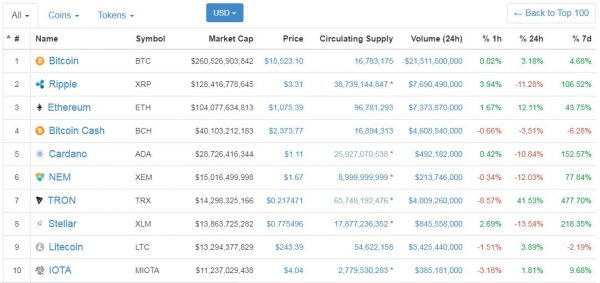

As you dip your toes in the water, the safest coins to trade are the top by market cap. Why? They are both the least volatile and the most likely to serve as a long-term store of value – that is, they won’t disappear into the sunset. Right now, you’d do well to focus your efforts on Bitcoin, Ripple, Ethereum and perhaps Bitcoin Cash.

Smaller altcoins can be incredibly profitable in the short-term, but the risks associated are much higher. Remember, values can plummet just as fast as they have risen.

Step 3: Do Your Research Before Investing in Altcoins

While Bitcoin and Ethereum are relatively safe commitments for new traders, the risks when dealing with less-known coins can be significant. While some coins are undervalued, some are simply pump-and-dump (or even Ponzi) schemes that rely on speculation and hype to artificially boost their prices.

When fraudulent or poor quality coins crash, your funds will go up in smoke – and this can be easily avoided by a little dash of due diligence. Picking a quality coin is a lengthy process; yet time worth spent. If you can ascertain that an altcoin is a legitimate, innovative project you could see a lot more profitable trades and much less time spent panic-selling or crying when your coins go bust.

Related: Top 50 Cryptocurrencies

Step 4: Sign Up to an Exchange

Currently, all currencies are traded against Bitcoin (BTC) and Ethereum (ETH), with Tether (USDT) recently coming onto the scene. If you don’t already own any of these currencies, you’re going to need to purchase some on an exchange. Here’s a list of exchanges where you can convert US dollars to BTC or ETH.

Since you’re day trading, you’ll be leaving your tokens on the exchange. With transactions slower than ever across the board, storing them in your wallet isn’t an option as you’ll miss out on rapid movements.

With millions being stolen during hacks, the importance of choosing a trustworthy exchange cannot be understated.

Looking for a reputable place to buy? Try Coinbase, the regular McDonald’s of crypto exchanges. Other noteworthy exchanges include Shapeshift, CEX or Changelly. We won’t go into too much detail here; hopefully if you’re considering day trading, you are these past baby steps.

While these are great places to get started, they aren’t the best for trading a range of currency pairs. When choosing an exchange, you may be limited by location so it’s necessary to do your research.

You will do well to consider the following factors when selecting an exchange for trading:

- How many altcoins are accepted?

- What are the commission fees?

- Are they a reputable exchange?

- Have they had any security breaches?

Popular picks for altcoin trading include Bittrex, Poloniex, Binance and Bitmex.

Step 5: Learn the Basics of Day Trading

Day trading is a whole new kettle of fish, so let’s look at a simple explanation of how you can make money as a cryptocurrency day trader.

Just like Forex, all cryptocurrencies are traded in currency pairs. When you purchase a currency, you are viewing its value in relation to another (namely ETH or BTC). Since the prices of all cryptocurrencies are constantly changing, you can leverage these fluctuations to earn more ETH or BTC through your crafty trading skills.

Confused? Let’s take a look at an example of a modest but profitable trade with XRP/BTC (Ripple and Bitcoin pair).

Example trade:

At 10.00 am, you buy 100 Ripple tokens where 1 token is worth 0.00018003 BTC ($1.97).

A few hours later, you sell at 0.00018746 BTC ($2.05). You just made yourself 0.000743 BTC or $8 worth (based on current market price of Bitcoin) of profit. Score!

While $8 probably sounds like pocket money, you are likely to make FAR bigger gains on the market as a day trader for two reasons:

- Cryptocurrencies are subject to rapid, enormous price movements (see stats below).

- This example was just ONE trade. You can make 20, 30, or 40 trades in a day. Add up a dozen trades, and you could be looking at thousands in profits. Not bad for a day’s work!

Also Read: A Guide to Start Day Trading Stocks.

