CoinMarketCap.com alone has over 1,600 cryptocurrencies listed at the time of writing this. And then there are projects that haven’t made it to CMC yet. The problem is, many of them don’t have good intentions and are pure money grabs or blatant scams.

But then again, the current state of the crypto market presents a once in a lifetime opportunity to create incredible wealth. So how do you evaluate a cryptocurrency in order to spot a gem among the garbage? You need to have a due diligence checklist that you can use whenever a new project pops up on your radar.

If you haven’t got one yet , then you will love the one we prepared for you:

Is the Business Model Legit?

Where there is a problem, there are people experiencing it and there is room for a solution. And where there is a solution, there are folks willing to pay for it. However, many crypto projects manufacture a fake problem to justify the existence of their cryptocurrency. As awesome as the blockchain technology is, it’s not suitable for every single area of our lives.

If you stumble upon a controversial idea and wonder why would that very problem need blockchain to be solved then it probably doesn’t need it at all. Many business models are fine without an ICO and their own token.

However, sometimes a business model can be legit but there are just too many projects out there trying to do the same thing.

Is It Just Another Copy Cat?

For instance, there are so many projects that market themselves as the ultimate privacy coin yet most of them feel like a poor copy of Monero or ZCash. We don’t need hundreds of privacy coins but just one or two that actually work.

If the business model is legit but it’s not original at all, then the new team has a little to no chance to compete with the established giants that already offer a great solution.

Is The Business Idea Realistic?

But what if the business model is indeed original and no one else is doing it yet? Is the idea actually realistic?

This can be a tricky one because if Henry Ford asked people what they needed, they’d answer with “faster horses.” Yet what they really needed were cars, although it seemed absolutely unrealistic at the time.

Is the Team Qualified to Deliver?

An idea is worth nothing without proper execution. When looking at a potential crypto investment, you need to pay close attention to people behind the steering wheel.

An idea is worth nothing without proper execution. When looking at a potential crypto investment, you need to pay close attention to people behind the steering wheel.

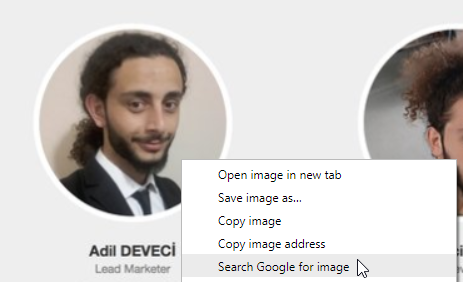

You always want to perform a background check on the CEO, co-founders etc. Check their LinkedIn and google their names to see what comes up. But before you proceed with that, use the following trick to find out if the people are legit in the first place.

Google Chrome provides us with a neat feature to quickly find out if the picture of a person is original or was copied from someone’s website.

And believe us, it is pretty common for scammers to use someone else’s identity.

If the profile pictures are legit, you can proceed with x-raying each of the top members.

A bunch of talented developers is often not enough to conquer any industry with blockchain technology. The team has to be qualified and have diversified experience so that they synergize with each other.

They need great programmers who can deliver but they also need ace marketing people who can promote it. And in case of any confusion from the community, they’ll need a great social media manager to represent them properly.

If they’ve been changing their concepts and industries like socks, then they might be temporarily riding the crypto hype only to move onto the next hot thing soon after. As the old saying goes, “a jack of all trades is a master of none.”

Is the Team Big Enough for What They Are Trying to Achieve?

Contrary to what many may wish, size does matter. A team of 10 talented developers can get things done faster than a team of 5. Obviously, if a dude who makes coffee and a bunch of irrelevant folks are listed as team members then that’s a massive red flag.

However, if you see many relevant and talented people working on the same thing, it has a higher chance of succeeding.

Are the Advisors Listed Legitimate?

Undoubtedly, a common trap fresh crypto investors fall into are fake advisors. If you have been in the space for a couple of months, you have probably stumbled upon Vitalik Buterin listed as the advisor on various sites.

Sadly, many crypto investors blindly invest in such projects. You can save yourself headache of bad investment decisions by simply checking in google the name “Vitalik Buterin” and a project you are about to invest in.

Not only Vitalik, but also other important actors of the crypto space are listed as advisors. Always perform a background check on the project advisors, especially during the ICO phase.

Does the Project Promise Profits?

This is a serious problem, especially in the ICO sphere where projects promise upfront significant returns to its early investors. If someone promises you something in this space and talks about guaranteed returns, it’s a red alert. Go away immediately.

