If you’ve read our previous article, All You Need to Know About Rentberry, you’ll know that Rentberry is a dynamic startup looking to revolutionize the rental market.

As well as offering the advantages of streamlining a multi-faceted collection of services and keeping an immutable record of transactions, Rentberry is introducing the BERRY token with the aim of freeing up the money tied up in rental deposits. They’ve already got a fully functional platform and are poised for growth, but to truly grasp the potential of Rentberry you must go a bit into the weeds.

In this article, we dig deeper into the technical and operational aspects that make this blockchain startup tick.

Ease of Use, Transparency, and Decentralization

The Rentberry platform is designed to carry out every task involved in renting a space, from searching for properties to screening processes to negotiating and e-signing documents. With such ambitious goals in mind, the Rentberry whitepaper outlines numerous benefits on both the landlord and tenant side.

Landlord benefits:

- Listing marketing and syndication

- Reduced vacancy rates

- Ability to take advantage of hot markets

- Improved screening tools

- Streamlined rent collection

Tenant benefits:

- Focused property search

- Convenient communication channels

- Transparent application processes

- Crowd-sourced security deposit coverage

- Security of personal information

And this is just the tip of the iceberg. But how exactly does Rentberry plan on delivering these benefits?

Auctioning Technology

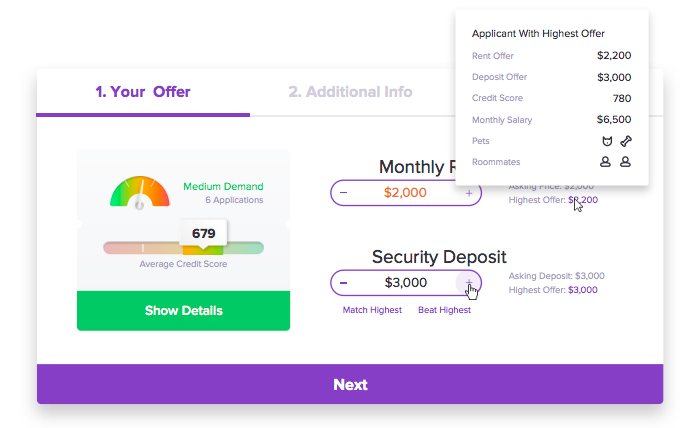

One of Rentberry’s key value propositions is auctioning technology that, if it functions correctly, achieves two things: (1) it ensures that landlords are optimizing their prices for whatever market conditions exist, and (2) it guarantees that potential renters are afforded 100% transparency in terms of competing offers.

For number 1, there is a machine learning system that will analyze local rental data to help landlords set prices reflective of the market. And for number 2, the interface displays information to the potential renter in a “cards face up” kind of way. Presenting renters with information about the rental market and other bids allows them to make targeted offers, negotiate accurately, and reduce any guesswork.

Some have speculated that Rentberry’s auction approach is creating competition where none existed, and may drive up prices. But CEO Alex Lubinsky has stood his ground, stating that market competition has always existed, and Rentberry just lets renters see what they’re up against. He goes on to say that “on average, agreed rents were 5% less than the landlord’s asking price on the platform.”

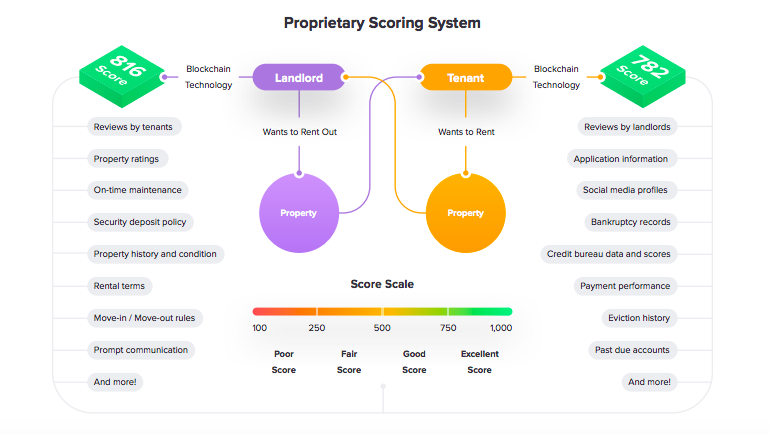

Proprietary Scoring System

Another pillar of the Rentberry approach is the implementation of a proprietary user scoring system. This system is based on the assumption that traditional methods of rating potential renters/landlords are outdated. Credit bureaus do a good job of classifying people into financial rating pools for loans and credit card applications, but fail to account for a wider range of relevant factors when it comes to renting.

The Rentberry scoring system captures a much wider scope of data points and crunches them through the use of a “smart oracle” to arrive at a rating. Some of the factors considered are:

- Information from applications

- Previous payment performance

- History of evictions

- Bankruptcy records

- Data and scores from credit bureaus

- Past due accounts

- Social media information

- Reviews from previous landlords

But this isn’t a one-way street, and landlord scores are also available so tenants can avoid the bad eggs. Data for landlords include some of their financial data, records of on-time maintenance, prior interactions on the platform, and property ratings.

Crowdsourced Security Deposit Network

The conventional security deposit model is broken, according to Rentberry, and their solution is crowdsourced microlending.

