American multinational investment bank Morgan Stanley has released a detailed 50-page report on cryptocurrencies and blockchain that reveals the bank’s ongoing research into the rapidly-developing asset class.

First reported by publication The Block, the report, titled “Update: Bitcoin, Cryptocurrencies and Blockchain” is an update of a previous report released at the height of the cryptocurrency mania in December 2017, originally titled “Bitcoin Decrypted: A Brief Teach-in and Implications.”

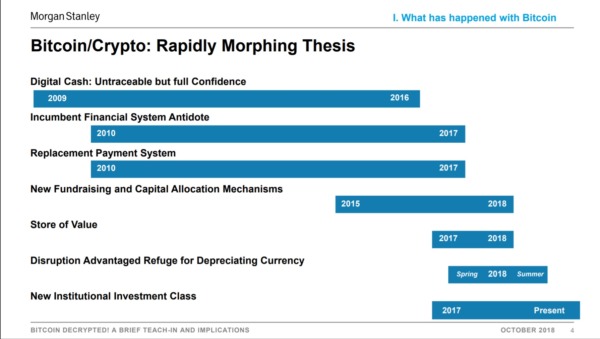

Morgan Stanley is developing a “rapidly morphing thesis” on Bitcoin and the general industry.

The report notes how the market has experienced a drop in trading volume and seen a surge in institutional investment. It also offers a brief historical overview of how Bitcoin and cryptocurrency has been perceived by the public, mentioning how it has been seen as digital gold, a fundraising mechanism, a hedge against failing assets and, most recently, a new asset class flocked to by institutional investors.

Stablecoins, which have grown in number in 2018 with the Winklevoss-backed Gemini Exchange launching its Gemini Dollar (GUSD) and Coinbase set to release the USD Coin (USDC) soon, are quickly becoming the go-to trading asset for Bitcoin and other cryptocurrencies. The report marks this and implies that those with the lowest costs, highest liquidity and sound regulatory structures will be the ones to succeed.

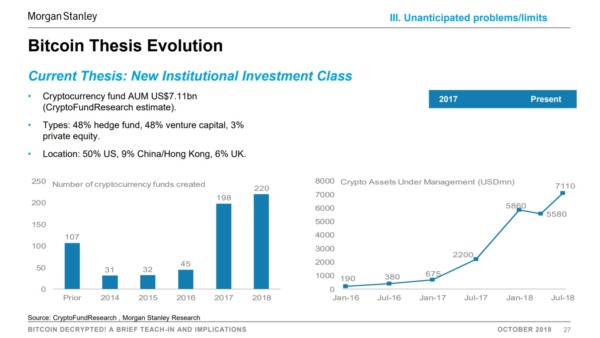

Institutional Investment Highlighted

Institutional investment into the cryptocurrency space has made the headlines in 2018, and continues to do so.

The bank’s research reveals that 48% of investment has come from hedge funds, another 48% from venture capital, and the remaining from private equity. These funds are largely flowing from America, which makes up 50% of institutional investment, followed by China with 9%, and the UK with 6%.

Industry insiders like Mike Novogratz, who has launched crypto-merchant bank Galaxy Digital, believe that institutional investment will precipitate a bull market in the near future. Indeed, 2019 is seen as a key year for the cryptocurrency market in this regard.

Challenges in the Crypto Industry

It’s not all pleasant news, however.

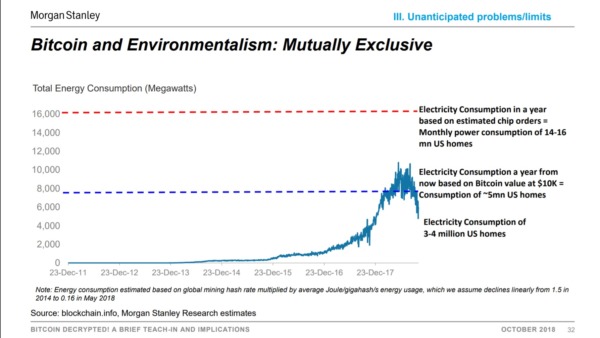

The electricity consumption of Bitcoin mining is also remarked upon, specifically addressing the drop in ASIC prices, which would lead to more rigs being sold and consequently increasing electricity consumption.

It also points out that Bitcoin is yet to be widely accepted in the U.S. eCommerce space, with only 4 of the top 500 accepting Bitcoin, a reduction of 1 since 2016.

Interestingly, the Morgan Stanley research team views AI and blockchain as “mortal enemies.” No details are offered on this, but it stands in contrast to some of the developments in the blockchain space, which has seen projects marry AI and blockchain developments together. These technologies are generally viewed as complementary.

Quantum computing is also considered a challenge, which has been discussed as being capable of breaking the encryption technology of distributed ledgers. This too has been foreseen by some projects, which have made quantum resistance a priority.

Blockchain Particularly Beneficial for Some Use Cases

Morgan Stanley states that the use cases that stand to gain most from distributed ledgers are cross-border transfers, B2B payments, shipping and finance, trade settlement and client onboarding/KYC.

Of course, while blockchain can greatly streamline these industries, it does have several other applications. Perhaps what we are likely to see is applications in the aforementioned spaces spearhead market growth, before other applications grow in popularity.

What is most clearly evident is that Morgan Stanley, like the wider public, has slowly changed their view on cryptocurrencies. While the report indicates that they expect the market to grow in the coming year, reservations still remain, as indicated in a comparison to the NASDAQ market in 2000.

Following the dot-com crash, roughly 48% of dot-com companies survived, albeit with lower valuations. Morgan Stanley’s doubts lie in whether the aforementioned industry-wide problems in the cryptocurrency market can be overcome.

Concerns regarding these issues may receive closure in the next few months, as early 2019 should see the release of many tangible products and practical applications, and the growth of crypto investment vehicles like ETFs.

These developments, investors hope, should pull the market out of the stagnant phase it has experienced in 2018.