When you’re investing in blockchain, you have to deal with cryptocurrency transaction fees. This is nothing new as you also pay for using the services of third parties such as exchanges in the stock market as well.

However, due to the decentralised nature of cryptocurrencies, you have to pay for using a the network of a crypto as well. The network needs be incentivised to verify all the transactions occurring on the blockchain, and you as a user are paying for that.

Hence, there are 3 types of transaction fees when dealing with cryptocurrencies:

- The fees for trading on exchanges

- The fees for transactions

- Wallet fees

Exchange Fees

Whenever you want to buy a cryptocurrency, you have to buy it from someone. Exchanges facilitate these markets and are the main point of entry for investing in cryptocurrencies. Whether you want to convert your fiat currencies to crypto or trade your crypto holdings for other cryptos, the safest and easiest way to do this is through an exchange.

Exchanges do not provide these services for free and to generate an income, they charge a fee on every trade you make on their exchange. Transaction fees make operating an exchange profitable. Every exchange charges different transaction fees and it can save you quite some money to research which exchanges have the most favorable fee policies.

Fixed Trading Fees

Bittrex, for example has fairly low exchange fees. For every trade made on Bittrex, they take a 0.25% cut. Bittrex doesn’t separate buyers and sellers and the 0.25% transaction fee is a set number. So if you sell 2 NEO, you will pay 0.0050 NEO for that transaction and if you buy 4 BAT, you will pay 0.01 BAT. Additionally, Bittrex doesn’t charge you for deposits and withdrawals

Binance has a fixed trade fee of 0.1%. Deposits are free of charge. However, you can get charged for withdrawals on Binance, depending on the crypto you are withdrawing. An additional feature of Binance is that you can decrease your trade fees by 50% by using their own cryptocurrency, BNB, for trading.

Maker-Taker Model

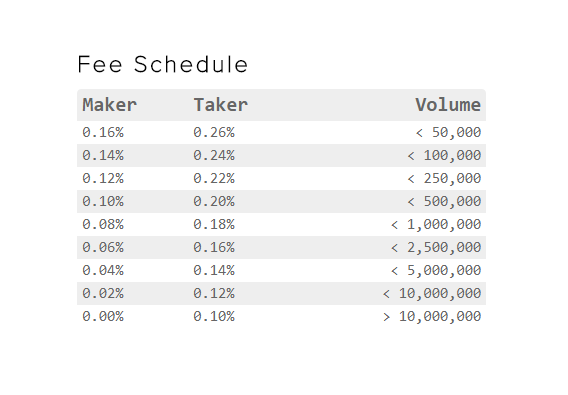

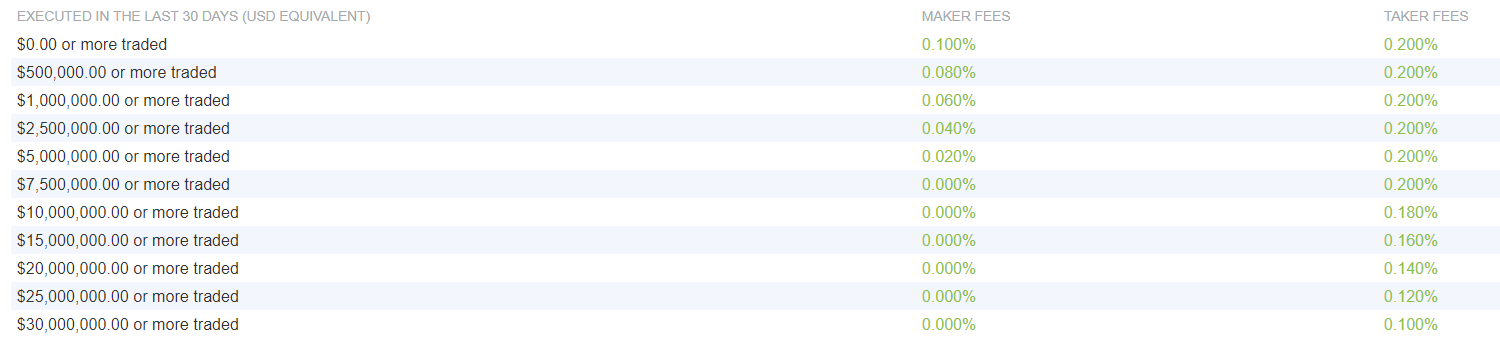

Other exchanges such as Kraken, Poloniex and Bitfinex charge transaction fees based on a maker-taker model. The maker is the party that wants to sell a crypto on the market. The taker is the party that buys. Both maker and taker are charged a trading fee; however, the maker, thus the seller, is always better off in this model.

