Want to know how to turn $27 into $48,385,475?

If you had bought into Bitcoin early enough, this would be your reality. When working on his thesis on encryption, one Norwegian man did exactly that – he bought 5,000 Bitcoins back in 2009. Had he sat on his stash, he’d now be a regular Monopoly man of Oslo.

The cryptocurrency revolution is a wild west-style frontier; a big, wide, world of raw, uncharted territory, loose laws, and unexplored opportunity. Prospectors are striking gold left right and center; for those lucky (or savvy) enough to invest early in the right coins, the payouts have been quite simply titanic.

But it’s not just lone rangers that are jumping on the crypto-bandwagon. The corporate world is joining the convoy like anyone’s business, with an all-time high of more than $4.5 billion invested into blockchain companies this year alone.

But can all investors be so lucky?

This article outlines some of the risks associated with blockchain. Whether you’re a lone wolf or a corporation looking into blockchain, we identify the key risks of investing in this new technology. Here are 6 questions you should consider before making an investment in blockchain.

1. Will Blockchain be Accepted?

While fiat currencies, gold, and other valuable assets have been around for hundreds (if not thousands) of years, blockchain is a young, spritely thing in the midst of these geriatric old folk. Will these jaded seniors beat it back into its place, or will it push back and roam free?

The masses are still largely unaware of the raw, disruptive power of blockchain, yet corporations are slowly starting to dip their toes in the water. Samsung, Microsoft and IBM saw the potential of blockchain early on, and have gone on to see incredible results with their testing.

Another massive benchmark was reached this year when some 30 powerhouse corporations (such as JP Morgan, Intel, and Microsoft) formed the Enterprise Ethereum Alliance. The world’s largest open-source blockchain alliance exists to connect the biggest hitters with technological experts, providing them with the much-needed expertise to give the technology a head start.

Stories like these are big steps forward for the adoption of blockchain, but there’s no disputing the technology is still very much in its infancy. There is still the possibility that it will not become accepted globally.

It wouldn’t be the first technology to quietly slink away with its tail between its legs. While blockchain has come too far to see this as a likely possibility, it is still a threat that any informed investor should be aware of.

2. How Will Volatility Affect My Investment?

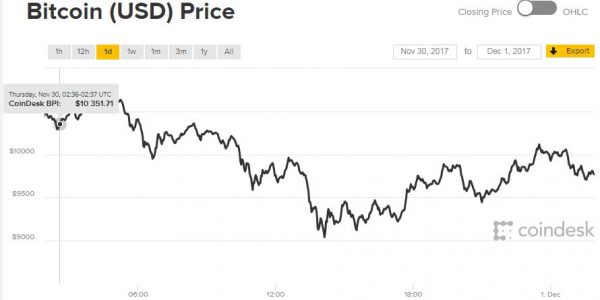

The volatility of cryptocurrencies is enough to make most stockbrokers break into a cold sweat. Several coins have seen jaw-dropping hikes in value, jumping hundreds of dollars in hours.

A year ago, Bitcoin sat at a humble $731 per coin. A year later? It’s broken every record in existence and passed the $10,000 mark.

Many of the factors listed in this article are responsible for the sheer unpredictability of a cryptocurrency’s value.

This instability may be a drawcard for those looking to make a quick buck: cash in on the dips, cash out when the price spikes. But if you are seeking a stable investment, volatility is not your best friend. When investing in blockchain, prepare for the ride of your life.

3. Will Blockchain be Regulated?

Just like how geopolitical events can affect the value of a fiat currency, rules and regulations directly impact the welfare of a cryptocurrency.

The decisions by governments or global institutions have a direct impact on their value, as we’ve seen in the widespread adoption of cryptocurrencies in Japan and China which has led to global price spikes. Equally, any move to ban or regulate crypto will almost certainly send their values plummeting like a lead balloon.

Governments are feeling the burn of cryptocurrency and may be looking to lash back with a vengeance. After all, these currencies pose a legitimate threat to their monopoly on printing money, as well as the tight grip on their economies.

If speculators believe the future of blockchain is still shrouded in uncertainty, this will invariably influence the price of cryptocurrencies as investors pull in and out.

4. Is Blockchain Secure?

As more and more cryptocurrency exchanges enter the market, it’s a given that these new technologies are vulnerable to attack.

The infamous Mt. Gox hack in 2014, which resulting in $473 million worth of bitcoin being stolen, seriously compromised the credibility of blockchain. And it wasn’t the only one. The list of large-scale hacks is steadily growing and is certainly a cause for concern; not only for the sake of security, but also for the reputation of blockchain and cryptocurrency.

As much of the value of cryptocurrencies is speculative, large-scale hacks will inevitably send prices spiralling south. That said, price drops should only be temporary, and will not affect long-term growth.

5. Mining Worries: 51% Attack?

The term “51% attack” sounds ominous and you can rest assured that in blockchain a 51% attack is not a good thing.

Essentially, this is a hypothetical situation where the majority of miners on a blockchain network band together to control it. In this fiendish situation, they would be able to choose which transactions go through, reverse transactions, and spend their own coins several times. Uh-oh. Needless to say, this would seriously compromise any cryptocurrency.

While cryptocurrencies sit on the back-burner of the global economy, a 51% percent shouldn’t have too much of an impact. However if or when blockchain technology is adopted by the masses – Houston, we could have a problem.

6. ICOs: Hit or sh*t?

If you had a time machine, you’d most likely be rewinding to 2009 and going all in on the likes of Ethereum, NEO, or any of the other cash cow ICOs. It’s common knowledge that the potential for ROI on an ICO is gargantuan, but statistics would say that when investing in an ICO, your money will be gone like the wind.

A credible ICO ought to have:

- A sound position in the market

For your chosen coin to succeed, the product must be needed and desired. It doesn’t have to reinvent the wheel, but it has to meet the demands of a clear market.

A tell-tale sign of a dodgy coin is uncertainty in describing the product; look out for vague language, unclear descriptions of what it does, and a general lack of purpose. - A strong team

Who’s back there in the kitchen adding the spices and stirring the pot? Look for ICOs with strong players on board, those with documented success on previous projects.

If you can’t find any information on the team, investing in their ICO is a valid risk. They may have the grandest designs for their new technology but if they don’t have the proof they can pull it off, you’re better off holding on to your precious dollar bills. - A solid whitepaper

A whitepaper is the foundation of an ICO and ought to offer:- A clean layout and accessible language

- Explanation of value

- Position in market

- Market analysis

- How product will work and use of tokens

- Statistics to prove its case

High Risk, High Reward

Still thinking about pulling the trigger on an investment in blockchain? Consider an investment in blockchain as though it is an investment in a startup; something new, exciting, yet unstable.

But do not confuse unstable with irrational; ask anyone who invested into Apple’s 1980 IPO for the truth of this. If you truly believe in the value of a blockchain technology and its ability to succeed, you have every reason under the sun to invest in it.