John Young is the founder of SpreadStreet.io, a digital currency data warehouse fueled by the power of spreadsheets! His motto: “Data is no longer the future. Data is the now.”

A former financial analyst, Young is a top-viewed writer on Quora under the cryptocurrency category. He chats to us about how to track cryptocurrencies and understand the market. He also lists some of his go-to tools and talks about the do’s and don’ts of the industry.

You’re a numbers guy. What’s your background?

I studied Finance at Towson University, and spent six years working various roles in Corporate Finance. My entire corporate career was spent at Capital One, where I was the lead on a few very large portfolios.

In my spare time, I was heavily interested in stocks, and stock options. This naturally led me to cryptocurrency, as this industry has been going crazy recently.

These days, you’re the founder at SpreadStreet.io. What is the company’s unique selling point?

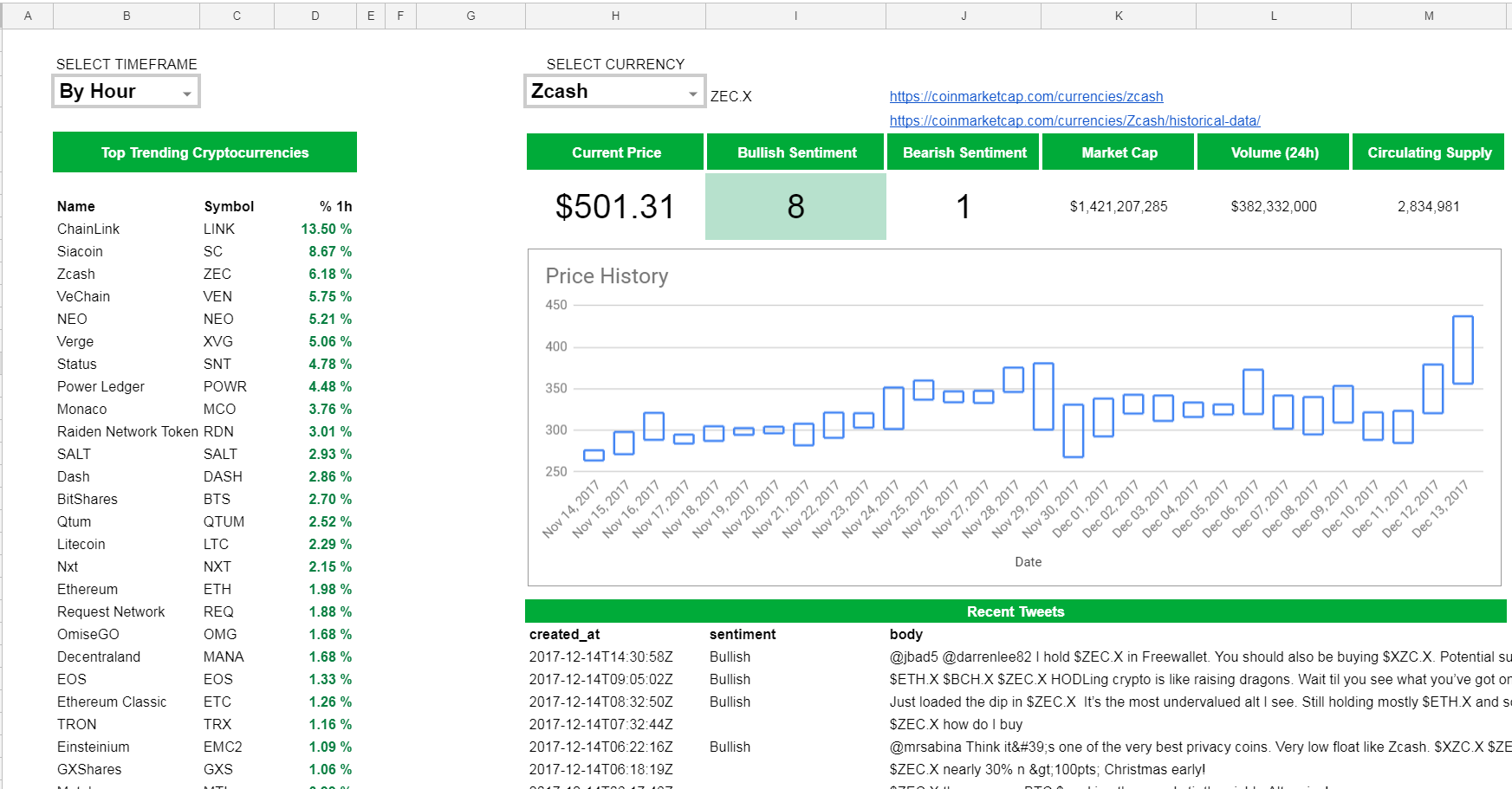

Spreadstreet makes it super easy to download datasets from different providers in the cryptocurrency space.

Our flagship product, the Google Sheets Add-in, is the first add-in in the cryptocurrency space to offer an extremely simple-to-use GUI for data download.

How did you first get involved with cryptocurrency?

I got seriously involved in crypto around April 2017. Crypto was really gaining steam, and a great portion of my knowledge from stocks and options translated well to cryptocurrencies. It was a natural move.

What are your thoughts on the importance of self-education in cryptocurrency and blockchain adoption, and where does SpreadStreet.io see itself in this landscape?

As with any industry, knowledge is power. But I see a dangerous trend in the space, where younger users who have seen some success with trade gains (because let’s be honest… ANYONE can make money right now) start to think they are infallible.

So to answer the question: self-education is EXTREMELY important. And part of what I’m doing, along with making my users’ lives easier, includes education.

You created a financial modeling spreadsheet for cryptocurrencies that quickly gained popularity on your Medium blog. This method led to your first 1,000% gain. Can you talk about this?