Additionally, all three exchanges mentioned above lower their transaction fees when you have trade volumes above a set threshold. Mostly, this threshold is valid for a 30-day period. For example, your trade fees will decrease on an exchange if your total trade volume reaches over $100,000 in 30 days.

Network Fees

Network fees are the second type of fees you pay for engaging in cryptocurrencies and they are paid to the miners of a cryptocurrency.

For blockchains, all transactions that happen on the blockchain need to be verified by the network. This is done by the miners of that blockchain. So, even though crypto deposits and withdrawals are free of charge on most exchanges, most of their networks charge you for these transactions.

It is important to understand that all blockchains have their own system for transaction fees. The description of transaction fees below is the most widely adopted approach for dealing with transaction fees.

Say that you send your recently purchased Bitcoin from Kraken to a personal wallet. You will enter your public key into the Bitcoin withdrawal option of Kraken and press send. This transaction will become a line of code which is sent to the Bitcoin network for verification.

Transactions are not processed individually, but they are put together, forming a block of data. When this block is full, the verification will be conducted by a miner. Once the block is solved, it is added to the chain of blocks, hence, the blockchain.

For solving this block, thus verifying a number of transactions, the miner is rewarded. This reward comes from the transaction fees paid by the parties making the transactions. The miner receives all the transaction fees set for a block.

Price Determinants

Transaction fees are set by the miners themselves and the sending parties can accept or decline this cost. Thus, it uses a free market mechanism.

A miner could set extraordinarily high transaction fees; however, no one would accept those transaction fees. The miner will not be assigned any blocks to solve because these blocks will be sent to a miner with transaction fees that are accepted by the sending parties.

There is a minimum amount as well, as the miners want the process of the verification of the transactions to remain profitable. Their costs are their investment in processing power and electricity bills.

There is a potential problem in this model, as the miners want the highest transaction fees possible. If an entire network agreed upon a certain price for the transaction fees, they could decide to set an unreasonably high price. This is the problem of miner centralization, which is similar to forming a cartel to ensure a certain profitability.

