If you’ve been in the investment world for a while, you’ll know that pump and dumps are illegal. In cryptocurrency, being an unregulated industry, it’s a free-for-all, and pump and dumps are becoming a familiar sight.

In this article, written for the average investor who isn’t a savvy or particularly skilled day trader, we look at the crypto pump and dump phenomenon, and whether it’s something to get involved in.

What is a Pump and Dump?

The textbook definition of a pump and dump, according to Investopedia, is:

The illegal act of an investor or group of investors promoting a stock they hold and selling once the stock price has risen following the surge in interest as a result of the endorsement.

Namely, let me buy up some stock (in our case, altcoins), market the heck out of them to get as many people as possible to buy into it for a delicious price rise, then sell when the price is at its highest so I’ll make a profit and, well, everyone else’s coins will be worthless. Insert evil, but newly rich, laugh.

Sometimes, pump and dumps can also occur as a result of a competitor’s desire to undermine market competition.

Earlier this year, ChainCoin caused a whole lot of investors to part with the contents of their bank accounts, and it wasn’t pretty.

Tarek Maza, a game designer who trades crypto on the side, says of the ChainCoin saga:

My friend lost US$2700. I lost US$700. We were all under the impression that we can take it all the way to US$100 [per coin]. There was a rise that made [it] believable: It went from US$0.7 to US$3,60 in 24 hours, which made a lot of people jump in hope that the same growth will continue. But it backfired on a lot of them: People lost thousands. A girl from the Netherlands told me that she will never again invest in crypto after borrowing money from her mother and friend and losing all of it.

Why Pump and Dumps Are Illegal

When an investment stock is artificially inflated, it’s as good as Pinocchio believing that should he head to the Land of Toys, he’ll get to play all day and never have to work again. Just as The Coachman ends up selling Pinocchio to the circus, and his friend Candlewick who first told him of this “amazing opportunity” ends up dead, pump and dump schemes are designed to benefit their masterminds. Everyone else is collateral damage, albeit to varying degrees.

While the financial world is, itself, designed to benefit The Few at a cost to The Masses (this is why we love the alternative option of crypto, after all), regulating pump and dumps protects investors from losing money to opportunists.

In short: they’re illegal because they allow people to commit fraud by conning others out of their money.

The Financial Opportunities of a Pump and Dump in the Crypto World

Investors are in the game to make money. And in the game of money, anything can be turned into an opportunity – even a pump and dump scam.

So while the practice is illegal and people can be prosecuted for it in traditional investing, the crypto industry sees action not only in the form of the birth of these scams but in investors wanting to ride the wave of said practice. In the process, many victims are created.

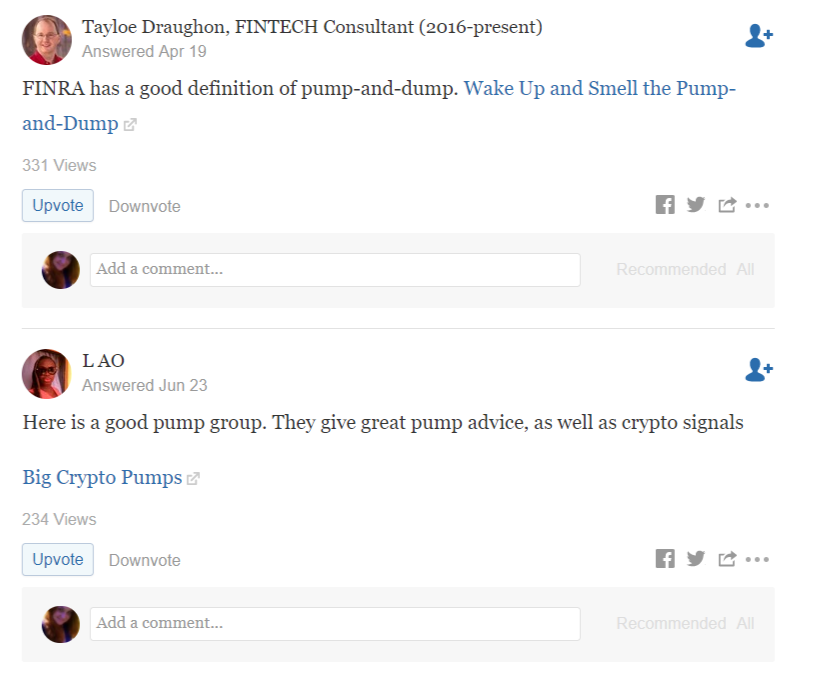

In fact, here’s an article that explains it well. The article also, conveniently, links to one of the 500 so-named “Whale Clubs” that is nameless and faceless but promises you the moon. The article does a great multi-layered job of illustrating exactly how a pump and dump operates.

Who Falls Prey to Crypto Pump and Dumps?

The most obvious victim of a crypto pump and dump scam are the unsuspecting investors who believe the hype flooding the market during the pump stage. Depending on the capacity of their buy-in capital, they may invest minimal amounts (that are to them still a substantial amount), or they can inject as much as thousands of dollars into an altcoin.

They do this in the belief that this is “the next best thing”. Naturally, without any awareness of what is about to go down, that money’s as good as down the drain before they’ve even hit “transfer”.

The second victim is someone who, keen on the profit opportunity that a pump and dump brings, buys into a dedicated scheme. Such investors are promised that, as part of a collective dedicated to cashing in on the coin in question, they’ll be reaping the rewards of “being in the know”. Only, their level of knowingness stretches only so far before they themselves are trampled on.

The Average Investor

You’ve heard of cryptocurrency, or have taken some steps to get in on the bitcoin game. Then you see an ad on Facebook or get a “hot tip” in a social media group, on Reddit, or through a friend, that Coin X is about to make it big.

