So you’ve decided to run an ICO. That means you’ve got your work cut out for you, as it takes a coordinated effort and a lot of planning. But we’re here to help; our “How To Run A Successful ICO” series aims to guide entrepreneurs such as yourself through the entire ICO process, from planning to implementation.

Since you’re reading this, it means that you’re serious about not only running an ICO, but you also want to do it right and do it well.

In “How to Run A Successful ICO (Part 1): Should You Even ICO?”, we went over some of the basics of an ICO and some topics you should consider before deciding to run your own ICO.

In this 2nd article in the series, we are operating under the assumption that you have chosen to go through with the ICO. Here we start getting into more of the technical details you need to consider.

Some topics covered in this article are:

- Different platforms from which to launch your token

- An overview of various token sale models

- How to choose the token sale model that’s right for you

- Legal considerations

It is crucial that you put in time to carefully consider these issues prior to launching your ICO. The repercussions for poor planning on any of the topics mentioned in this article could lead to catastrophic results for your ICO.

By the end of this, you should have a good idea of the next steps you should be taking, and some of the best practices crucial to your ICO’s success.

Which Platform Should Your ICO Be Launched On?

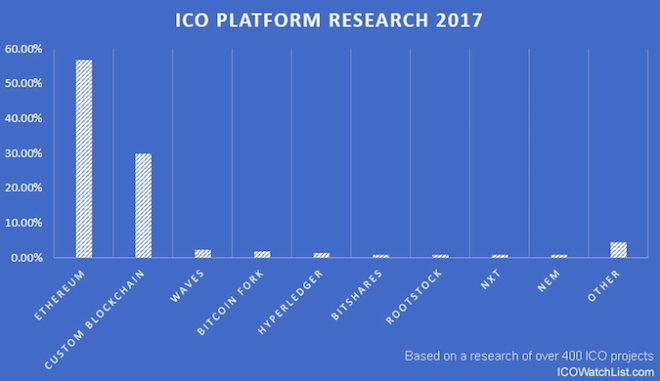

There are number of platforms on which you can launch your token. Each comes with its own advantages and disadvantages. The chart below shows a breakdown of ICOs in 2017, and the respective platform they were launched on. An up-to-date list of 2018 ICOs by platform can be found here.

We’ll take a detailed look at the top three on this chart: Ethereum, Custom Blockchains and Waves. We’ll also discuss a few other up and coming platforms which you may also want to consider for your ICO.

Ethereum

Ethereum is by far the most popular platform used to host ICOs. In 2017, about 60% of all ICOs were hosted on Ethereum. The success of the ICO model has been a huge factor contributing to Ethereum’s overall success. Matt Tan, one of the founders of Etherscan, has even gone so far as to call the ICO Ethereum’s “Killer App”.

Ethereum is by far the most popular platform used to host ICOs. In 2017, about 60% of all ICOs were hosted on Ethereum. The success of the ICO model has been a huge factor contributing to Ethereum’s overall success. Matt Tan, one of the founders of Etherscan, has even gone so far as to call the ICO Ethereum’s “Killer App”.

Similar to how the HTTP standard defined the way we used the internet, Ethereum has set the standard for ICOs with the revolutionary idea of the ERC-20 token. The ERC-20 is nothing more than a technical specification, which can be followed by anyone who wants to create their own token.

The key advantage of this standardized token is interoperability. Tokens built on the Ethereum blockchain which adhere to this standard will be able to interact with each other easily. The end result of the ERC-20 standard is less risk of poor coding and security loopholes, greater liquidity, more continuity and less time required to launch ICOs. This makes Ethereum a great choice for almost anyone looking to host an ICO.

For more information on the Ethereum platform, see “What is Ethereum”. More information on how to create your own ERC-20 token can be found on Ethereum’s website.

Custom Blockchain

This option requires the most technical aptitude and knowledge in blockchain technology. You’ll have to do a lot of the work yourself and you won’t have the luxury of learning from other people’s mistakes.

