The insurance industry has become an increasingly cost inefficient market sector. Large proportions of policyholders’ premiums are spent on many other things than paying claims to the ones that suffer a loss. Typically insurance companies spend a substantial part of their premium income on things like tall office buildings, an immense labour force, multiple – mostly redundant – management layers and legacy IT systems.

Sagittae has developed a new model of risk protection based on blockchain technology. It is a decentralized alternative to traditional insurance, completely eliminating the need for expensive and bureaucratic insurance conglomerates and costly middleman structures.

A New System For Risk Sharing

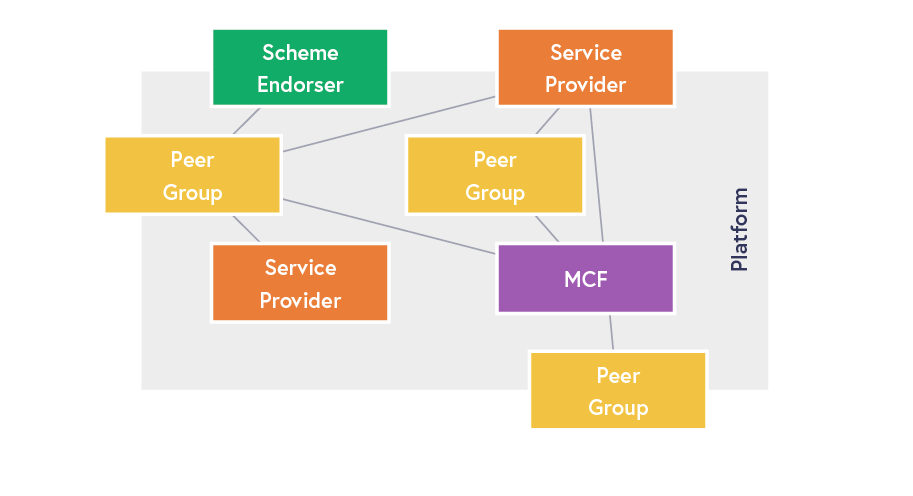

We have decomposed the traditional insurance value chain and created an entirely new system for risk sharing. In this system affinity groups can organise their own financial protection through digital peer-to-peer contracts for risk sharing. We use the Ethereum blockchain and smart contracts to return to the basis and essence of insurance: A mutual agreement between peers to cover each other’s losses. New technology has allowed us to reinstate these ancient and cost-effective mutual fund structures, but this time on a global scale and open to everyone.

Sagittae will operate a platform that allows and helps affinity groups to create or join digital peer-to-peer contracts for risk sharing. These peer-to-peer risk protection schemes:

- only govern the mutual relationships of their participants,

- fund their own capital needs,

- work with fair terms and conditions based on participants’ input and consensus; and

- are open to anyone that seeks financial protection worldwide, even in developing countries.

The platform will also allow businesses to provide insurance related services to the P2P risk sharing groups. Examples of such services being claims handling, loss control, object valuation, etc.

The Asset-Backed STAE-token

All transactions on the platform take place in STAE-tokens, Sagittae’s proprietary digital currency. This truly ensures global and unconditional access to our risk protection schemes. As cryptocurrencies can be extremely volatile, we have created the Mutual Custodian Fund (MCF). The MCF holds major fiat currency reserves and guarantees that STAE-tokens are exchangeable for major fiat currencies at a fixed rate. STAE-tokens are therefore different from many other cryptocurrencies as they have real underlying value. It is an asset-backed token.

The Team

Sagittae was founded by Robert Volkert and Ton Wennekendonk. They have worked for many years in the international insurance industry at senior management positions in Europe and Asia. They have built a strong and very experienced team that is ready and capable of taking this next step in the evolution of the insurance industry.

Our Launching Partners

Sagittae is a truly global initiative but will launch in Asia first. Our launching partners are Nessa Hearing and Tigas Alliance. Nessa has marketed a repair and replacement warranty programme to its customers, and it is now ready to deploy this service globally. To do so, it has decided to partner with Sagittae’s blockchain peer-finance solutions, based on Sagittae’s team expertise and similar values in reconnecting people.

Tigas Alliance’s ultimate aim is to cultivate a robust, connected healthcare ecosystem and has commenced rapid deployment across the Asia Pacific. Tigas Alliance partners Sagittae’s blockchain peer-finance solutions to further enrich its suite of unique programs to the MyTigas community.

More information: Sagittae