You’ve read our guide on dollar cost averaging. You’re fully versed on cryptocurrency day trading. You’ve even got a few altcoins picked out and ready to buy. The only thing left is to fork over the fiat and ride the roller coaster, yeah?

Well, hang on a second. Safe investing is crucial when starting out in the cryptocurrency world. It’s easy to get swept up in the hype of an ICO or promising blockchain project, and if you’re not careful, your first move could be catastrophic.

Thorough research into a potential digital asset can head off mistakes before they emerge. You also need to rank and compare tokens so you can spend investment cash in the right areas.

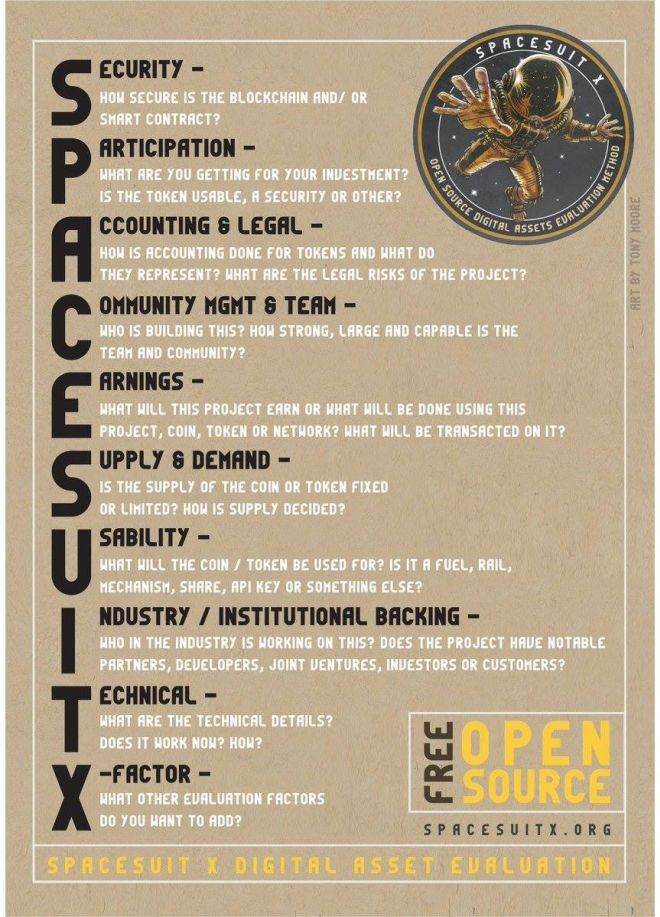

This is where projects like SPACESUIT X come into play. SPACESUIT X is an open-source digital assets evaluation method that helps focus your research efforts so you can analyze cryptocurrencies and ICOs, rank them, and make informed decisions before diving in.

Solving a Comparability Problem

Investors have a fairly standard method for investigating stock assets. Any company issuing public shares has to release audited financial statements, disclose information about the directors, discuss tax implications and potential risks, and so on. Everything is collected in a 200-page legal document made available to potential investors.

Investing in blockchain technologies isn’t so tidy. Most buyers follow the basic path of reading the project’s whitepaper, researching the development team’s background, looking at the token’s market cap, and finally poking around the community to see what else they should know. It’s haphazard, incomplete, and never guaranteed to be reliable. In fact, some ICOs only offer a paragraph or two of information on Github, which is a far cry from a 200-page legal document.

There’s also the issue of comparing potential properties. With stock investing, you can easily compare Microsoft’s earnings to Apple’s or look at Cisco’s quarterly reports to see if they’re outperforming IBM.

With digital assets you can check market cap numbers side by side, but those can be misleading, and they really only tell a small part of the story. Bitcoin and Ethereum are always at the top of the market cap listings, but they’re there for completely different reasons.

In late 2017, economist-turned-crypto-enthusiast Bruce Fenton realized comparability in the digital assets world was a problem. Since there wasn’t a codified way to research ICO and blockchain investments, Fenton came up with one.

SPACESUIT X Method

SPACESUIT X takes a step towards easy digital asset analysis by laying out important investment criteria in ten steps.

All you have to do is pick a project, then go down the category list researching each section in turn. When you’re satisfied with your findings, you condense it into a numerical score from 0 to 10. At the end, add up the categories and you’ll have a shorthand rating for investment viability – one that’s easy to compare between projects.

Below we take a look at each step in the SPACESUIT X method.

Security

The “S” in SPACESUIT X asks the question “How secure is the blockchain or smart contract?”. Everything from transparency to centralization are factors, as are previous breaches and the development team’s response to the attack. A vulnerable project won’t survive a meteoric rise to popularity, and neither will your invested cash.

Participation

What are you getting for your investment? Is it a few numbers in a digital wallet, or are you purchasing a stake in something greater? Many coins exist just to raise funds or make money for the creators, but others are fuel for a blockchain machine. Don’t be afraid to ask the question “What’s in it for me?”.

Accounting & Legal

What are the legal risks of the project? A coin built around anonymous drug trading could skyrocket overnight, but it’s just as likely to be shut down by a government agency. It’s also a good idea to dive into accounting information, such as how many tokens there are and if there’s a supply limit.

Community Management & Team

Who is building this project, and what’s their stake in its success? A dedicated team that’s in love with their work means the asset is more likely to innovate, expand, and adapt. Also, what does the project’s community spend their time discussing? Do they brainstorm clever new uses for their blockchain, or are they more concerned with turning a profit?

Earnings

What will the project earn, or what will be transacted on the blockchain? Are there earnings projections to look at? As Fenton points out in his 2018 talk at the North American Bitcoin Conference, putting dog training payments on the blockchain sounds like a neat idea, but is it really a “to the moon” investment? Read the fine print. See if the coins are built to increase in value, or if the creators simply want cash.

Supply & Demand

Is the coin supply fixed or limited, and how many will be issued? Is there enough market depth to support significant sales? A coin could have promising growth factors but only rise incrementally in value.

Usability

Why does this project even exist, and will people ever want to use it? Projects like Waltonchain or Sapien have definitive real world uses built in. This doesn’t guarantee their success, but it does mean there’s a higher chance they can expand beyond niche blockchain products.

Industry Backing

Are there any major players backing the project? Seeing news like Stratis signing two corporate-level partners bodes well for the project’s future. The industry backing category also includes which cryptocurrency exchanges list the token as well as the project’s plans to attract future investors.

Technical

What are the technical details of the project? Could scalability or efficiency be major stumbling blocks in the coming months? Are there glaring flaw critics are calling out? Issues like this are key for any digital asset, even if it’s just a currency. If you’re looking to invest in a dapp platform like Lisk or Ethereum, you could spend most of your research time here.

X Factor

What else do you think should factor into the asset’s potential value? Standout features that don’t readily fit into the SPACESUIT categorization can tip the scales. Make this the final research point you tackle. Once you’ve checked into the rest of the project’s metrics, you’ll know whether or not there’s a promising X factor in the cards.

To the Moon?

SPACESUIT X isn’t the only way to rate digital assets, but it’s an excellent place to start. By honing your research on a few categories, it makes it easier to pin down a project and understand its value.

It also makes it easy to compare items in your portfolio. If your current investment strategy is limited to “This coin looks cool, shut up and take my money.”, a method like SPACESUIT X could help you avoid costly mistakes.