But this option offers by far the most flexibility. For those looking to do something truly different than everyone else, it may be the best option. About 30% of ICOs in 2017 launched on their own blockchain from the start.

It is likely that if you are considering this option, your team has a high level of technical expertise and years of development experience in order to make this a success.

Waves

The Waves original slogan was “Your blockchain token in one minute”, and for good reason. Their platform was designed from the ground up with one purpose – to streamline the ICO process. They have since updated their slogan as they expanded their product offerings, but the essence of their original slogan still holds true today.

The Waves original slogan was “Your blockchain token in one minute”, and for good reason. Their platform was designed from the ground up with one purpose – to streamline the ICO process. They have since updated their slogan as they expanded their product offerings, but the essence of their original slogan still holds true today.

Waves was the first enterprise-ready ICO platform to be created. They have designed a number of tools on their platform to make it easy to create your own tokens with very little technical knowledge required. Waves also had the opportunity to learn from Ethereum’s scaling mistakes, so they have built their platform to support large transaction volumes.

Waves also built their own decentralized exchange (DEX). Any token launched on their blockchain will have nearly instant access to be traded on the exchange.

In this way, anyone who didn’t buy in at the ICO stage but has heard about your project will be able to exchange their fiat or cryptocurrencies for your tokens right away. This is a huge advantage that Waves offers its customers as it can sometimes take months to get listed on the popular exchanges.

Another great thing about Waves is that they are leading the charge to adopt ICO regulations. They even recently teamed up with Deloitte to help establish a list of best practices for ICOs. Some of these include the creation of reporting guidelines, KYC/AML guidelines for ICO investors and legal assessments for businesses.

Legal issues are a big concern for anyone who wants to host their own ICO. There will be more on this topic later on, but for now you can go forward knowing that Waves is doing their own due diligence to ensure that ICOs remain an accepted and legal funding method.

Waves is an excellent choice for anyone looking to host an ICO, but it is especially suited for businesses without the resources to use Ethereum’s less than user-friendly platform, or if you’re looking to get listed on an exchange right away. In 2017, Waves hosted around 2% of ICOs. Though those numbers are relatively small, they have set the groundwork to greatly expand their influence in 2018.

A full guide on how to create your own token on Waves can be found here. To learn more about Waves, see “What is Waves”.

NEO

Often called the “Ethereum of the East”, NEO has made huge strides in the past few years to dethrone Ethereum as the world’s standard platform for ICOs. There are some distinct advantages which NEO has over Ethereum which makes it a great alternative.

Often called the “Ethereum of the East”, NEO has made huge strides in the past few years to dethrone Ethereum as the world’s standard platform for ICOs. There are some distinct advantages which NEO has over Ethereum which makes it a great alternative.

For one, the platform has been designed with scalability in mind. It is able to handle over 10,000 transactions per second as opposed to Ethereum’s 15. NEO also uses the much more developer-friendly programming languages of Java and C#. This means it will be easier to find experienced people to develop your platform.

NEO boasts a few other technical improvements over the competition like the ability to integrate digital identities and digital assets into their smart contracts and using a unique consensus mechanism, dBFT.

With an impressive list of recently-announced ICOs, NEO is making huge strides to becoming a commonly-used ICO platform.

For further reading on NEO, see “NEO vs Ethereum” and “What is NEO”.

Lisk

Lisk is smart contract platform which is a frontrunner in the implementation of sidechain technology.

Lisk is smart contract platform which is a frontrunner in the implementation of sidechain technology.

Sidechains allow businesses to build their own blockchain applications without the worries of having to build and maintain their own blockchain infrastructure. They also have great scalability. Blockchains such as Ethereum have been constantly plagued with ‘bloated’ chains during times of especially high transaction volume. Sidechains act as parallel blockchains, meaning that the transaction volume of one chain doesn’t affect another.

Lisk also has the big advantage of being written in Java, one of the world’s most common programming languages. They have been gaining a lot of traction in the ICO world with new platforms launching regularly. Lisk is a great option for anyone worried about scalability issues or who is looking to use Java to develop their platform.

