Let’s face it, 2018 has been a bloodbath.

While I’ve never been more bullish on Bitcoin, I’m seriously concerned that the majority of altcoins will never reach their previous all-time highs.

Below I will cover 7 altcoins that I believe will survive the 2018 (and 2019?) bear market.

First Let’s Take a Stroll Down Memory Lane…

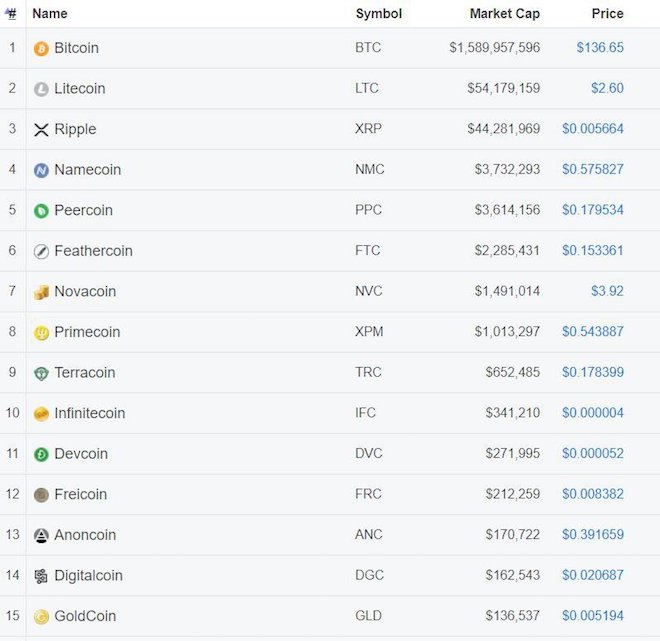

Here’s the Coinmarketcap Top 20 as it stood sometime in 2014.

Of the top 20 in 2014, how many are still relevant? How many have you even heard of?

Only 3 coins survived the great 2014/2015 bear market and still remain in the top 20: Bitcoin, Litecoin, and Ripple.

If we can compare the 2014/2015 market to our current situation, we’d better think long and hard about what shitcoins we’re holding, and whether or not to jettison them. I know selling heavy bags hurts, but cutting your losses on a bad deal is often the sign of a mature investor.

The Crypto Market Has Changed a Lot Since 2014

While it’s useful to look back to history (those who don’t learn from history are doomed to repeat it), a lot has changed since the last bear market. For one, back then the entire crypto space had a total market cap of around US$2 billion. That’s roughly 100x smaller than it is today.

Not to mention in 2014 few had even heard of Bitcoin, let alone knew what it was. Today, the entire world knows about Bitcoin after its crazy parabolic run up in late 2017. That being said, it’s still early days, as only a tiny percentage of the world holds crypto assets.

We’re also seeing a trend towards “financializing Bitcoin” due to recent interest from traditional financial institutions. In other words: when, ETF!?

That being said, we’ve got a lot of growing up to do…

The crypto market is still an awkward, hormone-fueled teenager who dropped acid for the first time at Burning Man and thinks they discovered the meaning of life.

