One of the things we’ve learned in the past year is that a lot of cryptocurrency projects – even some with large market caps – simply aren’t built to succeed in the long term. They might not have an experienced team with the chops to run a competitive business, or perhaps they are building a product that sounds cool in theory but that doesn’t solve any important problems in the real world.

Taking that into account, it’s encouraging to see established businesses who have found success outside of the crypto world bringing their experience and pedigree to the blockchain industry. That’s the case with the project we’ll be overviewing in this article, Nexo.

Nexo is a fintech application designed to give instant crypto-backed loans to users. The platform is powered by Credissimo, a leading fintech group that has been serving millions of customers across Europe for the past decade.

What Does Nexo Do?

With a few exceptions here and there, most real-world transactions in our everyday lives must still be done using fiat currency for the time being. This means that, in order for cryptocurrency investors to use some of the value stored in their crypto wallets, they must convert it to fiat currency.

There are a few reasons why somebody wouldn’t want to do that:

- They miss out on the potential upside of their investment when they sell

- They have to deal with capital gains taxes when converting crypto to fiat

- It typically takes multiple days to withdraw fiat from an exchange and have it show up in your bank account

Nexo provides an innovative solution to each of these problems with instant, online, crypto-backed loans. This allows customers to obtain liquidity in a convenient manner, without having to sell a portion of their portfolios and miss out on the potential upside of their investments.

Perhaps best of all, it simplifies taxes immensely by avoiding unnecessary crypto-to-crypto and crypto-to-fiat exchanges, operating just like any other fiat loan service apart from the asset being used as collateral being crypto.

How Nexo Crypto-Backed Loans Work

Cryptocurrency holders who want access to fiat currency without having to sell any crypto can use Nexo’s loan service efficiently thanks to a technological solution called the Nexo Oracle. The oracle is an independent system that performs real-time asset monitoring, loan setup, repayment analytics, automated notifications, data analysis, and wallet maintenance.

As described in the Nexo whitepaper, the process of receiving a loan starts with customers transferring their crypto assets to a Nexo wallet. Once the wallet is funded, the Nexo Oracle automatically calculates the customer’s specific loan limit based on the market value of their holdings.

At this point, the loan is instantly made available to the customer via bank transfer or the free Nexo Credit Card. Just like that, investors get access to liquidity without any hidden fees or hoops to jump through. Nexo doesn’t even perform credit checks, as the loans are fully secured by the value of the customer’s Nexo Wallet holdings which are retained in their personal Nexo wallets.

When it’s time to repay the loan, customers have a few options:

- Repay in fiat (USD, EUR, and JPY are currently supported) via a bank transfer.

- Receive a discount on interest rates by repaying the loan with NEXO tokens.

- Repay with a partial sale of the crypto assets in their Nexo Wallet, which can be done with the Nexo Oracle.

Should a customer owe an amount that exceeds their loan limit and that they are unable to repay, Nexo can repossess the cryptocurrencies stored in their Nexo Wallet as agreed upon in the loan contract. The wallet can be unlocked if and only if the customer fails to repay their loan.

Nexo History and Team

As mentioned earlier, Nexo is the venture of an established fintech company called Credissimo. Credissimo was founded back in 2007 by a group of entrepreneurs who wanted to use the latest and greatest technology to disrupt the inefficient lending market.

By 2010, Credissimo had developed proprietary process automation technology that enabled near-instant credit approval for giving out loans 7 days a week. In 2013, the company introduced an e-commerce solution for financing and direct utility bill payments, accepted by hundreds of merchants. In the same year, they released a user-friendly mobile app for iPhone and Android, which allowed them to process over 1 million loan applications.

Credissimo continued to improve their products by integrating machine learning techniques to enhance their loan-scoring algorithms and launching an automated-lending chatbot, the first of its kind. Their foray into the cryptocurrency world began in 2016 with the addition of a Bitcoin loan repayment option.

2017 saw Credissimo named one of the Top 10 Alternative Finance innovators in the European FinTech Awards. The company also received 2 Forbes Business Awards in 2017 for “Financial Sector Innovations” and “Quality of Services.”

