The total cryptocurrency market cap reached an all-time high of around US$820 billion on January 7, 2018. Then over the next 30 days, we experienced a massive 65% decline in total market cap. The mainstream media declared Bitcoin is dead (again), crypto Twitter went silent, and many new investors lost money selling at the bottom.

Assuming you didn’t panic sell at the bottom, congratulations, you just survived what seems to be the 6th mass extinction of the crypto markets.

It’s easy to get caught up in the headlines and check your portfolio every 5 minutes. Is this productive? Will this change the market? Of course not.

The question we should be asking ourselves is: “have the fundamentals changed?”

If you believe the fundamentals have gotten worse, then make the necessary changes to your portfolio.

If you believe the fundamentals have stayed the same or gotten better, then enjoy the discounts because all your favorite digital assets are on sale!

From my perspective, the fundamentals have never been better:

- The US government is supporting innovation and only cracking down on illegal activities

- Russia is planning to launch the Cryptoruble in 2019

- Despite mixed signals, China, India, and South Korean are not “banning crypto”

- Blockchain jobs are the #2 fastest growing market and offer salary premiums

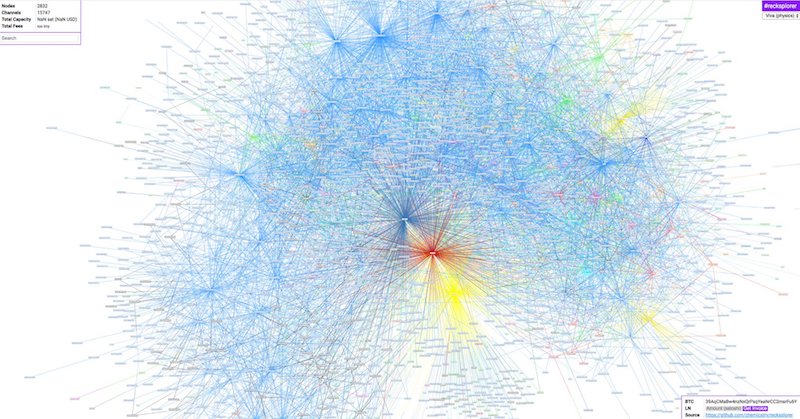

- BTC’s Lightning Network is slowly gaining traction

Although the future is bright, it’s safe to say we’re in a slow period right now. This is not a bad thing. It presents us with an opportunity: an opportunity to step back from the charts and invest in your crypto education.

Information is cheap but filtering out the noise is expensive. Avoid the short term price predictions, the next hot ICO, and the mainstream media. Instead, go deeper.

Learn from industry leaders, research new projects, better understand the technology, network with peers in the industry, and read books about decentralization, game theory, distributed systems, and the history of money.

Your future self will thank you.

During these down times, savvy investors find hidden gems and engineers build things that will be valuable in the future. This is a gift and I encourage you to enjoy it because it won’t last forever.

Today, I’m coming out of my dark cave of crypto research to present you with the fruits of my labor. In this article, I share 5 cryptocurrency trends for 2018 and how to leverage these insights to improve your investing strategy.

Trend #1: Platforms Are (Still) King

Investing in platforms is the safest and potentially most lucrative sector of digital assets in 2018.

In 2017, we saw Ethereum rise from $8 in January to an all-time high of nearly $1,400 in December – an increase of 175x in a single year.

This was mainly due to roughly 70% of all ICOs being launched on the Ethereum platform in 2017. The ICO craze will most likely continue in 2018, which will further increase the value of platforms that facilitate ICOs.

Although these dapps raise a ton of money through the ICO process, it’s too early for consumer dapps to see wide-scale adoption. Not to mention, over time the majority of the dapp’s value will be vacuumed up by the platform itself.

It’s too early for dapps to succeed.

When considering an investment, the timing is more important than the team, the technology, or by which any other factor you might use to judge a potential investment.

Imagine trying to launch Facebook in 1995 – it would have failed spectacularly. The internet wasn’t fast enough, mobile wasn’t available, the network effect was minimal.

While many fancy consumer-focused dapps promise the world, the landscape must be ready for wide-scale adoption in order for them to succeed. It’s still challenging for beginners to purchase and secure their own crypto, and smart contracts are mainly used for token sales. We’re just not ready for mainstream adoption.

Even if all the dapps fail, the underlying infrastructure (platform) will hold value.

Does that mean we should avoid all dapps? Of course not. I predict most dapps will ultimately fail, but this market is driven by hype and anything can happen.

This brings us back to platforms. Platforms provide infrastructure for other teams to build applications on. As more projects are launched on top of platforms like Ethereum, the lion’s share of the value will be captured by the platform itself… not the application.

Dapps will come and go, but sound infrastructure will weather the storm.

My Opinion:

Platforms and infrastructure projects have an attractive balance of risk vs reward. ICOs will drive increased demand and they’re less exposed to timing issues that most dapps face. Not to mention, institutional money is focused heavily on platforms in 2018.

