For a long time, many people have been asking when and if the managers of major institutional funds will start investing their powerful resources in cryptocurrencies.

The correct question ought to be: why should institutional investors consider such an investment at all? It is no secret that crypto investments are among the most volatile and risky available at the moment. When, then, would a pension fund, for example, whose fundamental principle is to protect its capital and minimize risk, be drawn into something as unpredictable and immature as cryptocurrencies?

There has been a flood of articles from the community suggesting that many institutional investors (also called Smart Money) are poised to invest trillions of dollars in the cryptocurrency market as soon as the regulatory conditions for this arise.

Big names such as Rockefeller, Rothschild, or George Soros investing in crypto have spurred the imagination of individual investors, reviving hopes of a return to the rapid growth and exorbitant returns on investment seen in late December 2017 and January 2018.

These articles claim that the main reason why these institutions will eventually invest in this market is the “huge development potential fueled by further development and real adaptation of blockchain technology in the economy.”

While this thesis sounds more or less logical and is difficult to dispute, in my opinion, this is not exactly the case when it comes to institutional funds themselves.

The main difference between an individual and institutional investor is that an individual investor looks at the investment through the prism of growth potential, while an institutional investor does so through the prism of risk.

As I have already mentioned, cryptocurrencies appear to be very “uninteresting” assets for institutions such as pension funds in this respect. Is there anything that could ultimately convince them to invest in this market?

It’s Called the Correlation Coefficient

The correlation coefficient is a fairly basic indicator that shows whether 2 investment assets are moving in the same direction. The coefficient has a value from 1 to -1, where 1 is a full positive correlation. That is, assets A and B are moving in the same direction with exactly the same performance, while the coefficient of -1 means a full negative correlation — that is, 2 assets are behaving exactly inversely with opposite dynamics. The coefficient around 0 indicates no correlation.

A good example of a strong positive correlation is, for example, the price of crude oil and the share price of mining companies.

Okay, but why is this so important?

When constructing an investment portfolio, it is extremely important to select investment assets in such a way as to minimize the risk of losses. But what does this mean in practice?

Let us assume that our portfolio consists of shares in mining companies, oil futures, Norwegian Krone (Norway is famous for its oil exports).

At first glance, we have highly diversified assets (equities, commodities, forex); we are feeling safe. The portfolio is doing very well; rising oil prices are pushing our mining company stocks up, while the Norwegian Krone is also strengthening against other currencies. Our portfolio is far ahead of market benchmarks; we are investment geniuses!

After a few days, however, the oil market tumbles, prices nosedive a dozen or so percentage points, the market is in complete panic. It turns out that we are not only suffering losses on oil contracts, but our shares and the Norwegian Krone are also in freefall. We have lost all our gains in the blink of an eye, and our portfolio is losing alue at breakneck speed despite the fact that we wanted to limit the risk of such losses through diversification.

Where did we go wrong?

Our portfolio’s fundamental problem was poorly selected investment assets, which contributed to the tumultuous fluctuations in the value of our portfolio. Assets were strongly correlated; therefore, a standard decrease in the price of oil contracts by 3 percent caused the value of the entire portfolio to drop even beyond this value. the form of portfolio diversification has failed to fulfill its assumed function.

So How Can We Control Risk?

One crucial indicator used by investment portfolio managers is the so-called Sharpe Ratio.

This indicates the relationship between potential risk, measured by the price volatility of a given asset, and the expected return on investment. In short, the Sharpe Ratio helps investors determine whether the fund manager is taking the appropriate risk in relation to expected return on investment.

The higher the Sharpe value the better, as it suggests a higher assumed return in relation to a certain level of risk.

Now for the most interesting part: we can improve our ratio by adding uncorrelated assets to our portfolio, even if they are very high risk.

Let’s return to our example portfolio, which was virtually based entirely on assets strongly connected to crude oil. If we added uncorrelated assets to our portfolio, for example, shares in transport companies (which may even grow from lower oil prices), our portfolio would be more diversified and would probably lose less in value.

So Where Do Cryptocurrencies Come In?

We all know that cryptocurrencies are an extremely risky investment, but the most interesting feature of this market is its correlation coefficient with the traditional financial market.

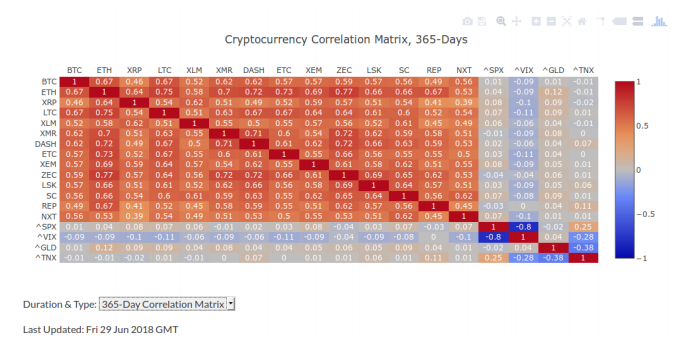

As we can see, all the cryptocurrencies listed on the above table are closely related (with a factor of above 0.5). At the bottom, we see “traditional” financial instruments that serve as a benchmark for the entire capital market.

For clarification, SPX means S&P 500 index, VIX is the market Volatility Index (colloquially referred to as the “fear index”), GLD broadly stands for the gold market, and TNX means yield on 10-year US bonds.

In all 4 cases, we see that the correlation with the cryptocurrency market over the last year fluctuates at around zero or is even negative!

This is key mathematical proof of a lack of a correlation between the financial market and the crypto market!

What Does This Mean for Crypto?

The efforts of investment fund managers to raise their Sharpe Ratio will lead them to add cryptocurrencies to their investment portfolios, even though they might not fully understand the technology itself or its potential capabilities in the future. For them, only historical statistics of this market’s correlation with traditional investment tools matter.

As I have already mentioned, their investment decisions are made on the basis of formulas and statistical models and not on hunches or a desire for quick profits.

In my opinion, this is the biggest factor that will attract big institutional money to the cryptocurrency market, which, as a result of the deflationary nature of cryptocurrencies and the hyperinflationary nature of fiat currencies at 99%, must lead to higher prices eventually.

Therefore, it’s a question of “when” rather than “if.”

So, if you believe in the development of this technology and you have kept the faith up until now, and if you are a real investor, I have only one message for you… HODL!

Contributed by Piotr Wojdat

Piotr Wojdat is the Head of Due Diligence and Analytics at Memorandum.Capital, an international investment company focused on blockchain-based assets. Their expertise in Venture Capital, Private Equity and Investment Banking allows them to provide exemplary services to their clients and great opportunities for investment attraction.