The meteoric rise of Bitcoin in late 2017 brought with it an explosion of companies running crowdsales in the form of ICOs. While the entire market has cooled off since then, ICOs are still turning heads, and investors are almost guaranteed to be more selective with their investments this year.

Among the thousands of cryptocurrencies that will end up worthless, the chances of finding a project with a strong use case and competent team are diminished, since there are only so many problems to solve with blockchain.

It’s becoming easier than ever to create your own token, publish a website and whitepaper, and launch a crowdsale. We at Invest in Blockchain have researched ICOs scheduled for the end of 2018, and there are a few that stand out to us as worth a second look. However, it’s necessary to remind potential investors to do their due diligence — as always, never invest more than you’re willing to lose.

With all that said, here are our top 6 ICO picks scheduled for the end of 2018, listed in chronological order.

Disclaimer: This is not professional financial advice, and you should always use multiple sources for information while doing your own research. Investing in ICOs is a high-risk endeavor.

CitiCash

CitiCash is a cryptocurrency that’s placed simplicity and user-friendliness at the forefront of its design. As much as cryptocurrency gained public awareness at the end of 2017, the general public still isn’t all that interested for a couple reasons.

As explained in the CitiCash whitepaper, the majority of people simply don’t understand what cryptocurrencies are, and that poses a major roadblock when it comes to mass adoption. Another common rebuttal among skeptics (and rightfully so), is that you can’t pay for everyday goods and services with it. While that’s changing rapidly, at the moment there’s little incentive for the average individual to switch from fiat to crypto.

In order to make the transition as easy as possible, CitiCash is developing a network between their wallets and established debit card technologies. Upon request, users will be provided a debit card that’s linked to their CitiCash wallet, which automatically converts funds into the respective fiat currency of the vendor receiving payment.

CitiCash will also offer the simple conversion of their native token into any other cryptocurrency, with all the work being done on the backend, maximizing ease of use for customers of all levels of tech saviness.

CitiCash ICO

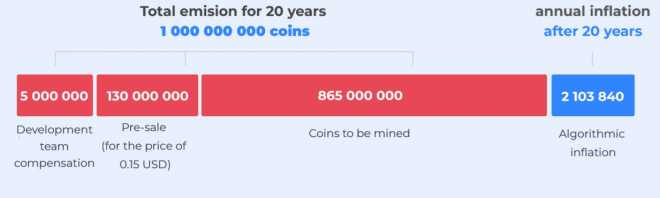

The CitiCash ICO will start on September 1, 2018, and will last 2 months or until sold out. 130 million CitiCash coins (CCH) will be available for the public sale, with a minimum purchase set at 10 CCH. Each coin will be worth $0.15, and no whitelisting is necessary to participate. All unsold coins will be frozen in the CitiCash wallet for 1 year, then used for further expansion of the project.

After 1 billion CCH are released into the market over a span of 20 years, an algorithmic inflation process will begin, releasing an additional 2,103,840 CCH into the market. The CitiCash team explains in their whitepaper that “this will ensure that the total coin supply will not shrink due to coins being lost by their owners over time.”

You can learn more about CitiCash by checking out their website and following them on Twitter.

Humancoin

Humancoin is what happens when philanthropy gets decentralized. The majority of us have been subjected to late-night commercials of sad-looking dogs complete with music meant to stir our emotions into opening our wallets. While there are legitimate nonprofits operating this way, trust in charities has dropped in recent years after scandals involving humanitarian charities were brought to light.

The Humancoin team is creating a blockchain solution for donors and recipients of funds worldwide. The inherently transparent nature of cryptocurrency makes them a perfect means of transaction for philanthropic industries. According to the Humancoin whitepaper, there are 3 main reasons that people who are ready to donate to change their minds:

- Lack of trust in charities, and doubts that their contribution will reach the recipient on time and in full due to a lack of international charity regulation.

- Cross-border payment complexity and potential issues dealing with foreign governments.

- The inability to see any additional benefits from making a donation.

To tackle these problems, Humancoin plans to focus their effort on the collaboration of charity, eCommerce, and cryptocurrency markets.

Humancoin ICO

The Humancoin ICO starts September 15, 2018 and ends November 1, 2018. Slightly more than half (50.9%) of the total 6 billion tokens will be available during the tokensale. Tokens are priced at US$0.01 per token, with a minimum purchase of 0.1 ETH required.

Including the already finished presale, the crowdsale has been broken up into 4 stages.

For more information on Humancoin, check out their website, whitepaper, and follow their official Telegram channel.

