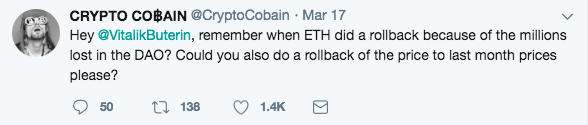

As crypto markets have tanked in recent weeks, many people have been left searching for any positive news or a piece of firm ground to stand on. This desperate sentiment was well captured in the following Tweet:

As prices fell across the board, many (especially newbies) wondered “where should I put my money? Why is this happening? Or should I invest at all?” I’m not a financial advisor, and this is not financial advice, but the bottom line is there are some hard truths that people have to face in times like these.

The market has fallen off a cliff in recent weeks, and there are numerous reasons for that. A few include the US SEC’s decision to issue subpoenas to several ICOS, an ongoing drama with Mt. Gox funds, a blanket ban on crypto ads announced by both Google and Facebook, and a US congressional hearing on crypto regulation.

Here’s the real thing though, mass user adoption for most cryptocurrency use cases are still years off. Less than 10 million people actively “use” crypto today, and aside from use as “digital gold” or “payment rail”, most other use cases won’t have meaningful traction for at least another year (probably more).

The price action in 2017 has led to this false confidence that every single cryptocurrency and blockchain technology is almost to the promised land. This simply isn’t reality.

So, what can be done in light of all this?

Platform Coins

To quote Invest In Blockchain contributor Suuper Dad: “In a gold rush sell shovels.”

The idea is that perhaps the best strategy is to invest in the tools that crypto users rely on. Who exactly is making the shovels? To continue the quote, “in my opinion, the shovel makers are the platforms, exchanges, and transfer-cryptocurrencies.”

Let’s put the other two to the side for now and focus on platforms.

As we peer through the wreckage of the latest crash, platform coins just might be one of the safest plays moving forward. What exactly is a “platform coin?”

For anyone who doesn’t already know, crypto platforms are blockchain-based networks that allow software developers to write smart contracts. Smart contracts (sometimes called crypto contracts) are programs that are coded to automatically control the transfer of assets between two or more parties, once predefined conditions have been met.

Platform coins are the native currencies that belong to these type of systems. Ethereum is the best known “platform coin” out there.

In the last year, we saw the rise of several platform coins:

These prices have all come crashing back to earth in various respects, but it begs the question: why did so much money flow into them to begin with?

There are, of course, many (some highly individualized) reasons but primary among them is their multipurpose nature. People will be able to build apps and all manner of services on top of these platforms in the future, thus making the potential a lot more than a single, glorified use case. Platforms are going to be the foundation that just about every blockchain technology is built upon.

In the face of crashing prices, negativity, fear, uncertainty and gloom, you can fall back on the fundamentals. You can invest in the infrastructure, you can be lucid about the state of crypto and you can invest in real innovation, not marketing hype.

Below we’ll highlight 5 platforms coins that have flown under the radar and have great potential going forward.

Substratum

Substratum is aiming to “decentralize the internet”. In other words, this platform wants to do to the internet what Satoshi Nakamoto wanted Bitcoin to do to currency. If Substratum can realize their goal, users will be able to circumvent old-school web hosts and restrictive government rules.

How does it work? In short, Substratum is designed to allow anyone to host or access web content through nodes on the Substratum blockchain. If you want to host, you simply download the Substratum software and run it. Once operational, the software turns your computer into a mini-server connecting to other nodes, thereby creating a decentralized internet for users. Hosts are incentivized to participate with the native Substrate (SUB) cryptocurrency.

If you simply want to use this internet, just connect to the Substratum network and the protocol does the rest. Using your Domain Name System (DNS) request, its AI geolocates your search request and connects you to the nearest node. Voila!

One of the issues plaguing crypto platforms is getting people to run nodes and become active users. Without a big number of users, Substratum won’t ever truly succeed. Those deeply immersed in the technology understand its value, but for average Joes, there seems little incentive to jump in.

And here is where Substratum has a real shot at going mainstream in the future. In countries like China, Russia, Indonesia, and Thailand, people are constantly using VPNs to get the unrestricted internet access they want. Unfortunately, VPNs are far from a perfect solution and can easily be blocked. Substratum is the answer for this type of user, and the value can be articulated to them in immediately tangible terms.

In an era of net neutrality uncertainty and state-sponsored web censorship, projects like Substraum are needed more than ever. If Substratum can get on the right side of the network effect, developers will start building dapps and services on top of it.

