The blockchain is revolutionary for many reasons, of which continued technological advancement is an important part. But for much of the world’s underserved such as the unbanked and underbanked, blockchain technology has the potential to be a saving grace.

Unbanked Has Traditionally Meant Underserved

The term ‘unbanked’ refers to those segments of the national or international populace who do not own a bank account, thus relying on alternative financial services where and when these are available. These activities include payday loans, pawnbrokers, and loan sharks.

These alternative services are often highly unregulated and can be exploitative and even downright criminal. Yet, the target audience it serves often have no other choice, as they fall outside the formalized banking realm. This is mostly due to their low income, making them ripe targets for undue financial victimization with little to no legal recourse.

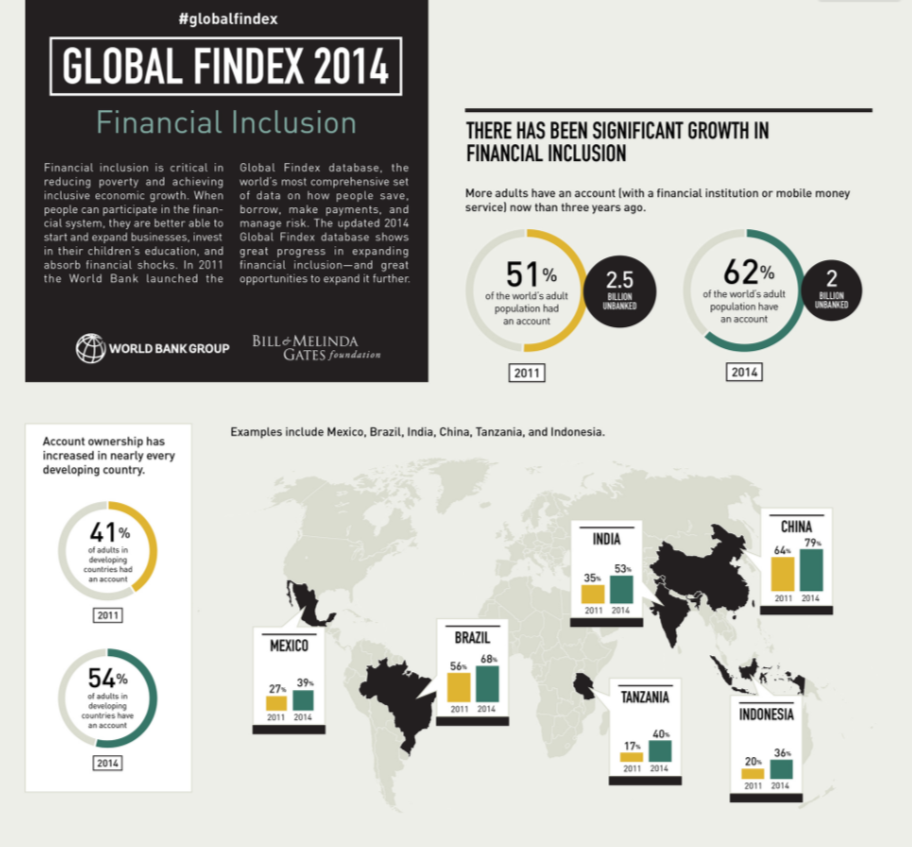

While the number of unbanked individuals is decreasing, there are still 2 billion people on the planet without access to traditional banking services. If you took all of the unbanked people in India alone and put them in their own country, it would make it the 7th largest country in the world.

There’s also another segment of people called the ‘underbanked’, who have limited access to formal banking services. This segment includes migrant workers and the elderly. They, too, are in need of alternative services and can fall prey to unscrupulous financial services.