My favorite platforms for 2018 are: ETH, NEO, EOS, and ICX.

Trend #2: The ICO Craze Will Continue, But the Landscape Will Change

The ICO craze took the crypto world by storm in 2017, delivering at least 3.5x more capital to blockchain startups than VC since 2017. Rightfully so, the ICO model can be seen as an improvement from the venture capital model. Both the investors and the founders win.

Investors see increased liquidity. When venture capitalists invest in early stage companies, their capital is typically locked up for 5-10 years in hopes of a massive payday. Token sales provide investors with instant liquidity allowing them to freely move in and out of projects whenever they see fit.

Founders receive more money and more freedom to create. Traditionally startups were forced to live in Silicon Valley in order to receive capital investments from VCs. Today, token sales raise funds globally and the average person can get in on the action. Instead of founders giving up ownership and answering to VCs, they retain complete ownership and receive smaller contributions from a larger pool of investors.

While the ICO craze will continue, here are 3 predictions on the ICO market in 2018:

Prediction #1: Pre-ICO investments will raise more money than ICOs in 2018

If an ICO doesn’t sell out, the price tanks as soon as the tokens are tradeable. In order to minimize this risk, more projects are electing to sell a large percentage of their tokens for a discount during a “presale” period. These “pre-ICO” funds will mainly come from private investors and syndicate groups.

Syndicate leaders pool funds together and then negotiate a discount during this presale period. Projects benefit from a simplified fundraising process and their ICOs appear in higher demand because they’re “already 50% sold out” on day 1 of the ICO. Of course, this is just a trick as most of those tokens were sold before the ICO at a steep discount.

Syndicates can help the average investor get a piece of “pre-ICO” projects at a discount; however, you must really trust your leader because they act as a custodian of your funds.

Prediction #2: ICOs will face pushback from regulators around the globe

In 2017, we saw China and Korea temporarily ban ICOs and the SEC publicly stated that most ICOs are subject to US Securities laws and failure to comply will result in legal action. More and more, governments will take a stance on ICOs in 2018.

As new regulations come into place, we’ll see regulatory arbitrage increase as ICOs will leverage countries with more lax regulations such as Switzerland.

Increased pushback from regulatory agencies may lead to a temporary slow down in the ICO craze but will ultimately build a stronger foundation for a larger, more mature, and legally compliant token sale environment. As regulation around token sales becomes more clear, Wall Street will have more incentive to participate which will increase access to capital in the crypto space.

Prediction #3: Ethereum will launch the most ICOs but with a lower market share than 2017

In 2017, roughly 70% of all ICOs were launched on the Ethereum network. With the current scaling limitations with Ethereum, more and more projects will launch their ICOs on alternative platforms such as NEO, XLM, and EOS.

My Opinion:

Investors need to be more selective with presales and ICOs in 2018. Not only will most ICOs fail but if you’re not getting in during the presale, you’ve already lost.

If half the tokens were sold for $1 during the presale, and the ICO price is $3, who wins when the coins hit a major exchange? While you might still turn a profit by buying at the ICO price, those who purchased at presale have a much better risk/reward profile.

Identify the presale discount prices before investing by scouring telegram groups and networking with people who participate in presales. If you’re considering joining a syndicate, be sure you can trust the leader as they can run away with your funds.

Also, as regulations around token sales are constantly in flux, be sure to do your due diligence before participating in ICOs or presales. The SEC has already sent subpoenas to at least 80 projects who have completed token sales.

Lastly, keep an eye out for ICOs on platforms other than Ethereum, especially NEO which has an impressive list of ICOs slated for 2018.

Trend #3: The Scalability Debate Will Heat Up — with Lightning Network Leading the Pack

As the hype surrounding cryptocurrencies reached an all-time high in December 2017, the current scalability limitations of both Bitcoin and Ethereum were exposed to the masses. The fees skyrocketed and confirming transactions took too long. Remember Crypto Kitties?

We all agree scaling is the top priority, but the community is divided when considering scaling solutions:

- BTC is focusing on off-chain solutions such as Lightning Network

- BCH is focusing on on-chain scaling solutions, such as increased block sizes

- ETH is slowly transitioning to PoS and considering technologies such as sharding and a layer 2 solution similar to Lightning Network called Raiden.

- Altcoins are experimenting with different consensus algorithms such as DPoS

The important question is: can the big players improve scalability before the newer projects swoop in and steal some market share?

We’ve already seen Kik cancel their ICO on Ethereum and switch to Stellar. EOS boasts incredible speed, zero fees, and is being launched in 2018.

I personally believe BTC will maintain dominance in the currency space as current technologies such as SegWit and Lightning Network continue to be adopted. We’ve already seen transaction fees on BTC come down dramatically as the adoption of SegWit reaches an all-time high (30%, at the time of writing). However, this is only a temporary relief from an ongoing scaling process.

The most promising scaling solution is the Lightning Network.

I’m not going to dive into it here, but you can learn about the basics of Lightning Network in this article. If you want to dive deep, here’s a list of more resources.