For more information on Lisk, see “Ethereum vs Lisk” and “Understanding Lisk”.

Stellar Lumens

Stellar recently hosted their first ICO in January 2018. But just because Stellar is new to the ICO world doesn’t mean that it is a poor choice to host your ICO.

Stellar recently hosted their first ICO in January 2018. But just because Stellar is new to the ICO world doesn’t mean that it is a poor choice to host your ICO.

A big advantage Stellar has over its competition is its high liquidity. Similar to Waves, Stellar has their very own decentralized exchange (SDEX) which makes your tokens tradeable from day one. Stellar recently stated that their number one goal in 2018 is to make their exchange more user-friendly, meaning that your customers will be able to buy your tokens with ease.

SDEX boasts a few advantages over centralized exchanges such as day one trading for any Stellar ICO token, atomic pathfinding to find the cheapest rates possible, very low trading fees and giving the end-user control of the token’s keys.

Launching a token on Stellar is easy; according to their website, this can be completed in only a few hours. In addition, the Stellar platform is super secure. It has been built with a few well-planned limitations to minimize the areas which a hacker could exploit weaknesses. This, coupled with the lightning fast transaction speeds which virtually eliminate any potential for scalability issues, makes Stellar a great option.

For more info on Stellar, see “What are Stellar Lumens” and “Stellar Lumens vs Ripple”.

Stratis

Similar to Lisk, Stratis allows you to deploy your own sidechains off the Stratis main blockchain.

Similar to Lisk, Stratis allows you to deploy your own sidechains off the Stratis main blockchain.

Stratis comes with the added advantage of being written in the C# and .NET programming languages. If you’re looking to develop in these languages, Stratis is the way to go.

In November 2017, Statis announced that they have created an test ICO platform. It is undoubtedly one of the most anticipated features of Stratis. In the near future, the platform will be available for enterprise use. Stratis is one to watch moving forward.

For more information on Stratis, see “What is Stratis”.

An Overview of Token Sale Models

Once you’ve decided which platform to use to launch your ICO, you have to figure out how you will actually offer the tokens to the public. There is no standardized or “right” way to do this. Every model has its own strengths and limitations. You need to look at your own organization’s goals and find the model which fits you best.

The list provided below is by no means exhaustive. For each model listed, there are many different variations possible. It is important that whatever you choose to do is clearly laid out in your organization’s whitepaper or ICO document prior to the sale.

Here are 4 of the most common distribution models used today.

1. Capped Fixed Token Sale

- Tokens are offered on a first-come-first-serve basis

- The number of tokens available for sale are predetermined

- The price for a token is fixed

- A cap exists on the total amount raised, which is calculated by the number of tokens for sale by the price per toke

- Insiders have a predetermined allocation of tokens which is expressed in the whitepaper or by other means

This is by far the most common token sale model. There are many variations to this model. For instance, discounts to the token price are often offered to early participants, with the price gradually increasing until all tokens have been sold.

Usually the total sale duration lasts for one month or until the hard cap is reached. Any unsold tokens will be distributed or kept by the development team as defined in the organization’s whitepaper.

In the event the soft cap is not reached, any tokens received as contributions will be returned to the supporters as defined in the project’s technical documents.

2. Uncapped Token Sale

- There is no limit to the number of contributors and no limit on the amount of capital raised

- Insiders are allocated a fixed amount of the total supply of tokens

- Buyers can contribute as much as they choose to the project

- The value of each token is unknown until after the ICO is completed

- Anyone can participate in the token sale

In this model, you sell as many tokens as people are willing to buy but the percentage of the tokens available is still limited. The amount of tokens allocated to an investor depends on how much they supported the sale. The real percentage of tokens available for sale and the cost per token is not known until after the sale has completed.

This can alleviate any funding issues for an organization, but can also attract huge amounts of attention and public pressure. A good example is the Tezos lawsuits which occurred after their highly “successful” July 2017 ICO.

