I’m operating under the assumption that most current blockchain-based projects will fail miserably. However, a tiny percentage will cater to just the right market, flourish, and capture a ton of value.

Based on this assumption, I decided to weight my portfolio as such:

- Majority towards “safe” investments (BTC, ETH)

- Remaining minority reserved for smaller positions in risky investments with very high upside

I expect the majority of these risky bets to return nothing. However, all it takes is one of these investments to succeed in order to realize great returns overall – more or less, the Venture Capital model.

What do I look for when selecting a “risky bet?”

Primarily, I’m looking at the risk versus reward of a specific project. What are the potential factors that make an investment fail? And if it succeeds, how big would the returns be?

By my assessment, Waltonchain (WTC) has a very attractive risk-versus-reward profile.

This article will explain why I believe WTC is a smart long-term investment.

If you’re new to the project, I suggest you start with Jeff Kuan’s article: Waltonchain: Ushering an Era of IoT Mass Market Adoption.

Why is Waltonchain Undervalued?

As many of Waltonchain’s ardent fans will tell you, WTC is criminally undervalued.

Waltonchain is a Chinese-based project that has historically struggled with marketing communication with the Western world. Although this has gotten better recently, it appears the majority of investors in the West don’t actually understand the project.

Waltonchain is generally considered a “supply chain project” in competition with VeChain. VeChain is undoubtedly better at marketing, and they capitalize on their high-profile partnerships, which has led to a market cap of $1.3 billion, roughly 6.5x larger than WTC. In reality, WTC is much more than a supply chain coin, and I don’t think the market has priced that in yet.

A couple other potential reasons WTC is undervalued are that they have a very long roadmap demanding patient investors, and their hardware advantage isn’t fully appreciated by the market.

4 Reasons Why WTC is a Good Long-Term Project

1. WTC is a Leader in the Growing IoT Industry — An Industry Estimated to be Worth $9 Trillion by 2020

The global Internet of Things (IoT) industry is expected to grow to $9 trillion by 2020. IoT plus blockchain is a match made in heaven due to the security improvements and disintermediating potential offered by the blockchain. Waltonchain considers themselves to be forerunners of the “Value Internet of Things” industry, essentially combining Internet of Things and blockchain.

One of the biggest challenges in the IoT space is that the existing RFID chip industry cannot meet the needs of the IoT market. Current chips are too expensive, and they’re not secure enough to ensure data integrity.

Waltonchain is emerging as a leader in IoT + blockchain chip manufacturing by solving these hardware challenges. They manufacture patented chips that are more advanced, more secure, and cheaper (less than 5 cents each).

Waltonchain’s hardware security advantage stems from ensuring each tag (chip) is unique, authentic, and tamper-resistant by automatically generating random public keys and private keys.

These chips can be inserted into any item and tracked on the blockchain as they move around in the “meatspace.” Imagine putting these sensors into all items in the global supply chain or tracking boats and shipping containers in every port in China.

Waltonchain created a defensible “moat” around their business by combining both hardware (chips) and software (blockchain).

This enables Waltonchain to stay “vertically integrated,” meaning they can keep both the chip design and blockchain development inside the organization. This is a competitive advantage because Waltonchain can produce chips specialized for their needs, while competition will be forced to use generic third-party chips.

The team is making steady progress, and even announced their first run of chips are ready for mass production.

Superior hardware combined with Waltonchain’s parent/child blockchain structure ensures the decentralization of asset management by ensuring tamper resistance.

WTC has a current market cap of $210 million. If Waltonchain can capture even a small fraction of the IoT business, they will be a massive success.

2. Waltonchain Has a Strong Foundation: Multiple Subsidiaries, a Massive Team, and High-Profile Partnerships

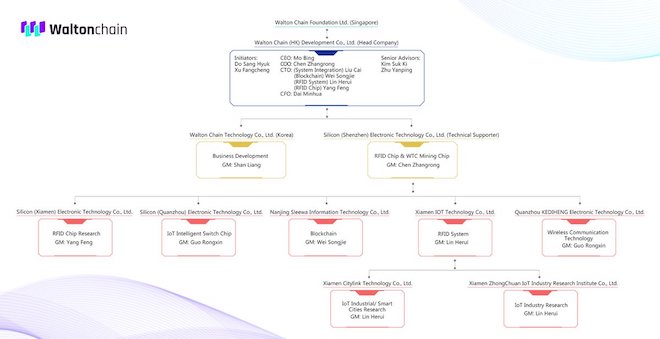

Waltonchain is building a massive foundation of subsidiaries focused on hardware design, mobile and RFID technology, blockchain systems, and various related research institutions.

