- TRON has recently broken out of a 3-month long symmetrical trading pattern.

- The market has broken below support at the $0.020 handle and is now trading around $0.018.

- Support moving forward: $0.01852, $0.018, $0.01733, $0.01629, $0.01497, $0.01307.

- Resistance moving forward: $0.02051, $0.02192, $0.02332, $0.02510, $0.02695, $0.02806, $0.030, $0.03111, $0.03278.

TRON has seen a small price decline totaling 2.76% over the past 24 hours of trading. At the time of writing, the cryptocurrency is presently exchanging hands at around $0.18, after suffering a precipitous 20.46% price decline during the previous 7 trading days amidst the mid-November industry-wide market turbulence.

The TRON project is currently ranked in 11th position in the market, with a total market cap valued at $1.23 billion. The 14-month old project is now trading at a value that is 92% lower than its all-time high price.

Let us continue to analyze TRX/USD over the long term and gather an overview of the market behavior.

TRON Price Analysis

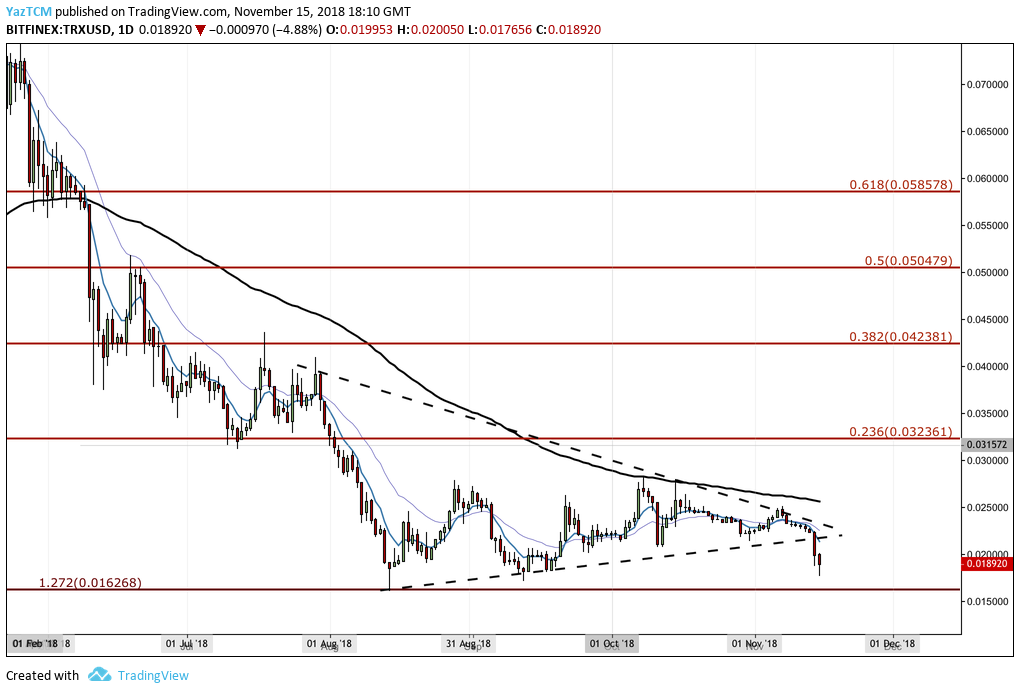

TRX/USD – LONG TERM – DAILY CHART

From the long-term perspective above, we can see that TRX/USD was in a steep declining market before it found support at the downside 1.272 Fibonacci Extension level priced at $0.01626 during August 2018.

As TRX/USD approached this area, the downtrend halted; the market changed direction and started to trade sideways. We can see that over the past 4 months, the market was trading with a consolidation pattern known as a symmetrical triangle, characterized by the upper falling boundary and the lower rising boundary.

The recent Bitcoin price fall has caused TRX/USD to break below the lower boundary of the symmetrical triangle as the market breaks below the $0.020 handle.

Let us continue to analyze price action a little closer and highlight any areas of potential support and resistance moving forward.

TRX/USD – SHORT TERM – DAILY CHART

Analyzing price action from the short-term perspective above, we can see that the market fell below the confines of the symmetrical triangle and continued to drop until it recently found support around the .786 Fibonacci Retracement level (drawn in black), priced at $0.01852. We can see that the market had managed to create a low at $0.01765 but the buyers have stepped back in to attempt a recovery.

If the overall looming bearish sentiment continues to drive TRX/USD below the support at $0.01852, we can expect immediate support beneath to be located at the .886 Fibonacci Retracement level (drawn in black) priced at $0.01733.

Further significant combined support below this can be located at the previous downside 1.272 Fibonacci Extension level priced at $0.01629. As TRX/USD approaches this area, the buyers should defend the position aggressively.

If the sellers manage to drive price action further below $0.01629, we can expect support beneath to be located at the downside 1.414 and 1.618 Fibonacci Extension levels (drawn in red), priced at $0.01497 and $0.01307 respectively.

On the other hand, in our bullish scenario, if the buyers can hold the support at $0.01852 and drive price action higher, they will immediately encounter resistance at the .618 Fibonacci Retracement level priced at $0.01051. Further support above this can then be located at the .5 and .382 Fibonacci Retracement levels, priced at $0.02192 and $0.02332 respectively.