One issue with this model is that supporters do not know exactly how many coins and the valuation of what they are purchasing. Generally, investors are more willing to contribute if they know exactly how much of the total supply they are purchasing.

With this funding model, the number of tokens distributed gets divided based on the value of each individual’s contribution and the total amount received during the ICO event.

A notable project using this model is EOS, which is running a year-long uncapped ICO.

3. Capped Auction

- Buyers bid the price which they wish to spend for the tokens

- There is a variable amount of tokens sold

- It can be utilized as a “Dutch auction”

- There is a capped amount of funds which can be raised

- The total number of tokens sold is variable, depending on the price paid by contributors

Here, contributors bid what they are willing to pay for the tokens. In this case, the “market” determines the price of the tokens, not the development team itself.

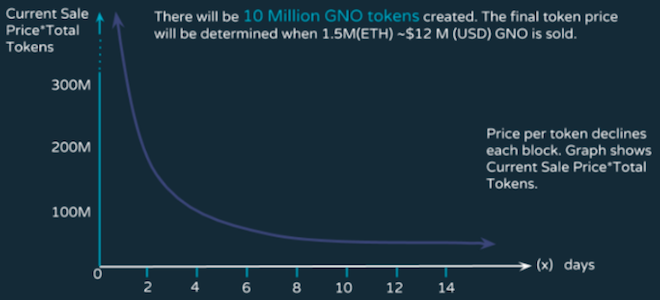

The Gnosis ICO employed a variation of this model which is commonly referred to as a “Dutch-style auction”. In this case, the price of tokens drops gradually as the sale goes on. Early contributors will have the opportunity to participate at a much higher price, while those who wait would be able to purchase at a lower price but run the risk of the tokens selling out.

The idea behind this model is to incentivize people to wait to buy the tokens. Since, in theory the longer you wait, the cheaper the tokens become, there will be a mix of people who both want to buy at the start of the sale at the higher price and a group of those who are willing to take the risk of the tokens being sold.

This should provide an even distribution of different types of investors across the board.

However, in the case of Gnosis, the plan backfired. The token sale ended in a matter of minutes, and since all the tokens were sold at a high price, the cap was reached and only 5% of the total token supply was distributed.

This brings up the important point that if you plan to have a Dutch auction, careful rules must be put into place to ensure that such an outcome does not occur with your ICO.

4. Uncapped Auction

- There is no limit to the amount of funds raised

- The market determines the price of the tokens

- Insiders are allocated a fixed amount of tokens prior to the sale

- Buyers bid for the tokens at a price which they choose

- Tokens are sold to the highest bidder first to the next highest bidder down the line until all tokens are sold

The main difference between this model and the capped option mentioned above is that this fixes the number of tokens which will be sold. The price of the tokens themselves, however, will be dependent on what price the contributors are willing to pay.

Tokens will be distributed to the highest bidder first, decreasing in price for the lower bidders until all tokens are sold.

Hybrid Sale Models

For every token sale model mentioned here, there are countless hybrid models which combine certain characteristics to reach desired results. Implementing a few of these techniques can help pull some of the advantages of one model into another, while still keeping key characteristics of the original.

A technique which has been implemented in the past is what is sometimes referred to as a capped “parcel limit”. In this distribution model, there is a limited number of tokens that a participant can purchase during the ICO. Usually there will be some sort of 2-factor code mechanism in place to make it difficult for someone to automate the process with a program.

This should in effect remove any “whales” from coming in and swooping up large percentages of the tokens.

But what has shown the most promise is implementing clever redistribution models which can, in effect, even the playing field for “ordinary” buyers.

An example of this is to host a capped sale which automatically refunds any amount collected over a set limit.

This will ensure that everyone who wants to participate will be able to do so. However, in the case where the ICO goes over its capped amount, supporters will receive fewer tokens than they wanted to buy because the tokens will be evenly distributed based on the relative amount contributed.

