It has become clear over the last year that cryptocurrencies can do so much more than replace existing currencies. They can be used to tokenize assets, give access to dapps, represent ownership, make holders become active participants of decentralized networks, among many other uses.

Due to this, digital tokens are creating entirely new economic models which we refer to as token economics.

Because of its novelty, token economics can be incredibly difficult. Cryptocurrencies are often used for multiple features on their related blockchain platform, and each cryptocurrency, or token, is programmed in its own unique way.

Understanding the token economics behind cryptocurrencies can assist you with determining which projects are solid, high potential investments and which are not. These models can make or break a cryptocurrency and its related platform.

In this article, we will go through the dynamics of token economics and provide you with several insights to help you understand the token economics behind your next cryptocurrency investment.

Token Economics 101

Token economics essentially refers to the study, design, and implementation of economic systems based on blockchain technology. Every blockchain platform and blockchain application has its own token economic model.

The subject of token economics focuses on the actual, new economic models that are created through cryptocurrencies. This excludes tokens that are solely used for fundraising and play no significant role in its underlying platform as they do not pose new models.

Securities have been around for a long time and their dynamics are well understood. Even though blockchain and cryptocurrencies allow for a superior way of dealing with securities in terms of transferability and ownership, they do not change the traditional dynamics of securities. Once regulatory frameworks are in place, tokenized, blockchain-based securities will likely be more or less similar to the current system.

Cryptocurrencies allow for so much more than simple fundraising and they make the construction of entirely new business and governance models possible. Token economics is about blockchain models in which the related digital tokens play a pivotal role.

There is one assumption on which nearly all token economic models are based: people act upon incentives. This is based on incentive theory, a human behavioral theory that assumes behavior is motivated by a desire for reinforcement or incentives. In token economics, these incentives are the tokens themselves and they are used to motivate network members to behave to the benefit of the network.

Act according to the rules of the network and you’re awarded with cryptocurrencies. So the rules of a network must be set in such a way that people contribute to the entire network because of personal incentives. People want more money and they get more money by doing what’s best for the network.

These incentives are mostly financial incentives because tokens have a financial value. This financial value stems from the money that has been invested in specific cryptocurrencies in an ICO and on the crypto exchanges.

Designing the Basics of Token Economies

Models for token economies are designed and implemented before a new cryptocurrency is launched. The organization behind a cryptocurrency has to decide on the role of their native token on their platform. This is no easy process as any weakness in their model will sooner or later be exploited by someone in the network, so the economic model must be rock solid.

The first step of designing models for token economies is choosing the consensus model. However, cryptocurrencies can also be continuously created through several consensus algorithms. For example, Bitcoin and Ethereum use Proof-of-Work. In this model, you have miners that secure the network and verify transactions by solving blocks. When a miner solves a block, they are rewarded with cryptocurrencies.

Other cryptocurrencies such as Dash and NAV coin use the Proof-of-Stake algorithm. In this model, holders of the native cryptocurrency stake their holdings in a wallet to solve blocks. The more tokens you hold, the bigger the chances are that your wallet solves the block and that you’re rewarded with new tokens.

In these consensus models, the cryptocurrencies are used as an incentive for participating network members to secure the network, verify transactions, and improve the blockchain ecosystem.

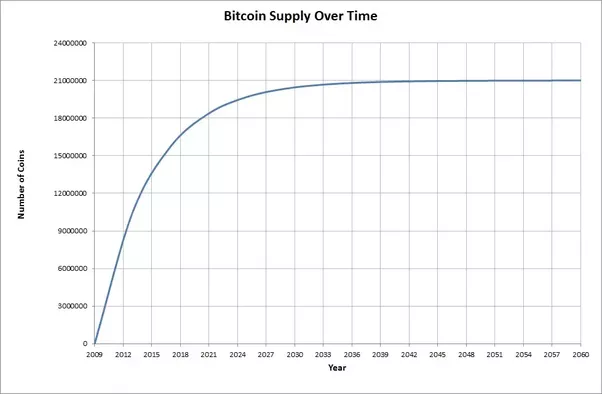

Through this, more of the currency come into existence which causes inflation. The supply increases and thus each token becomes worth less, assuming that the demand remains constant. Every consensus model employs its own rules for inflation. For example, for each Bitcoin block solved, the miner receives 12.5 bitcoin. This will be halved somewhere around 2021, after which the reward becomes 6.25 and goes on until all 21 million bitcoins are mined.

