Flying the banner “rebuilding finance”, Wanchain is a growing team of engineers, developers, cryptographers, technologists, PhDs and marketers whose aim is to improve existing financial infrastructure.

Wanchain’s vision starts with the premise (and expectation) that the world is moving toward an all, or mostly, digital economy, and in response, they’re building a global financial blockchain platform that uses cross-chain smart contracts to power this new economy.

The current financial system relies on a network of traditional banks, Wanchain is taking the promise of blockchain to build a distributed bank.

As stated in their whitepaper:

Wanchain seeks to build a new, distributed infrastructure of digital assets to form an improved, modern framework.

Once complete, the Wanchain platform will allow any institution or individual to set up their own virtual teller window in the “bank” and provide financial services like loans, settlements, and credit payments with digital assets.

What Problem is Wanchain Solving?

The first question that needs to be asked of any new crypto project is: what problem is being solved? If there isn’t a solid answer to this question, you’ve got a red flag.

In Wanchain’s case, the answer to this question is obvious and simple. The number of digital assets and blockchains has proliferated at a dizzying pace in recent years but there’s still not currently an efficient, decentralized way to exchange value between them.

Today, a crypto user may be required to download numerous wallets and rely on centralized exchanges to conduct all their financial dealings. This entails a lot of hassle and counterparty risk. DEXs are popping up, but looking at the current state of the crypto ecosystem, there is still much room for improvement.

It’s into this breach that Wanchain is stepping.

The main goal of Wanchain is to solve the issue of value transfers between different ledgers (blockchains).

According to the whitepaper:

Wanchain is using the latest cryptographic theories to build a non-proprietary cross-chain protocol and a distributed ledger that records both cross-chain and intra-chain transactions.

Just as traditional banks are the bedrock of our current financial system, Wanchain is positioning itself to be one of the distributed banking solutions of the future. By linking chains, Wanchain will keep costs down, eliminate single points of failure and, ultimately, help the world’s unbanked population by providing easier access to financial services.

As its own blockchain, Wanchain achieves the above by syncing the accounts of various other chains to provide a simplified framework for exchanging digital assets.

The functionality of the platform extends far beyond transfers, and to think of it in terms of a one trick pony is a mistake. Via smart contracts, privacy protection protocols, and its native token (WAN), you can use also Wanchain to build a wide range of financial applications, something we’ll discuss later in this article.

How Does Wanchain Work?

Wanchain started as a fork of Ethereum, and is now an independent, separate blockchain.

There are many important components that make up this platform but any discussion of how Wanchain works must start with its cross-chain communication protocol.

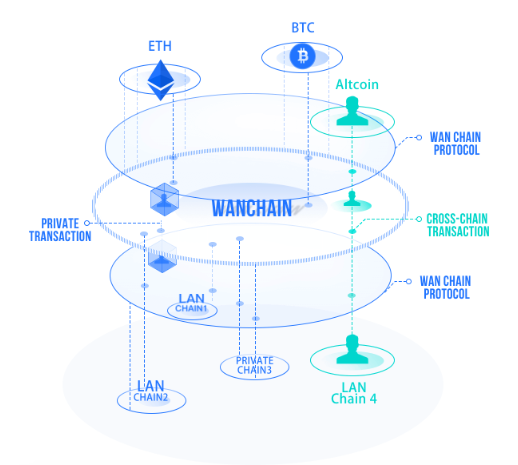

Before we get to that, here is an overview of Wanchain’s architecture:

Cross-Chain Communication Protocol

The centerpiece of Wanchain’s technology is the cross-chain communication protocol which allows for data transfer between otherwise unconnected blockchains. These are the connections that will provide the framework for the “distributed bank.”

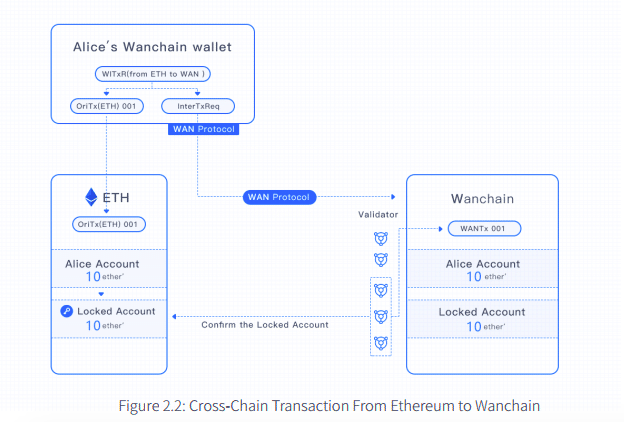

The protocol has three core modules:

- The registration module records the chain from which a transaction starts and also keeps track of any asset transfers.

- The cross-chain transaction data transmission module initiates any cross-chain transfer requests, checks the response of a validator node, and processes the transfer from the validator node to the original chain.

- The transaction status query module acts as a monitor for all cross-chain transactions.

Poke further beneath the surface and you’ll find things get complicated quickly. This protocol works on the “basis of complex algebra, locked accounts with SMPC enables low threshold to convert any digital asset from any blockchain into a corresponding proxy asset on Wanchain’s blockchain.”