Microfinancing

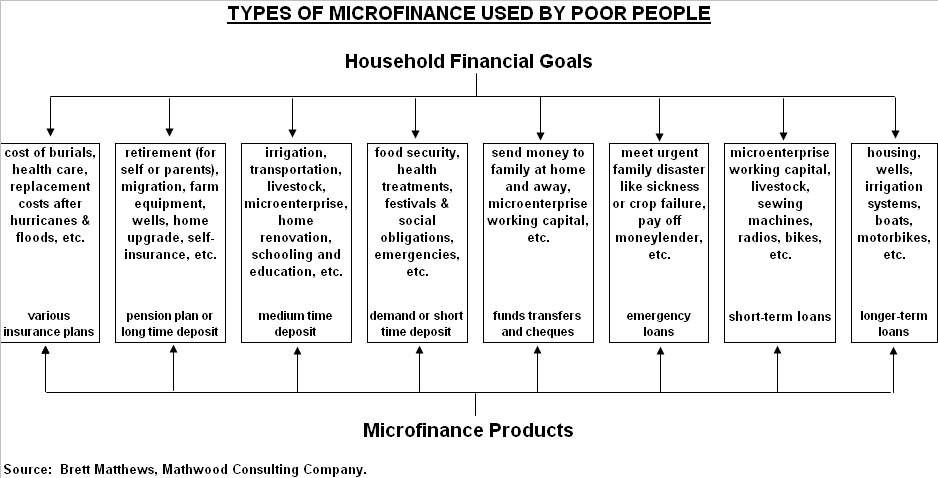

Microfinancing is a movement that works toward providing the poor and socially marginalized access to financial products and services. There are many variations of microfinancing, based on the particular need.

Mobile payment services such as Vodaphone’s m-Pesa, one of the earliest such innovations, play an important role in providing emerging markets, such as those of Sub-Saharan Africa, access to easy and affordable payment methods. In this region, the developing world average is increased by a factor of 4, with 12 percent of every adult registered to a mobile money account.

Credit forms a cardinal part of traditional financial services. In microfinancing, social entrepreneurs work to employ technology to provide access to the world’s underserved. Technological advances have given rise to online peer-to-peer lending platforms such as Kiva and Zidisha, both of which have had tremendous success connecting lenders to borrowers.

The Importance of Fintech

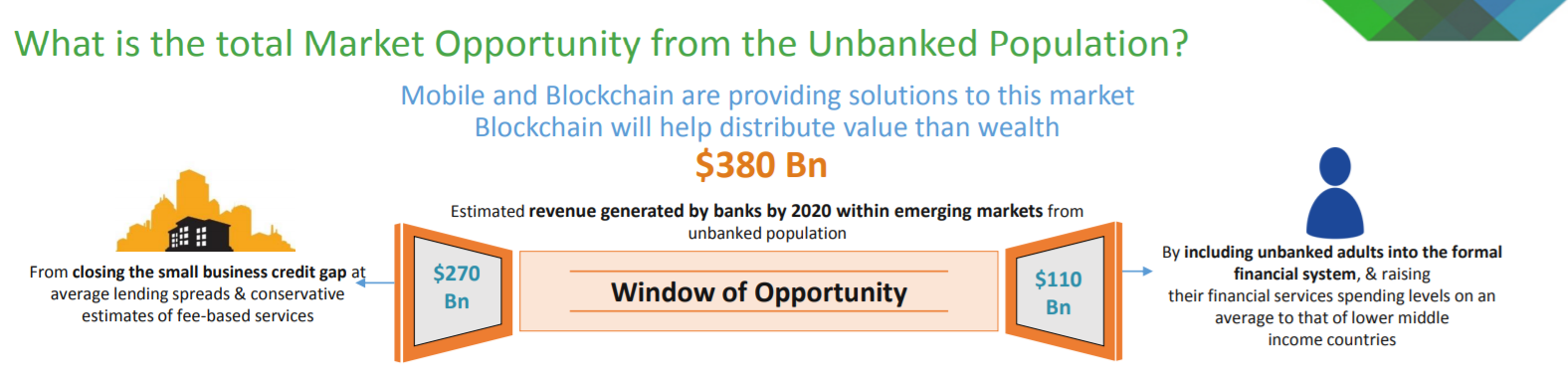

The McKinsey 2016 Global Payments Report estimates that by 2020, an additional US$400 billion worth of payments will be generated on top of the 2016 figures. Fintech is alive and well, and with good reason: it’s the differentiating factor in transforming the financial landscape, especially with regards to the financially marginalized.

