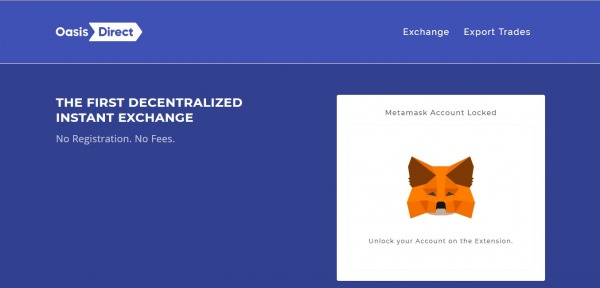

As the quest for a wholly reliable stablecoin continues, MakerDAO, the project behind the Dai stablecoin, has announced the launch of Oasis.Direct. This new feature is an application that offers decentralized trading through a simple and user-friendly interface.

The Oasis.Direct dapp allows users to exchange Ethereum’s Ether for the Dai token, which is pegged to the US dollar, and the Maker token MKR, which derives its value from DAI and interests rates attached to it. Unlike a fiat-backed cryptocurrency like Tether, MKR is backed by collateralized assets.

The application makes use of Metamask, and the exchange is instant. While only these two tokens are supported at the moment, it is the Oasis.Direct team’s goal to serve many more tokens in the near future. This would make instant trading for various coins a cheap and fluid process, greatly opening up trade for the many lay users in the world.

The launch of this application is among a series of releases that has occurred over the course of Q1 2018, and it will likely be joined by many more as the year progresses. Multiple projects are close to deploying usable applications with effective use cases, such as Request Network.

The Oasis.Direct app is a dapp that provides access to the liquidity pool of the Oasis Decentralized Exchange, the OasisDEX. As is the case with functioning applications, 2018 appears to be the year when decentralized exchanges will take hold of the market.

Maker themselves point out that the Oasis.Direct is for those who want quick and easy trading options, while the OasisDEX is for more serious traders. Both are completely decentralized and charge no fees for its use, except for gas fees. A quick refresher: gas fees are the fees a user of the Ethereum network pays for the set of instructions/computation demands of a smart contract. The fee compels the network to focus on more important computations.

The team believes this development to be a critical step in making blockchain technology a viable financial mechanism. They also believe that stablecoins will unlock unique benefits that will lead to a complete financial ecosystem on the blockchain.

Other Project Updates

In addition to launching Oasis.Direct, MakerDAO has completed several tasks in recent weeks.

First, DAI is now listed as a quote currency on ERC dEX, making it a pair with 37 other utility tokens. ERC dEX is a hybrid-decentralized trading platform that lets users trade directly from their wallets. Dozens of tokens are tradeable, including OmiseGO, Golem, Aragon, and EOS. The full list of tokens is available here.

Maker has also partnered with Shark Relay, a relayer that uses the 0x protocol to facilitate the finding, buying, and selling of token orders through popular browsers.

The Dai Dashboard was also listed on Toshi as a dapp. Toshi is a browser for the Ethereum network, created by Coinbase.

Development Updates

The team has taken several incremental steps forward. Development highlights from recent weeks include:

- The live launch of the GraphQL API, a query language

- Auditing by Trail of Bits has begun, focusing on current price-feed and medianizer contracts, as well as the setzer software. Trail of Bits is an information security organization.

- The Oracle Security Module is ready for audit. The OSM functions as a delay mechanism which offers forewarning to the community if the data pushed to the Maker is malicious.

The team has also made adjustments to the architecture by:

- Building a trade database

- Building a set of connectors to populate the trade database with our own and also all market trades from a few exchanges

- Extending the GLME model with the ability to pull data from two new exchanges.

- Allowing distinct buy and sell prices to be used for market making

Lastly, they have completed the JavaScript library and have implemented most Proof-of-Concept functionality.

At the time of writing, the MKR token is valued at $528.25 or 0.0717 Satoshi, with a market cap of $326 million. The DAI token, being a stable coin, was valued at $1 with a circulating supply of 19.6 million.