Sure can. It was a gain through multiple trades (with by far the largest being IOTA). The “trending” section brought a few different coins to my attention, of which I was able to ride a massive volume explosion to profitability.

What are some of the limitations associated with using this model?

The biggest limitation is that it is not real-time, and does not automatically update (requires a user to refresh). Another limitation is that it does not have notifications. So it requires more user focus than I would like. I am currently working on a pretty game-changing solution to these problems, so stay tuned 🙂

What’s an easy way to understand bullish and bearish trends?

One of my favorite descriptions is the following (from the late Benjamin Graham):

Imagine that you are partners in the ownership of a business with a crazy guy named Mr. Market. Mr. Market is subject to wild mood swings.

Each day he offers to buy your share of the business or sell you his share of the business at a particular price. Mr. Market always leaves the decision completely to you, and every day you have three choices:

- Sell shares at Mr. Market’s price

- Buy Mr. Market’s shares at the same price

- Or you can do nothing.

Sometimes Mr. Market is in such a good mood that he names a price that is much higher than the true worth of the business (aka Mr. Market is Bullish). On those days, it would probably make sense for you to sell Mr. Market your share of the business. On other days, he is in such a poor mood that he names a very low price for the business (aka Mr. Market is Bearish). On those days, you want to take advantage of Mr. Market’s crazy offer.

One key piece of advice in the investment world is to leave your emotions out of it yet as human beings first and foremost, many of us tend to find that difficult to achieve. What is your take on how “sentiment analysis” can be used to a trader’s advantage, from a statistical point of view?

Understand the example above of Mr. Market, and you now have two different ways to take advantage:

- Buy low, sell high (the ultimate mantra).

- Ride the wave of emotion as it begins.

Another extremely important point is to develop a plan and stick to it no matter what happens.

Have a profit target of US$1,000, which you hit, but it goes higher after you exited? Doesn’t matter, stick to the plan. You will be elated when the scenario comes where you take profit, and it plummets afterwards.

