The brain-child of Daniel Larimer, founder of BitShares, and Ned Scott, a former financial analyst, Steemit is a blockchain-based social media platform modeled loosely on Reddit.

Anyone who uses Reddit knows that content lives and dies with the sacred upvote (or downvote). Upvotes bring “karma,” greater visibility, and even the chance of landing on the front page.

Similarly, Steemit users are vying for upvotes, but this is because engagement and attention lead to actual financial reward. Steemit rewards users for posting, commenting, and even just upvoting other content. Rewards are paid in the platform’s native cryptocurrency, STEEM.

Also Read: This platform is a Steemit rival that pays in crypto for both publishing and reading. Learn more about it here.

To describe it using their own words:

Steemit has redefined social media by building a living, breathing, and growing social economy – a community where users are rewarded for sharing their voice. It’s a new kind of attention economy.

Steemit has been around since July 2016, it has a significant number of users, and it’s currently the 27th biggest cryptocurrency by market cap.

Yet there doesn’t seem to be much of a verdict on this platform (at least in a broad sense). In this article, we assess the platform on how it works, how to use it and if you can really earn money from Steemit.

How Steemit Works

Steemit, Inc. is a privately held company based in New York City. So behind this blockchain platform is a private company, not a random group of developers as is often the case. Compared to some of its blockchain bretheren, Steemit is relatively simple.

Here is a video overview:

Steemit.com is only one platform for blogs and social media content that sits atop the Steem blockchain. There are other platforms that use the same blockchain and underlying economic mechanisms. An example of this is D.tube, a decentralized video platform based on the InterPlanetary File System protocol. D.tube is YouTube without the advertisements (and user base) – instead, it uses the built-in Steem currency to reward content producers. D.sound is another example, in this case for audio streaming.

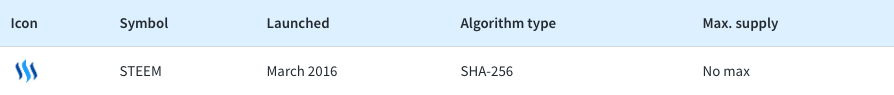

The entire Steem system is built on secure blockchain software that runs on a network of computers. At the root of the platform is the currency STEEM, which is your typical transferrable, fungible, freely moveable token (similar to bitcoin). The currency comes in 3 variants.

- Steem (STEEM) – Steem is the fundamental unit of account on the Steem blockchain. All other tokens derive their value from the base value of STEEM. STEEM is liquid and can be sought, sold, or exchanged in any way a holder sees fit. STEEM can be converted to both Steem Power and Steem Dollars. Turning STEEM into STEEM Power is referred to as “powering up.” The current inflation rate of STEEM is 9%, and it will decrease by 0.5% every year until the rate reaches 0.95%.

- Steem Power (SP) – STEEM that has been committed to a 13-week vesting schedule is referred to as Steem Power (SP). SP has a 2-pronged intent; it creates an incentive mechanism where holders take a long-term interest in the project, and by having Steem Power it increases an account’s voting weight (and by extension its ability to be further rewarded). A win–win for both users and for the ecosystem as whole. SP is illiquid, and it can be thought of as network equity. When a user decides to convert SP back into STEEM, it is referred to as “powering down.”

- Steem Dollars (SD) – SD are a debt-like instrument, pegged to the US dollar, that promise to distribute US$1 worth of STEEM per SD to the token holder at some point in the future. You can trade Steem Dollars with STEEM, or transfer them to other accounts for commerce or exchange. The aim here is to provide a vehicle to lend the community money and, ultimately, to foster growth.

The Steem blockchain is consistently minting new STEEM tokens and adding them to a community “rewards pool.” The STEEM is then awarded to users for their contributions, based on the votes that their content receives. Create valuable content and get rewarded, so the theory goes.

With every new block, 15% of the new STEEM units are awarded to the people who hold Steem Power, 75% are handed off to content creators, and 10% of the new Steem units are paid to miners.

When you create content that actually earns money, 50% is paid to you in Steem Dollars that can be exchanged for actual money right away. The other 50% is paid in Steem Power. The Steem Power Units are locked in the vesting period mentioned above.

The phrase “minting” might have made you think of cryptocurrency mining or forging processes, like ones found on many other blockchains. STEEM is a mineable currency, but it’s not the primary way of earning tokens.

Producing or interacting with content on Steemit is the main way for users to get STEEM. You can, of course, also purchase Steem on an exchange or earn interest (a very small amount) by holding SP.

