Forks are a common phenomenon in computing software, but despite their commonality, they elude many people’s understanding. If you’ve read our guide to essential cryptocurrency terms, you’ve probably already heard a bit about cryptocurrency forks.

“Fork” is a phrase that’s come to denote any divergence in a blockchain protocol, and at its most basic is a way of describing a scenario where a split occurs.

For example, many of the altcoins that exist today started off with the same codebase as Bitcoin, only to “fork” into their own version.

There are more than a few reasons why a fork may occur, and there are even multiple varieties. This guide to cryptocurrency forks that will answer the most important questions: What is a fork? What are the different types of forks? Why do forks happen? And what are the implications?

What Are Cryptocurrency Forks?

To properly explain forks, some context is needed. Cryptocurrencies run on blockchain technology, a distributed ledger made up of an ever-expanding chain of data blocks (thus the name “blockchain”). Since these systems function as decentralized networks, users of the system must agree on a set of rules for how transactions are verified and added to the blockchain ledger. This process is called consensus, and it’s what forms the “true” record of a blockchain.

A fork occurs when there is a significant split in the consensus of users or a need to change the fundamental rules governing the protocol. Changing the protocol of a blockchain requires developers to actively alter the code, and this process can have serious and permanent implications.

In sum, “fork” is just a simple name for a software or a protocol update.

When a fork occurs, users will have to choose which version of the software they want to go with. Forks can be contentious, but before we get into the different types (and some of their ramifications), let’s talk about why they happen in the first place.

Why Do Forks Happen?

There are a few different scenarios that create the need for a fork. Here are three of the primary ones:

As a Solution to Technical Disagreements

Bitcoin Cash exists today as a fork of Bitcoin due to a prolonged disagreement about Bitcoin’s scalability problems. A group of influential developers, investors, and miners who were not happy with the proposed “Segregated Witness” (SegWit) solution decided to increase the block size of Bitcoin, thus forking another version of the protocol. Some claim it’s the “true” Bitcoin, while others say it’s an imposter that co-opted the Bitcoin brand – this is open to debate.

To Reverse Transactions

In 2016, Ethereum famously had a smart contract called “The DAO” which was hacked, an incident that cost investors millions of dollars. The hack of The DAO resulted in an Ethereum hard fork. The community voted to roll back history and restore all of the money lost as if the hack never occurred. Not everyone agreed with this move, however, and it’s why today we have Ethereum Classic (a group that decided to stick with the original protocol and not adopt the hard fork).

To Add New Features or Functionality

The fact that Windows 10 exists today is a testament to the fact that Windows has been continually tweaked and improved upon. The same general forces are at work when it comes to blockchain software. Most of it is open source, so anyone can go to GitHub, grab the code of a coin, and then do the development work needed to update the software.

If it’s good enough and there is support for it, the update may be added to the next version. An example of a hard fork for the sake of features is Zcash Overwinter, which once completed will include “versioning, replay protection for network upgrades, performance improvements for transparent transactions, a new feature of transaction expiry and more.”

Hard Forks

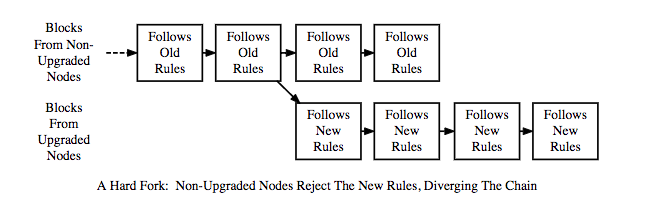

A hard fork is a permanent split from a previous version, and any nodes running an old version will not be accepted by the new one. In this way, a hard fork is non-backward compatible.

Hard forks only occur when the vast majority of miners/validators give a positive signal towards the upgrade or fork. This essentially creates a split in the blockchain: one path follows the new, upgraded blockchain, and the other path continues along the old path (as seen below).

(Source: Investopedia)

In most cases, those running an old version of a protocol will quickly realize their version is old or becoming irrelevant and switch to the new one. Let’s again use Microsoft as an example.

Imagine you want to open an MS Word 2015 file in MS word 2003. Without a special compatibility pack you won’t be able to (or you’ll have extremely limited features). You’ll have this problem because it’s not backward-compatible, precisely in the same way hard forks are not.