Apart from spreadsheets, what are some of your top go-to tech tools for working with crypto?

- Trading View (for charting)

- Cryptoping (for notifications)

- Chain Hub (for news)

- Coin Stats (on the go)

- A super secret tool that I’m not telling anyone about, but will probably be huge soon

What are your key tips for spotting cryptocurrency trends?

A few tips to help:

- Do not trade into a coin that has already exploded; you want to get in when the trend is starting, not when it’s peaking.

- To help with #1, set a stop loss. If you are wrong, get out early. If you are right, ride it till it fades.

- Average True Range (technical indicator) helps with formulating a stop loss. 2x ATR for aggressive, 3x ATR for conservative.

What are some no-no’s you’ll never be caught dead indulging in when it comes to cryptocurrency trading?

I feel like I may be overusing the numbered lists by this point, BUT I DON’T CARE:

- Do not over-leverage yourself.

- I repeat: DO NOT OVER-LEVERAGE YOURSELF. I have had countless stories of people coming to me, and asking: “Should I (use my credit card, use my student loans, take out equity in my house) and put it into crypto?” The answer, every time, is a resounding NO.

- I can only speak to U.S. residents here, but if you are looking at potentially joining any Telegram, Slack, or Discord groups that have the word “pump” anywhere in the title or description: please avoid these like the plague. Pump-and-dumps are HIGHLY illegal in the U.S., and the regulation surrounding this industry is very much in its infancy. People in the stock industry have gotten YEARS IN JAIL for doing this sort of thing.

For the average investor, the market can seem a bit overwhelming right now. Bitcoin’s sitting at an insane value, yet transaction confirmations have slowed to a halt. Meanwhile, there are so many altcoins these days that a new startup is popping up seemingly every day. How do you know where to focus your attention and not get swayed by every new Bright Shiny Object that comes along?

This is an excellent question, so thank you for asking it.

Trying to remain focused in an industry that is skyrocketing is very challenging. There are some experts out there who are truly worth listening too (such as Chris Burniske) but ask yourself: what is this person’s motivation? Why should I listen?

At the end of the day, it still comes down to due diligence. If you really want to put your money into crypto, you have to do your homework.

What are your thoughts on the price discrepancies for coins trading at different exchanges? It’s something savvy traders are managing to make a pretty penny out of and you, naturally, have a spreadsheet to track it? How advanced in skill and know-how does a trader have to be to get involved in this practice?

I would say that you have to at least be an intermediate trader to perform this.

While cryptocurrency is currently one of (if not the best) industries to perform arbitrage (taking advantage of price discrepancies), it still comes with a few roadblocks to get around. These roadblocks include buy/ask spread, capital (best way is to have money at both exchanges so you do not have to wait for transfer times), execution times, etc.

What are some of the most important observations you’ve made during your time in cryptocurrency?

The most important observation I have made is that while this industry has characteristics indicative of a bubble, I am struggling to find the scenario of what will “pop” it.

For example, the dot-com bubble was popped due to over-leveraging of large telecom companies (I’m looking at you, AOL). The real estate bubble popped due to the transfer of risk to entities down the line, causing underwriters to say “…wait, why don’t we just give loans to everyone since we do not hold the risk?” Eventually, the loans started defaulting, and the dominoes toppled.

I am unable to find the same “over-leveraging” scenario in crypto. One potential avenue is looking at margin borrowing. If the margin borrowing gets out of control, this could cause the bubble to pop.

As a general rule of thumb, for someone who is a casual investor, how widespread should their investments be? Focus on a few top coins, or invest a little bit in many of the promising tokens on the global market?

I am not a licensed financial advisor. But since you said “general rule of thumb”, I would say the strategy of a little bit in different tokens is much more my preference. That way you can avoid one coin tanking and take out your entire investment.

Last question: Can spreadsheets save the world?

I thought spreadsheets already saved the world?