Blockchain technology is starting to disrupt industries across the board, and real estate is no exception. One of the most promising projects in that sector, and the subject of this ICO review, is Rentberry.

Much like Airbnb, the idea for Rentberry was conceived out of necessity. In 2015, co-founders Aleksey Perfilov, Alex Lubinsky, and Lily Ostapchuk began searching for a rental property in San Francisco. To their frustration, the process didn’t go very smoothly. After dozens of failed applications, lost bidding wars and hours wasted, it became clear that there was some serious inefficiency in the rental market.

As with many of the Bay Area success stories before them, the group’s firsthand experience of the problem compelled them to come up with a solution. From there, they developed Rentberry – a long-term rental platform that manages every aspect of the real estate renting process.

Project Overview

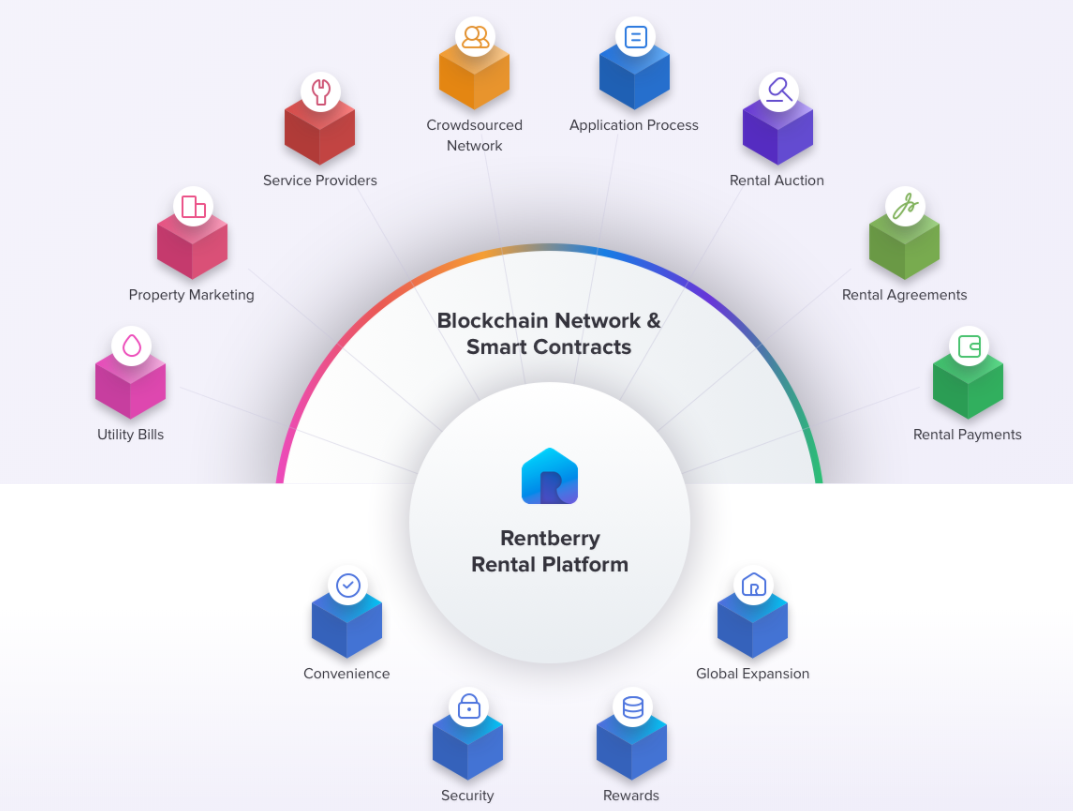

Rentberry is a decentralized platform connecting landlords with tenants directly, and simplifying the entire rental process.

Impossibly long and incomprehensible paper leases are replaced with trustless smart contracts. Inefficient bidding wars are made obsolete by a unique auctioning technology for transparent pricing. The time-consuming and expensive screening process landlords must carry out to protect themselves is streamlined by a proprietary scoring algorithm. And, on top of all that, Rentberry has created a crowdsourced fund for security deposits to reduce the upfront cost of moving.

Crowdsourcing security deposits is a potentially revolutionary idea in itself. In the current rental system, there are billions of dollars frozen as security deposits and earning no interest. On one hand, a renter with a clean history receives no benefit for that history. On another, renters who are living paycheck-to-paycheck must make difficult sacrifices to afford the upfront deposits.

Through a communal approach, all of that capital can be unfrozen and put to better use. Meanwhile, community members are incentivized to help subsidize other people’s security deposits in exchange for earning up to 5% interest.

Beyond that, the benefits of blockchain technology are still numerous.