Another potential option is to host a reverse Dutch-style auction like Gnosis; instead of holding any unsold tokens, commit to some sort of automated sale or pre-planned donation. Brainbot or the Ethereum Foundation are all good options for donations. These organizations are working independently to develop the blockchain space.

If you want to sell any remaining tokens, it is possible to automate the process by selling the remainder at predetermined time intervals. This would remove the potential issue of your organization acting like a bank and manipulating currency prices, and will help to further decentralize the token distribution.

How To Choose Your Token Sale Model

There are trade-offs with each type of token sale model. Nearly every single high profile ICO has been met with bouts of harsh criticism.

Vitalik Buterin summarized it well when he stated:

We have still not yet discovered a mechanism that has all, or even most, of the properties that we would like.

Since there is no perfect ICO model, you’re going to have to look at your own organization and decide which one suits you best.

So ask yourself: what are the goals and desired outcomes of your ICO? Some potential goals your organization may have are:

Raise a Certain Amount of Capital

It is wise to align your desired funding goal with the actual estimated costs of developing your own platform. If you only need $10 million to accomplish what you’ve set out to do, then go for that funding goal. Ethereum has become what they are today after only receiving $14 million in their ICO.

Distribute the Tokens Fairly

How you want the tokens to be distributed will greatly affect the way in which you go about the token sale. There is no perfect way to achieve this but certain models promote even distribution more than others.

Enable Buyers to Purchase Set Percentages

Capped token distribution models will give you more control over the number of tokens sold. For example, if there are 1 million total tokens for sale, offering 900,000 of them in your ICO will give supporters the knowledge of exactly what percentage of the total supply they are purchasing.

Guarantee Everyone Can Participate

If you want to make sure that everyone who wishes to participate can do so, you’ll have to make sure that there are strict rules in place. These guidelines can help ensure that all interested parties can buy the tokens, not just those who are there the moment the ICO goes live or who are willing to pay astronomical gas fees.

The BAT ICO is a perfect example of what can happen when a relatively small number of “whales” swoop in and purchase a large percentage of the coins in a short amount of time.

Fix a Certain Percentage to Investors and the Development Team

If, for example, you want to reserve exactly 20% of the total tokens for the development team, you will want to have this determined well ahead of time and choose a token model which allows for this.

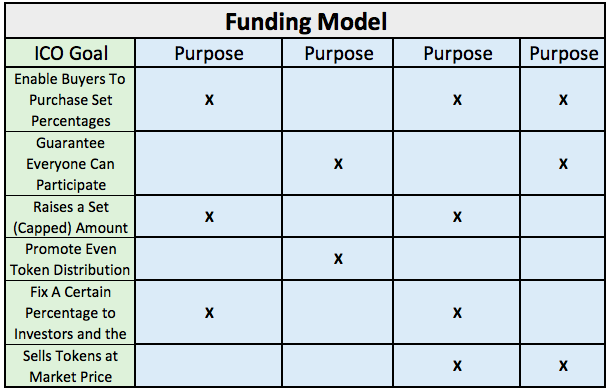

A summary of these considerations can be seen in the table below:

There are trade-offs with every model, and in some cases the inclusion of certain attributes will inevitably exclude others.

Example A

In this instance, let’s imagine that Company A wants to give buyers the ability to purchase a fixed amount of the total tokens in existence while also guaranteeing that everyone who wants to participate in the ICO can do so.

So they decide to sell 900,000 tokens at the value of $1 each. There are a total 1 million tokens that will be created and the investors know exactly what percentage they are getting prior to the sale. When the ICO is launched, the response is much larger than expected – backers with a total of $1.8 million to spend show up trying to participate.

But because this is a capped sale, the smart contract automatically ends the sale at the 900,000th token; the other $900,000 worth of contributions are not able to be accepted. This effectively “blocks” half of the potential contributors from being able to participate (assuming that everyone was contributing the same amount) in the ICO.

