The whole world seems to have gotten crypto fever. Seemingly every day, new entrepreneurs are learning about the potential uses of decentralized applications and blockchain technology, and are wanting to cash in.

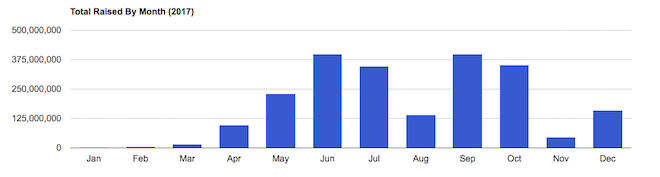

Together with this growth of the cryptocurrency space comes the growth of ICOs. 2017 was a blockbuster year for ICOs, with over $2.2 billion raised. This was up from $62.6 million raised in 2016.

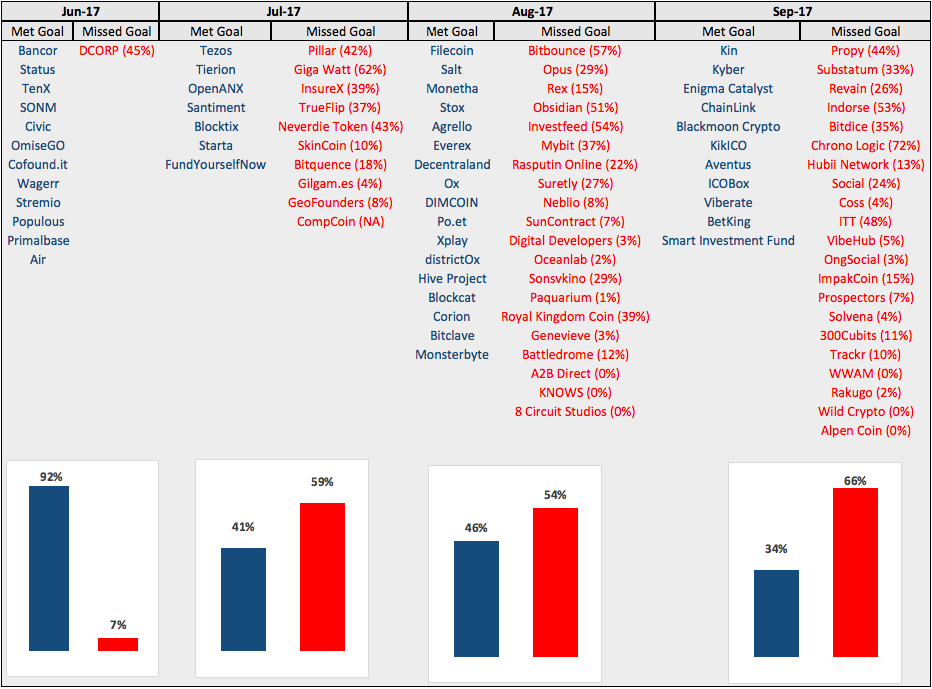

But what is getting missed time and time again are the best practices and foundations needed to launch a successful ICO. Statistics show that in September 2017, 66% of ICOs failed to reach their funding goal.

So what does it take to run a successful ICO in what is now a highly saturated and competitive space? We examine just that in this “How To Run A Successful ICO” series.

In this first article, we cover the basics of an ICO, the differences between tokens and coins, take a look at case studies of successful and failed ICOs and, most importantly, help you decide if an ICO is right for your business.

By the end of this article, you should have a good idea of whether or not an ICO is for your project, and what the next steps you should take to make it a reality.

This series of articles is for you if…

- You are crypto-literate, and familiar and well-versed in the space.

- You already have a blockchain-based technology which you are looking to bring to market.

- You are someone who is looking to host your own ICO for the first time.

Let’s get started!

What is An ICO?

An ICO (Initial Coin Offering) is a crowdfunding process where an organization sells a portion of or all of their cryptocurrency tokens to the general public for the first time. Traditionally, Bitcoin was the standard payment method. However, Ethereum has now become the most commonly accepted payment method. From time to time, you may also see other currencies such as the US dollar, Litecoin, or other cryptocurrencies being accepted in ICOs.

For a more detailed explanation on ICOs, read our article “What is An Initial Coin Offering”.

