We have previously looked at the role of blockchain in serving the unbanked. WeTrust is a startup in the microfinance space that is gearing up to introduce a decentralized microlending model to emerging markets.

What is WeTrust

WeTrust is a microfinance Dapp that lives on the blockchain. The company is releasing its first product, a collaborative lending circle called Trusted Lending Circles. At a later stage, WeTrust will also provide collaborative savings and insurance services through its online platform.

WeTrust’s Trusted Lending Circles

Informal lending circles are one of the ingenious ways in which financially challenged communities gain access to larger cash flow through a collaborative saving scheme. In a lending circle, a set amount of people each contribute a set amount of money during a predetermined time cycle (i.e one month), with the total sum claimed by each of the group’s participants in a rotating fashion.

Rotating savings and credit associations, or ROSCAs, as they are formally known, combine peer-to-peer banking and peer-to-peer lending to satisfy its members’ financial needs. The practice, however, is nothing new and is prevalent in developing communities.

ROSCAs are a handy way to save money for anything from getting access to credit, saving funds to make a purchase, or gathering capital to start or expand a business. It has a place in developed nations as well.

WeTrust is taking this voluntary self-governing structure one step further. Through its Ethereum-powered blockchain platform, it aims to give the already decentralized practice a technological boost thanks to smart contracts.

Using WeTrust, group members can automate almost the entire process, whilst adding an additional functionality layer thanks to the technological drivers. A circle can determine under what conditions payouts are done, for example, according to a set schedule or via a bidding auction.

Its main audience is twofold:

- Serving the unbanked

- Providing alternative solutions to those who do have access to banking institutions.

The signup and walkthrough process is simple and intuitive, as is deploying, maintaining the lending cycle, and withdrawing funds.

The WeTrust Team

WeTrust has a robust team who bring valuable experience to the table thanks to their rich professional backgrounds at some of the world’s top companies.

CEO and co-founder George Li is an ex-Googler and has worked for McKinsey, Motorola, and Verizon. COO and co-founder Patrick Long is a CPA, and platforms architect Ron Merom is also a former Googler. Ethereum’s founder Vitalik Buterin is one of their most notable advisors.

Initial Success and Next Steps

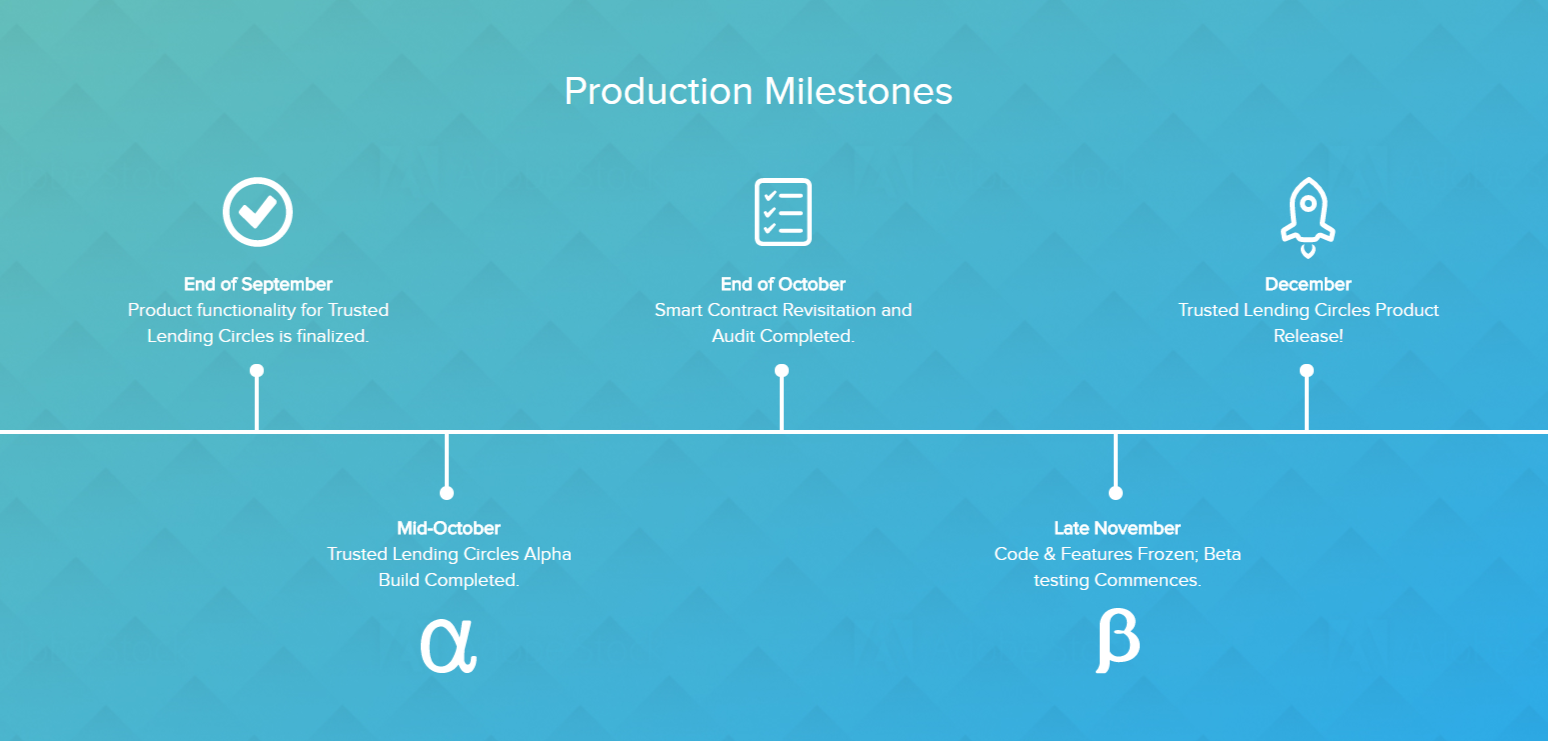

The company’s ICO successfully concluded in March 2017 with $4,978,366 banked. Up ahead, their roadmap is as follows:

Connect with WeTrust on their website, Twitter, Facebook, GitHub, Reddit, or their blog. The whitepaper can be found here.