The Steemit platform has grown immensely since its inception. Here’s how the traffic on Steem grew in the last year, according to Alexa’s web ranking:

To delve deeper into Steemit’s technical details, you can read the whitepaper or browse their FAQ.

Can You Really Earn on Steemit?

Now that we’ve understood the basics of how Steemit functions, the next question is: does it work from a content producer’s perspective? The short answer is yes, but there’s a lot more to it than that.

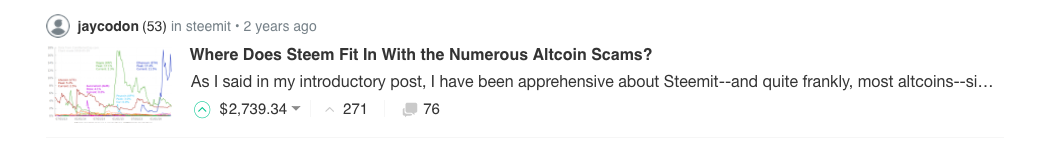

Before we delve further into Steemit’s merit as a content platform or investment vehicle, it’s worth noting there are some question marks regarding Steem’s launch. One article alleges that the initial distribution process of tokens was rigged and that Steem is not truly a decentralized network (Dash, anyone?). Whether or not this is true remains debatable – read the article and draw your own conclusions.

Despite the arguably questionable nature of some of its history, Steemit is by no means a fly-by-night operation or a scam. It is working and people are getting paid. The question is how well is it working? Are users satisfied with it?

The answer to these questions seems to depend on who you ask. One author claimed to have made around the equivalent of $2,300 in about 4 months:

Can I participate in an online community for rewards and actually make money that can really buy stuff or pay bills? YES… the answer is yes. The process isn’t super fast and has a few steps involved but it absolutely can be done.

Another author chimed in:

There is definitely A LOT of money to be made on Steemit but to be honest you’re going to have to work the system to see any success.

On the flipside, you can also find far less satisfied users:

Out of 230 articles roughly 5 had any noteworthy returns, none of which offset the cost to write them. They also have a shelf life as long as a tweet […] I’m going to have to give Steemit a ‘D’ for content creators. There’s a lot more you could accomplish on your own site in less time, other platforms are more robust with stronger monetization, stronger tools, more resources for those new to the community.

So there are anecdotal pieces for evidence pointing in both directions, how can we make sense of this? You can always try it for yourself or take a closer look at the fundamental dynamics in play.

Starting from scratch on Steemit is undoubtedly a challenge. The odds of organically growing a following on the back of nothing more than quality content is a long shot that requires quite a bit of effort upfront.

To use the words of one redditor:

“I think Steemit desperately needs a better way of giving exposure to good new content. You could write the best blog post in the world but it’ll get immediately lost in a sea of s*** if you don’t upvote it into the hot or trending section quickly.

Also, if you already have a following, then joining Steemit wouldn’t make much sense, as it would require all your followers to get on board the platform to support you.

On the other hand, if you’re an early adopter, willing to invest a good deal of money in Steem Power, or you succeed in developing relationships with those holding SP, you can leverage these positions to make a lot of money on your content. Scroll down the front page of Steemit and you’ll find posts that have all made an average of $200–500.

There are also stories of huge payouts for single viral pieces of content. Those, however, are the exception.

Getting paid $2,739 for a blog post isn’t bad. But it’s like any social media platform – a few people are making a killing at the top while quite a few others will end up languishing with 56 followers.

Getting paid $2,739 for a blog post isn’t bad. But it’s like any social media platform – a few people are making a killing at the top while quite a few others will end up languishing with 56 followers.

If you’re already a blogger with pre-existing content to share, there is little harm in giving the platform a try to see how you fare. The key to success here is having realistic expectations.

Using Steemit

If you are curious and want to give Steemit a crack, there are numerous “how to get started” guides out there. It’s about as simple as running a Tumblr account.

The Steemit UI is pretty easy to understand and will be familiar to anyone who has used Reddit, Medium or Quora before. One thing that is different about Steemit is that, unlike other social media sites, once you sign up with your email and phone number you’re placed in a waiting list. An administrator will then need to verify your account, which can take a few hours or upwards of a week.

Don’t forget that Steemit is blockchain-based, so be extra careful with your account passwords (there is no retrieval system in place) and keep in mind that anything you publish will be stored on the blockchain indefinitely.

Beyond these practical details, here are some other important things to remember.

- At its essence, Steemit is a large collection of smaller communities or subcultures. Just like Reddit, there are various “tags and topics” that subdivide the content into individualized streams. In order to get upvoted, attract views, and get paid, you need to understand these “subreddits” and how they function. Engaging with them is step one.