A Short History of the ICO

The concept of an ICO was masterminded by J.R. Willet. He administered the first ICO in 2013 when his project Mastercoin successfully raised around 5,000 bitcoins (worth about $500,000 at the time). Though Mastercoin no longer exists (it has since been converted to Omni), the funding model was adopted by other new cryptocurrency projects.

The ICO model has exploded in popularity since then, becoming a common and accepted form of funding for cryptocurrencies.

Total ICO Capital Raised by Month – From ICOWatchlist.com

Since the creation of the ICO, there have been a few massive success stories. Of course, we’ve all heard of the success of the Ethereum ICO. In the summer of 2014, they successfully raised $15.5 million and have gone on the become the number two largest cryptocurrency by market cap.

Since its creation, Ethereum has become the standard platform to host ICOs in the blockchain world. The process of issuing an ICO with an Ethereum smart contract is so common that it has been standardized into an ERC-20 token. A list of the Top Ethereum Tokens shows that some of today’s largest cryptocurrencies such as Augur, EOS, ICON and Populous are based on the ERC-20 contracts.

For further reading, also see: “The Ten Most Successful ICOs of All Time”

The Current ICO Market

The current ICO market has reached a level of craziness which we’ve never seen before. Some have even gone so far as to call it “grotesque”.

Fabian Vogelstellar, the key developer behind the ERC20 standardize token, stated that:

The problem right now is that too many people outside of the blockchain space focus on tokens and ICOs; frankly speaking, it’s the least interesting part of ethereum.

The infamous “Wolf of Wall Street” Jordan Belfort even stated that what is going on in the ICO market is “far worse than anything I was ever doing”.

Just a look at Coin Telegraph’s ICO Calendar shows how many ICOs are running right now. That’s great, except for one problem – most of these tokens have no business hosting their own ICOs.

Sure, there are more than a few “joke coins” out there (for instance, Jesus Coin and Useless Ethereum Token). However, there are also a lot of other projects which are using the ICO model simply to capitalize on a bullish cryptocurrency market but actually have no business creating their own tokens in the first place.

Before We Begin: Should You Even Have An ICO?

This is the first question that every cryptocurrency team needs to be asking themselves and it is one, which frankly, needs to be asked more.

The reality is that anyone thinking of launching an ICO needs to take some time to decide whether it is even necessary to have one. It will save everyone, especially you and your project, a lot of time and energy.

Ask: Is an ICO actually right for your business?

Ask: Is an ICO actually right for your business?

William Mougayar said it well when he stated that a token is simply:

A unit of value that an organization creates to self-govern its business model, and empower its users to interact with its products, while facilitating the distribution and sharing of rewards and benefits to all of its stakeholders.

That is the point of a token distribution: to distribute something that has value and is integral to your business to a key group of supporters.

A fancy marketing campaign may help gain initial project backers. However, the token usage relationships and how the tokens specifically plays into your business model are the most important factors which will affect your token’s success in the long run.

Aside from whether your business model will benefit from a token distribution in the long-term, here are some other key questions to ask in order to get you going in the right direction:

- Does your token have utility? Do you actually need the coin?

- What is the value of having the coin?

- What will your platform add to the crypto/blockchain community that isn’t already being served by another project?

- Does your technology need its own token, or will another serve the same purpose for you?

- How will you offer your token? What token distribution method will you use?

- How will you issue and accept contributions: Bitcoin, Ethereum, or other cryptocurrency?

- What are some of the use cases your token will have?

Why Have an ICO?

In some regards, an ICO is similar to an IPO where a company offers ownership shares of its company to the general public for the first time. However, there are some key differences which cannot be stressed enough.

The main difference is: with an IPO, you are purchasing a portion of the company itself. With an ICO, you are not.

There is a lot more flexibility with an ICO and what you, the entrepreneur, are actually selling to the public can vary greatly depending on the coin. Unlike IPOs, there are currently very few (or even no) regulations governing ICOs and what you are actually required to do.

The name “ICO” is actually a bit of a misnomer. “Token Donation Event” or “Token Crowdfunding” would be a much more accurate way to describe an ICO.

Tokens vs Coins: What You Need To Know

These two terms, tokens and coins, tend to be used incorrectly. The difference comes down to the cryptocurrency’s functionality.

Generally speaking, a coin is designed to be a simple transfer of value and is normally on its own blockchain. In this case, “simple” means that the value of the coin is not dependent on numerous dynamic functions. Examples of coins are Bitcoin, Litecoin, Bytecoin and Monero.