Finally, in 2018, Credissimo made its big move into the cryptocurrency ecosystem with the official launch of Nexo.

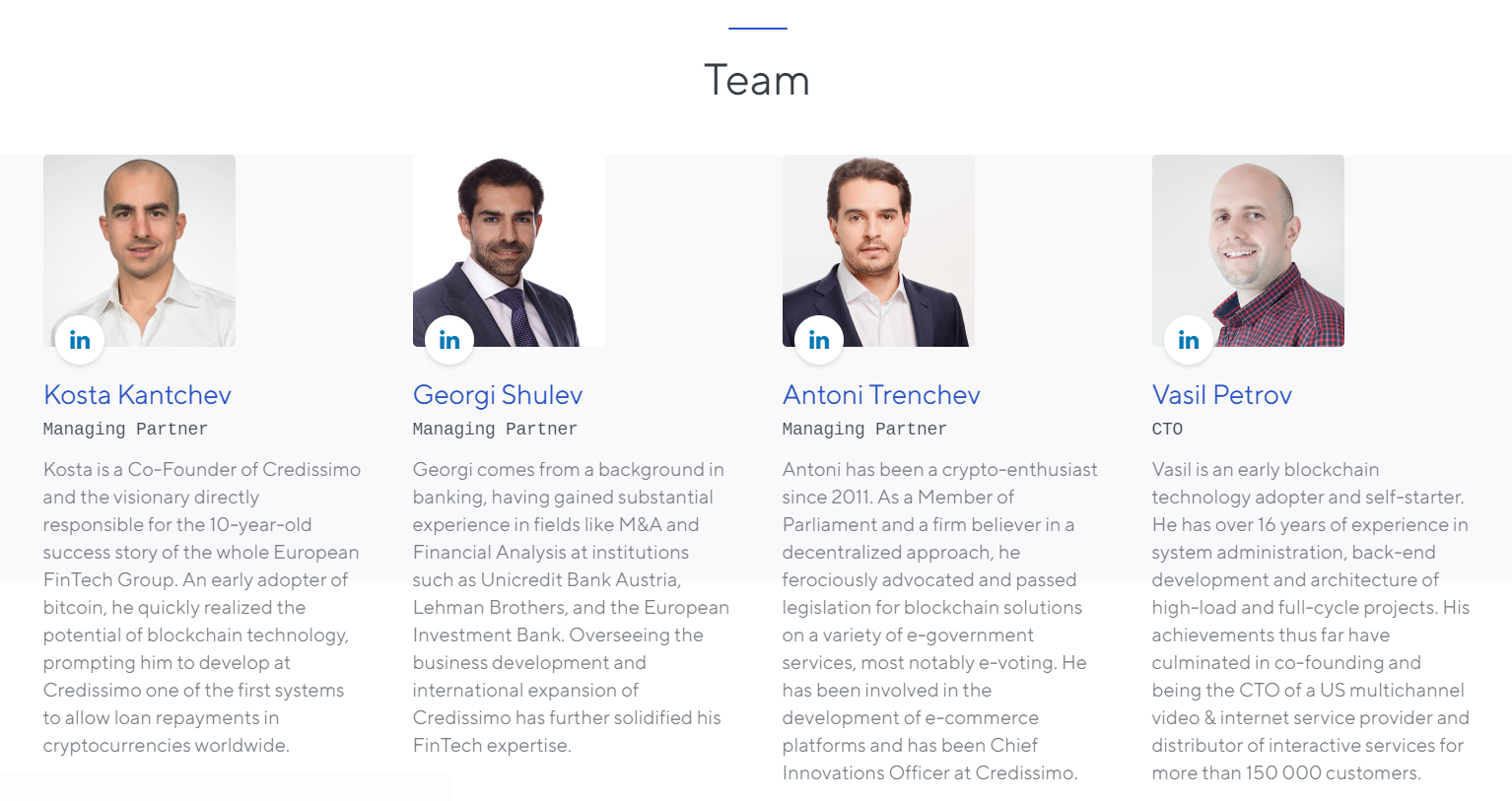

Nexo’s 3 managing partners are Kosta Kantchev, Georgi Shulev, and Antoni Trenchev. They bring to the table a good mix of expertise in the finance industry as well as a passion for the core ethos of cryptocurrencies.