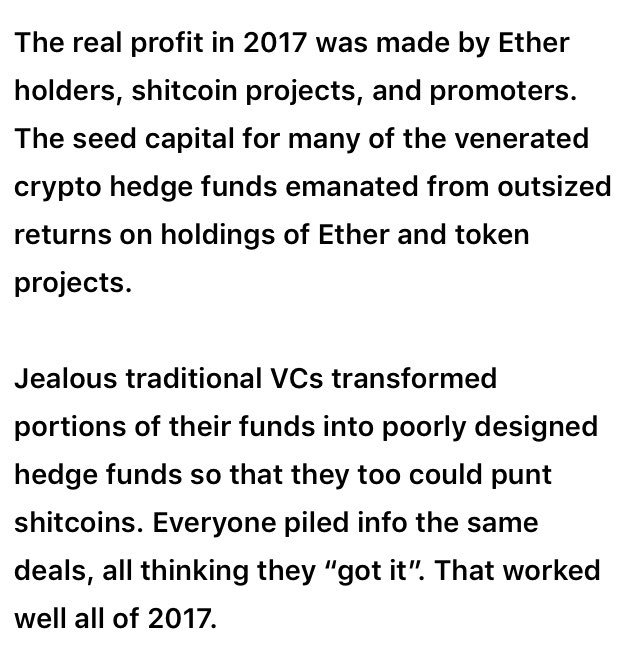

In the latest BitMex Crypto Trader Digest, CEO Arthur Hayes shares some scary insights about the 2017 crypto bubble. Essentially, much of it was fueled by the mindset of, “You pump my bags, I’ll pump yours.”

All things considered, I’m optimistic that our current bear market will probably (hopefully) be shorter than the Great 2014/2015 Bear.

And now, the question I’m sure is on everyone’s minds…

How to Assess If Projects Will Survive a Bear Market

First off, I’m not even going to discuss Bitcoin or Ethereum in this article. If either of these market leads never recovers, we’ve got bigger problems than the Shitcoin Waterfall.

Here are a few key features to look at when picking projects that will survive the bear run:

- Strong community

- Actual product with a product-market fit

- Elite team

- Fully capitalized (many projects will be decimated because their treasury was stored as ETH. ETH is down 60-80% since many 2017 ICOs)

- Old projects that are still relevant (Lindy effect)

- Projects supported by China which, in case you haven’t noticed, is becoming the next technological world leader

Another way to evaluate a project’s ability to survive this bear market is to split them into different categories.

You can break down the crypto space into 3 simple categories. Tier 1 projects have the best chance to survive, whereas Tier 3 projects will have a high extinction rate.

- Tier 1: Cryptocurrencies – Best use case, longest history, such as BTC, LTC, and XMR.

- Tier 2: Platforms/Protocols – Benefit from being insulated by other projects building on top, some have huge treasuries (looking at you, EOS).

- Tier 3: Dapp tokens – Too early for these, most will go the way of the dinosaur.

Now, let’s take a look at the top 7 projects that will survive the 2018 bear market!

As always, I’ll be hanging out in the comments section below. I’d love to hear your opinion on any of these.

7 Cryptocurrencies That Will Survive the Altcoin Apocalypse

1. Stellar Lumens (XLM)

The Stellar Protocol is best suited for completing cross-border transactions quickly and efficiently. Stellar can also be used to issue tokens via ICOs, power decentralized exchanges (DEXs), and host decentralized applications (dapps).

Stellar will survive this bear market because it has a long history, a strong product-market fit, and real-world use cases.

Stellar was founded in 2014 during the middle of a 2-year bear market. Since its inception, the XLM token has climbed to ~6th overall in terms of marketcap. Since XLM has already survived an extended bear market, this lends confidence to it surviving our current market conditions.

A few of the real-world use cases that will keep Stellar relevant, giving it the momentum to power through the bear market, include:

- International bank settlement with their Universal Payments Network

- Remittance competitor to Western Union, Moneygram, etc.

- Capacity to bank the “unbanked” and “underbanked,” especially in Africa and Asia

- Powering exchanges, stablecoins, and ICOs

Stellar also has a strong ecosystem insulating the project from failure.

The community surrounding Stellar is impressive and minimizes the risk of the platform dying off during a bear market. In addition to their team and users, Stellar partnered with IBM on their Universal Payments Network product and has big-name banking customers, such as Deloitte.

Stellar is also becoming a viable alternative to Ethereum for launching ICOs. Stellar is attractive to developers because it can process more transactions per second and does not require GAS to execute programs.

We’re also seeing promising signs, such as exchanges leveraging Stellar as the underlying technology, stablecoins launching on Stellar, and plans to integrate the Lightning Network by the end of 2018.