A token, on the other hand, tends to be multi-functional. It can be defined as a digital asset which can be programmed to store and use multiple levels of value. Examples of this are voting rights, memberships, flight rewards, IOUs to physical items, or virtual items used in a video game.

Simply put, a token can be almost anything which is programmable on top of a “smart-contract” blockchain.

Many times, tokens are initially hosted on another platform’s blockchain, and then later are switched over to their own chains later on. For instance, EOS, OmiseGO and Tron are all ERC-20 tokens currently hosted on the Ethereum blockchain. Qtum was initially hosted on Ethereum, and then transferred over to their own blockchain months after their ICO.

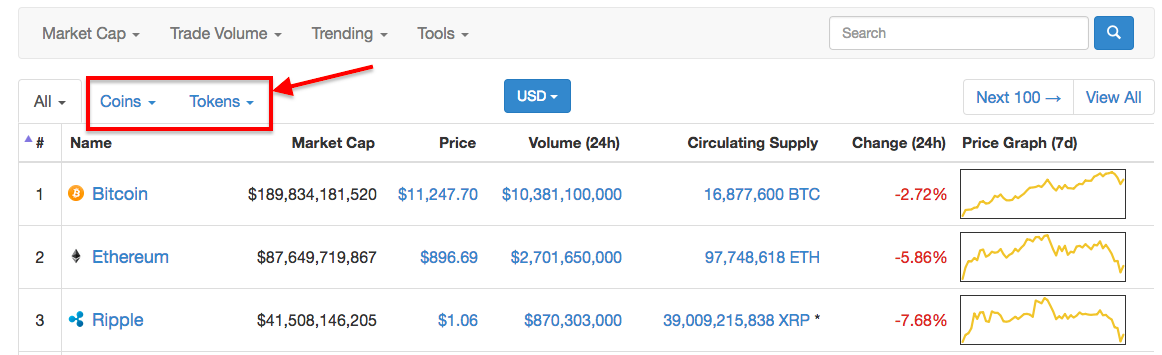

Since you’re interested in hosting an ICO, you will most likely be interested in tokens. You can look at an up-to-date list of tokens and coins on Coinmarketcap by clicking on the tabs as shown below.

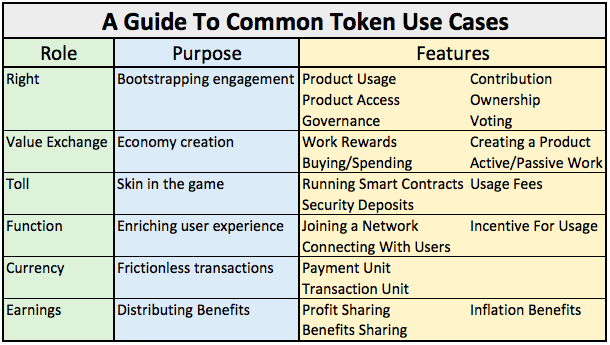

Common Token Use Cases Explained

Use cases are crucial to your token’s success. It doesn’t matter how good your team is; if the token doesn’t have any intrinsic value in your platform’s ecosystem, it will fail in the long run.

The following table shows the most common uses for tokens. If your token isn’t serving at the very least one of these options (but ideally more than one), the token isn’t needed so you shouldn’t be considering an ICO in the first place.

Data Source: William Mougayar

Here’s a brief explanation of each token use case:

Currency

This is probably the first thing that comes to mind when you think of how a cryptocurrency can be used. The easy P2P transfer of value is the basis on which Bitcoin was founded. Other cryptocurrencies such as Litecoin and Monero have a similar function.

Value Exchange

This isn’t necessarily monetary value exchange but an exchange of ideas and concepts. For instance, think of posting content on Facebook or YouTube. A reward for posting good content would be receiving a token which has monetary value attached to it.

By posting content which is “valuable”, you benefit the community and platform as a whole. Steem is attempting to revolutionize the social media world by doing just that. Everpedia plans to do this in the future as well using the EOS blockchain.

Toll

This is the fee which you must pay to use the platform’s services. It is one of the most common token usages today. This is commonly seen in network fees for digital currencies such as Bitcoin and Litecoin. It is also seen commonly seen in smart contract platforms as the cost to execute a smart contract, like on Ethereum.

