NEO originates from the ancient Greek prefix, ‘νεο-’, meaning ‘new’, ‘modern’, and ‘young’. We quite like the idea of an old word with the meaning of youth. It brings about the feeling of a gateway that leads us from the physical world to the digital.

When you google the name, you generally hear NEO referred to as “China’s Ethereum“. But in truth it is much more than that.

NEO, formally Antshares, was founded as both a community-driven and funded project with the goal of using blockchain technology to digitize assets using smart contracts and common programming language.

The similarities between NEO and Ethereum are quite apparent: both are smart contract development platforms which are attempting to bring blockchain to the masses.

But NEO has learned from Ethereum’s mistakes, and thanks to various technological advances, has positioned itself to become the world’s premier smart contracts platform.

They have branded themselves as the “smart economy”, not wanting to only be known to speculators but for its value in the new post blockchain era.

So, What Does That Mean?

What NEO has actually set out to do is enable businesses to manage smart contracts effectively, safely and legally.

That comes down to two separate parts: ‘smart assets’ and ‘smart contracts’. I won’t go into too much detail on these here but a smart asset can be described as a programmable asset which exists in the form of electronic data. Think of this as something of value, such as a stock in a company, a title to a house, or loyalty reward points.

For a thorough discussion on digital assets and smart contracts see: “Digital Assets and Smart Contracts: A Beginner’s Guide“.

A smart contract is in effect a customized blockchain which enables you to execute certain actions automatically. For instance, if an online shopper wants to buy something, the online retailer wants to make sure that the item has been paid for before sending it. With a smart contract, the item can be automatically sent only after the agreed upon amount has been paid. This would eliminate the need for a third party to act as a middleman (like Paypal cough, cough) and therefore also eliminate the 2.6% fee that Paypal charges.

With blockchain technology, smart assets and smart contracts can be decentralized, transparent and can exist without intermediaries.

NEO also operates with digital identities. This means that when smart contracts execute, individuals will have their identities associated with the smart assets. Though to some, digital identities can been seen as going against what blockchain is trying to do, it comes with various advantages such as increased industry compliance and the ability to add security measures such as facial recognition, voice, SMS and other multi-factor authentication methods.

The NEO Team

The founder of NEO is Da Hongfei. He has been working in the crypto world since 2011, and has worked on numerous projects before founding NEO.

Erik Zhang and Li Jianying are the core developers and technical experts of the NEO project.

Tony Tao is the CEO of NEO and founder of Nest Fund.

NEO has an extremely credible and active development team with both in-house developers and various third-party developers such as City of Zion, NEOtracker and PeterLinX. One of the NEO’s strengths is its large community of third-party developers. Hongfei has said that the NEO in-house team will be focusing on developing the platform, while the development of DAPPs (decentralized apps) will be left to the community.

The NEO subreddit page has over 33,000 subscribers, and it’s growing every day!

In total, NEO has about six full-time developers located in Shanghai and a few dozen more contributing code and ideas as community members. This may sound like a small number but keep in mind Bitcoin itself only has about 15 core developers.

But They’re Not the Only Ones…

There are a lot of smart contract platforms currently being developed. Some of these names include QTUM, NEM, UBIQ and the biggest of them all: Ethereum, the world’s most well-known smart contract platform and the number two largest cryptocurrency by market cap. Ethereum has the competitive advantage of being the first mover in the smart contract space, and in addition they have a competent community backing their tremendous growth.

When asked about NEO’s competition with Ethereum, lead developer Erik Zhang responded by saying that NEO has at least three distinct advantages over Ethereum:

-

Better architecture

-

More developer-friendly smart contracts

-

Digital identity and digital assets for easy integration into the real world

For a closer look on the differences between NEO and Ethereum, see “NEO vs Ethereum“.