In other words, the Wanchain team has found a way (with the help of smart contracts) to accurately and securely transfer data from one chain and represent it on the WAN chain. This interoperability mechanism is what positions Wanchain as the glue that can hold future financial systems together.

Here’s a visual of what a transfer looks like in practice:

Smart Contracts and Transaction Privacy Protection

Wanchain’s blockchain builds upon the (considerable) strengths of Ethereum. Any Ethereum dapp can be run on Wanchain without the need for any code changes. And to boot, applications can be strengthened with Wanchain’s APIs, leveraging other benefits like privacy protection.

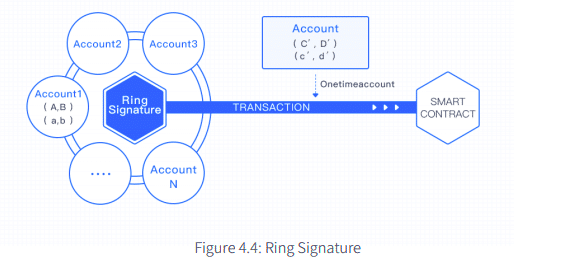

The option to execute private transactions, similar to those provided on privacy coin platforms like Monero, is another key feature offered by Wanchain. This makes them one of the first to attempt to implement a privacy feature into smart contracts.

Wanchain uses ring signatures and a One Time Address (OTA) generation system to allow users to protect their identity. Senders can sign transactions without revealing their identity, and receivers can verify the sender signed off without compromising privacy.

The third privacy layer offered is what Wancahin refers to as the “private send” function, which “breaks down every transaction input to a standard denomination, thereby providing further obfuscation to the transaction amount.”

In concert, these three features provide a high level of privacy for Wanchain users.

Wanchain has plans to join Ethereum in its move to a Proof-of-Stake (PoS) consensus algorithm. The platform intends to adopt solutions like Plasma and the Raiden Network as well.

There are many other technical features such node consensus verification mechanisms, a smart contract virtual machine, and the locked account generation scheme that make Wanchain tick.

For further technical information, refer to the Wanchain whitepaper. Or if you prefer a shorter read, check out the commercial version.

Wanchain Applications

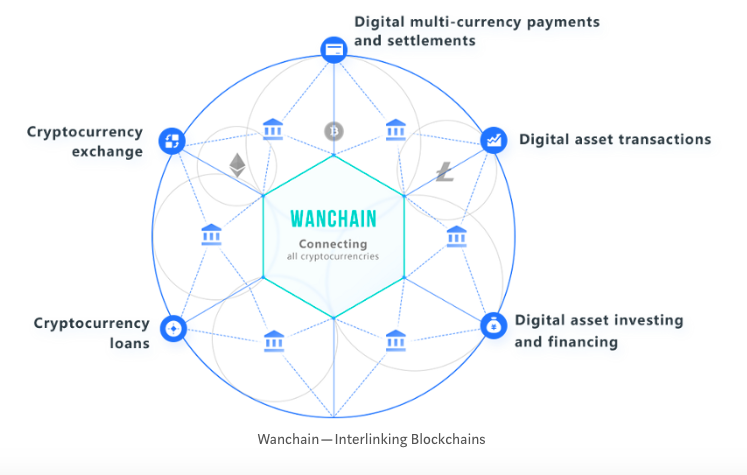

The vision is for users to utilize Wanchain the same way you would use any other bank. Borrow or lend money, make payments, conduct transactions, perform digital currency exchanges and invest — you name it.

In an effort to make interconnection between different blockchain ledgers a reality, Wanchain envisions three general groupings of use cases:

- Decentralized exchanges: Users can transact using Wanchain’s multi-currency wallet and exchange digital assets “on chain”.

- Asset management tools: Users can minimize the counterparty risk associated with using centralized exchanges, and conduct transactions privately.

- ICO platforms: Wanchain streamlines the ICO process making it easier to collect funds from a wide range of currency denominations.

Under these larger umbrellas are more specific uses like digital currency debit and credit services, mechanisms that allow more third-parties to perform clearing & settlements, and commercial financing and derivative investment.

As more big players get involved in crypto and the public at large warms to it, the demand for ease of use and access to crypto will go through the roof. In the near future, it’s not hard to imagine how valuable a super-exchange or a cross-chain network like Wanchain could be. As the technology evolves more and more, additional use cases will become possible.

The Wanchain Team

The Wanchain Foundation is a non-profit organization that (among other things) raises capital and supports open-source projects. Wanchain was founded by proven blockchain entrepreneur and technical expert, Jack Lu. Lu previously cofounded another notable crypto project, Factom, and blockchain startup, Wanglu Tech.

Lu launched Factom in 2014 and successfully raised over $9 million to fund its development. Factom’s current market cap is US$167 million, a positive check mark for anyone curious about past performance.