Function

In this use case, the token itself will be used to enrich the user’s experience. Think, for instance, of being able to watch a video without any ads by paying with a YouTube token. Well, this is exactly what the Brave Browser aims to do with their BAT token. They are offering users a way to “opt out” of viewing advertisements when they browse on the internet and social media.

Right

Token holders are afforded some sort of privilege. This could be voting or a type of governance privilege. The DAO was a famous attempt at this, but there have been others since then such as Firstblood, Tezos and SwissBorg where tokens have similar power.

Note: These coins are currently not the norm. Vitalik Buterin has predicted that these type of “tokens 2.0” will start to become much more common in 2018 and 2019.

Earnings

In this case, a token holder would be entitled to receive a portion of a company’s earnings. This is a feature commonly seen today with stock dividends from traditional securities, but it is almost unheard of in the cryptocurrency world.

An example of this would be how holders of NEO tokens are paid in NEO Gas based on the number of tokens they hold. No staking or mining required. If Buterin’s predictions come true, we will see more tokens like these in the future.

Know What You’re Getting Yourself Into: Most ICOs Will Fail

Though there have been some great ICOs over the years, there have also been a lot of bad ones. Sadly, a lot of ICOs are just garbage, and even most of the good ones will fail. That’s the prediction from Vitalik Buterin.

When Buterin said this, he was referring to a new project as a whole, not specifically the ICO itself. That is, you can hold a “successful” ICO, have a great team and a great technology but ultimately not succeed in what you set out to do.

That said, if we consider whether ICOs hit their funding goal, most fail at that too. The number of ICOs which missed their targets rose from only 7% in June 2017 to 66% in September of the same year!

For the remainder of this article, when we refer to an ICO “failing”, it will generally mean “failed to hit their funding goal”, not the project failing as a whole.

The table below is a breakdown of ICOs from June to September 2017, showing which ones failed or succeeded in reaching their funding goal.

Data Source: Hackernoon

Data Source: Hackernoon

Common ICO Mistakes

There are a lot of factors which play into an ICO failing or succeeding, and it would be extremely time-intensive to analyze why each ICO “failed”. That said, there are common mistakes that should be avoided.

As today’s ICO market is saturated and competitive, avoiding these mistakes is paramount in setting your organization apart.

The ICO is A Scam From the Start

It bears mentioning that there have been numerous ICOs in the past which were scams from day one. The “team” had no intention of following through on the promises which they laid out. But in a new industry with a lack of regulations, it is easy for someone to create a coin out of nothing and then disappear after collecting the funds raised in an ICO.

You must be honest and transparent with your intentions if you wish to succeed. Project supporters are becoming increasingly more sophisticated, and it takes more convincing than ever before to persuade them to part with their money and invest in a project.

Flawed Economics

Is the coin crucial to your business? Could it run without it? ICOs have started to replace traditional forms of venture capitalist funding, but the days of being able to write a whitepaper and get $10 million are over. It is competitive out there, and if your business isn’t centered around the token, it is likely to fail.

A good question you should ask is “can my company run without this coin?”. If it isn’t absolutely crucial to your business model, you may want to rethink even having an ICO in the first place.

Issues Due to Poorly Written Code

ICOs have repeatedly had issues due to poorly written code. This has led to glitches in the smart contract or hackers exploiting weaknesses in the programming for their own personal gain.

This can lead to the theft of huge sums of money and also leaves supporters of your project questioning your capability to follow through on your promises.

About 60% of projects go with the standardized ERC-20 token for this exact reason. It has been tried and tested. About 30% of ICOs choose to do so on their own blockchains and the remainder go on other platforms. If you are doing the latter, be extra cautious.

Linked to this issue is when the platform you’re launching your coin on can’t handle the transaction volume experienced during the ICO. This is seen time and time again when a popular ICO is launched.

The most noteworthy example is the BAT ICO, where 35 million dollars were raised in under 30 seconds. One user even paid over $6,000 in gas fees to put their transaction at the front of the line to ensure that they got their tokens before the hard cap was reached.

If you think your ICO will experience large transaction volume, be sure to take preemptive actions to mitigate these effects.

The Project is Too Ambitious, or is Trying to Do Too Much

Sure, it’s great that you want to be a P2P anonymous currency that can also do smart contracts and dapps; but maybe trying to do it all will just cause you to fail at all of them. For this reason, some projects have opted to go back to the basics and focus on just one or two things – doing them well.