Example B

Company B is running an ICO and wants to make sure that everyone who wants to can participate in the token generating event. They host an uncapped sale of 1 million tokens. Like before, 10% of the total token supply is reserved for the founders. And like the previous example, the same number of supporters show up and contribute a total of $1.8 million to the ICO. This time all of the funds are collected, and every supporter receives 0.5 tokens for every dollar which was given.

See the problem though? Those same initial supporters now only get effectively half as much (by percentage) of the circulating supply as before, even though they contributed the same amount.

This is, in essence, the paradox we face with any distribution model. Allowing for certain parameters to be true will in effect exclude others.

Once again, when you are deciding on your token distribution model, you need to look at your own organization, and see what you are trying to achieve and what core values are driving you.

Take Note of Legal Considerations

The “wild west” days of the ICO are still here, but those days are starting to fade. Almost every major country in the world has started to introduce legislation regarding ICOs. China, for instance, temporarily banned ICOs all together until they can decide how to regulate them.

Since each country is going to have different rules and regulations, it is paramount that you do your own research to uncover the laws relevant to your organization and the country you are operating in.

Let’s take a look at three of the most popular countries in the world for ICOs and some of their specific legal considerations.

The USA

The SEC has recently announced that it would consider DAO tokens as securities. In December 2017, they released a statement to warn consumers of the dangers of ICOs. This was not the first time the SEC has released something like this; only a few months prior in July 2017, they issued a statement with a similar sentiment.

Announcements such as these seem to imply increased regulations are coming.

The USA’s securities laws are the most vague and the most frequently enforced of any security laws in the world. The laws of most countries generally have clear lists of which type of investments apply to which types of laws. However in the USA, “investment contracts” must follow differing laws depending on what type of investment they are classified as.

The SEC has stated that:

… federal securities laws apply to those who offer and sell securities in the United States, regardless whether the issuing entity is a traditional company or a decentralized autonomous organization, regardless whether those securities are purchased using U.S. dollars or virtual currencies, and regardless whether they are distributed in certificated form or through distributed ledger technology.

This means that even though if you plan to have your organization listed outside of the US, you’re going to have to play ball with the SEC.

There are two predominant schools of thought regarding dealing with the SEC. One is to ensure that your token does not pass the Howey Test, which would in essence make you obligated to treat your token as a security.

The second is to just assume that the SEC’s regulations will apply to you, and therefore make sure that you are completely compliant in case the SEC starts asking questions.

The Howey Test

The Howey Test was created by the US Supreme Court to decide whether certain things should be considered an “investment contract”. It is a standard test to see if an investment in a business will provide profits to the purchaser based entirely on the efforts of others.

The SEC has recently ruled that Ethereum is not be considered a security, while DAO tokens are. The main argument for this is that the main use of a DAO token is to be purchased and sold with the expectation of profit. Ethereum, on the other hand, has many uses, with the expectation of profits being the least of which.

Arnold Spencer of the Bitcoin ATM network Coinsource summarized it well:

If you buy an interest in a golf course to make money from the business, it is a financial investment and therefore a security. If you join a golf club to play golf, it is not a financial investment and not a security.

To help remove some of the ambiguity regarding this, Coinbase has came up with an excellent spreadsheet to help you decide for yourself if your token will be considered a security or not.

Switzerland

Switzerland is one of the most crypto-friendly countries in the world. The town of Zug is sometimes referred to as “crypto-valley” and is home of a few crypto giants such as the Ethereum Foundation, Bitcoin Suisse and Shapeshift.

In Switzerland, cryptocurrencies are generally considered assets, not securities. For this reason, their regulations for ICOs are less strict than the US. Partially due to relaxed nature of the regulations, Bitcoin Suisse (one of the world’s leading financial services provider for crypto assets) has helped advise on a number of hugely successful ICOs in the past such as Bancor, Status, OmiseGO, and Tezos.

