Grayscale Investments, an asset management firm that has released reports on the state of the cryptocurrency market, has just released an annual investment report that indicates that there is much interest from institutional investors.

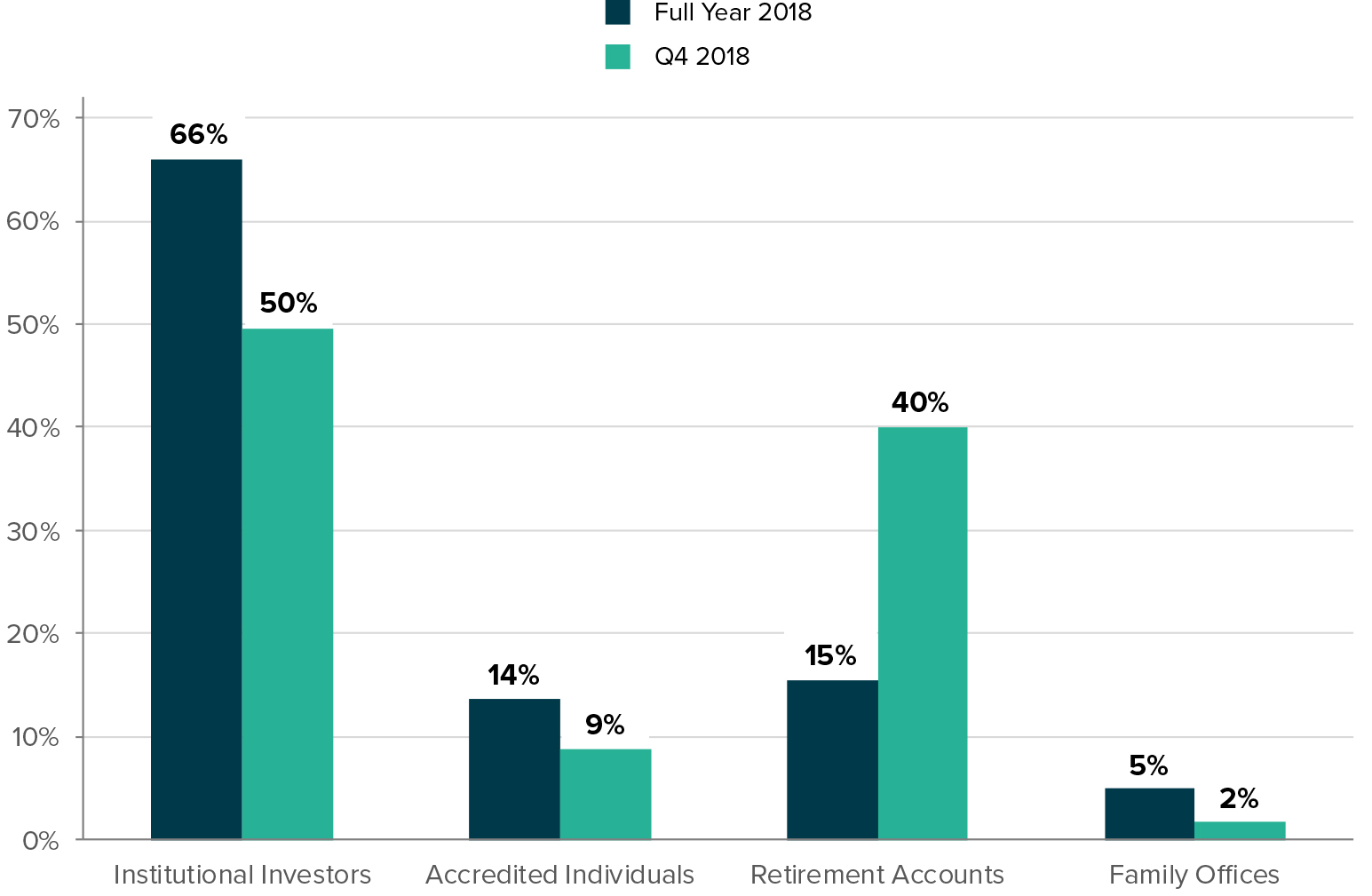

The report not only showcased the increased interest in crypto assets, but also an increased asset inflow for the firm, in spite of the bear market. Grayscale’s total inflows for 2018 amounted to approximately $360 million — and a telling 66% of the investment came from institutional investors.

One of the key takeaways mentioned in the report reflects the belief in the asset class:

New investment dollars deployed into the Grayscale products in 2018 represent approximately 44% of the value of current assets under management (“AUM”). We view high inflows relative to asset prices as a potential fundamental sign of perceived value and future price strength.

The report noted how the investors are being patient with the market and/or building strong core positions:

These datapoints reinforce two important trends that we’re observing. First, the average investor at this stage of the bear market is patient with a multi-year investment horizon (i.e., investing for retirement). Second, institutional investors are building core strategic positions in digital assets over time and have largely viewed the 2018 drawdown as an attractive entry point. While the dollar amounts invested declined in Q4, institutional investors share of the ‘new investment pie’ was roughly consistent throughout the year.

Grayscale’s Bitcoin Trust is the firm’s most well-performing product, accounting for 88% of the inflows, with the remaining 12% tied to other digital assets.

2018 will be known in crypto history as a transitional phase when the market vied to push out of a middling market and into the mainstream. The bear market, which has continued for longer than investors would like, has not affected the outlook of the firm — and it shows in its largest ever yearly inflow.

The continued investment from high-profile individuals and firms at a time when the market is at its recent lowest shows that conviction in the crypto asset market is high, and that individuals from all over are building a strong foundation — which could speak well for market performance in the near future.