Cryptocurrency forks have been momentous events in the digital industry since the inception of Bitcoin. Historically, the concept of fork became the center of interest among the crypto community after Bitcoin successfully launched its first tremendous hard fork, giving rise to Bitcoin Cash.

A fork is when a change is made to the software of a cryptocurrency to create another version of the blockchain, technically. In other words, a fork is a change in protocol that makes previously invalid transactions valid. Every successful fork leads to the creation of another version of the existing cryptocurrency.

Usually, forks are launched when there is a difficulty in reaching a consensus on the functions of an existing cryptocurrency by the community. In this case, they create another version to offset some of the weaknesses of the original one. One important observation is that previous Bitcoin forks have had a favorable impact on the cryptocurrency market, affecting the mode of cryptocurrency trading through the high volatility of the market during such periods.

This article presents some of the most impactful Bitcoin forks, their influence on the cryptocurrency market and a guide for cryptocurrency traders and investors to help them respond to an upcoming fork.

Bitcoin Cash (BCH)

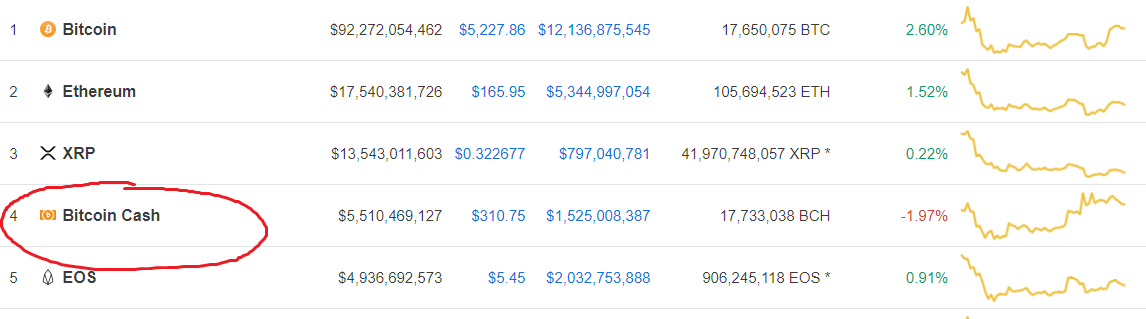

Bitcoin Cash (BCH) is one of the most widely known digital assets that emerged from an existing asset, and currently sits at #4 in ranking on CoinMarketCap.

Following many concerns on the high transaction fee of Bitcoin, a group of developers came together to create another version of Bitcoin with a larger block size. In other words, Bitcoin Cash came about due to a lack of consensus on the expansion of the block size of Bitcoin by the Bitcoin community.

A group led by Roger Ver proposed an expansion of the Bitcoin block size, citing an argument from Satoshi Nakamoto’s Bitcoin whitepaper that Bitcoin was designed to be a better transactional asset than an investment asset. However, the resistance that arose from the majority of the Bitcoin community left Ver and his followers with no option but to come out with a similar but a better version of Bitcoin.

On August 1, 2017, Bitcoin Cash came into existence. The blockchain and the cryptocurrency were split into two, and everyone who held Bitcoin received an equivalent amount of Bitcoin Cash on a 1:1 ratio. This was designed to solve BTC’s transaction problem by increasing its block size being from 1MB to 8MB. This means that BCH processes transactions 8 times faster than Bitcoin. Bitcoin Cash also emerged with a block height of 478,589. The main technical difference between Bitcoin and Bitcoin Cash is the time they spend to process transactions.

Bitcoin Gold

Following the successful fork of Bitcoin to create Bitcoin Cash, developers and miners led by Jack Liao, the CEO of Hong Kong mining manufacturer LightningAsic, subjected Bitcoin to another fork in a bid to restore the mining functionality with Graphics Processing Unit in place of ASIC Bitcoin mining. There was a concern on how few miners and the mining community had monopolised the Bitcoin network with their hash power. To make the decentralised nature of the network more effective, developers launched the fork to change the Bitcoin consensus algorithm to GPU.

Bitcoin Gold was one of the few successful forks that introduced GPU to attract more miners into the network in a quest to discourage the monopolisation of the Bitcoin market by few miners.

One of the fundamental reasons that led to the creation of Bitcoin gold was the complex process of Bitcoin mining. The need to be part of a pool and to own an expensive ASIC hardware to mine Bitcoin limited the operation to a few miners with high hash power. This influenced the creation of the Bitcoin Gold with mining algorithm of GPU to give everyone the chance to mine from their home as they improve the decentralised nature of the network.