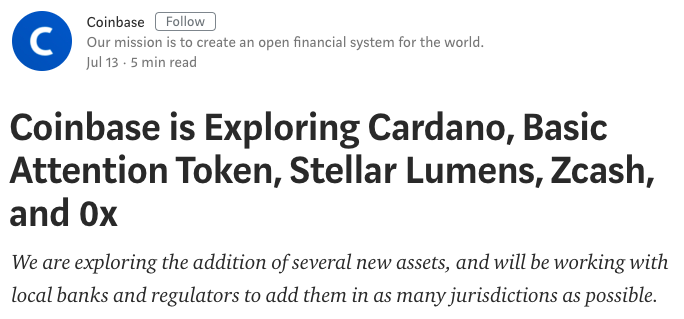

Lastly, Coinbase announced that XLM is one of 5 tokens they’re considering adding to the Coinbase family. This would provide more liquidity and a nod of confidence for the token.

2. EOS.IO (EOS)

EOS is a general-purpose smart contract blockchain created by Dan Larimer and a company called Block.one. EOS has chosen to focus on speed, scalability, and user experience (with optional transaction fees and the ability to recover accounts).

EOS uses a Delegated Proof-of-Stake (DPoS) consensus mechanism to achieve high throughput, with no transaction fees. The EOS token is required to leverage shared network resources such as bandwidth, storage, etc.

EOS will survive the bear market because it’s focused on scalability during a time of desperation, it’s extremely well funded, and Dan Larimer has a proven track record of successful blockchain launches. His other 2 blockchain projects are BitShares and Steem, both of which lend confidence to EOS maintaining relevance as well.

EOS has had a rocky start since launching their mainnet, however there is still a lot to be optimistic about.

We’re in the middle of the “great scaling debate.” From the dapp platform perspective, all eyes are on Ethereum. Ethereum is attempting to shift from POW to POS and implement sharding in an attempt to increase throughput of their blockchain.

I personally believe EOS’s take on Delegated Proof-of-Stake (DPoS) is a really important experiment in scaling of decentralized application platforms. Most notably, how will the governance model perform over time? 21 block producers make up the “delegation” that decides and enforces rules for the entire ecosystem. Will an oligarchy form? How corruptible are publically known block producers?

Since launching their mainnet, EOS has quickly become the blockchain with the most transactions (5+ million per day). While this is certainly an imperfect statistic, it is also a positive indicator.

EOS raised over $2 billion during their year-long ICO. Many people have voiced (justifiable) concerns over this “cash grab.” That being said, it also means the company behind the EOS development is well capitalized. They’ve pledged to invest over $1 billion in funds that will build the ecosystem. That should be enough capital to survive this bear run.

3. Monero (XMR)

Monero (XMR) is a cryptocurrency focused on privacy, fungibility, and decentralization. Monero was created in 2014, which means it also survived the great 2014/2015 bear market unscathed.

Monero will likewise survive this current bear market because “native asset digital money” is still the best use case for blockchains, and the demand for private transactions will never go away.

Private transactions are really important and will always have a demand from the market. Contrary to mainstream talking head nonsense, they serve more important use cases than “buying drugs on the internet.” In fact, private transactions preserve fungibility and protect free speech.

Some organizations are considering “blacklisting” certain bitcoins that are currently held by someone an authority figure deems as “bad.” This prevents bitcoin from being “fungible” which negatively impacts the network as a whole. Imagine if Coinbase seized your bitcoin because “4 years ago that same btc was used by someone else on the Silk Road.”

Without being able to “vote with your dollar” a.k.a. exercise free speech, our current forms of “democracy” will erode. What happens when citizens cannot support/donate to their political party of choice without fear of being tossed in jail or worse?

What About Other Privacy Coins?

You can make a strong case of multiple privacy coins surviving the current bear market. Behind Monero, ZEC and DASH are the privacy-focused cryptocurrencies most likely to survive.

ZEC has been listed by Gemini, and Coinbase has indicated they’re considering adding the coin. ZEC also has among the strongest cryptography and privacy technology. These are strong indicators that ZEC isn’t going away any time soon. That being said, ZEC feels more like a research project than a consumer-facing privacy coin. Confidential transactions are currently optional on ZEC, which means the tiny percentage of people using confidential transactions stand out like sore thumb.