Real Estate Doc

The real estate market is rife with paperwork that’s begging to be automated. The Real Estate Doc (RED) vision is to set the standard for commercial real estate leasing technology, allowing users to manage their businesses through customized, self-executing smart contracts.

Taken directly from their whitepaper, there are 5 distinct modules that make up the RED platform:

- Digital Document Management

- Asset Planning and Budgeting

- Streamlined Client/Vendor KYC Process

- Payments and Loyalty Points Management

- The Space Exchange

The Digital Document Management module allows users to easily build and manage contracts for monthly lease payments, maintenance requirements, security deposits, and more. Clients will be able to grant access and collaboratively build contracts, track edits made to documents, sign electronically, and even work offline.

The Asset Planner presents analytics on contract values, payment schedules, revenues, and more on a user-friendly, customizable dashboard. Users will be able to set monthly, quarterly, and annual budgets for each asset category, and track them to monitor performance.

The Streamlined KYC framework allows corporate landlords to ensure vendor applicants are in good standing with the law. Checks are typically made with third-party applications by Experian and Equifax, and the KYC is automatically recorded on a private sidechain, and can be used for future lease agreements.

The Loyalty Points Management module allows users to transfer loyalty points between separate establishments within the same RED network. They also offer a payment gateway, meant to streamline the payment management process and reduce transaction costs.

The Space Exchange allows real estate companies to rent out a variety of spaces, from entire shops to shelf space in storage units. Customers will be able to bid through the RED payment gateway listed above, which has tokens pegged to the US dollar.

Real Estate Doc ICO

The Real Estate Doc public token sale runs from October 4, 2018 to October 31, 2018, or until their hard cap of US$9 million is raised. Out of the total 1 billion REDT token supply, 500 million will be available during the entire token generation event. There’s a minimum contribution of 0.1 ETH, and 1 REDT will cost US$0.018.

You can learn more about Real Estate Doc and their ICO by visiting their website, checking out their whitepaper, and following their blog.

Code of Talent

The rise of the internet and technology are begging to revolutionize one of the most important aspects of our society: the education system. Originally, schools and universities acted like gatekeepers of knowledge.

Today, you can find Ivy League college courses online for free. However, e-learning hasn’t reached the same level of effectiveness as our traditional educational institutions.

Code of Talent is looking to close the gap between students and teachers operating online, covering a wide array of educational programs. They describe their purpose as such:

To create equal opportunities for everyone on the planet, by igniting their motivation to learn and develop their skills and talents. Otherwise, they don’t stand a chance in the world of tomorrow.

The Code of Talent team has broken down the problem into 4 main sections: there’s no access to good teachers, classroom learning is boring, there’s a disconnect between theory and skills, and people are not motivated to learn. In order to solve these 4 problems, Code of Talent is implementing a 5-pronged approach:

- They’ll create a gamified micro-learning engine, making it fun to learn about subjects in short bursts, rather than powering through a 2-hour lecture.

- There are merit-based incentives for students and teachers.

- Students and teachers will be able to interact directly.

- Being that the system is built on blockchain technology, there will be an immutable record for future employers.

- Employers, advertisers, and sponsors will be able to integrate directly into the platform.

Code of Talent ICO

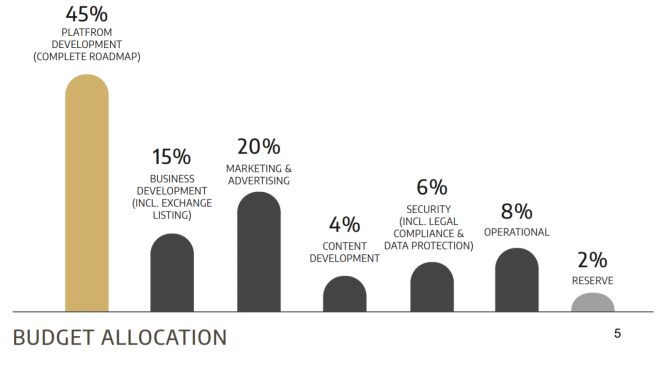

The Code of Talent ICO event begins October 15, 2018, with 55% of the total 336,363,636 CODE tokens available during their public sale. Each CODE token will be worth US$0.10, and will be available for purchase with ETH. The budget allocation following the tokensale will be as follows:

For more information about Code of Talent, check out their website, read their whitepaper, and follow them on Twitter.

MenaPay

As Middle East and North African (MENA) countries begin integrating crypto into their populations, one of their unique barriers is a religious one. The conservative Islamic traditions in the area means that new financial technologies will be carefully vetted before integration is considered.