Nano (formally Raiblocks), which focuses solely on solving coin scalability problems, is a great example of this.

If you’re trying to do too many things at once, you might find it harder to get people to understand and support the endeavor. Most supporters need to understand the project fully before backing a project. So, it’s important to make sure you can clearly convey what you are trying to do, and how.

Small Target Market

Problems can also arise from being too specialized to a point of uselessness. This has been happening more frequently as more niche coins come out. It might be cool have a coin specialized for marijuana or gamer sales, but what’s to stop people from just using another established currency to pay for these things?

A large target market will greatly help you on your way to success. A small percentage of a multi-billion or trillion dollar industry is far better than a larger percentage of tiny market.

Lack of Regulatory Awareness

ICOs are operating in a grey area as regulations are currently relatively lax. But the “wild west” days of the ICO are starting to fade. China temporarily banned ICOs. The SEC has recently made an announcement regarding ICOs, making a distinction between digital currencies such as Bitcoin and DAO tokens, which from now on will be treated as securities.

The SEC announcement went on further to state that “the federal securities laws apply to those who offer and sell securities in the United States, regardless whether the issuing entity is a traditional company or a decentralized autonomous organization, regardless whether those securities are purchased using U.S. dollars or virtual currencies, and regardless whether they are distributed in certificated form or through distributed ledger technology.”

It’s only a matter of time before more regulations are introduced. But for now, know that anyone looking to host an ICO must do their due diligence to ensure that they follow the appropriate laws of the country they’re operating in.

Having Poor Technical Documents and Website

Sophisticated supporters will be looking at your technical documents or whitepapers to see exactly what your platform is trying to accomplish. Nowadays, it is common to see multiple whitepapers explaining different aspects of a project. These whitepapers must clearly articulate the reasons that the potential contributors will want the coins in the first place and spell out any benefits and use cases of the tokens.

Paired with this, a professional website is essential to market your project.

Failing to Market Your ICO and Build a Community on Relevant Platforms

If you are starting from scratch, like most of you will be, this is probably the most important step you can take to ensure your ICO’s success. In years past, most of the founders were active members of the blockchain community, and so they already had a huge leg up when it came to building trust and a following.

Nowadays, a successful ICO needs a coordinated and strategic plan to market and increase awareness about the project. This includes but is not limited to: press releases, subreddit, Bitcoin Talk forum thread, Facebook page, Twitter account, Telegram, Slack and Discord, just to name a few.

We will take a closer look at how to successfully market your ICO later in this series.

A “Weak” or Silent Team

Potential supporters need to know exactly who the key players on your team are. They also need to know your team’s background and expertise. Having a few well-known advisors will go a long way. Nothing erodes confidence like an ambiguous list of team members with little information to flesh out their expertise and skills.

Notable exceptions to this would be platforms such as Komodo where, in the spirit of anonymity, they have chosen to keep the identities of most of their team hidden.

Anonymous in no way should mean silent, however. If you have a good team but they are non-existent in the community, people will begin to worry. Your team should be active on the above mentioned channels, answering questions and concerns from community members.

What You Can Learn From ICO Failures

Now that you know some of the most common mistakes people make when running an ICO, let’s take a look at case studies of some well-known ICOs and see what went wrong.

The DAO

The DAO is probably the most well-known ICO failure of all time. In July 2015, a hacker was able to exploit a loophole in the Ethereum smart contract and steal about one third of the total $150 million raised for the project.

The hacker was never caught, and the result of the attack caused a hard fork of the blockchain, leading to the two chains, Ethereum and Ethereum Classic.

The “loophole” in the code had been brought up to the developers prior to the attack but was considered to be insignificant. This faulty code caused over $50 million to be lost and resulted in not only the hard fork, but arguably the failure of The DAO as a whole.

Further reading on The DAO attack and its aftermath can be found here in our article, “What is Ethereum? Everything You Need to Know”.

CoinDash

In July 2017, 43,500 ETH (valued at around $10 million) was stolen during the CoinDash ICO. A clever hacker cloned CoinDash’s website, CoinBase.io, and contacted CoinDash’s DNS server using a fake registered email to request the site traffic to be redirected to another site.