This total and limited supply of cryptocurrencies is another key component of the basics of token economics.

To prevent endless inflation, most cryptocurrencies have a finite supply. Through this, the digital coins are scarce and there is no way to create more of it at any point in order to control its price. This measure (of having limited supply) is evident in most cryptocurrencies; it is largely seen as a countermeasure against the current economy in which fiat currencies are endlessly created by the authorities, making the currencies worth less and less, and deteriorating trust in the value of fiat currencies.

Use Cases of Cryptocurrencies in the Network

After a team has decided on the basic model for the creation of cryptocurrencies, they have to create a model for the usage of their token. For transactional coins such as Bitcoin, Dash, and Monero, this model is easy — the cryptocurrencies are a way to transfer value to other parties and to store value digitally. This, however, is by far the most basic use case for cryptocurrencies, something that the rise of Ethereum pointed out.

Blockchain and cryptocurrencies allow for decentralized networks — networks that are governed and controlled by its members without a central party — and smart contracts, which are agreements between parties that are automatically updated and executed.

To ensure that the network of a blockchain or a blockchain application functions effectively and keeps on developing, cryptocurrencies are used. Because there is no central authority, the tokens are essential to the survival and progression of a decentralized platform, and can be used for many different purposes, which include but are not limited to the following uses.

Incentivize Miners

In this model, the cryptocurrency is used to reward miners for securing the network and verifying transactions. How this functions is based on the consensus algorithm in place. The tokens are distributed to those nodes and the fastest miners, making it competitive. Through this competition, more and more people enter the network because they also want a piece of the pie. In turn, this makes the network more secure and allows for faster and cheaper transactions.

Staking

In the PoS and Delegated PoS model, token holders can stake their holdings. Staking is the process of keeping your cryptocurrencies in a private wallet related to the cryptocurrency’s blockchain. This helps secure the network and stabilize the price of a cryptocurrency as less token holders trade these tokens. In return, token holders usually receive rewards.

PoS is a mechanism in which staking individuals have the chance to validate transactions based on the amount of their token holdings. For instance, the PoS model is currently employed by Dash and OmiseGo. In the Delegated PoS model, which is used by Lisk and Ark, token holders can vote on delegates that validate transactions for which voters are awarded part of the earnings of the delegates.

Payment of Transaction Fees

Cryptocurrency users that conduct transactions pay a transaction fee. This fee can go to the miners of a blockchain, but also to the entire network. For example, when you send Ripple’s XRP to another wallet, a minor percentage of this transaction is burned as a means of payment. This payment is indirectly awarded to the entire network since the supply of XRP is decreased by doing this.

Governance

This is one of the most interesting aspects of token economics as it involves sociology, psychology, networked cooperation, power distribution, and (new) models of democracy.

Through token-based governance, network members that hold tokens can vote on the direction of the platform. Developers can propose alterations to the network’s programming, upgrades, new features, and cooperations on which token holders can vote with their token holdings. In this way, token holders are part of the network’s governance process.

The best example of this is a Decentralized Autonomous Organization (DAO). This is a fully]-automated, decentralized network that can perform tasks and provide products and services.

DigixDAO is such a network that lets their token holders decide on protocol decisions. The amount of holdings determine the weight of someone’s vote. DigixDAO has recently launched its stablecoin DigixGold, which is pegged to the value of gold. DigixDAO token holders all share the profits of transaction fees of DigixGold. This incentivizes token holders to make informed decisions about the future undertakings of DigixDAO.

Contribute to the Network

Network participants can also be awarded for contributions to the network without this being automated. Lunyr, for example, is a knowledge-sharing platform on which users can submit articles. These articles are peer-reviewed by other users and both writer and curator receive tokens for their contributions. On the other hand, if a contribution violates the platform’s rules or a curator approves something that is not accepted by other curators, they can get penalized.