Decentralized web hosts, VPN-like services, and anonymous messaging platforms are only the tip of the iceberg. The price of SUB has fallen substantially from its ATH in January, so now may be a good time to shift some of your position in that direction.

Icon

ICON is a project developed by a Korean company named theloop. This project is founded on the belief that in a data-rich world, one of the biggest problems we face is the division of systems and communities that could be working together. The solution, as the ICON white paper puts it, is to “hyperconnect” the world.

ICON is a project developed by a Korean company named theloop. This project is founded on the belief that in a data-rich world, one of the biggest problems we face is the division of systems and communities that could be working together. The solution, as the ICON white paper puts it, is to “hyperconnect” the world.

How does it work? From the bird’s eye view, the ICON protocol aims to build a decentralized network comprised of individual blockchains that can communicate and transact with one another through the use of its ERC-20 token, ICX. In this way, ICON can be thought of as a blockchain comprising of other blockchains.

With ICON, communities that were previously isolated can now connect, exchange value, and share services. ICON plans to achieve this by using features such as the ICON Nexus and Loopchain technology. In reductive terms, these features provide the space and tools for ledgers to communicate and transact.

But for all its rhetoric as the all-encompassing connector, ICON is first and foremost a decentralized applications platform, with the additional feature of interlinking various blockchains.

In fall 2017, ICON conducted their ICO, had ICX listed on exchanges and launched pilot services to financial and educational groups. In early 2018, the ICON team successfully launched their mainnet, and plans are in place to push the expansion of the DEX reserve pool and to promote more forcefully outside of Korea.

ICON is addressing an inevitable problem in the cryptocurrency market – how do different blockchains work with each other? Whether or not ICON will be the interoperability provider of the future remains to be seen.

But in terms of current price, ICX’s market cap has a lot of room for growth. The value of the token surged with the entire market in December/January and has now fallen down to the potentially very reasonable level of $3.50. The potential of this coin suggests that its future market capitalization could easily rival that of top competitors such as NEO or even the big dog, Ethereum.

Lisk

Lisk is is an open-source blockchain platform powered by LSK tokens that will allow developers to write decentralized applications in JavaScript. Lisk is aiming to achieve roughly the same goal as Ethereum but is tackling some of the more vexing challenges with unique solutions.

How does it work? Lisk’s secret sauce is in its approach to making blockchain accessible to everyone. The LSK team is toiling away on an SDK that will lower the barrier to entry by making dapps buildable in the world’s most common programming language.

Lisk is also tackling the scalability issues by using sidechains. Lisk’s sidechain model provides a way to solve the problem of network congestion under high transaction volume. Lisk is also focusing heavily on the user experience, unlike many existing platforms, as well as offering in-depth documentation and developer support.

Lisk uses a Delegated Proof-of-Stake consensus protocol and, unlike some of the alternatives, DPoS is meant to offer a layer of technological democracy to offset the “negative effects of centralization”.

Lisk’s play for the future is slow, methodical, and carefully thought out, down to the infinitesimal details. Lisk’s flagship SDK is coming and once it arrives, it should spark a lot of developer interest. Lisk is also pushing newbie user adoption and awareness through the introduction of the Lisk Academy, an arm of Lisk dedicated to educating the masses.

Lisk sometimes gets called the “Apple of blockchains” but the LSK token still remains less buzzed about than many others. With the recent slide in prices, LSK dipped below $10 at one point. If you believe in Lisk’s future, these reduced levels arguably represent an excellent value.

VeChain Thor

According to its website, the Singapore-based project VeChain is “the world’s leading blockchain platform for products and information.” To get a little more specific, the vision of VeChain is to build a trust-free and distributed business ecosystem based on the blockchain technology that is “self-circulated and expanding”.

VeChain just underwent a major rebranding and is now officially Vechain Thor. VEN, the VeChain currency, was also officially changed to VET. All of this has been referred to as the “VeChain Apotheosis”.

So, how does VeChain Thor work? The company is using distributed ledger technology to create a platform for business solutions on which businesses can easily interact and transact with each other without an intermediary.

A finished VeChain system will allow manufacturers to assign products with unique identities, like RFID/NFCs and sensors, which are capable of tracking information at every step of the production-to-sale process. This information gets stored on the VET blockchain; thereby manufacturers, partners, and consumers will have total access to the details of how a product was handled. The Vechain Thor blockchain has a native asset, VET, that greases all of this activity.

