Vitalik Buterin may think that the days of 1,000x returns are over, but the crypto community is hoping otherwise. True, the barrier of entry is now much higher and the days of $30 bitcoins are long past.

The floor is getting higher, but the ceiling is anyone’s guess.

The thought of the rising coin prices, like Bitcoin’s realization of $20,000 in December 2017, has led to the creation of a now legendary phrase in cryptocurrency — “to the moon.”

McAfee has predicted the peak value of Bitcoin to be $1 million in a few years; more conservative opinions have Bitcoin’s value at a few hundred thousand dollars.

The prospect of moonshots and general bullish sentiment has been quickly embraced by cultish investors, often to describe their own favored projects as a surefire success, with the hope that it will create a new batch of crypto-millionaires.

That sentiment might betray some irrationality, but the idea that there are projects whose potential is extremely undervalued right now is still sound.

Since the crypto boom, many startups have jumped on the blockchain bandwagon.

A closer look will reveal that there exists several projects in the huge market that are incorporating blockchain solutions with sound business logic, have teams with a strong work ethic and are concentrating on the long-term goal of carving out a more permanent place for the fledgling technology.

It brings us to the question, though: how can we tell if a project can go big, become a potential moonshot?

Is it purely in its use case? Is it in its attempt at upgrading the technical fundamentals of an existing project, like in the efforts of EOS and Zcash? Is it in working with regulators and finding a more abstract purpose, as security tokens are doing?

It’s a tough question to answer and everyone will have their own opinion.

In our view, the ultimate test of a project’s potential is in its use case. Specifically, rather than compete with existing entities, it should work with them to better existing processes, services and products. The platform should be able to the bring decentralization to systems in such a way that it improves efficiency and reduce costs.

A more subtle indicator of potential is in the network’s ability to redistribute power.

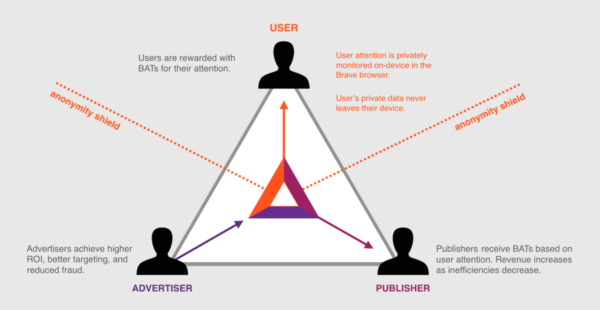

The BAT project is an example of this, taking power from advertisers and platforms to content creators. In the same way that the printing press and the internet opened up possibilities for the masses, platforms that give more power to the general individual will have a good chance of succeeding.

Lastly, there is the nature of the technology itself.

Being so nascent, there is much development yet to be done. We do not know if today’s top blockchain network’s will be the highest performing ones in the future. An entirely new project could make a fundamental breakthrough in scaling, transaction costs and consensus.

The development of blockchain technology is an ongoing process that will no doubt capture many investors’ attentions in the years to come.

Though this is by no means an exhaustive list of criteria, blockchain projects that check these qualities are certainly ones worth monitoring, and is why the following have been chosen as potential moonshots.

Disclaimer: This is just an opinion. This article is meant to be used only as guidance and is not meant to be financial advice. There is no substitute for doing your own research and, as always, don’t invest more than you’re willing to lose.

Top Potential Moonshot Coins

OmiseGO (OMG)

Few projects approach blockchain technology and cryptocurrencies with as much composure and sensibility as the OmiseGO team does.

Headquartered in Thailand, the project is taking a fastidious and systematic approach to bringing blockchain benefits to the populations that most need it.

With a laser-like focus on creating liquidity for a burgeoning regional economy, OmiseGO seems to be approaching blockchain implementation as a traditional business, foregoing the hype and pomp that is associated with the cryptocurrency market.

The combination of this work ethic and professionalism with the grand possibilities of its use case is a compelling reason to keep a close eye on OmiseGO.

We’ve written about OmiseGO extensively before, covering their use cases, investment opportunities and technical architecture. Roughly speaking, OmiseGO can be described as a clearinghouse for crypto and fiat with the outlined infrastructure including wallets, oracles and a decentralized exchange.

While many projects are effectively building new-age equivalents of startups and/or apps, OmiseGO is one of the few that is precipitating a deeper social revolution, seeking to provide a significant portion of the potential economic superpower that is the ASEAN region with access to the global financial market.

The e-wallet SDK of OmiseGO can give a population that is heavily dependent on e-wallets for day-to-day transactions financial access to the global market. Simultaneously, it can also boost the global economy by bringing a significant portion of the world’s population to the table.

