While the euphoria of the 2017 bull market continues to fade from memory, one needn’t look far to find optimistic sentiment from prominent figures in the blockchain industry.

Bear markets reveal who’s playing the long game—and since you’re reading this, chances are that includes you. (That is, unless you’re reading this during the next bull market, in which case chances are that you’re wishing you had read it earlier.)

Not only do bear markets help provide a clearer picture of which individual investors have strong hands, they also can help show which projects have strong teams and communities. When well-funded marketing teams can no longer compensate for weak ideas and engineering, overhyped projects fall short of expectations *cough cough*.

Meanwhile, consistency and sound engineering stand out more and more. The subject of this article, Decred, has no shortage of either, and has been steadily moving up the market cap rankings in the last few months.

If you’re investing for the long run, Decred deserves your attention now.

About Decred

In case you haven’t heard of Decred before or don’t know much about it, it’s worthwhile to read our Decred project overview.

To briefly summarize, Decred is setting the example for the entire cryptocurrency market in terms of what truly decentralized blockchain governance looks like. It was founded by some of the early developers of Bitcoin with the aim of empowering token holders to collectively decide the future of the coin, rather than leaving those crucial decisions solely in the hands of the development team.

Since its creation in 2015, Decred has done as good a job as any cryptocurrency project at living up to the core principles of decentralization. As a result, some of the brightest developers in the space have been contributed to Decred by working on innovative solutions including atomic swaps, Politeia (a voting and proposal system that will eventually allow Decred stakeholders to democratically determine the future of the project and how its development funds are spent), and now Decred’s one-of-a-kind decentralized exchange.

More on that in just a bit, but first let’s catch up on some other recent news.

New Exchange Listings

Exchanges have been quite busy integrating new Decred pairs over the last month or so.

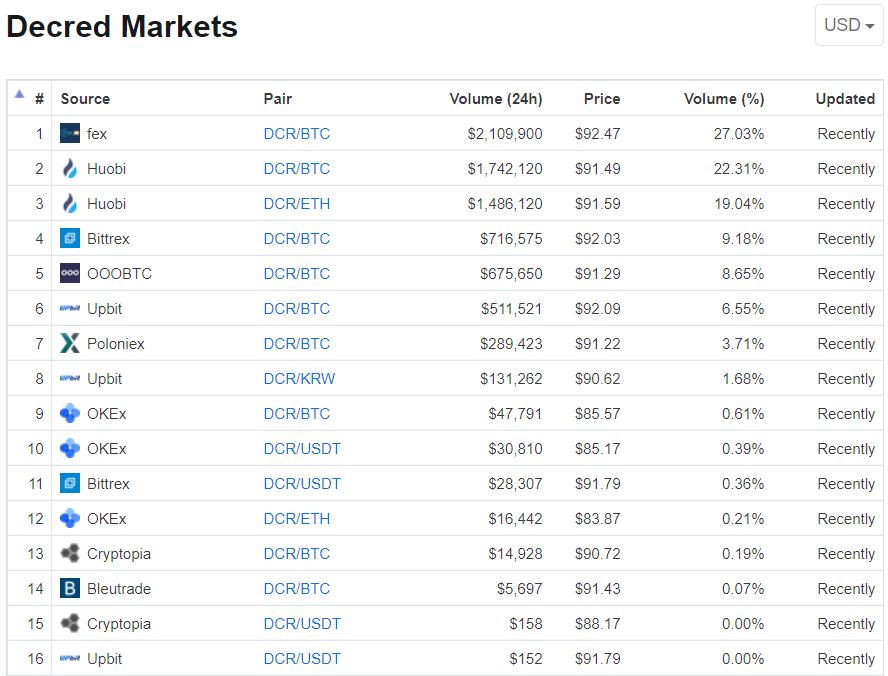

Bittrex and Cryptopia both added a DCR-USDT pair in May, while the major Brazilian exchange OmniTrade also added a DCR-BRL fiat pair. Some smaller exchanges including Upbit, CoinEx, and Bleutrade added DCR pairs as well, making May a solid month for increasing awareness and liquidity in the DCR market.