It is important to note here is that developers are much more inclined to aid in the development of a platform when they own tokens of that platform, since there is a personal financial stake involved. When the value of the platform increases, so does the value of the holdings of the developer. To increase this effect, the network can distribute tokens to key contributors to increase the personal financial stake involved, incentivizing them to develop the platform even more.

Blockchain-Based Services

When a token is used for this, a blockchain application’s native token is needed by users to access the application’s product or service. An example is Siacoin. Siacoin is a decentralized cloud storage platform in which network members with excess digital storage capacity can rent this out to network members that need extra storage. Those that want extra storage pay the providers of storage with Siacoins for this service.

There are many more applications that use this model, for example Ethereum-based applications such as Augur, Civic, and Golem. As more people start using these blockchain-based products and services, the demand for the native currency will increase, making it more valuable.

Profit-sharing

Some blockchain applications let their token holders share in the profits made by the platform. The token of the cryptocurrency exchange KuCoin, which is called KuCoinShares, entitles holders to 50% of KuCoin’s daily transaction fees.

Iconomi also shares their profits with token holders through recurring buybacks. This means that the Iconomi platform uses portions of their profits to buy ICN tokens back from the market and burns these tokens, decreasing the overall supply of ICN tokens.

Why Token Economics Matter

The most important question to ask yourself before buying a cryptocurrency is: what is the purpose of the cryptocurrency I’m buying? The token economics behind a cryptocurrency will guide you towards answering this question.

Currently, there are several problems with token economics.

One problem is that newly-issued cryptocurrencies are mainly created just to attract (ICO) funds and the actual purpose of the cryptocurrency comes later, if at all.

Second, too much of a network’s tokens are held by investors and the creators instead of by who they are meant for—developers and users of the network.

These two problems give an insight as to how to value a cryptocurrency based on its token economics. A platform’s token economy describes how a token will be used on the platform. If a cryptocurrency is only used as a tool for attracting funds, the demand for the crypto will die out over time. Also, if the token is only used for profit-sharing, the token will not be able to compete with tokens that serve multiple purposes and thus have multiple reasons to create demand. A strong demand and valuation derives from the actual usage of a cryptocurrency.

The more use cases a token has on its platform, the more it will increase in value as the platform gets used more. Lisk is a solid example of this. The Lisk token, LSK, has various use cases on the platform. LSK is used to pay for transactions, vote for delegates, and is awarded to the top delegates. It is also used to launch applications and sidechains on the Lisk blockchain, and as a base currency to trade native application tokens.

As the Lisk ecosystem increases in size and usage, its LSK token will grow in value with it because more people need the token to participate in the ecosystem. The intrinsic value of cryptocurrencies is based on the utility it provides. The more use cases a currency has, the more utilities it serves.

Another important aspect of token economics is whether the token plays a role in the governance of its platform. In the end, blockchains and blockchain-based applications are meant to be decentralized; to make decisions on a decentralized basis, its users must have a way to let their voices be heard. Through decentralized governance, a platform can move forward by making community-based decisions on upgrades, alterations, and new opportunities.

For a more technical analysis on how to assess the value of a utility token, click here.

Conclusion

As we’re still in the early stages of the blockchain era and most blockchains and blockchain applications aren’t used yet, the question as to whether a coin will actually be used is still highly speculative. A thorough analysis of the token economics behind a cryptocurrency will provide insights on whether there will be a demand for a cryptocurrency in the long term.

We are just getting started and already we are seeing an increasing number of different models for token economics. Governance, providing incentives, profit-sharing, access to applications, and contributing to the network are currently the most widely applied token economic models, but there are still numerous ways to utilize tokens in other economic models and these ways are still completely unexplored.

When looking for your next new cryptocurrency investment, find out what purpose a cryptocurrency serves on its platform. The more sensible use cases a cryptocurrency has, the higher the chances are that the demand for it will increase in the long term.

Related: A Guide to Long-Term Cryptocurrency Investment Strategy