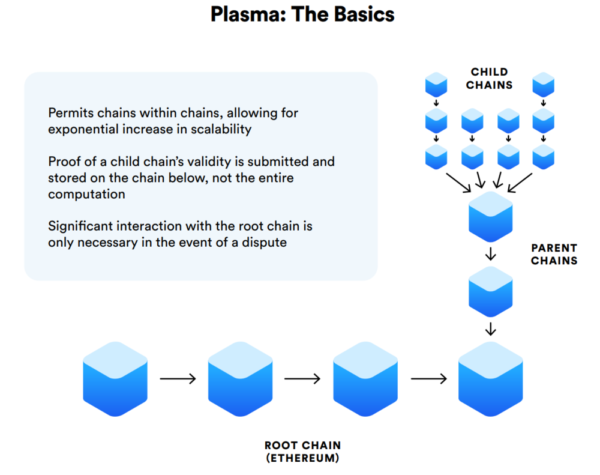

As favorable as the aforementioned features and use case is, OmiseGO has yet another trick up its sleeve: Plasma architecture.

Plasma is an off-chain scaling solution that is a highly anticipated scaling solution, enthusiastically described as being capable of reaching millions of transactions per second.

The OmiseGO project will be the first to implement this — and much to the delight of market enthusiasts, it’s nearly complete.

The seriousness with which OmiseGO is approaching blockchain implementation grants a lot of legitimacy to its effort.

The team knows that this is a long game, and a balance between innovation and regulatory compliance is required to truly make inroads in an economy.

OmiseGO is a potential moonshot because of how its using blockchain to benefit those who need it the most.

Golem Network (GNT)

The cloud computing market is a multi-billion dollar industry that is growing at a rapid pace.

Almost of all our content, work and activities, from computation to gaming, are shifting to cloud-based services. A further improvement in cloud infrastructure will precipitate a shift towards non-local computing.

However, as computational power increases, which it undoubtedly will, we will grow to rely on the centralized entities that provide these services.

Currently, these are the tech monopolies like Microsoft and Amazon, which are used for everything from machine learning to gaming.

Soon, almost all digital interactions will have some form of cloud use involved. The cost of this is that we are at the mercy of these centralized monopolies, which have the power to charge us high prices and hold our data.

Cloud computing is an industry ideal for blockchain application. Indeed, several projects are working towards developing a decentralized supercomputing network where every user makes a contribution towards computing power.

The most established of these is Golem Network, a project that shares many similarities with OmiseGO, in terms of how the team is executing their plans.

Measured and carefully, the team has put their noses to the grindstone and met major milestones which are segregated into different phases named after various versions of the mythical Jewish creature, the Golem.

The current phase, Brass Golem, sees them testing out the decentralized computing mechanism for a CGI rendering use case. This is already available for people to work with, and users have taken to renting out their computing power and getting paid for it.

However, it is the arrival of the next phase, Clay, which will bring several more use cases — and therein lies the exciting prospects for Golem.

Machine learning, financial market analysis, neuroscience and simulations are all on the cards, and the team is working on making computations possible with GPUs.

If Golem can successfully execute these use cases, then they can provide consumers with a cost-friendly and accessible cloud computing platform — and let anyone earn money for renting out idle computing power.

Like OmiseGO, they employ restraint when developing the platform — foregoing hype and bombast for a more low-key and prosaic image.

Substance over style, and this shows on Golem’s Trello page, which gives one a glimpse into their well thought out plans.

Among the many other ideas, a marketplace is in the works — and it’s well-known how cryptocurrencies can facilitate marketplaces, much like how the Android and iOS app stores have come to create opportunities for hundreds of thousands of developers.

If that’s not enough, Golem harbors an even greater ambition: making the holy grail of “Web 3.0,” a decentralized internet, a reality.

The team has made this a long-term goal. Many other projects are setting out to accomplish this as well, but should Golem become the go-to cloud computing use platform, they could amass investor confidence as the project that can herald the holy grail that is “Web 3.0”.

Regardless, simply enabling decentralized cloud computing makes them a project to closely monitor.

Basic Attention Token (BAT)

The Basic Attention Token project, fresh from receiving a boost by being listed on major exchange Coinbase and Goldman Sachs-backed startup Circle, is a potential moonshot for both its targeted use case and its success in nabbing some of the biggest names in content creation.

Launched by Mozilla Firefox and JavaScript co-creator, Brendan Eich, the Basic Attention Token project is aiming to revolutionize the way content creators are compensated for their work, stripping away the dependence on publishing platforms like YouTube and Facebook.