MenaPay is the first fully backed, 100% Islam-compliant crypto solution looking to enter the MENA region. One of the tenets of Islamic banking, called Mudarabah, equates to systems of profit sharing. In order to abide by local financial laws, the MenaPay token cycle will distribute 75% of revenue amongst token holders through various fees.

Since stable coins play a vital role in the mass adoption of crypto, MenaPay will also introduce a token called MenaCash, which is backed by USD at a 1:1 ratio. With the volatility of the crypto market taken care of, MenaPay is able to focus on integrating their crypto solution into the MENA region in a couple of ways.

The desktop and mobile applications will be present in Arabic, providing an enormous 24% of the global population an everyday crypto solution in their common language. According to the MenaPay website, the MENA region alone supports 420 million people, and an estimated 86% of the population is unbanked.

To facilitate the simple onboarding of third-party enterprises, MenaPay will offer Application Programming Interfaces (APIs) and Software Development Kits (SDKs) to interested businesses. They’ll also offer merchants a user-friendly management and reporting dashboard to keep track of expenses and revenue.

MenaPay has released their roadmap, which shows their goal to be listed on a top 10 exchange by the end of 2018. They also plan to reach 5 million active users and a $1 billion market cap before Q3 2019. It’s a tall order, however, MenaPay has hired an impressive team covering every aspect of their business, and they plan to partner with creative influencers in the region. They’re also building an offline reseller network that will operate within local communities.

The MENA region has shown itself to be a very lucrative market, holding strong potential for the first cryptocurrency platform that can navigate through Sharia law.

MenaPay ICO

The MenaPay token sale is currently set for November 2018. Of the total 400 million MPAY tokens being issued, 256 million will be available for sale. Their target hardcap is sitting at $25 million, and each MPAY token is worth an estimated $0.165 at ICO price. All unsold tokens will be burned.

Learn more about MenaPay by visiting their website and checking out their One Pager, and stay in the MPAY loop by following their blog, Twitter, and joining their Telegram group.

Akropolis

Decades ago, it was common to find men striving for a career they’d commit to working their entire lives. The fortunate ones were able to lock down jobs that earned them a pension after retiring.

As time has gone on, and technology has increased transparency across the board, there are problems within the pension industry that require a solution.

Akropolis is setting out to disrupt pensions by means of decentralization.

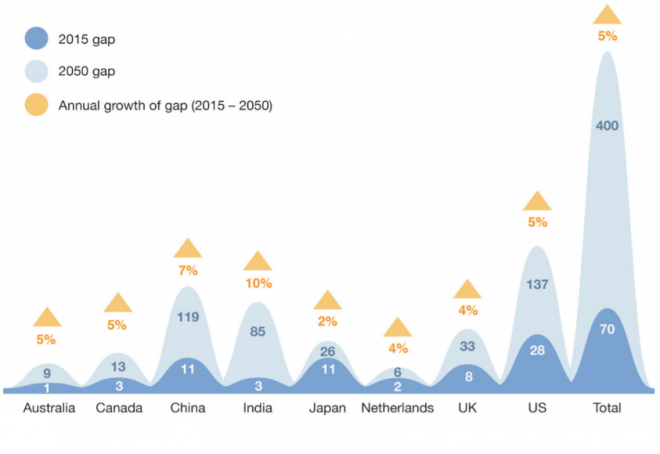

In their introductory blog post made in March 2018, Akropolis explained that a collapse of the pension system is mathematically inevitable. They opened the post by citing the World Economic Forum prediction that the worldwide pension gap will grow from $70 trillion to $400 trillion in 2050, which is roughly 5 times greater than the current global GDP.

Later in the article, they went on to succinctly describe one of the main issues as such:

As observed by a many a sector analyst, most of the world’s state pensions systems function like glorified Ponzi schemes, diverting the savings of younger investors to support the obligations to the older demographic.

With average life expectancy on the rise (therefore increasing the necessity for pension savings) a transparent and decentralized solution could be the answer we need. The Akropolis platform is based on a smart contract infrastructure that will manage pension funds. This allows all users to observe what’s been happening with their funds as the years roll by.

By outsourcing pension management to blockchain-based software, overhead is directly cut, leading to less fees—and better retirements.

Akropolis ICO

The official start date for the Akropolis ICO is yet to be announced, and you can join their official waitlist by signing up on their website. For more information on the Akroplis solution, you can read their whitepaper, join their Telegram, and follow them on Twitter.