Kantchev is one of the original co-founders of Credissimo that has helped it achieve much success in the past 10+ years. Shulev, meanwhile, has a strong background in finance, having worked with Unicredit Bank Austria, Lehman Brothers, and the European Investment Bank prior to joining Credissimo in 2015. Trenchev has been advocating for decentralization and cryptocurrencies since 2011, and served as a Member of Parliament in the Republic of Bulgaria from 2014-2016. He became the Chief Innovation Officer and an advisory board member at Credissimo in 2014.

The Nexo team is currently 15 members strong in all, bringing together backgrounds in blockchain development, corporate finance, legal compliance, marketing, and business development.

Roadmap and Achievements

In the cryptocurrency market, competently delivering on your roadmap is enough to set you apart from the majority of projects. Nexo goes well beyond that, having developed a solid working product that reaches a wide audience in less than a year since the first NEXO airdrop campaign in February 2018.

The world’s first instant crypto-backed loans were launched in April 2018, with the option for USD loans secured by BTC and ETH. Currency support for EUR was added in June, and numerous additional altcoins and fiat currencies were added beginning in Q3.

Major tasks on the list for Q4 include a second NEXO airdrop campaign, an affiliate program for spreading awareness about the project, as well as launching the Nexo Credit Card and Nexo Mobile Wallet.

In early 2019, Nexo plans to finalize their acquisition of an FDIC-insured Banking Institution. The team is also working to introduce deposit accounts, installment loans, and an enterprise API to serve large customers.

Competitors and Challenges

Nexo may be the first to launch instant crypto-back loans, but they are not the only project in the crypto lending space. Another well-known project is Salt, which is a decentralized lending and borrowing platform offering crypto-backed loans.

Salt is a solid project, but it doesn’t present a massive threat to Nexo. If the cryptocurrency market continues to grow as anticipated, there will be more than enough space for both to succeed long-term. The two may have to compete with each other on providing low interest rates, however, which works out well for end customers.

That being said, Nexo does get a nice leg up by virtue of being associated with Credissimo, which provides a proven track record and a well-established lending network in Europe, whereas Salt is operational in the US only. Not only that, but the NEXO token economics are stronger, as you’ll learn in the next section.

The NEXO Token

Coming from the fintech space, it’s no surprise that Nexo’s native cryptocurrency has some unique features. As described in Nexo’s token terms, the NEXO token is the first ever US SEC-compliant, dividend-paying, asset-backed security token with additional utility features.

Probably the most important piece of that rather long description – at least as far as investors are concerned – is the “dividend-paying” portion. 30% of the Nexo’s profits from interest on loans will be shared directly with NEXO token holders.

Also critically important is the fact that NEXO is legally compliant with the US SEC rules and regulations pursuant to the US Securities Act Regulation D Rule 506(c). Again, you can see where the team’s background in the finance industry at Credissimo comes in handy. Nexo will not be one of the casualties of the big ICO crackdown.

NEXO additionally has 2 main utility functions:

- Lower interest rates for customers who repay their loans with NEXO tokens

- NEXO tokens can be used in the Nexo Wallet to obtain instant financing based on their value with the interest rate discount

All things considered, NEXO has a better value proposition than the vast majority of cryptocurrency projects. If Nexo is successful in establishing a large consumer base, NEXO token holders will share in the profits. Simple as that.

Conclusion

Nexo’s crypto-backed loans offer a lot of advantages over traditional loans. They allow customers to retain ownership of their crypto assets that are being used as collateral, whereas traditionally collateral is held by the lending institution. They also offer instant approval, while traditional lending can take days or even weeks. Best of all there are no hidden fees of any kind and no credit checks, whereas traditional lending has application fees, administration fees, commitment fees, legal fees, and credit checks.

With an airdrop and affiliate program coming up in the near future, it wouldn’t be a surprise to see Nexo grow rapidly and become one of the most used working products in the entire cryptocurrency ecosystem while NEXO continues to climb the ranks of the top Ethereum tokens.

To join the Nexo community, follow them on Telegram and Reddit.