The maximum supply of Bitcoin was maintained, and so was the block size of 1mb. However, the transaction speed was made to be a lot faster than Bitcoin with 2.5 minutes, unlike Bitcoin’s 10 minutes.

Also, the Bitcoin block had a level of difficulty of adjusting block every two weeks and also had unstable hash power after the Bitcoin Cash fork. In response, the Bitcoin Gold was made to have a level of difficulty adjusted to every block found.

Bitcoin Private

Bitcoin Private is one of the most exciting Bitcoin forks in existence. It is a forked digital currency of a forked digital currency. This means that Bitcoin private is not a direct fork of Bitcoin. This digital currency emerged fromZclassic, which was a hard fork of Zcash, which was a hard fork of the original Bitcoin. (Bitcoin> Zcash> Zclassic> Bitcoin Private.)

Rhett Creighton launched Bitcoin Private in March 2018. The idea was to combine the privacy and the secrecy of Zclassic with the popularity and security of Bitcoin. Those who held Bitcoin and Zclassic in their wallets got an equivalent amount of Bitcoin Private after the fork.

Bitcoin Private has a block size of 2MB, and it is 4x faster than Bitcoin. It enables miners to join the network without acquiring any expensive hardware. Bitcoin Private also ensures that a transaction is kept private. In this case, the blockchain will record the transaction, but the identities of the sender and the receiver are treated with utmost confidentiality.

From the above points, it can be said that Bitcoin Private is faster, fairer, and more anonymous than Bitcoin. Like Zcash, it uses zkSNARKs to improve its functions. It has a maximum supply of 21 million and has managed to record market capitalization of $10 million.

Bitcoin Diamond

Bitcoin Diamond was created from a direct fork of the original Bitcoin. This occurred after a group of developers identified as Team Evey and Team 007 felt dissatisfied with Bitcoin’s operation, mostly on the ground of its block size. With the addition of many new clients to its network, Bitcoin began to suffer from slow transactions and higher transaction fees. Bitcoin Diamond sought to implement an increase block size of 8MB to address this. So they introduced Bitcoin Diamond which has a block size that is 8x larger than that of Bitcoin.

Unfortunately, the introduction of this digital asset into the market faced severe resistance from the cryptocurrency community. Many suspected it to be a scam because there was no official whitepaper released. On November 25, 2017, Bitcoin Diamond was trading at $85, but as of time of writing this article, it is trading at $1.

Unlike the above-listed forks, this digital asset has a maximum supply of 10x more than that of Bitcoin, which gave every Bitcoin holder a 10x the equivalent of their BTC in Bitcoin Diamond.

The Impact of Bitcoin Forks in the Bitcoin Market

Interestingly, the announcement of a Bitcoin fork has a predictable effect on the market, both in the weeks running up to the hard fork and in the aftermath.

One thing that usually happens after a Bitcoin fork is that holders of Bitcoin get an equivalent amount of the forked token on a 1:1 ratio. What this means is that Bitcoin holders get the rare chance of doubling their holdings in a wallet that supports the fork.

In response to this, a group classified as “whales” control a lot of Bitcoin and exert that influence to fluctuate the price to a considerable price height. Whales are known to own thousands of bitcoins, with the power of determining the direction of the price movement. Before a Bitcoin fork, whales get involved in taking advantage of the free equivalent tokens distributed by buying more of the original digital currency, which drives the market to an insane bull run.

A typical example is the fork of Bitcoin Gold. On October 23, 2017, a day before the Bitcoin Gold fork, Bitcoin’s price hit an all-time high of $6,000. After the fork, the price continued to rise and finally hit near $20,000 in December 2017. The same happened after Bitcoin Cash forked from Bitcoin.

The truth is that the market usually benefits from the involvement of the whales even after the fork until they decide to convert their assets into fiat. When this happens, the market takes a deep fall from its price level and struggles at the bottom before showing another bull run.

For now, there is no listed upcoming Bitcoin fork, but more are expected to come as developers try to produce better versions of Bitcoin in a bid to offset its weaknesses and make it fit as an investible asset and a medium for a digital transaction.

Michael is a financial enthusiast who has been studying the crypto field for over 3 years now. He is also a bitcoin long-term hodler and forex day trader. His most current interest is in spreading his financial expertise among masses to educate everyone about trading options.

Michael is a financial enthusiast who has been studying the crypto field for over 3 years now. He is also a bitcoin long-term hodler and forex day trader. His most current interest is in spreading his financial expertise among masses to educate everyone about trading options.