When is the best time to invest?

There is only one answer to that question: nobody knows. Nobody knows whether the market is going up, down, sideways, or in f$&%ing circles, as Matthew McConaughey so eloquently explained in The Wolf of Wall Street.

This is an important realization to have before investing in anything, and especially important when investing in cryptocurrencies. The crypto market has experienced huge volatility due to it being highly unregulated, prone to manipulation, strongly affected by unfounded rumors, and caught up in hype.

Timing it is impossible, and thus we need a sound strategy to minimize risk when buying into this market: dollar cost averaging.

The Basis of Dollar Cost Averaging

Dollar cost averaging is a method by which you spread your risk evenly throughout a preset number of days/weeks/months. You do this by consistently buying based on a strategic schedule which you determine before you start investing. There are three ingredients for dollar cost averaging:

- your investment budget

- the timespan over which you invest this budget

- a portfolio you want to invest in

There are some premises for dollar cost averaging, which you need to be aware of before applying the method:

- You expect the market to go up in the long run.

- You’re investing for the long term.

- You’re about to invest in a volatile market.

- You understand that you can’t time the market and want the best average price to buy in.

- You accept lower potential returns because you want to minimize your risk.

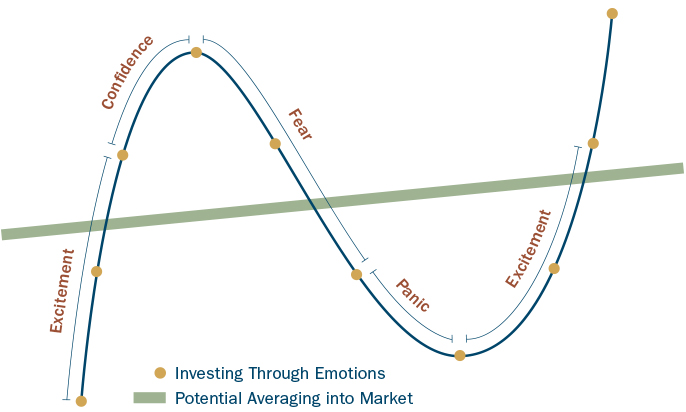

Dollar cost averaging is based on disciplined consistency. You reduce the risk of buying in at an unfavorable price, and it allows you to be unaffected by market volatility because you’re ignoring prices. However, the problem with dollar cost averaging is that most investors can’t commit themselves to consistently buy according to what their plan dictates. Discipline is key.

You remove all emotion from your investment decision and ignore the price of the asset you want to invest in, in this case a basket of cryptocurrencies. Emotions generally lead to most investor mistakes, and by dollar cost averaging you remove all your emotions from investing. No matter what the price is or how the market is behaving, you invest based on your schedule. Always stick to the plan. If you don’t, you’ll end up trying to time the market, which, again, you can’t.

A Simple Example

Let’s say you want to invest in Lisk. The market as a whole and the price of Lisk have been volatile recently, and you can’t find a comfortable point of entry. Both the market and Lisk can go up just as easily as they can go down. Because you want to get the best price to buy in and this is extremely difficult, you find the average price by applying the dollar cost averaging method.

A general rule is that dollar cost averaging over a longer period of time decreases the risk you’re exposed to. If you decide to invest 10% of your budget every week, your risk exposure is much higher than when you decide to invest 10% every month.

Don’t take too long, though. Even though dollar cost averaging spreads the risk out the most, if the market has been going up on the long run, which you expect it to do, your idle capital is relatively losing value.

If you are planning to invest $10,000, you create a dollar cost average schedule. This means that you simply need to determine the number of days/weeks/months over which you spread out your investment. In the cryptomarket, it is advisable to take 1 or 2 weeks as the period between your buy-ins.

For this example, I’ve decided to invest 5% of my investment budget once a week, on the same day at the same time.

Week 1: $500 / $24 = 20.83 Lisk

Week 2: $500 / $22 = 22.73 Lisk

Week 3: $500 / $18 = 26.32 Lisk

Week 4: $500 / $21 = 23.81 Lisk

Week 5: $500 / $25 = 20 Lisk

And so on.

From this example, you can see how you get the average price and protect yourself from market fluctuations. If Lisk is cheap then the same amount of money will get you more Lisk, and vice versa. Based on these 5 weeks, you have paid an average of $22 per Lisk. Sure, you could have bought it all at $18, but you’d have to be lucky with timing the market, plus confident enough to buy in at such a dip.

This is just an example to show you how dollar cost averaging works. Never put all of your eggs in one basket. This is an easy example of one crypto, but you really want more than one crypto in your portfolio.

Less Risk, Less Returns

A downside that has to be mentioned is missing out on potential gains. If the market goes into bull mode right when you start dollar cost averaging into the market, in hindsight you would’ve been better off buying in all at once. You have to decide whether you want to mitigate as much risk as possible, or on the other hand accept high risk with the potential of high returns. A study conducted on dollar cost averaging concluded that while investing all-at-once generally produced greater returns, dollar cost averaging strongly reduced risk involved with investing.

With dollar cost averaging, you hold cash for a longer period of time, and cash generally doesn’t lead to returns. However, there is little risk involved in holding cash, and sticking to the schedule will give you a solid average price. Think carefully about the following question when deciding on your strategy: how would you feel if you invested all-at-once and the price suddenly dropped 30%?

Additionally, do your research on the trading and transaction fees. Since you’re buying in frequently, these costs could add up. This should be taken into account when making your buy-in schedule.

Conclusion

Dollar cost averaging might seem quite dull, and it actually is. That’s the beauty of the method. Through dollar cost averaging, you minimize your risk, which saves you a lot of stress, as you are entering an extremely risky and volatile market.

This investment method might not give you the greatest return per se, but it does mitigate risk. Dollar cost averaging is highly appropriate when you’re about to invest in a volatile market that you can’t time and can’t find a clear point of entry of this. Moreover, for the method to be effective you need to invest for the long term and expect the market to grow.

To dollar cost average into the crypto market, simply follow these steps;

- Determine the total amount you want to invest.

- Choose the cryptocurrencies you want to invest in.

- Determine the time intervals between each investment and what % you’ll be investing at each investment (more time = less risk).

- Stay disciplined and stick to your plan.

And that’s how you minimize your risk exposure in one of the riskiest markets of all by dollar cost averaging. Good luck!