The goal of disrupting supply chain management by integrating it onto a blockchain platform is just the beginning for VeChain. Plans for allowing dapps and ICOs on the VeChain platform, as well as IoT (Internet of Things) integration, illustrate VeChain’s aspirations to become an all-inclusive blockchain platform for enterprise solutions.

Perhaps the most exciting thing about Vechain Thor is the fact they’ve already got multiple products in action. So many blockchains exist as little more than a proof-of-concept at this point, in Vechain Thor’s case, this isn’t so. According to The Merkle, they currently have all of the following up and running:

- An API gateway service, which is used by a Chinese company in connection with importing goods

- Use by PricewaterhouseCoopers for “third party services” (a huge validation of the technology).

- A part in the Liaoning Academy of Agricultural Sciences’ distributed data storage system

Vechain has an impressive group of partners lined up, a revamped website and is expected to carry out a mainnet launch in June.

All of this spells exciting times for Vechain Thor. VEN prices were around $0.30 a not that long ago before soaring to around $9 only to fall back to $3.67 (at the time of writing). Once all VEN has been converted to (at a 1:1 ratio), VET will be the currency of the Vechain Thor blockchain.

ARK

Similar to ICON, Ark is a cryptocurrency launched in February 2017 that aims to connect the blockchain of every single cryptocurrency in existence.

To quote Ark’s official website, “We aim to create an entire ecosystem of linked chains and a virtual spider web of endless use cases that make ARK highly flexible, adaptable, and scalable. ARK is a secure platform designed for mass adoption and will deliver the services that consumers want and developers need.”

How does it work? At the core of Ark’s functionality is something called a “smart bridge”. Smart bridge technology allows for communication between blockchains using “a special data section called Vendor Fields and special Encoded Listener nodes that comb through this data for tasks that it can perform.”

In simplified terms, this means that means that once a bit of code makes it into the core a blockchain, that blockchain can “talk” with any other blockchain using the smart bridge. This means that if you wanted to create an Ethereum smart contract but only hold Ark tokens, you’d just go to your wallet, issue a few instructions and it’s done.

The ARK token itself runs on a Delegated Proof-of-Stake (DPoS) consensus system, which is good from an environmental and anti-centralization perspective. ARK also employs alternative programming languages which means that almost any developer can feel comfortable building on top of ARK. Support already exists for 10+ languages, and that number is said to be growing.

The Ark token hasn’t been immune to recent bearish market, falling from its perch near $10 in January to around $2.70 now. If ARK developers are able to accomplish everything on their audacious roadmap, there’s little doubt that this ecosystem will be one of the most influential catalysts of blockchain technology adoption and continued evolution.

If ARK does manage to become the one-stop shop blockchain, a $2.70 price point could seem ludicrously cheap.

Concluding Thoughts

It is difficult to limit this list to five coins as there are easily 10-15 that deserve a mention. We’d be remiss if we didn’t at least mention the following projects, which are also showing potential.

- Ardor is an open-source, permissioned blockchain-as-a-service platform written in Java. It was launched by Amsterdam-based company Jelurida in January 2018. Many argue that Ardor should get more attention because it’s already a tangible product, not a theoretical one.

- Qtum (pronounced Quantum) is an open-source value transfer platform which focuses on mobile decentralized apps or dapps. Qtum is exciting for many reasons, but most notable is that developers are trying to take the best of ETH and BTC functionalities and package them into one business-friendly blockchain.

- High-Performance Blockchain is considered by some as a hidden gem, HPB is a smart contract platform that’s building (among other things) hardware acceleration chips. There are rumors of partnership with Unionpay and a revamped whitepaper. It is definitely worth a look.

- Stellar advertises itself as “an open-sourced, distributed payments infrastructure”, which is why many people think of Stellar Lumens as a tool for payments and not much else. But Stellar has a lot of ICOs running, dapps too, and according to some, it’s the best fiat-to-crypto platform out there.

- Stratis is a Blockchain-as-a-Service (BaaS) platform that is focused on the requirements of financial services and other businesses that aim to utilize blockchain technology. As blockchain starts to impact a wider range of sectors, Stratis is positioning itself to be the BaaS platform of choice.

- The Waves platform offers up solutions for “storing, trading, managing and issuing digital assets, easily and securely.” Waves currently sits at #33 on biggest cryptocurrencies by market cap and their 2018 roadmap has some very ambitious targets.

Did we miss any sleepers? Which platform coins do you see as having the biggest potential in 2018? Let us know in the comments!