- A good tactic is to study past content topics and formats that have proven successful and then see where you can emulate this with your passion/expertise. By getting to know the individual mini-communities and studying the platform’s history, you’ll have a better idea of how to appeal to and reach out to readers.

- The two types of content that seem to perform particularly well on Steemit are bite-sized news commentaries or long, in-depth pieces that dig into a topic and provide an intellectual perspective on it. Before starting, it’s probably worthwhile to determine which one you’d like to pursue and then approach your niche with one of these approaches.

Instead of posting something to a particular subreddit, you can simply tag your Steemit content with relevant labels so people can find things that interest them. If your post or comments are funny, informative, or simply attract a lot of attention, you will see results – it will just be a question of time.

Investing in STEEM

After Steem’s initial launch, people quickly warmed to the idea. The STEEM token saw a massive boost in price, touching a market capitalization of almost US$400 million in mid-July 2016.

But the explosion in popularity highlighted a number of flaws in the system, namely that a few whales controlled so much Steem Power that they had almost unlimited control over what content got rewarded (in many cases, their own).

This hasty ascent and subsequent exposure of shortcomings (among other things) led to the price of STEEM tanking. This trend didn’t reverse itself until mid-2017, when Steem picked up some of the momentum from crypto’s barnstorming rise last year (as the chart above shows). Rising from its low of around $.07, STEEM currently costs $2.01, and whether or not this is a good investment depends mostly on how you see the platform.

If you buy into the skeptics’ and critics’ point of view, you don’t see much of a future for Steemit. You don’t foresee a spike in demand for STEEM tokens, and thus you’ll probably pass it over almost regardless of price.

If you view Steemit as a platform that’s going to disrupt all social media, then buying something akin to stock for $2.01 could be seen as an absolute steal.

From the more bullish perspective, consider the following:

- The Steem blockchain functions relatively well – it has 3-second blocktimes and no fees.

- Everyone that contributes to the blockchain gets paid (even if it’s just $0.01, this is more than any other social media platform).

- Steemit has a strong community that continues to grow, and there is hope that big names will join it, bringing with them an influx of new users.

- Signing up is free. There are no hidden costs or ads on the site – a fresh alternative to social media giants like Facebook or Twitter.

- Steemit has the first mover advantage and is currently the blockchain social media platform.

Steem’s developers are also actively working on a notable addition to the custom blockchain: Smart Media Tokens. Smart media tokens are a content-specific alternative to Ethereum’s token protocol. This means that issuers of these tokens will be able to run ICOs, sell tokens, or freely distribute rewards as they see fit.

You also won’t have to look far to find content creators who are moving toward Steemit after dealing with negative issues on other platforms.

All of the above are positive indicators and might lead one to conclude that investing in Steem is a good decision. Then again, any investment must be done within the context of a proper risk management strategy. As always, do your own research and don’t overextend yourself.

Steem can be traded on a number of exchanges, and the most popular options include Binance, Bittrex, and Poloniex.

Final Thoughts

Steem and its best-known platform, Steemit.com, represent a widely used, pragmatic utility that continues to grow at a respectable clip. Steemit’s use case of blockchain technology is undeniably useful, as the world has long needed a decentralized version of Reddit/Medium where content creators are financially rewarded for their efforts.

Anyone with the knowledge or desire to blog can join the hundreds of thousands of individuals already active on Steemit. But those starting out should expect a stiff challenge in going from the starting line to any decent amount of income. The consensus is that Steemit needs to provide a better path for new users who produce legitimately good content to get noticed. The good news is the Steemit team is listening and there are a lot of good ideas on the table.

Also, while Steemit’s payment model is good, it’s not flawless. Payments are subject to volatile crypto market fluctuations, and for many new users, figuring out how much and when they will be paid for various actions can be confusing. Steemit also has competitors like E-chat, Akasha, and Golos cropping up. STEEM is no longer undiscovered, and it might not provide the bargain it once was, but there is still plenty of room for growth.

All that said, the concept is great and truly needed.

Decentralized social networks like Steemit may not be as popular as their traditional rivals, but these projects bring together all of the benefits of blockchain. They are safe, sustainable, and progressive. They don’t curtail freedom of speech, and if they function properly, they strengthen content quality. If Steemit can improve their execution and continue to grow in healthy ways, the sky’s well and truly the limit.

To join Steemit click here. You can also follow them on Twitter or become part of their Reddit Community.