Step 6: Learn to Use Market, Limit, and Stop Orders Effectively

To effectively manage the risks of day trading, you will need to use your Stop and Limit Order functions. Humans have a tendency to get emotional, and usually this is when losses happen.

TIP: never stake more than 2% of your trading account on a single trade.

Market Order

This is the simplest trade to perform: immediately buying or selling your coin at the market price, plus extra fees. This can be bad news in a volatile market, as you might buy/sell at a lower or higher price than your anticipated level as the markets change.

HOW TO USE: Use the market order function when prices are going up or down VERY rapidly, and you want in (or out).

Limit Order

When buying or selling with a limit order, you are setting the specific price that you want to buy or sell at. When the limit it reached, your crypto will be automatically traded at this price. The beauty of a limit order is that you will either get a better price, or the one you asked for.

HOW TO USE: Use whenever you can- set a buy limit lower than the market price, and your sell limit must be higher.

Stop Order

If the price of your chosen pair drops, your coin will be sold at a specific price to limit your loss. This reduces the risk of unnecessary losses, and guarantees your profit from a successful price movement.

HOW TO USE: Only use when trading altcoins for short-term gains. Set your sell stop at the lowest price (loss) you can tolerate. Place as a back-up plan, in case your coin’s price plummets.

Now you’ve got the basic mechanics down, how do you know which currencies to pick and when to buy and sell? That is the million dollar question, and this takes expertise.

Step 7: Learn Advanced Trading Analysis

This could be a whole article on its own, but let’s briefly walk through a few of the main methods to analyse currencies and make informed predictions.

Fundamental Analysis

This method uses exterior events to read into the future movement of a currency. For example, say a newly published report states that X is a huge problem in 2018 — is there a new cryptocurrency that can solve this issue? If so, it is probably undervalued, and is likely to rise in price. Ka-ching!

Technical Analysis

This is a complex beast, but it comes down to the basic laws of supply and demand. It is a statistical approach that uses price, volume, and the assumption that everything moves in trends. It takes years of experience and the ability to deal with complex statistical patterns and economic trends, so this method is the least user-friendly for rookies.

Sentiment Analysis

Of all the ways to predict price movements, this is the easiest to wrap your head around. Sentiment Analysis is all about psychology of the market: how are people feeling about a currency?

Compared to fiat currency, the volume of crypto traders is nothing, and this means how the coin is viewed can dramatically alter its value. Did you buy Bitcoin because it was plastered all over the media as the “future of finance”? Without even knowing it, you’ve just invested based on sentiment analysis.

Momentum Analysis

Okay, so the purists wouldn’t say this is real method of trading analysis, but it deserves a mention. It’s simple: momentum traders look for coins that are moving up fast in high volumes, and jump on the bandwagon by buying in then selling at a higher price. Most amateur traders start out with this type of analysis, as it’s the simplest concept to grasp.

Step 8: Follow Cryptocurrency News

Given that the cryptocurrency market is still a pipsqueak in size compared to stocks or forex, price movements are highly influenced by news. Coins can erupt in value when new developments or partnerships are announced, creating a momentary explosion in value.

Take Tron, which leapt some 90% in a day after its founder issued a vague tweet about upcoming partnerships. On the other hand, announcements of regulation, legitimacy, security breaches or technical issues can send prices plummeting to the ground.

If you are able to stay one step ahead of the beat, this can be a very effective means of momentum analysis. This is helpful even for a more long-term strategy: imagine uncovering early information on an upcoming partnership. Discovering news before the majority of investors will help you get in (or out) of a coin much faster, giving you the upper hand.

That said, be wary of the speculative and unregulated nature of cryptocurrency news. Between Reddit, Steemit, Twitter, Telegram and mainstream media outlets, there are vast discrepancies in the quality of information and plenty of outright falsehoods. In time, you will develop your own understanding of what is credible; and what to take with a grain of salt.

Step 9: Only Invest What You Can Afford to Lose

Every trader that’s been around the block knows never to go beyond their means. The explosion of cryptocurrencies has seen a tsunami of investment, with many reportedly taking out loans and mortgages to invest in cryptocurrency. For prospective day traders, look at these people as the prime example of what NOT to do.

Yes, these loaned investments may indeed flourish, but the potential to lose it all is a mind-boggling risk when considering the unknown future of the cryptocurrency market. When coins fail, you do not want to be losing money you cannot afford to lose.