DASH is less privacy focused but has a long history, a strong community, and a well-funded treasury model to incentivize further development and community building efforts.

4. Waltonchain (WTC)

Waltonchain is a Chinese and Korean-based project focused on combining blockchain technology and Internet of Things (IoT) to create what they’re calling the “Value Internet of Things” (VIoT).

According to their website:

We will create a genuine, believable, traceable business model with totally shared data and transparent information, depending on the combination of RFID technology and Waltonchain.

Most people toss Waltonchain into the “supply chain projects” camp, which is selling the project short. Besides improving supply chain management, Waltonchain has a focus on retail, logistics, product manufacturing, powering the smart city revolution, and ultimately achieving the full coverage of business ecosystem.

WTC will survive the bear market because of their many real-world use cases, support from future superpower China, and the fact that they’re a highly defensible business.

Waltonchain is tightly integrated with China, who are on pace to become the world’s next technological superpower. Waltonchain is building state-sponsored blockchain schools in China and powering the largest infrastructure project in the world (One Belt, One Road). Being “supported” by the Chinese government is the only way to truly succeed inside the country.

Lastly, Waltonchain is a very durable, defensible business, which is important when it comes to outlasting a potentially long bear market. Not only is Waltonchain a software business (blockchain, etc.) but they’re also a very capable hardware business, as demonstrated by their incredible feat of producing RFID tags for 5 cents each. These chips can be inserted into anything and then tracked through their lifecycle. The entire product data can then be written to the blockchain.

While most current blockchain projects will likely fail, Waltonchain appears to be a good long-term investment.

5. Neo (NEO)

According to their website:

Neo is a non-profit community-driven blockchain project. It utilizes blockchain technology and digital identity to digitize assets and automate the management of digital assets using smart contracts. Using a distributed network, it aims to create a ‘Smart Economy’.

Founded in 2014 by Da Hong Fei, the project was originally called Antshares, before being re-branded to NEO. It’s commonly referred to as the “Ethereum of China.” While this analogy works if you’re brand-new to blockchain, the reality is NEO and Ethereum are quite different.

NEO will survive the bear market because of their robust ecosystem, tight integration with the Chinese government, long history, and strong ecosystem/community.

The NEO ecosystem is growing fast and already has 66+ dapps launched on the platform.

Compared to Ethereum, this is really small. However, the average quality on NEO is much higher, probably due to the increased cost to deploy on NEO. Launching dapps on NEO costs 500 GAS, which at the time of writing costs around US$2,500. At the market peak, launching dapps on NEO cost around US$37,000 — compared to Ethereum which costs less than US$100 in gas.

NEO also has 2 partnerships that are particularly promising: Ontology and Elastos.

Ontology acts like a bridge linking governments, businesses, and individuals to the main hub of the digital economy, NEO. Ontology was created by the same parent company as NEO (Onchain).

Elastos is trying to create the infrastructure of a new internet (powered by a blockchain operating system) that is more secure and allows for transfer of value.

According to the Elastos Github:

Key features of the smart web include the virtual machine, runtime environments and trust zone, provided by Elastos and Bitmain, consensus provided by NEO and KYC provided by Ontology.

In addition to this, NEO has a very strong community.

This can be a very strong indicator of a coin’s surviving a bear market. Since inception, the NEO community has grown tremendously. Most notably is City of Zion, an independent group of developers building cool things on NEO, such as the Neon Wallet (which I love). The NEO team also does a good job of recruiting talent by continuously hosting community events around the world.

Lastly, like Waltonchain, NEO benefits tremendously by being in alignment with the Chinese government. China will never allow a foreign smart contract platform like Ethereum to succeed on Chinese soil, and NEO has thrived from this preferential treatment. The fact is, China likes homegrown technology (read: easy to control), and NEO is their golden child.

6. Binance Coin (BNB)

Binance Coin (BNB) is an ERC-20 token used to support the the world’s largest exchange, Binance. Users receive a 50% discount on exchange fees when they pay with the native BNB token. This is a very strong incentive for high-volume traders to keep it circulating.