NEO’s Competitive Advantages Explained

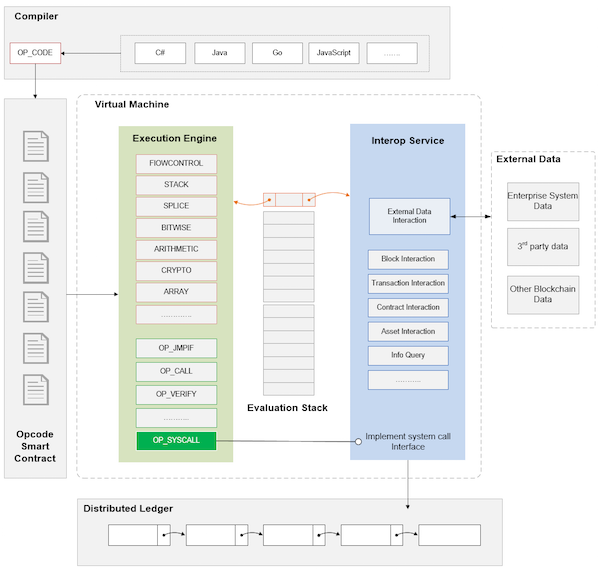

As described in the NEO whitepaper, NEO developers can write smart contract protocols using common programming languages such as Java or C#. Ethereum, on the other hand, developed their own programming language which developers must learn first before creating smart contracts on the platform.

NEO supports these coding languages through use of a compiler; Ether supports one language – Solidity. This is an obvious edge for NEO.

NEO built its own consensus mechanism different than that of Ethereum (Ethereum uses PoW) called dBFT. In addition to being fast (it is capable of handling up to 10,000 transactions per second, compared to Ehereum’s 15 per second), it is two-tiered.

The first tier is like PoS where you use your stake to vote on who can take part in the consensus process. In the second tier, the nodes which were voted to participate will then take place in a BFT-style consensus which has some technical advantages such as removing forks and added finality or ease of confirmation.

A notable difference between NEO and its competitors is the way you pay to use their services. With Ethereum, you pay a system fee to utilize their blockchain. This is generally paid in the form of a small fraction of an Ethereum coin.

With NEO, you don’t pay to use their services with NEO coins, but with Gas.Their reason for this: “You wouldn’t pay for an apple with a share of Apple (the company)”. So they decided to de-couple it and that’s how GAS was formed.

In the genesis block where the initial 100,000,000 NEO was made, GAS wasn’t made with it. Instead, GAS is slowly generated over the course of 22 years, with the amount of GAS you get per NEO slowly decreasing. All NEO holders are paid GAS in dividends, with 1 NEO giving you 1 GAS over the course of 22 years. The more NEO you have, the more GAS you get (per day). As users spend GAS, it gets recycled into the system. The more GAS that is used, the more that’ll be recycled and given to all holders.

NEO itself isn’t divisible, as it is a share in a company, but GAS is divisible so it is generally used as a form of payment.

How to Purchase and Store NEO

NEO currently offers an Android mobile wallet, a Linux, Windows and Mac Desktop wallet and an online wallet. All can be downloaded here. There are light options available for users who aren’t interested in development so you won’t have to sync the full blockchain to store your coins.

As mentioned before, anyone who has NEO tokens are able to stake your coins to earn NEO Gas. NEO Gas, or just Gas, can be thought of as a dividend that NEO pays its users for holding its coins. But to do this, you need to have your NEO stored off of an exchange and on your own wallet (which you should be doing anyway).

Another important point regarding NEO tokens is that they aren’t divisible. In other words, you can’t buy half a NEO. This is important when you are taking your coins off the exchanges.

Most exchanges charge a flat fee of 1 NEO to withdraw (ouch!). If you, for instance, had 10.5 NEO tokens on an exchange (you can have decimals on the exchanges only) and wanted to withdraw all of the coins, the exchange would take one coin as a fee, then round off the 0.5 leaving you with only 9 coins! Before you withdraw, make sure that you purchase to make your coins whole numbers (in this case, add an extra 0.5).

NEO, Is it the One?

NEO, the Ethereum of the East, has made huge strides in the last few years and has seen explosive growth. They have strong leadership, an experienced development team and a devout community pushing their platform.

Their cooperation with Microsoft has only moved to put them in a more favorable position and the adoption of their software by the software giant only looks to strengthen NEO’s position.

This isn’t to say that everything is positive for NEO. They have lots of competitors at their heels and even though many claim this isn’t something to be worried about, I’m not convinced. NEO also lacks a clear roadmap for the future of the platform that investors and supporters alike can look to. This sometimes leads to investors and community members scratching their heads when trying to see what’s coming next. This coupled with China’s recent ICO ban leads to a lot of speculation as to what comes next.

But NEO has a strong base and enough capital to last for a few years. That, coupled with their attractive staking rewards and huge potential market, means there is a lot to be excited about when it comes to NEO.