The problem: To rent almost anything, you’ve got to slap down a (sometimes quite sizable) deposit. This is problematic, because it locks up a good chunk of the renter’s money and it creates another thing for landlords to deal with. Rentberry estimates that there is more than $500 billion locked in rental security deposits worldwide. This removes a huge amount of money from the economy to lie stagnant in escrow accounts.

The solution: With one of the company’s most innovative features, Rentberry allows people to tap into this frozen capital. They do this by letting people use a crowdsourced security deposit network – “a community of users on the Rentberry platform, such as friends, family members, landlords, tenants and even Rentberry itself – who will finance part of the required security deposit.”

Why would others want to pay your security deposit? Simple – their contribution is treated as a loan that pays a small interest rate (usually between 3–4%). Here’s how a crowdfunded security deposit process might go:

- Year rental contract security deposit = $2,000

- Renter pays 10% = $200

- Crowdsourcing network picks up the remaining $1,800

- Renter pays monthly interest to lenders $1,800 x .03 = $54

When the renter moves out (unless they’ve caused damage, obviously) everyone’s money is refunded automatically via smart contract and the renter is only out about $50. To some people, paying an extra $50 may be well worth not paying in bulk up front, or having $1,800 in liquid capital.

This solution aims to harness the economic power of microlending to create a triple win. Crowdfunders get a relatively low-risk way to make a return, renters hang on to their money, and landlords get a larger pool of tenants (plus the guarantee of the deposit).

All transacting on the platform will be done using Rentberry’s own cryptocurrency, the BERRY utility token. Perhaps best of all, this means landlords won’t be subject to escrow requirement laws (which vary by US state). According to their whitepaper, “Rentberry isn’t required by law to put anything in a bank because everything is done in smart contracts. It’s not even really qualified as a security deposit because it’s done on the blockchain, using cryptocurrency.”

Rent Payments & Smart Locks

Once a rental contract is established, paying and collecting rent are the primary monthly duties that most tenants and landlords must contend with. Rentberry plans to allow tenants to make their rental payments in BERRY tokens starting in 2018. Why would people want to adopt this method?

There are several reasons. Paying in cryptocurrency reduces the risk of fraud, as payments on the blockchain are immutable and cannot be forged or tampered with. This will also eliminate bounced checks, credit and bank wiring fees, unrecorded cash payments, and long delays. By using a cryptocurrency, you also have an international medium of exchange, thus circumventing any cross-border issues.

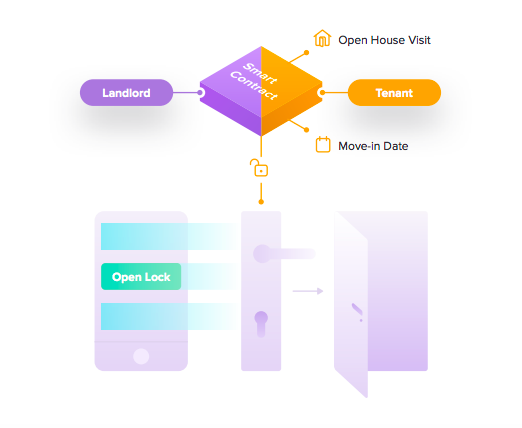

Beyond the practicalities of sending and receiving money, Rentberry is tackling the issue of getting renters their keys, which can be a hassle if the landlord lives far away from the rental property. The Rentberry team is currently hard at work developing smart lock solutions. What’s a smart lock?

As Wikipedia puts it, “a smart lock is an electromechanical lock which is designed to perform locking and unlocking operations on a door when it receives such instructions from an authorized device using a wireless protocol and a cryptographic key to execute the authorization process.”

With smart locks, tenants and landlords will no longer need to coordinate a time to meet at a property. The renter simply plugs their smartphone into the lock and, if the smart contract conditions are right, the lock opens. The renter’s identification would be confirmed using an existing identity verification solution (Rentberry has plans to integrate with Civic Technologies).

Issues exist surrounding the battery life of smart locks, but Rentberry is working on a next-generation lock that solves this problem. And although it may be a way off still, it’s a potentially exciting development.

While the specifics outlined here explain how Rentberry plans to deliver some of its promises, let’s not forget that blockchain technology plays a starring role as well. All transaction data – property, location, date, amount, outcome – will be stored on the blockchain and the platform will run as a tokenized ecosystem utilizing the BERRY token. Transactions will be carried out seamlessly via smart contracts, and all of the data will be looped back into Rentberry’s algorithm to perform analysis and enhance its recommendations.

The real magic of the Rentberry platform lies in the coupling of elegant, tech-based solutions with blockchain.

The RentBerry ICO

If you’re wondering where you can get your hands on some of the BERRY tokens mentioned throughout this article, the Rentberry ICO is currently underway.

The ICO began on December 5, 2017, and will conclude on February 28, 2018 (or when the hard cap of $30 million is reached). So far, more than $20m has been raised, with almost a third of the sale period still remaining.

This makes it the largest amount raised for a real estate industry ICO.

The initial coin supply will distribute 70% of the tokens to sale participants, with 20% going to the Rentberry reserve and 10% going to the employees and founders of the company. You can buy BERRY tokens now on their official ICO website, and you’ll just need some ETH or BTC to make the purchase.

Curious to learn more about the Rentberry ICO? Check out their whitepaper or visit their official website. You can also visit their 24/7 Telegram chat where all the latest news is posted.