Hard forks are generally not a bad thing, unless a political impasse is reached. This can cause a community to unravel, with one group sticking with the old rules no matter what or pushing for new ones at all costs. This is called a contentious hard fork, and examples of it are the previously mentioned Bitcoin Cash and Ethereum Classic splits. Both of these brought with them a good deal of acrimony and drama.

But there have also been more than a few hard forks that were simply on a project’s roadmap and always part of the development process. In this case, the entire community simply (in theory) adopts the upgrade and the old version dies without anyone supporting it. Ethereum Byzantium and MoneroV are examples of non-contentious hard forks.

There are, of course, also many coins that have used Bitcoin code to fork their own version. The most famous example of this is Litecoin. But there are tons of other examples, including Bitcoin Clashic, Namecoin, Peercoin, Bitcoin X, Oil Bitcoin, and Lightning Bitcoin to name a few.

Soft Forks

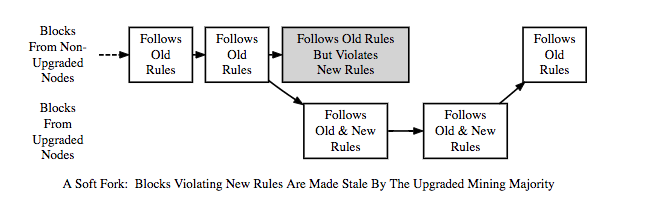

Soft forks involve optional upgrades. A soft fork is a change to the software protocol that remains backward compatible. In other words, the new forked chain will follow the new rule set but will also honor the old rules.

Just like a hard fork, they involve two versions of a blockchain, the difference being users who did not upgrade will still be able to participate in validating or verifying transactions. In this way, soft forks are much less restrictive.

(Source: Investopedia)

Soft forks are much easier to pull off than hard forks because they only require a majority of nodes to sign on, not all of them. Soft forks can be thought of as a gradual upgrading mechanism, as opposed to the stark, immediate change of a hard fork. Soft forks change the existing code, but, unlike hard forks, they aim to result in one blockchain, not two.

A few past examples of Bitcoin soft forks include BIP 66 and P2SH.

Pros and Cons of Forks

From an investor’s perspective, forks (both hard and soft) bring with them a number of pluses and minuses. The most obvious benefit is when a currency undergoes a hard fork, holders of that coin are often airdropped an equivalent number of the new coins for free. This happens because the new cryptocurrency is based on the original’s blockchain, but there are now two versions.

In Bitcoin’s case, everyone who owned BTC was awarded Bitcoin Cash at a 1:1 ratio. At the time of writing, the price of Bitcoin Cash is close to US$650, making this particular hard fork a huge windfall for some.

While it’s questionable how many forked coins offer a good value to investors (some are outright scams), hard forks have created more investment options for people. Bitcoin Gold and Litecoin both came into existence through hard forks.

There are a number of positives, but there are some disadvantages as well. Sometimes forks lead to infighting and endless drama between miners and developers of a specific cryptocurrency. A prime example of this was the Bitcoin Segwit2X hard fork that was proposed in 2017.

People disagreed vehemently about Segwit2X, splitting the community and leading to a stalemate of sorts. Ultimately, it was scrapped because no agreement could be reached. So in some cases, forks can create a lot of tension and discord, to the point where progress grinds to a halt.

Some argue this is the messy process needed for blockchains to evolve; others worry that a contentious hard fork might stall or damage their project. Others simply dislike any type of fork, with the idea that too much change is flippant and makes a project look unstable.

Final Thoughts

Both hard and soft forks tend to create a lot of controversy in the cryptocurrency world. This is mainly because forks represent change, and, generally, people don’t like change. Agree with them or not, forks are an inevitable aspect of cryptocurrency at this point in time. Some are legitimate and desperately needed, while others are questionable and unnecessary. But the bottom line here is that they’re an integral part of a crypto community’s ability to self-audit and evolve.

There is a lot of misinformation and false interpretations that have been spread about forks (particularly hard forks), how they work, and what they mean for investors. The truth is forks can be confusing, and you need to investigate (and thoroughly understand) the reasons for why they are taking place.

With all the spinoffs out there, it’s little wonder some people have developed a disregard and skepticism for forks. But without them, there would be little way to amend and enhance the software. Forks provide recourse when there is disagreement between the various groups within a crypto community – they provide a path forward.

Ultimately, most forks bring positive change, but some do create (sometimes inadvertently) negative change. If the cryptocurrency market continues to grow, it is highly likely that both soft and hard forks will remain a long-term feature of this industry.