This site contained different Ethereum addresses and caused CoinDash project supporters to send their coins to an address controlled by the hacker. CoinDash has received a lot of criticism for failing to secure their site and some have questioned the competence of the team.

MaidSafe

The Maidsafe ICO dates back to 2014, where they accepted both bitcoins and Mastercoins as payment. Originally the plan was to only have about 10% of the $8 million funding goal to be paid via Mastercoins. However, due to what was described as a “technical failure”, about 60% of the funds raised came in the form of Mastercoin.

The problem? Mastercoin was a relatively uncommon and illiquid currency. The huge increase of market activity for the coin caused its price to rise considerably as the ICO approached, and this was followed by a subsequent market dip once the event had concluded.

Maidsafe was stuck with millions of dollars of a quickly-devaluing currency, and even worse, they were unable to liquidate the coins in the market because the huge increase of coins being sold would result in the price of Mastercoin to drop sharply.

Gnosis

For the first time in an ICO, Gnosis implemented what is referred to as a “Dutch-style auction”. The way this works is that the coins initially sold would be most expensive, with the price gradually decreasing with each block. The goal was to sell 9 million of the total 10 million supply of Gnosis coins, with a cap of $12.5 million for the token sale.

The point of this was to dissuade investors from rushing in and buying all of the coins at once. Since waiting would get you a cheaper price, it makes sense that people would wait to buy their tokens, right?

Wrong.

The token sale reached the $12.5 million cap in only 12 minutes.

Now why is this a failure? After all, didn’t they reach their funding goal?

Well, in a sense, yes. But it completely missed the point of a token distribution because the tokens weren’t really distributed. Since no provision was written into the contract restricting the number of tokens reserved for employees, only about 5% of the total supply of coins were ever sold to the public.

This now leaves Gnosis in the sticky situation of figuring out how to distribute their remaining tokens without severely devaluing the ones currently on the market.

What You Can Learn From Successful ICOs

Now that we’ve examined some well-known ICO failures, let’s take a look at a few ICO success stories and what they did right.

EOS

EOS is in the midst of an almost year-long ICO. They have already raised at least $700 million for their project, selling about $2 million worth of tokens each day. That’s a lot of money considering the fact that EOS has yet to release a product.

But what has EOS done to attract so many investors? Well, for one they have a very strong team, led by Brendan Blummer and Dan Larrimer. They also had an impressive list of investors and backers before the ICO such as Fenbushi Capital, Blockchain Capital, Li Xia Lai, Michael Cao, Bitfinex, Yunbi, Aurora Investment advisors, Hyperchain Capital. Seeing big names backing a project will always get people excited.

EOS also ticked all the boxes in terms of social media and community forums. Prior to launch, they already had their telegram, reddit, whitepaper, website and blog set up and and firing on all cylinders, creating hype and getting people excited.

SwissBorg

Since we can’t all have Dan Larrimer on our team and most of you interested in running your own ICO probably won’t have a powerhouse team of developers and backers at your disposal, you may have to go about it a different way.

Let’s take a look at another recent ICO which had slightly more modest means but was still able to host a successful ICO – SwissBorg.

SwissBorg started from the ground up doing everything right. They had a professional-looking website. They also had a great list of technical documents including a whitepaper which clearly laid out what they were planning on doing, why they were selling their CSB tokens, and what token holders get in return.

Swissborg also had all their community channels and platforms ready before the ICO started, with links to all of them neatly laid out on their website.

SwissBorg’s Community Channels

Swissborg took it a step further and sponsored various press releases on The Merkle, CNN and here at Invest in Blockchain, to name a few. This allowed them to get the word out about their project and ICO, and reach people who weren’t aware of them.

All of this led to a smooth and successful ICO, with Swissborg successfully hitting their hard cap funding goal of 50,000,000 CHF.

Final Thoughts

By now you should have a good idea of what an ICO is, its purpose, and whether or not you should be having one in the first place. We’ve taken a look at some ICO success stories and failures, with the hope that you’ll avoid the same mistakes.

If you’ve reached this point and you still think that an ICO is right for your business, then it’s essential to set your ICO up for success. In How To Run A Successful ICO: Part 2, we take a look at how you can best prepare to launch your ICO.

Disclaimer: This article is meant to be an educational guide for people interested in running an ICO and is for information purposes only. It is not intended to be legal or financial advice.