If the bullish momentum can proceed to push price action above significant resistance located at the $0.02696 handle and above April 2018 lows at $0.02806, we can expect further higher resistance to be located at the 1.272 Fibonacci Extension level priced at $0.3111.

The RSI is trading within extreme oversold territory. This indicates that the sellers are completely in control of the momentum within the market. For a sign that the bearish momentum is fading, we will look for the RSI to rise back toward the 50 handle.

Let us continue to analyze price action for TRON relative to Bitcoin over the long term.

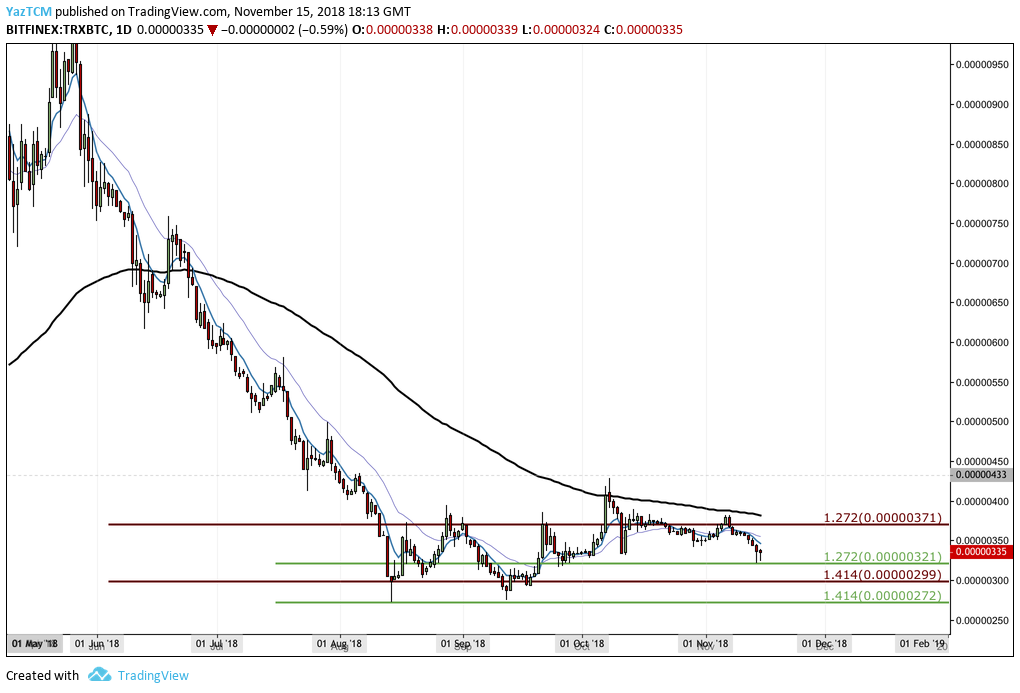

TRX/BTC – LONG TERM – DAILY CHART

Examining TRX/BTC over the long term, we can see that Tron was in a strong decline against Bitcoin for the majority of the year. The downtrend had met support in August when it had reached a combination of two downside 1.414 Fibonacci Extension levels, priced at 229 SATS (drawn in red) and 272 SATS (drawn in green).

After reaching this area of support, price action reversed the downtrend and proceeded to trade sideways. It made an attempt to break above the 100-day moving average during October 2018, but was unsuccessful in doing so.

Let us continue to analyze price action a little closer over the short term and look at any areas of potential support and resistance moving forward.

TRX/BTC – SHORT TERM – DAILY CHART

Taking a look at TRX/BTC from the advantage of a closer perspective, we can see that the recent price drop had found support at the downside 1.272 Fibonacci Extension level (drawn in green) priced at 321 SATS.

The bulls have since made a recovery and climbed above support provided by the short-term .618 Fibonacci Retracement level (drawn in blue) priced at 333 SATS.

Moving forward, if the bulls can continue to hold the support at 333 SATS and push TRX/BTC higher, we can expect immediate resistance above to be located at the .5 and .382 Fibonacci Retracement levels (drawn in blue), priced at 351 SATS and 370 SATS. The resistance at 370 SATS is further strengthened by a long-term downside 1.272 Fibonacci Extension level priced in the same area.

If the buyers can continue to cause price for TRX/USD to move above resistance at the .233 Fibonacci Retracement priced at 393 SATS and above the October 2018 high at 429 SATS, we can expect higher resistance to then be located at the 1.272 and 1.414 Fibonacci Extension levels (drawn in purple), priced at 471 SATS and 493 SATS respectively.

The final level of resistance to highlight is located at the 1.618 Fibonacci Extension level (drawn in purple), priced at 525 SATS.

Alternatively, in our bearish scenario, if the sellers continue to push price action below support at the 333 SATS and 321 SATS handles, we can expect immediate support beneath to be located at the .786 Fibonacci REtracement level (drawn in blue) priced at 307 SATS.

Support following this can be expected at the downside 1.414 Fibonacci Extension level (drawn in red) priced at 299 SATS, as well as support at the other downside 1.414 Fibonacci Extension level (drawn in green) priced at 272 SATS.

The RSI is trading within oversold conditions in this market, indicating that the sellers would need to take a break before being able to push the market lower. Thus, a short-term recovery may be on the horizon. If the RSI can continue to rise toward the 50 handle and break above it, we could see TRX/BTC rise higher.