Examples? There you go:

Bitconnect offered a daily return at range of 1%! That’s insane. Yet, it was nothing but another ponzi scheme, where people who invested early got money from fresh investors.

How did they end up?

Are There Any Important Partnerships?

The crypto community loves partnerships to such an extent that many projects fake them only to boost the price of their token.

But then again, a legit and extremely relevant partnership will take the project to the next level. So how do you spot a great partnership among all that noise?

Nexus is a cryptocurrency that claims they will shoot mini satellites into the orbit. As exciting as it sounds, you’d probably want to know how they’ll be able to do it so you do your research.

As you dig deeper, you find out that Colin Cantrell, the CEO of Nexus, is the son of Jim Cantrell, the man who co-founded SpaceX with Elon Musk. You do some checks on Jim Cantrell and realize he runs Vector Space Systems – a space technology company which launches small satellites into orbit.

Suddenly, it makes total sense. You keep going and find out that Vector Space Systems not only partnered with Nexus but will also accept NXS as one of their payment methods for satellite launches.

Now you know you’re looking at a legit partnership.

Is Their Website A Good Business Card?

Some crypto enthusiasts get bullish purely because a project has a nice-looking website. Whereas what’s on the surface is not enough, we can draw many important conclusions from the website alone.

The most basic one is the SSL certificate. Using an SSL is the new standard and takes a few minutes to install. Just take a look at the image below to see what an SSL looks like:

![]()

The “s” in “https” stands for “secure”

If you see a crypto project that couldn’t bother to spend 5 minutes installing their SSL to have a secure and more professional looking site, then how are they going to accomplish things on their roadmap?

Talking about professional appearance, does the website look like it was made by a high-school student or a professional web development company? If someone is cutting corners with their site, then how can they be trusted with your money?

Again, you have to take aforementioned things into consideration. Some great projects do have mediocre websites but they can still be good investments.

Another thing to look at are languages that the site is available in. If a project went the extra mile to translate their content to a few different languages, then they’re more likely to have a long-term vision in mind.

Do They Use Generic Stock Images?

The presence of stock images doesn’t automatically mean a project doesn’t deserve your attention. Sometimes, you can find a really neat stock image that fits your site perfectly.

However, more often than not, if a site doesn’t have their own pictures and heavily relies on lifeless and generic images that you’ve seen all over the Internet, then be extra careful.

Poor quality projects tend to try and get their sites up and running as soon as possible to see if they can raise any funds. Using stock images is one of their go-to methods to cut corners.

What Does Their Whitepaper Look Like?

While you’re browsing through the site of your next potential investment, you should obviously take a look at the whitepaper. If it’s translated to many languages then that’s a first good indicator.

Not everyone is skilled enough to understand the technical nature of many whitepapers but that’s completely fine. If you feel like you can’t full grasp the technicalities, then at least try to spot any obvious grammatical errors.

If one can’t bother hiring an editor to make sure their whitepaper is spotless, then how can we trust them when it comes to their big promises?

By running a thorough analysis of the whitepaper you can examine whether their business model seems legit or not – as mentioned at the beginning of our checklist.

How Active Is Their Community?

The community plays a key role in the growth of any crypto project. At the end of the day, if their initial community of early adopters and visionaries is not really convinced then how can it ever go mainstream?

A great place to take a look at the community is Reddit. In fact, if your potential investment doesn’t have their own subreddit where people can freely discuss the idea and share their feedback, then that can be a potential red flag.

When you find the right subreddit, go through recent as well as old threads to get a feel of the community. Can you even find any recent threads? If not, you might be looking at a dying project.

Ideally, you don’t want to just see the activity of the potential investors but also from the team themselves answering different questions. They might be doing it in a different form on their Medium blog or Telegram channel, so be aware of that.

Are There Any Big Investors?

Big investors definitely do their own thorough due diligence so sometimes they can be a good indicator, although you shouldn’t just blindly follow the whales because you can end up getting burned. They might have a deal that you can’t have and access to information that most people don’t know about.

Summing up

Next time you’re evaluating a cryptocurrency, you can follow our step-by-step process to make it more effective and efficient. By using the rules we outlined before, you’re far less likely to invest in a scam but then again, always be sure to do your own research and do it so thoroughly.

What’s on your due diligence list that we’ve not mentioned? Let us know in the comments.

This blogpost was written by London Letter – a monthly newsletter featuring the most undervalued cryptocurrencies.

Related: 3 Winning Factors to Look For in Your Next Cryptocurrency Investment