As it stands, these platforms have a lot of say in what content is published (as the censorship on cryptocurrency-related content shows) and how effectively they are distributed. As is the case with all centralized systems, the power to decide what is influential, and what is not, lies with these entities.

The BAT project seeks not to just make compensation more fair, but speaks to the larger problem of censorship.

The internet is no doubt a boon, allowing information to move freely across the world, and giving people a means to create employment opportunities that never existed 5 years ago — think influencers, opinion providers and video producers of all kinds.

To a certain degree, the internet has stayed true to its principle of democracy, but the ability to communicate with users is limited by the business policies of corporate giants and governments.

What’s worse is that the commodity that sustains this nefarious cycle of power is your personal data. Advertisers vy for digital space so that they can target, with increasing accuracy, products or service to users — and platforms are happy to share and even sell this information to them.

The BAT project solves the problems of information control, platform power, advertiser influence and user data privacy in one fell swoop by having a platform that lets users choose whether they receive ads and allow them to pay their favorite content creators directly.

Decentralized technologies are particularly apt at securing data (through encryption and the fact that no central point stores it), and BAT seems to have hit on a pain point that has become noticeable as content creation has become a more viable career option.

The BAT whitepaper has some thought-provoking statistics to offer:

…mobile advertising results in as much as $23 in data costs for the average user. About 21% of the battery life of the phone of the average user is depleted due to mobile advertising. Publishers have lost about 66% of their revenue over the past decade (inflation adjusted) as a result of ad blocking by users.

The biggest factor that makes BAT a potential moonshot is that it has a lot of the fundamental requirements it needs to effectively carry out its use case.

It has several notable publishers (over 3,000 in fact) like Guardian, the Washington Post, and InvestInBlockchain, as well as a user base of millions that grows by the month — proof that there is something of worth going on here.

Another excellent reason to consider this project is the fact that they have no true rivals. There are some projects that are indeed working on improving the advertising model, but BAT is by far the most advanced in this effort.

Perhaps the most important reason why BAT might succeed is because the use case they are targeting is a necessary one.

For a long time now, content creators have been railing against publishing platforms for the poor remuneration and demanding workload they must carry out in order to make a sustainable living.

It is why platforms like Patreon have been flourishing — the high level of support that creators generate has translated into viewers who are willing to shell out their hard-earned money in order to support them.

BAT is honing in on this, and the decentralized nature of cryptocurrencies mean that users have the most direct and effective way of paying their favourite creators.

While Patreon may have this idea executed to some extent, crypto payments are near instantaneous and come at a much lower cost. It is effectively like viewers handing out money by hand to creators, and there is no closer connection between a creator and a supporter.

IOTA (MIOTA)

Many already regard IOTA as a moonshot, and with good reason — the sheer scope of its potential to disrupt entire industries is impressive.

Not operating on a blockchain, but on a Directed Acylic Graph, IOTA stands as one of the most potentially lucrative investment opportunities, and for several reasons.

The elephant in the room is IOTA’s Tangle, which is their proprietary Distributed Ledger Technology that actually becomes faster as more users hop on board the network.

Recent data shows that the Tangle is processing transactions at an increasingly faster rate, which is tantalizing in a space that is still struggling with validating data.

The high transaction capability of IOTA has been designed with the intention of supporting another major industry that is expected to soon mature, the Internet of Things.

With the average household expected to have 50 IoT devices by 2020, and the global total of such devices estimated to grow to 50 billion, researchers and developers see the potential in being able to facilitate communication and interaction between these devices, streamlining industries such as automobile and supply chain.

IOTA’s Tangle, which is already being implemented in Taiwan for the creation of Digital IDs, can sustain an ever growing number of devices, if its technology can hold up.

The project has already formed several partnerships, most notably with German car manufacturer Volkswagen, with whom it will launch a car analytics product called “Digital CarPass” in Q1 2019.

The automobile industry is a very lucrative industry for the project, given that cars are now becoming a part of the Internet of Things.

Earlier this year, IOTA joined the Mobility Open Blockchain Initiative (MOBI), a consortium created by Ford, Renault, BMW and General Motors, and also involves IBM.

The consortium comprises of partners and sponsors from a variety of industries, academic institutions and non-profits, who are all bringing their expertise and knowledge to create, among other things, a new standard for technology in vehicles.

The mission of the consortium is described as “[making] mobility services more efficient, affordable, greener, safer, and less congested by promoting standards and accelerating adoption of blockchain, distributed ledger, and related technologies.”

Also raising the favorability of the project is Qubic, a project sub-task that is listed as a top priority. Qubic devoted to smart contracts, oracles and machine to machine interaction and will be worked on for the next year and a half or so.