Even in Switzerland, it’s important to make sure that you are following the rules. All businesses are required to abide by the Swiss Anti Money Laundering Act. In addition, any organization looking to be headquartered in Switzerland needs to be registered with the Swiss Financial Market Supervisory Authority (FINMA). But besides that, there are no additional regulations specific to cryptocurrencies.

Singapore

The Monetary Authority of Singapore (MAS) announced that “the offer or issue of digital tokens in Singapore will be regulated by MAS if the digital tokens constitute products regulated under the Securities and Futures Act (SFA).”

Generally speaking, cryptocurrencies issued from Singapore are not considered securities but are regulated as “assets”.

The MAS does not regulate the “soundness” of any digital currency. Singapore also has no Know Your Customer (KYC) laws like the United States, meaning that there are are a few less hoops you’ll have to jump through to legally sell your token.

The MAS stated that some token sales will be subject to the laws under the SFA while others will not. Those tokens which do fall under the SFA will “be required to lodge and register a prospectus with MAS prior to the offer of such tokens, unless exempted”.

The MAS will be looking closely at the function and utility of the token itself when deciding how to regulate. If ownership of a token is deemed to give rights over normal assets or property, they will be regulated in the same form as securities and collective investment schemes (CIS).

Singapore also has special government programs such as the MAS Sandbox, specifically designed to provide a medium to nurture emerging technologies.

All things considered, in terms of legislation of the crypto space, Singapore is arguably one of the most advanced countries and, not to mention, one of the most relaxed. In November 2017, the MAS even released their own Guide to Digital Coin Offerings, showing just how far ahead of the times they are. In comparison, most countries are still trying to figure out what to do about cryptocurrencies in general, let alone ICOs.

For further reading on blockchain-friendly countries, see “8 Blockchain-Friendly Countries From Around the World” and “How to Choose the Best Country for an Initial Coin Offering or Blockchain/Cryptocurrency Startup”.

Mitigate Your Legal Risk

Generally speaking, the way that your token will be legislated depends on the token’s function. Four of the most common uses for today’s tokens are: rights, toll, ownership, or reward. Some of these functions are more likely to put your token into the security category, while others are not.

If the token comes with an expectation of profits, if it arises from a common enterprise, or if the token’s success depends solely on the efforts of a third party, it is likely to be considered a security.

This is important because ICOs can easily be a “yes” on all of these points. Simply pooling your money together will fast track your company to be considered a common enterprise. Couple that with an expectation of profits based on the the work of the development team and “bingo!”, you just may have a security.

Knowing this means that you can take some proactive measures to ensure that you won’t meet this criteria (if that’s your goal).

The more ingrained the token is into the functionality of your platform, the less likely it will be considered an asset. Similarly, if an investor’s own actions largely dictate if the investment will be profitable or not, it is probably not a security.

If you build your token from the ground up with these classifications in mind, you can save yourself a lot of headache in the future.

Here are a few things (in no particular order) which can reduce the risk of your token being considered a security:

- Distributing the tokens only after the network is live (i.e. avoid a token presale)

- Ensuring that your tokens have specific use cases and are not just speculative investments

- Having your software be open-source to ensure that it’s not a scam

- Having a transparent blockchain

- Using open network validators such as Proof-of-Work or Proof-of-Stake

- Using open processes like mining to distribute tokens

As mentioned above, Waves has taken a very proactive approach with these issues. They have recently partnered with Deloitte to create a self-regulating body which will provide “reporting, legal, tax & accounting, KYC and business due diligence standards for ICOs and blockchain industry.”

In addition, they have been working with organizations like The ICO Governance Foundation in an attempt to be in the forefront of these discussions. Waves looks to set the standard for various best practices regarding ICOs such as the creation of reporting guidelines for ICOs, KYC and AML guidelines, and other standards for legal assessment and due diligence.

It is likely that as we move forward, there will be more organizations following suit and taking a proactive approach to ICO regulations.

Why Having a Legal Team is Important

If you are not sure if your token is classified as an asset or a security, it is best to err on the side of caution. It is better to put in the time now and play it safe than have the SEC banging on your door at a later time. There are a number of well-established organizations that have held off on holding an ICO for just that reason.