Consider the maximum amount of money from your paycheck that you are willing to dedicate to cryptocurrency, and then stay within your limit. When news of “imminent price explosions” in some supposedly unknown altcoin comes onto your radar, stay vigilant and disciplined.

Follow this rule, and you will make your career as a day trader a long and (hopefully) lucrative one. Ignore it, and you could face losses and debts when you end up being another crypto sob story.

Step 10: Have an Exit Strategy

So you’ve watched your profits soar, but when do you exit your trades? Exiting your trade will ultimately determine how much you make or lose, so your exit strategy is absolutely crucial to your success.

Creating an exit strategy with a stop loss and profit target is safe, sensible, successful trading. It will minimize risk, help you identify if a trade is risky or profitable, as well as eliminate emotion from the equation (a trader’s worst enemy!).

To determine your exit strategy, you will need to ask yourself two questions:

1. How long will I be in this trade?

Since you are day trading, you will be using a short-term strategy when determining your exit point. There are a number of methods to calculate your price exit point, and we will briefly touch on the main ones:

- Trend line breaks, pivot point and Fibonacci levels – these are complex means of technical analysis to predict price movements and will take time and diligence to learn.

- Reward:Risk ratios – this refers to how much you anticipate you will profit from a trade, compared with how much you could lose. For example: you enter a trade at $1.00 and set your stop loss at $0.90. If you take profit at $1.20, this is a 2:1 reward-to-risk ratio. Generally, in day trading, you want to aim between 1.5:1 and 3:1.

- Market Tendency/Measured Moves – this involves trends in price movements, and basing your exit strategy on your predictions.

2. How much can I afford to lose?

You may anticipate the price of your coin to rise but in the eventuality it moves against your prediction, you need a stop-loss in place to minimize your losses.

For less risky trades, set a tighter stop-loss near your entry point.

NOTE: take volatility into consideration. The beta indicator will help you to decide an appropriate stop-loss. This saves you from absorbing a loss when anticipated fluctuations in price occur before the upward price movement you anticipated.

Alternatives to Day Trading

If all of this sounds a bit much, don’t worry. There are still other viable ways to make money from cryptocurrencies that don’t involve the risks, commitment or stress of day trading.

The HODL

A long-term strategy involving buying a cryptocurrency and holding it -w aiting for its price to rise over weeks, months, or years. Of all types of cryptocurrency investments, this is the most common type. Why? It’s without a doubt the safest, and it is relatively stress-free.

With many coins increasing thousands of percent in value over months, this is a valid and profitable strategy. When buying to HODL, it always pays to do your due diligence; you should know your chosen coin inside and out if you are to make a safe and profitable long-term investment.

HODLing is also a good way to reduce your crypto taxes.

The Swing Trade

This method follows the same principle as day trading: buy low, sell high. But whereas day trading involves making moves within 24 hours or less, swing trading involves holding your position between 2-6 days or 2-3 weeks, at the most.

The objective here is to identify mid-term trends using technical analysis. Here’s a great article outlining the finer details of swing trading strategies. Bear in mind that this method is probably just as risky as day trading.

The ICO

Buying into an ICO can be a valid way to make mouth-watering ROIs, some as high as 100,00% (or more). Here you’re buying the tokens of a brand spanking new coin before it is launched, so obviously you are getting a discounted rate. As long as you do your research on the ICO and project, you could see enormous spikes in value and huge returns on your investment.

Putting It All Together

Now that you have Day Trading Cryptocurrency 101 up your sleeve and have come to terms with the risks involved, it’s time to go and get a piece of the pie. There are countless day trading strategies and a wealth of information out there, so it pays to do your research (literally). The more you know about the cryptocurrency market and various trading strategies, the better off you’ll be.

Do your homework and stay updated on your chosen pairs, and always trade within your means. We can’t stress this enough: don’t risk money you can’t afford to lose! Stay cool, calm, collected and start out small, never risking more than 2% of your account on a single trade.

Follow these basic rules of thumb, and you can take your first steps to a successful journey as a cryptocurrency day trader!

Disclaimer: This article is meant to be an educational guide for people who want to learn how to day trade cryptocurrency and is for information purposes only. It is not intended to be investment or day trading advice.