In that time, we should see IOTA grow to facilitate a range of smart contracts and outsourced computation which has a great two-fold benefit for the ecosystem. A greater variety of computing tasks can be performed, which feeds itself by the computing power that can be bought from outsourced computations.

IOTA then becomes a computing marketplace that encourages creative development of decentralized applications.

All said and done, however, IOTA’s Tangle remains the most tantalizing aspect of the project.

If it can well and truly improve performance as more users join the network, there is no readily visible project that can match it — at least in the near future.

It has already made great progress at the enterprise level, with MOBI, Taiwan’s ID system and, most recently, a palm scanning technology called IAMPASS.

Does all of this mean that it will certainly outrank Bitcoin and Ethereum? No. But the likelihood of IOTA rising greatly in value seems like a very realistic possibility.

Stratis (STRAT)

The Blockchain-as-a-Service niche has been calculated to be worth $7 billion.

Say what you want about cryptocurrencies as a form of money, but it is gradually becoming clearer that the underlying technology is here to stay and holds immense possibilities for several industries.

Similar to what happened in the early years of the internet boom, the trouble is that existing companies have trouble absorbing new technologies, are short on resources, and consequently unable to build their own blockchain systems or integrate it into their current system.

That’s where projects like Stratis come in, creating platforms that allow one-click deployment of blockchain systems tailored to fit the particular needs of a business.

Stratis is focused particularly on C# developers, who form a significant portion of the world’s development community.

It’s not the only BaaS project out there, as Lisk and Ark are creating comparable platforms, though focused on different development communities.

However, Stratis’ implementation of sidechains and smart contracts, and great provision for customizability is extremely persuasive, given that many businesses already make use of C#.

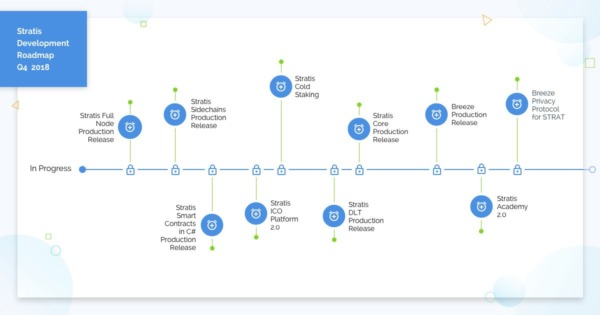

One intangible aspect of the Stratis project that must be mentioned is the work ethic of the team, and their remarkable achievements in hitting several major milestones.

In 2018 alone, they have launched an ICO platform, C# smart contracts in alpha, the Breeze privacy protocol, the Stratis Academy and an Identity app for iOS — and this is only a partial list.

Source: Stratis Blog

It would be remiss if we didn’t mention that Stratis is deepening its relationship with Microsoft (which is very keen on C# development, we might add), having been approved as a certified Microsoft Independent Software Vendor and making available its full node on Microsoft Azure.

The intention here is very apparent: Stratis wants to bring its end-to-end solutions directly to developers, and the Microsoft marketplace is a developer pool that can help them expand into the enterprise world.

This very expansion into the enterprise world is key to this project’s moonshot potential.

As more institutional funds pour into the cryptocurrency market, the wider world, especially small and medium businesses, are beginning to see the value in blockchain technology.

The issue is that the resources required to upgrade legacy systems and integrate blockchain technology is quite high. Stratis gives them the boost they need by making blockchain implementation as simple as a few clicks.

This is Stratis’ biggest x-factor, as it allows the biggest market, enterprises, to ease itself into the blockchain era.

Final Thoughts

Could we have included more projects? Very much so.

Are these projects surefire successes? There’s nothing to absolutely guarantee that.

However, there is one thing that can be agreed upon: each of the projects listed here embodies those characteristics listed in the beginning of our discussion.

Only the ignorant and the impatient would look at prices as they are and draw conclusions about a project’s potential. BAT is a case in point — while its price has largely moved sideways, the project is showing good progress in achieving its stated goals.

Despite what the title of this piece might suggest, when picking a token to invest in, it is not about whether it will go to the moon.

It’s actually rather similar to the school of value investing.

Whatever has value will naturally rise in price and significance over a period of time. First gauge whether the world needs the project or not, and then assess how the project team plans to do it.

Projects should be treated as businesses — plain and simple. All eyes should be on the management and how they carry out their work.

The time where almost anyone can just launch a platform or an ICO has passed — the market is slowly maturing. With institutional money said to be on its way in and regulatory oversight growing, the cryptocurrency market is on its way to being taken seriously.

And only those projects that conduct themselves like a business and take the development of their blockchain solutions seriously will stand the test of time.