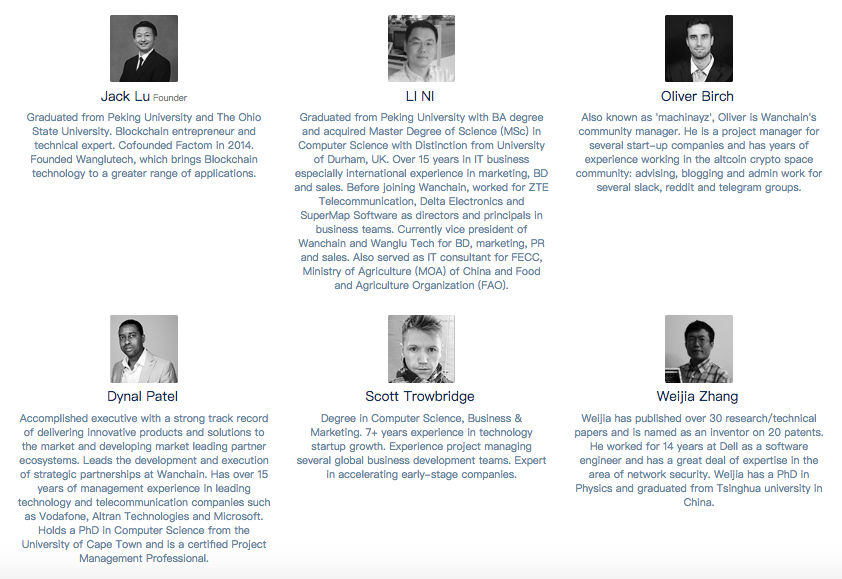

Beyond Lu, the Wanchain team is diverse and experienced. Here are some key faces:

Wanchain counts some of the top software engineers and cryptographic experts in the world among its ranks. With presences in Austin, Texas, Singapore, and China, Lu has assembled a prolific team — many of whom were cherrypicked from the prestigious Peking University.

The official website currently lists 32 employees (plus 12 advisors). While most of them have technical expertise, there are a few key marketing and PR staff in place as well.

It is also worth noting that in late 2017, Wanchain became part of the Blockchain Interoperability Alliance (IOA), joining the likes of ICON and Aion. The Alliance has a unified goal of promoting interconnectivity between separate blockchain networks, through “joint research and collaboration”.

The WAN Token

Wancoin (WAN) is the native coin of Wanchain. In a landscape littered with “utility” tokens of dubious value, one has to wonder: what’s the role of WAN?

WAN will be used to process fees for Wanchain transactions as well as inter-network and cross-chain transactions. It will also be used for “bonding” security deposits for the cross-chain verification nodes.

Its design makes it an integral cog to the overall function of the Wanchain system

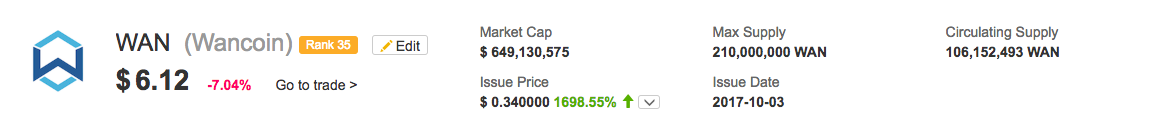

Roughly 107.1 million WAN tokens were sold during the ICO, raising north of 120,000 ETH. 80% of this budget is going to R&D, community building, and marketing.

Here are some other notable stats:

(Source)

How to Buy And Store WAN

WAN tokens were initially distributed as ERC-20 tokens to ICO participants, but it’s now possible to exchange these for tokens on the Wanchain mainnet or buy them directly. It’s a common misconception that WAN is an ERC-20 coin.

Wanchain was first listed by EtherDelta but has since been picked up by other exchanges including Binance and Kucoin.

To store WAN, download the WAN Wallet. Currently, this is the best option while the community waits for hardware wallets like the Ledger Nano to add WAN.

Looking to the Future

After successfully launching its mainnet (Wanchain 1.0) in January 2018, the roadmap shows that Wanchain 2.0 is expected by June, and 3.0 by December. The coming releases will feature a more complete integration with Ethereum, integration with Bitcoin, and a multi-coin wallet.

Whether or not the team hits all these milestones on time remains to be seen, but the most recent official update indicated that a testnet for 2.0 is imminent.

Final Thoughts

Wanchain is a pioneering and potentially disruptive project with its sights set on becoming a super financial market of the world. Although achieving its lofty goal(s) is going to require a lot more work, Wanchain is further along its roadmap than some projects. But there’s still a good bit of “in theory” going on here.

As Wanchain is addressing the whole financial market, it has a number of competitors. Most notably Fusion, Pantos, Ark, and Qash; some may even consider big players the likes of Ripple, Stellar and Ethereum competitors.

On the positive side, Wanchain has strong fundamentals, they’ve got a functional mainnet, the vitality of their use case is indisputable, the huge interest in their ICO showed a powerful vein of investor confidence, and the team has a track record of success.

Currently perched at #37 on Coinmarketcap at a price of around $6, WAN has vast growth potential. With v2 of its mainnet within arm’s reach, the rest of 2018 could shape up to be huge for Wanchain.

To learn more about Wanchain, visit their website. Stay up to date via Twitter, or join their Telegram group.