You’re bummed that you missed bitcoin’s big jump from zero to hero but, not to worry, here’s your chance. The next big thing is about to go down, and if you’d like to cash in, then get in quick! Little do you suspect it’s more of a heist job, and you’ll soon be cashed out.

Someone has to serve as the human wall for the guys who play the game to get over to the other side to where the green grass awaits… and as the most common victim of a scam like this, you’re it. Prepare to have someone else’s boots sink deep into your skull: they’ve a way to climb to the top to execute their getaway plan, after all.

The “Insiders”

Once you’re in the know and eager to add to your cash stash, pumps and dumps might seem like a good idea.

After all, if they’re going to happen anyway, then why not be one of the insiders benefiting from the deal?

This is what gives rise to pump and dump clubs, where investors pool together, agreeing to artificially pump a coin before dumping it so that they can rake in profits off the (sweat-drenched) backs of the Category I victims.

Unfortunately, what pump and dump owners fail to tell their compadres is that there’s a members-only party they’re not invited to, making them a Class II victim: duped while duping. Who needs Mata Hari when you can play this game?

How a Crypto Pump and Dump Fails Everyone but its Designers

Step 1:

Buy low. Super low. In fact, ideally buy a coin so low that there’s no chance, no way, that it’d somehow capitalize on your planned pumping efforts and miraculously make it on its own. There’s no ruining this plan for you; you’re the king of this pop-up castle.

Step 2:

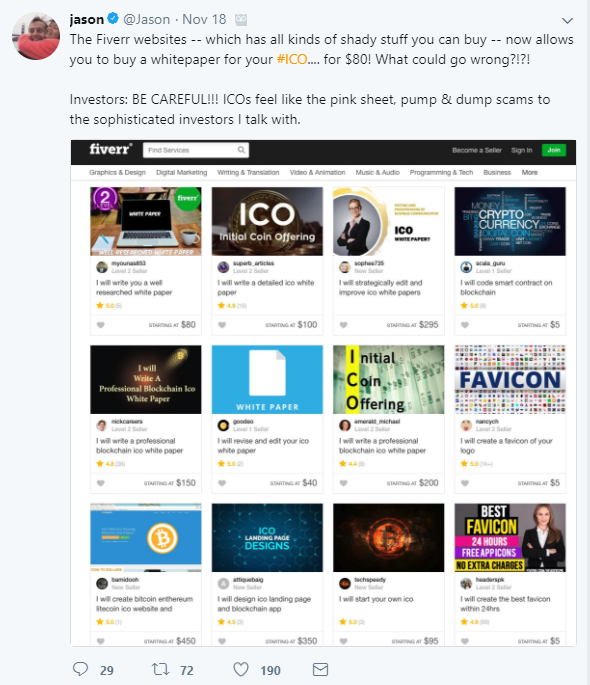

Bamboozle. Cheat. Dupe. Flimflam. Hoodwink. Swindle. Do whatever it takes, but take fingers to keyboard and lie through your teeth so the unsuspecting public with lots of dreams and little know-how will run to the bank and prepare to give you their money.

(Bonus points if you manage to step up your game to such a degree that you roll with the guys who do actually know what the heck is going on. Then you can sit at the island bar sipping an extra cocktail for getting them good.)

Step 3:

All that pumping is hard work, and you’re about to live the Boss Life. Time to rope in some minions. Get a group together, start a club, and let other desperates do the dirty work for you. Whisper sweet nothings into their selective hearing, and tell them bedtime stories about the beach parties they’ll have once you’re all home free. (And if you’re charging them for the privilege to hang with you, you’re really good at this stuff!)

Step 4:

Hodl it, hodl it … wee! Up the arrow goes, $1, $2, $3, 4! This little piggy is going to the exchange to blow down this house of cards! Once your Frankenstein creation hits a sweet spot price, it’s time to break your promises to your little gang and cash out before anyone suspects a thing.

Step 5:

You’ve pulled it off! A one-way ticket to a life of living it up like a king (or if it’s going to be a particularly good life, then a year or two). After all, this is Sparta, and the clever guy gets the suckers. So long, losers!

How to Protect Yourself

Websites like Invest in Blockchain, along with countless other great blockchain investor education resources, exist in order to help investors along this journey.

It’s a new industry for us all, and everyone is busy figuring it out. We’re living in it and, as industry figures and investors, are part of something that history will look back on as one of the most important events of the 21st century.

There’s a lot of good guys and, since life is all about the yin and yang, there’s a fair share of bad guys, too.

Wall Street and its equivalents around the world exist because a large number of people dedicate their careers to knowing what’s happening in the stock market so others can pay them for it.

In the blockchain industry, we have comparatively very few experts and trusted go-to allies. The community itself is creating a decentralized open-source expertise. This is the spirit of blockchain, and it’s the crux of what this technology is about. This is why it’s so exciting, so revolutionary, and why we’re all so passionate about it.

But it’s also why you need to keep your wits about you. Know the landscape of the community you’re in. Join reputable communities.

If you’re invested or wanting to invest, be prepared to scrutinize everything and everyone, all the time. We live in a world that’s been largely set up to lull us into a false sense of security; what’s needed is mental rigor and constant critical thinking.

It’s not exhausting when – or once – it’s a habit! Align yourself with sources that have your best interests at heart, but never fail to be aware of the fact that the only person who is 100% invested in your investments and your financial well-being, is you.

Knowledge is power. Don’t stop learning, don’t stop questioning, and don’t stop researching. Take everything with a pinch of salt. It’s not living with a suspicious mind, it’s being smart. And we all like being smart instead of ending up a statistic.