Arguably, the greatest fintech innovation to date that many of us will witness in our lifetimes is blockchain technology. What originated with bitcoin is currently being innovated by pioneering companies across the world who are racing to find innovative blockchain solutions to solve ailing businesses and societal problems.

Cryptocurrency and its parent, blockchain technology, are – thanks to its very nature as set out by Nakamoto – designed to be financially inclusive thanks to its decentralized nature. There ought not to be any central organization controlling individual access to cryptocurrency and blockchain technology.

Naturally, governments are not always in agreement with this sentiment, leading to forced technological exclusion in some countries. But in the world of the underbanked, blockchain could turn out to be a lifesaver.

Cryptocurrency and Remittance

Increased financial inclusion is a goal many hope will be furthered thanks to blockchain technology. Cryptocurrency the likes of bitcoin is making headway in providing a more cost-effective alternative to costly international money transfer services in the US$400 billion-strong global remittance industry.

Remittances are a crucial – if underlooked – part of many developing countries’ economies, as diaspora from developing nations who work in more developed countries do so in order to send money home. Remittance brought US$40 billion into Africa in 2016 alone.

Stellar Lumens is a prime example of a example of a cryptocurrency looking to capture this market. They are focusing on making money transfers easy and cheap with two of their main target markets being Southeast Asia and Africa. To quote their website: “Stellar connects people to low-cost financial services to fight poverty and develop individual potential.”

Furthermore, according to KapronAsia’s managing director, Zennon Kapron:

A number of the bitcoin-based remittance solutions on the market allow users to fix an exchange rate before a payment is made. With a pre-agreed rate, there is effectively no exchange rate volatility risk as the sender will know how much money the recipient will receive for a given sending amount before it is sent.

Experts like Andreas Andropolous are not convinced that formalized cryptocurrency services will be the answer to the plight of the globally underserved.

He has said that it won’t be companies bringing fintech to the third world:

It’s not gonna be companies, I think that’s the really important understanding here. The barriers for companies to develop things are much higher than say, open-source projects and grassroots adoption. If you build a company around bitcoin remittances, then the governments or banks that don’t want that to happen have a company to target. A company in itself is a form of centralization; it provides a target.

Cryptocurrency and Local Currencies

Cryptocurrency is also fundamental in providing financial refuge in volatile currency climates such as hyperinflated Venezuela or Zimbabwe.

According to Franco Amati, co-founder of Argentina’s virtual currency hub Espacio Bitcoin:

If you receive dollars in Argentina, the Central Bank give you less pesos (30 to 35 percent less) for each dollar than what the real market price is. But if you buy bitcoins abroad and send them to someone in Argentina, the Argentinian will be able to sell them at a real exchange rate and get 100 percent of the money, excluding a small broker fee.

Moreover, in theory, cryptocurrency will allow the unbanked access to a decentralized savings account that doesn’t have the barrier to entry a traditional bank demands.

Cryptocurrencies like Omise are looking to do just that. “Unbank the Banked” is the slogan for their platform, OmiseGO. This is a play off of Bitcoin’s slogan of Bank the Unbanked, and it is implying that with the OmiseGO platform, you are able to essentially operate without the banking system.

With OmiseGO’s revolutionary system, you are able to add money directly to your phone and use it to make payments online or at brick and mortar shops. This, amongst other things, will remove the need to pay bank fees to use their services.

Microfinancing and the Blockchain

Products the likes of Africa’s BitPesa – a global bitcoin money payment portal operational in Kenya, Tanzania, Nigeria, and Uganda – are making great strides in the blockchain fintech space in emerging markets.

Further afield, microlending is also getting the blockchain treatment. Companies like WeTrust, Everex, and Jita are bringing technology-driven decentralized microlending capacities to those who need it most.

While the unbanked is a long way off from having easy, cost-effective access to financial services, the blockchain is promising to empower these population segments with greater financial services access and engagement by picking up where more traditional fintech has left off.

Utilization of the technology for such social purposes is in its infancy and there are many inroads yet to be made before a shift from the current nascent experimental phase into widespread cultural adoption can occur. However, there’s no doubt that the door has been opened for increased transformation to take place. We plant today in order to reap tomorrow.

For future reading see: “5 Altcoins with Socially Conscious Use Cases“.