It came, it grew, it conquered. Bitcoin has officially passed the US$10,000 mark!

Bitcoin: The Beginning

The story is so often told that it hardly needs a retelling anymore.

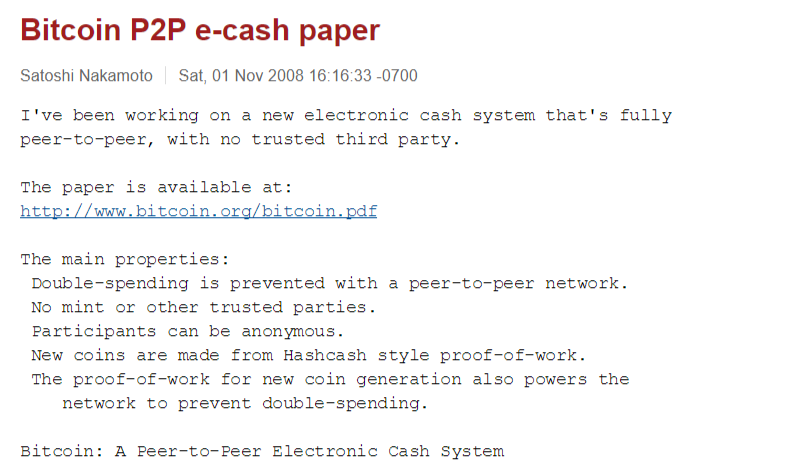

In 2008, an unknown cryptographer with the username handle satoshi released a PDF to the cryptography email list he was on. In it, he described a virtual currency that, by its very nature, transcends political boundaries and shackles financial growth not within the confines of the hands of banks that feed us our daily bread, but within reach of Average Janes and Joes. It was a dream of a digital currency – a cryptocurrency – that is trustless, borderless, and opened up the doorway to possibilities as yet unimaginable at the time.

And thus, Satoshi Nakamoto’s Bitcoin was born. The mysterious founder, who remains anonymous to this day, had sparked the beginning of a new era in human ingenuity, and the rest is history in the making.

Nurturing the Seed

After Nakamoto disappeared from the public eye, his dream was taken up by a group of believers. Thanks to the dedication of a small but growing group of programmers around the world who saw in Bitcoin an alternative route to stand apart from the control and influence of governments and banks, the sapling grew.

In July 2010, 5 days and 1,000 percent growth were all it took for the price of 1 bitcoin to rise from US$0.008 to US$0.08.

Around the world, these early adopters were contributing to the realization of the Bitcoin ecosystem and bitcoin currency, a digital asset rooted in nothing but logical, computable, principles. Devoid of deep-seated beliefs, hierarchal power structures, or unquestioned political agendas. Through the power of their collective code and within the limitations of their spare time, they birthed into existence a technology that would eventually be hailed one of the greatest discoveries of the century.

Bitcoin grew.

Growing Pains

Like many teenagers busy finding themselves, bitcoin went through phases. Sometimes it was Silk Road, and it carried the label “crime currency”. Sometimes it was Mt Gox, and it was passed off as scary and dangerous.

But the dedicated marched on. And the pied piper found more followers, so the naysayers said, as an ever-increasing number of people around the world – in fact, some of the very smartest – started opened their doors to take bitcoin in.

Bitcoin was growing up.

Putting Down Roots

And so, it snowballed. From its earliest beginnings at US$0.008, bitcoin grew fatter and fatter as it soared past its disbelievers.

In January 2014, bitcoin hit an unexpected three-year high of US$1,023. This high would not be reached again until January 2017, when it would finally pass the US$1,000 once more.

Investors started to sit up and take note. Bitcoin grew. Households began to hear this strange new term. Bitcoin grew. And in every country, businesses started popping up, saying “Bitcoin this” and “Blockchain that”.

Touching the Stars

In 2016, bitcoin once more appreciated by more than 1,000 percent. In 2017, this pioneering cryptocurrency entered the new year at US$966.60. Publishing house CoinDesk spoke of bitcoin’s 2017 prospects, noting:

“As asserted by analysts, 2017 is expected to be a banner year, one that could finally lead the price to pass its all-time high of $1,216.7 set in 2013.”

CNBC reported on a prediction that bitcoin would go as high as $2,000 in 2017:

“The price of Bitcoin could hit more than $2,000 in 2017 driven by expectations that U.S. President-elect Donald Trump may introduce economic stimulus policies, which could send inflation soaring and propel the dollar to record highs, a report from Saxo Bank claims.”

But there was yet another prediction lurking about – one that had walked with bitcoin all the way from 2014. One that sounded crazy, yet had been reached by a respected billionaire, venture capitalist Tim Draper.

His prediction said that bitcoin’s value would climb to US$10,000 in 2017.

In an interview with Fox News at the time, Draper said:

“[I’m] very excited about bitcoin and what it can do for the world. Bitcoin is as big a transformation to the finance and commerce industry as the internet was for information and communications. If bitcoin were here in 2008, it would be a stability source for our world economy. Everybody should go out there and buy a bitcoin. Every investor who’s a fiduciary should at least be partially involved in bitcoin because it’s a hedge against all the other currencies. There’s a whole ecosystem being built that’s going to make commerce much easier with much less friction and safer.”

“No way,” said some. “Long way off”, countered others. “Maybe, maybe not,” the cautious shrugged. “It’s a bubble.”

And yet, Wall Street embraced it, some opening doors, others windows. Some governments welcomed it. Bitcoin aimed ever higher and higher, setting its sights on the moon. Up it went, growing and growing, until…

Reaching the Moon

On 28 November 2017, bitcoin hit its mark: spiking to US$10,009 on exchange CEX IO.

Just two days prior, on November 26, Forbes published an article suggesting Draper’s US$10,000 mark would become a reality by 2018.

And voila! Bull’s eye.

What’s next? Mars? Jupiter? Bitcoin will surely show us. And blockchain will take us there.

If predictions are to be believed, we’ll reach Mars in 2018 where it sits at the US$40,000 level.

According to hedge fund billionaire Michael Novogratz, mere hours before bitcoin hit the 10k mark:

“Bitcoin could be at $40,000 at the end of 2018. It easily could. Ethereum, which I think just touched $500 or is getting close, could be triple where it is as well.”

Novogratz has previously revealed that a whopping 20 percent of his fortune is in cryptocurrency. As for the rest of us, less than 1 percent of the world currently owns any cryptocurrency. This is, indeed, cryptocurrency’s 1994. Are you in?