Setting and Managing Transaction Fees

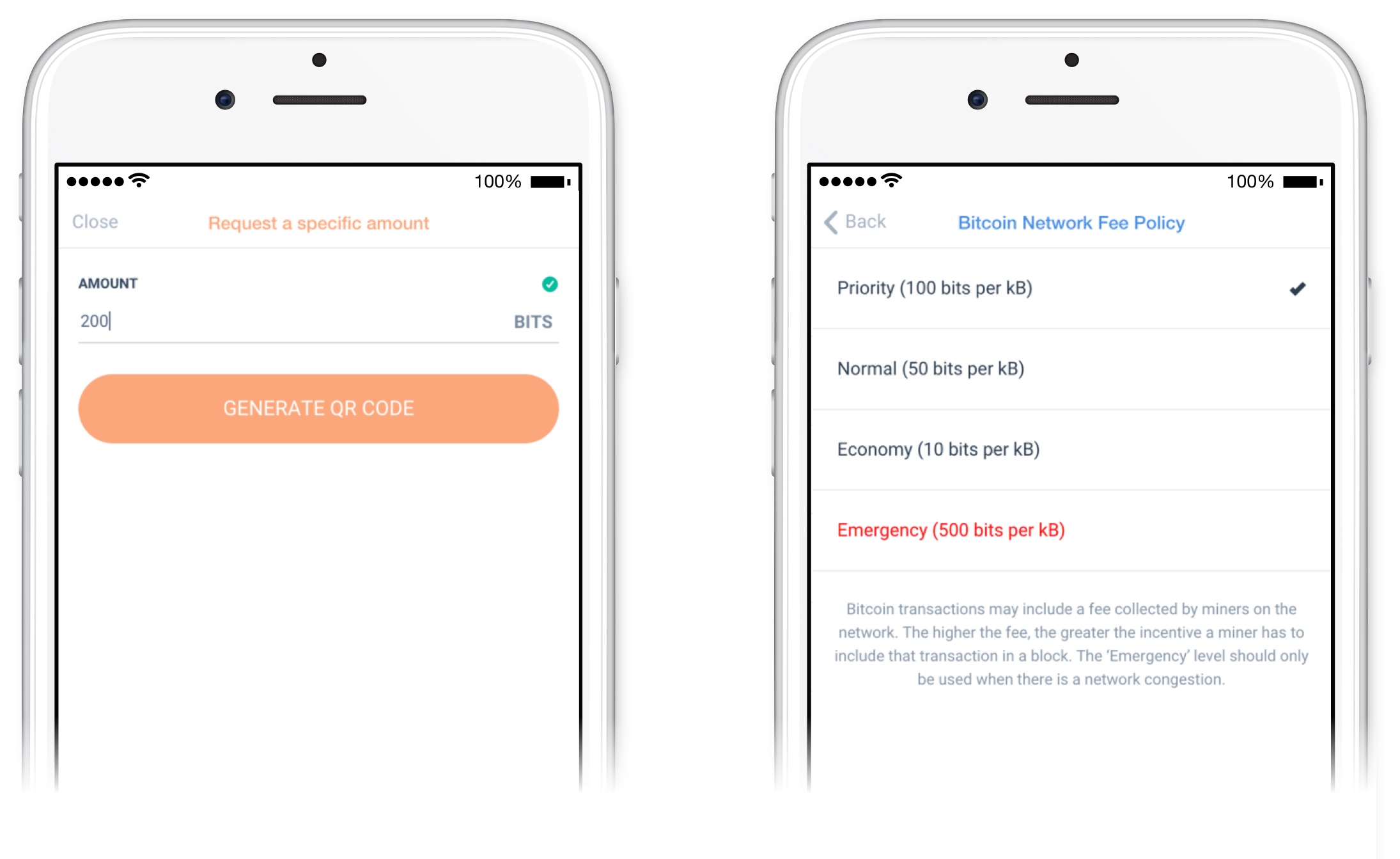

Several wallets let sending parties set a transaction fee they are willing to pay for their transactions. You can adjust your transaction fee preferences in the settings. Most wallets provide a predetermined price that will ensure your transaction will come through within a given time frame. There are several wallets that will only allow you to use this predetermined price for your transactions.

Here’s something to note if you set your preferred transaction fee: the lower the transaction fees you are willing to pay, the longer it will take for your transaction to be verified. This is because it will have lower priority for the miners, who are financially motivated to solve the block with the highest transaction fees first.

The number of transactions a blockchain network can handle per second is limited. With an increasing number of users, more and more transactions need to be processed. This means that in order to ensure your transaction is verified first, you will have to outbid an increasing number of transactions. This comes down to setting a higher transaction fee.

You set the total transaction fee and this is not relative to the amount you’re sending but to the length of the code that needs to be solved. If you’re sending $500,000 worth of a crypto, you won’t mind paying a few dollars in transaction fees. However, if you send $5, you will definitely mind. This means that small transactions are being priced out of the market.

A solution for this problem is increasing the limit of possible transactions per second.

Wallet Fees

A third fee that you might come across is a fee for using a wallet. You use wallets to safely store your cryptos, and the software development and updates aren’t free. You pay minor fees for using a wallet which go to the company that created it. You can check your fees in the wallet settings.

Creating a new address for a cryptocurrency, a wallet, also needs to verified by the network of the cryptocurrency. This can occur for both personal wallets as well as for wallets on exchanges. Whether you are charged depends on the blockchain of a cryptocurrency. In the case where you have to pay a wallet fee, you will be charged on the first deposit you make to that wallet.