What is paramount is that you fully understand the rules and regulations specific to whichever country you are operating in, and which are specific to your token itself.

In order to do that, you are going to need legal advice.

You don’t necessarily need a “blockchain lawyer”. For one, they don’t really exist (yet). And two, even for the handful out there, they are most likely so backed up with work that you might be waiting a long time to hire one.

If you can find a lawyer who is interested and eager to take on the project, you’re already doing well. Someone smart will see that this is a huge opportunity to grow their expertise and potentially expose their firm to an entire new stream of business in the future.

Look for a lawyer and/or firm with as much experience as possible in the following industries: tax law, securities law, crowdfunding, and KYC laws. It is unlikely you will find the “perfect” lawyer, so just worry about finding “your” lawyer.

Coinbase has released a document called A Securities Law Framework for Blockchain Tokens which gives a good overview of some of the legal considerations for ICO events in the USA. This may be a good place for you and your lawyer to start in order to get familiar with current regulations.

One last thing to mention: just because your business is located in Switzerland, Singapore, Hong Kong or the Moon doesn’t mean that you are immune to the SEC’s tentacles. If you are doing business with US citizens, you’re going to have to follow their rules.

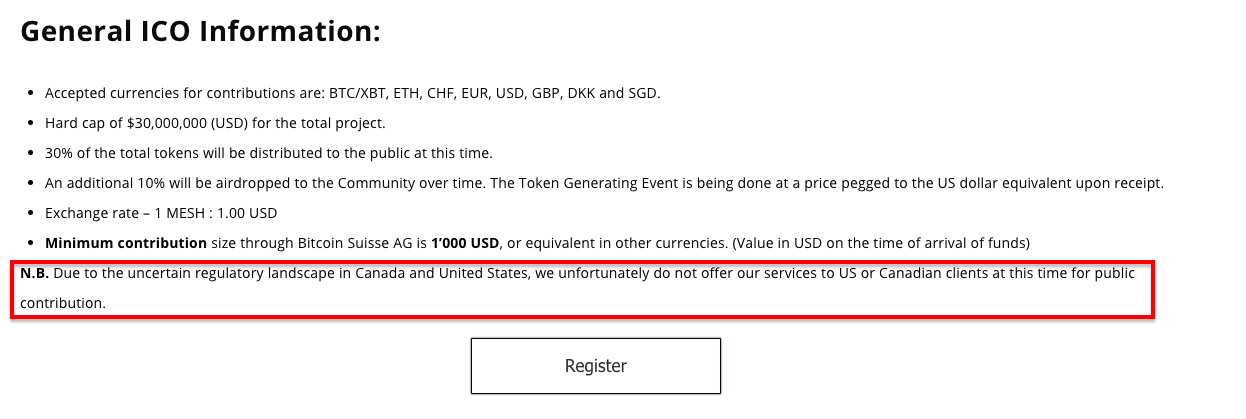

For this exact reason, some organizations have decided that it is just easier to exclude US and Canadian citizens from ICOs all together. Remember Bitcoin Suisse that was mentioned earlier? A quick look at their upcoming ICOs will show you what we mean:

Final Thoughts

You should have now a good idea of the platform to launch on, the token sale model you wish to implement and some of the legal considerations you need to consider. By this point, you will have made many of the biggest decisions necessary to run a successful ICO.

Although you’re well on your way, there is still more to consider.

In Part 3, we’ll focus on some of the “soft” skills required to run a successful ICO. We’ll cover topics like how to build trust around your platform, successfully host a pre-ICO, cultivate a community, build a social media presence and more.

If you would like to take another look at the basics of running a successful ICO, see “How to Run A Successful ICO (Part 1): Should You Even ICO?”.

Disclaimer: This article is meant to be an educational guide for people interested in running an ICO and is for information purposes only. It is not intended to be legal or financial advice.