Cutting out the middleman will eliminate the costs typically incurred by going through real estate brokers and agents. At the same time, landlords and renters can both benefit from the convenience of having a modern, all-encompassing platform.

Renters won’t have to look through Craigslist or Gumtree for hours to find a couple of half-decent options anymore. Instead, they can go to Rentberry for one-stop shopping, with transparent landlord history included. After moving in, rent payments and maintenance requests are carried out simply and easily on the platform as well.

Landlords will have an easier time screening prospective tenants, negotiating leases, having contracts signed electronically, collecting payments, and hiring third-party services when needed.

All of this is done with unparalleled security, efficiency, and transparency through the public blockchain.

To learn more about the project, you can read the full whitepaper, which is one of the most thorough and easy-to-understand whitepapers in recent memory. You can also check out the Rentberry GitHub for a look at their open-source code. You can also find a more in-depth look at Rentberry’s technical and operational aspects here on Invest In Blockchain.

Vision

Long-term rental markets exist around the globe. Eventually, Rentberry hopes to expand to all of those markets, becoming the default platform for housing rentals everywhere.

To make that vision a reality, Rentberry has developed a roadmap for effective and sustainable growth. It starts with a focus on technological advancement in 2018 and 2019. The team is already working to integrate blockchain and smart contract technology into the platform, as well as developing iOS and Android apps.

Once that has been accomplished, the next tasks will be adding the crowdsourced rental deposits feature and tokenization of the Rentberry payment system. BERRY tokens will be used for every aspect of the rental process, from paying for rent and other services to accumulating interest on crowdfunded security deposits.

By 2019, the Rentberry team will set their sight on perfecting the platform’s proprietary scoring system. Additionally, they will begin offering API integration to local third-party service providers, so that tenants can do things like request maintenance directly from their Rentberry portals. From there, the platform will be ready to expand across Europe and Asia.

Product

Investors in the typical ICO in 2017 often had little more than a whitepaper and a project website to inform their investments. Some projects have made progress and stuck to their roadmaps. Many others, however, have proven to be infeasible or even outright scams. Trying to separate the good projects from the bad is with so little information to go on is practically gambling.

That’s why Rentberry really stands out from the pool of other ICOs. With a fully functioning platform listing over 224,000 properties and being used by more than 120,000 people, Rentberry is much more than just a whitepaper and a dream.

The existing Rentberry platform has substantial listings in major cities across the United States – including New York, Chicago, Los Angeles, Houston, Miami, and many more. It is the only platform out there that provides transparent rental auctions, making it possible for prospective tenants to make informed decisions while saving time and avoiding frustrations inherent in the old rental search process.

Team

As a startup that has already achieved some measure of success, the Rentberry team is well established and continues to grow. It currently consists of 23 members, coming from diverse backgrounds including real estate, investment banking, marketing, product development, and IT.

You can learn more about the team – as well as some of the project’s partners – on the project’s ICO website.

The BERRY Token Sale

Rentberry stands out as a low-risk ICO. The company has already successfully raised $4 million in seed funding from high-profile investors and VC funds from 11 countries – all before opening investment to the general public through the token sale.

An investment in BERRY tokens is an investment in an already existing product that has potential for enormous expansion in the coming years. With over 2 billion people around the world living in long-term rentals and a growing trend of new households renting instead of buying, there is a need for the service Rentberry provides. Building their platform on the Ethereum blockchain helps ensure that Rentberry will be meeting that market need with a secure, efficient, and transparent service.

The breakdown of BERRY token allocation is:

- 70% of tokens will be allocated to the public token sale.

- 20% of tokens will be kept in the Rentberry Reserve for future distributions, performing real estate community initiatives and offering inside-platform promotions. This reserve may also serve as a stability mechanism for circulating BERRY tokens through calculated buying, selling, and burning of tokens.

- 10% of tokens will be distributed to Rentberry’s founders and employees.

The token sale is already live and is fast approaching the hard cap set at $30 million. With participation from over 13,000 contributors investing more than $25 million so far, BERRY has achieved the status of Largest PropTech ICO in history.

There’s still 2 weeks left to buy tokens, and those who do will receive a 25% bonus on their investment. But with the hard cap less than $4 million away, you should act fast.

Final Thoughts

ICOs like the BERRY token sale are few and far between. Before cryptocurrencies, opportunities to take a risk on a promising business were reserved for investors who were already wealthy.

Now, ordinary people like you and I have the chance to buy a stake in a company with massive potential. Ultimately, Rentberry represents all that is good about democratizing investments.

Head to the Rentberry website to participate in their token sale which ends on February 28, 2018 (or when the hard cap is met).