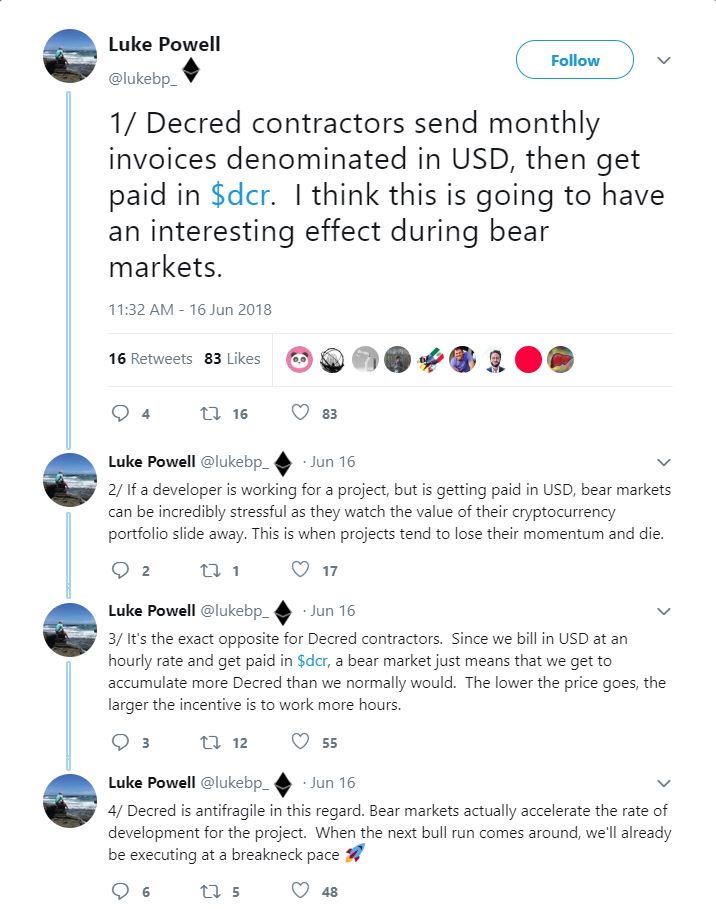

Things have gotten even better so far in June, as notable exchanges Huobi and OKEx added DCR pairs to their platforms in the first half of the month. All together, these new pairs are already accounting for a substantial amount of trading volume for DCR, as shown in the graphic below from coinmarketcap.com.

The number of listings and total trade volume aren’t the only things that are increasing. There has also been a notable increase in hashrate, from under 10k Thash/s 4 weeks ago to over 35k Thash/s now.

When hashrate rises, it becomes increasingly more expensive for a malicious actor to attempt a 51% attack on the network. That is to say, it’s certainly nice to see Decred’s mining power and resiliency growing as it climbs the market cap rankings and continuous to gain awareness.

Decred’s Plans For A New Kind of Decentralized Exchange

The section above is evidence that the increased marketing efforts described in Decred’s 2018 Roadmap are paying dividends. But Decred has always been about sound engineering first and foremost, and they have continued to deliver on that front as well in 2018.

One of the most intriguing items on that 2018 roadmap was the plan for a uniquely designed decentralized exchange. In a recent post on the Decred blog, project lead Jake Yocom-Piat went into much greater detail on those plans.

As Yocom-Piat explains, decentralized exchanges (DEXs) are seen as a good solution to some of the problems faced by centralized exchanges such as being hacked, used as an exit scam, or subjected to restrictive or privacy-infringing government regulations.

However, Decred isn’t designing just another DEX. They are creating the first ever DEX that doesn’t require users to purchase a corresponding token, use a 3rd party blockchain, or even pay trading fees. Instead, all transactions occur as atomic swaps and are facilitated by a simple client-server system architecture.

Benefits of Atomic Swaps for a DEX

Atomic swaps are important because they enable different cryptocurrencies to be exchanged trustlessly without going through a middleman. Rather than reinserting that middleman through a blockchain or token in order to capture revenue, the client-server setup makes the Decred DEX a more purely decentralized marketplace in which clients never actually control funds being transferred nor collect a fee.

Collecting fees is, of course, one of the biggest incentives for people to operate a server for a DEX. However, the unmatched utility provided by the Decred DEX should serve as incentive enough for many people to run servers, especially considering how strongly the Decred community adheres to the project’s original ethos.

And because these are non-custodial servers (e.g. they don’t control funds), they won’t need to collect private information from users or share any information with law enforcement. At the same time, there aren’t incentives for server operators to steal user funds, manipulate order books, or to treat individual users favorably at the expense of others.

In the event that bad actors decide to run servers anyway, yet another benefit of atomic swaps comes into play. On-chain atomic swaps are fully transparent, meaning that malicious behavior by either clients or server operators will result in poor reputation. Using their own proposal platform and filesystem, Politeia, Decred will be able to track the reputations of participants in the DEX such that bad actors are quickly removed if they behave maliciously.

Finally, on-chain transactions make it straightforward to verify trading volume by checking it against the blockchains involved in the atomic swap. This addresses another significant problem for cryptocurrency traders, which is that a number of exchanges create fake volume in order to attract new users and perhaps venture capital as well.

Decred is building an alternative that doesn’t ask users to trust that trading volume is real. If anything looks suspicious, it can easily be externally verified.

Additional Notes

There are a lot of interesting points from the blog post about the DEX that aren’t discussed here, and we recommend giving the full post a read if you have the time.

Some of the other points that are mentioned in the full post include: how trade orders will be verified and executed, how decentralized regulations can be established and voluntarily enforced by clients and servers in the network, how pseudorandom order matching can combat high frequency trading (HFT), and how the DEX architecture lowers the barrier to entry for potential participants.

Last Thoughts

It has become obvious in the last several months that picking a random altcoin and throwing some money at it—as many people did with success in 2017—is not going to be a profitable investment strategy anymore.

Now that a greater percentage of investor money must be earned through demonstrated competence and trustworthiness, it’s no surprise at all to see Decred as one of the top performing cryptocurrencies of Q2 2018. From the beginning, this has been one of only a few projects in the blockchain space that is consistently transparent, productive, and diligent in its mission of building a better currency for the future.

There are no sure bets in a market this nascent. But if you’re planning to stick around for the long run, holding a couple bags of DCR is as good a bet as there is.