BNB will survive because Binance is the biggest exchange in the world, exchanges are the most lucrative sector in crypto, and the token has proven it’s able to perform well so far in our current bear market.

Binance is projected to earn up to $1 billion in profits in 2018. This is a lot of capital to build a moat around their business. Optimistically, 90% of the Binance employees chose to receive their salary in the native BNB token.

What’s more, it appears Binance is gearing up to become an all-encompassing crypto utility. After moving operations to Malta, the team is planning to create a fiat onramp, a blockchain investment fund, and even the first “tokenized bank.”

So far, the BNB token has performed relatively well during our current bear market.

According to Bravenewcoin:

Many consider BNB as a hedge against BTC price fluctuations because the primary driver of BNB prices is trading volumes on the Binance exchange. In a situation where negative market news inspires a sell off, exchange tokens are in demand because they provide access to cheaper transactions when dumping coins.

Lastly, Binance burns some BNB tokens quarterly, which mimics “share buybacks” by publicly traded companies in traditional equities markets. This reduced supply then puts an upward pressure on the token price.

On the flipside, this also means the token price is tied firmly to the exchange, and historically exchanges are volatile spaces. Remember Mt. Gox?

7. Litecoin (LTC)

Litecoin (LTC) is a decentralized P2P digital currency. In fact, it’s a slightly modified (shorter block times, increased maximum supply, different hashing algorithm) clone of Bitcoin core, created by Charlie Lee in October 2011.

LTC will survive this bear market because of its long history surviving bear markets, strong brand recognition, proven technology (PoW), Lightning Network Integration, and because it can ride on the coattails of Bitcoin.

Litecoin is one of 3 coins that are still in the top 20 since 2014 (along with BTC and XRP). This shows that its intrinsic value was enough for it to survive the great 2014/2015 bear market. Like Bitcoin, the Lindy effect applies here: “The longer LTC stays alive, the longer it’s lifespan will become.”

This is a powerful investment thesis for Litecoin. It’s rooted in “real life,” which helps the average investor remember and assign value to LTC.

And, like Abraham Lincoln famously said…

LTC benefits from the constant development and network effect created by Bitcoin. Since they share the same code (more or less), any new Bitcoin developments can easily be tweaked to accommodate little brother Litecoin.

For example, Litecoin will be fully integrated with the layer-2 scaling solution, Lightning Network. This will enable some really cool innovations such as: refilling your Bitcoin Lightning Wallet with LTC, and sending BTC to someone who can opt to receive the payment in LTC. Lightning Network will make most privacy coins and some alternative cryptocurrencies obsolete.

So far, the blockchain space has produced a ton of hype, stolen incredible talent from other industries, and proven that native token digital currencies put on a blockchain enable a more decentralized money. In other words, money is still by far the best use case for “blockchain technology” to date. While I’m fascinated by all the potentials for the blockchain space, in a bear market it’s smart to seek safe assets.

When the dust settles, Litecoin will be fundamentally stronger than it is today, and I believe that in time that will be reflected in the price.

Let’s Wrap Up

Bear markets are no fun, but they’re natural aspects of markets and really important for the long-term health of the space. Bear markets provide time and space for engineers to build important new developments, and they shake out the weak investors. In other words, we need this downtime to improve the fundamentals, which will then serve as catalysts for the next hype cycle.

Instead of staring at charts, build something useful, or maybe it’s time to finally start getting paid in crypto.

Either way, take a look at your portfolio and determine what you’re comfortable holding long term. What if this bear market lasts another 6-12 months?

To weather the storm, seek out projects with strong communities, obvious product-market fit, relatively long histories, and backing from elite teams with deep pockets.

Your turn: How long will the bear market last? What coins are you holding through the downturn? Let us know in the comments.

Disclaimer: This is not intended to be financial advice. As always do your own research. At the time of writing, author holds a position in XLM, EOS, XMR, WTC, NEO, BNB, and LTC.

Related: Top 10 Coins in 2020 (Opinion)

Download the Brave Browser.