Due to Waltonchain’s complicated business structure full of subsidiaries, it’s unclear exactly how large their team is. I’ve seen anywhere from 80–500 employees discussed. Waltonchain is run by elite tier talent, including former VP of Samsung, Google engineers, Chairman of the Taiwan Cloud Services Association, and research scientists from all relevant fields.

Waltonchain has also announced many high-profile partnerships including China Telecom and the Fujian IoT Industry Association.

The Waltonchain team, hardware subsidiary Silictec, and their first child chain, Freyrchain, all have offices in the same complex, located in Shenzhen, demonstrating aligned interests and potential for efficiencies.

Waltonchain has a massive team, high level partnerships, and an extensive roadmap, which when put together gives them the scope to become a major player in the business of tomorrow.

3. Waltonchain is Supported by the Chinese Government

The first thing to consider when examining investment opportunities in China is government support. Historically, the organizations that succeed in China are homegrown and receive support from the central government, which would be considered “anti-competitive” in the West. Instead of Facebook, China has Wechat and QQ. Instead of Google, China has Baidu. You get the idea…

Waltonchain is involved in a number of government-backed projects.

Here are a couple examples:

The “Cross Strait” program creates a Chinese and Taiwanese government partnership turning Zhangshou (Fujian province) into a blockchain industrial park. Historically China has created these economic “zones” that concentrate an entire industry into a specific area (manufacturing in Shenzhen for example).

Air pollution is a huge problem in the densely populated urban centers in China. Waltonchain is contracted by the Jiangu province to create IoT-connected purification systems for homes and for businesses.

Also, it appears that the Chinese government has invested in various subsidiaries of Waltonchain. For example: a portion of the Waltonchain subsidiary, Xiamen ZhongChuan IoT Industry Research Institute, is owned by Dragonsoft, which is part of the Chinese National Government’s Torch Plan.

4. Waltonchain to Power the One Belt One Road (OBOR) Initiative?

(Source)

(Source)

China is launching the largest infrastructure project in history, called One Belt, One Road (OBOR). This $1 trillion initiative will create infrastructure connecting 60+ countries spanning all of Eurasia (Asia, Africa, and Western Europe). This project effectively extends trade routes by land and sea that connect 65% of the world’s population, about 1/3 of the world’s GDP, and about a quarter of all the goods and services the world’s supply chains move.

From the outside looking in, OBOR appears to be a smart move in China’s effort to become THE single global superpower.

Waltonchain appears to be the #1 technology provider to support OBOR from many different angles. Waltonchain will support the new futuristic maritime industry, facilitate warehouse management in Hainan, support smart cities by reducing pollution and improving waste management, among many others.

Waltonchain has been chosen to revolutionize both the IoT and blockchain industries in China. They were chosen to create 2 seperate blockchain focused-industrial parks in Fujian which is the center of the OBOR initiatives.

Waltonchain project director, Lin Herui was elected as the VP of the Fujian IoT Industry Association. This means Waltonchain has tremendous influence in the future of IoT in both China and Taiwan through the Cross-Strait Initiative. They have also been chosen to guide the IoT standards in China

Examining the wide, sweeping industries, IoT initiatives, and synergies with OBOR, it becomes clear that Waltonchain is much more than another “supply chain token.” In fact, it’s one of the most ambitious projects in the space and has a good chance at becoming a top 10 coin by 2020.

Risk Versus Reward: How Does Waltonchain Stack up?

Could Waltonchain fail completely? Yes, of course it’s a possibility. 5 years from now, the vast majority of current projects will most likely have failed.

However, not all projects have the same chance of failing (risk), nor do they have the same potential upside (reward).

Compared with other projects with relatively similar marketcaps, Waltonchain is among the least risky. They’ve created a uniquely defensible enterprise due to their strong ties with the Chinese government, combination of hardware and software, a world-class team, synergies with OBOR, and their diversified portfolio of use cases.

Looking to the future, if Waltonchain comes even remotely close to achieving their ambitious goals, the project will be absolutely massive. From an investor’s perspective, the potential upside is very attractive considering their relatively small market cap ($212 million at the time of writing).

Based on my observations, there are few (if any) projects in the top 100 that have a better risk versus reward profile as Waltonchain.

As always, nothing I write should be misinterpreted as investment advice. Never make financial decisions based on some internet guy’s analysis. Always DYOR and take responsibility for your own financial decisions. Author currently holds a position in WTC.

Related: Match Made in Blockchain: Waltonchain + Request Network (Analytical Speculation)