If Lightning Network delivers, Bitcoin transactions will cost less than 1 satoshi and can be confirmed almost instantly.

Lightning Network also increases privacy dramatically by using onion routing (similar to Tor) to obfuscate transaction sender/receiver. If Lightning Network has a built-in privacy feature, what is the future for privacy-focused coins?

The biggest unknown with the Lightning Network is when it will be ready for mass adoption. Currently Lightning Network is running live on the main Bitcoin network but it’s not ready for mass adoption according to Elizabeth Stark and the development team at Lightning Labs.

Cross chain atomic swaps over Lightning Network

By leveraging the Lightning Network and atomic swaps, it’s possible to send BTC and for the counterparty to receive LTC, for example. This has massive implications for increasing Lightning adoption as well as affecting the decentralized exchange landscape.

Lastly, it’s important to note that the Lightning Network is a layer 2 solution that can be used with any blockchain that has the “malleable transactions fix” such as SegWit.

My Opinion:

We will see Lightning Network dramatically increase adoption in 2018. That being said, it’s really hard to predict development cycles and we could see Lightning Network growing slowly this year and only hit its stride in 2019/2020.

I predict currency coins that do not adopt Lightning Network will lose market share to Bitcoin. BCH, Dash, Pivx appear particularly vulnerable.

Privacy coins may also lose some market share because the Lightning Network comes with built-in privacy. On the other hand, privacy is an important niche and if privacy coins continue to adopt new and better technologies, there will always be a need and thus a solid valuation.

Over time, as Lighting Networks gradually become adopted, I predict generic currency coins will lose most (or all) marketshare to Bitcoin and other coins that leverage the technology.

Trend #4: Security Token Offerings Will Disrupt the Traditional Finance World

Currently, we differentiate tokens into 3 different categories: payment tokens, utility tokens, and security tokens.

Payment tokens are used for making payments as a currency. Utility tokens are used to purchase a service or leverage access to an application.

Security tokens, on the other hand, are used to tokenize any asset that can be owned. This includes but is not limited to: real estate, equities, art, and debt.

Security tokens provide several benefits over traditional financial products such as decreased fees, reduced risk of financial manipulation by banks, and increased access to investors since anyone with an internet connection can participate.

Not to mention that distributing security tokens can be done completely legally. According to Anthony Pompliano, Managing Partner of Full Tilt Capital:

When Security Tokens are done correctly, they don’t skirt laws & regulations, they remove financial institutions and middlemen.

Due to the massive efficiencies gained from security tokens and the ability to perform token sales free from legal risk, I predict we’ll see tokenization of some traditional financial products in 2018.

My Opinion:

Keep an eye on projects that are looking to tokenize traditional assets, such as tZERO and Polymath.

For those who dabble in the stock market, I recommend researching Overstock.com (OSTK). They will probably sell the ecommerce business (Overstock.com) to focus 100% on launching T0.

The CEO of OSTK, Patrick Bryne has a vendetta against Wall Street corruption and launched T0 to attack Wall Street where it hurts them most, their pocket book. If Patrick Bryne and the T0 team pulls it off, it will be a legendary win for the “good guys.”

Trend #5: Purchasing Digital Assets Will Become Significantly Easier Due to Improvements in the Exchange Landscape

Our current cryptocurrency exchanges are not prepared to serve the increasing demand of investors and speculators around the world. Nearly all the big exchanges (Bittrex, Binance, etc) had to temporarily close their doors to new investors in 2017.

Coinbase now has more users than Charles Schwab. Not to mention, “several million” new accounts were being created on Binance every week.

This is a good sign for the cryptocurrency market as a whole, but also demonstrates how the infrastructure surrounding cryptocurrency has a long way to go before mainstream adoption can occur.

Running an exchange provides a massive opportunity to make money.

Considering the issues our current exchanges are facing, there are massive opportunities for new companies to step in and serve this demand.

I predict 2018 will be the year when purchasing digital assets becomes significantly easier than ever before due to an influx of both centralized and decentralized exchanges, traditional fintech companies joining the party, as well as value added services such as ETFs.

Centralized exchanges are fast and efficient, but they pose a massive security risk.

I predict we will see one major exchange getting hacked within the next 12 months:

- Exchanges have continually been hacked over the years.

- Exchanges act as custodians of large sums of money which makes them targets. This draws sophisticated attackers.

- Most exchanges are “centralized” which means they’re inherently vulnerable.

- If we continue to see rapid growth, exchanges will face more pressure to improve scalability in fear of losing market share to competition. This may lead to some exchanges taking shortcuts that expose vulnerabilities.

If you hold coins on exchanges, you’re taking an unnecessary risk. Hardware wallets such as the Trezor or Ledger offer a huge increase in security.

In response to the inherent risks of centralized exchanges, we’re seeing a myriad of decentralized exchanges popping up. Currently they’re not very efficient or user-friendly but this will likely start to change in 2018.

With new technologies being introduced such as atomic swaps, how will the decentralized exchange (DEX) market fair? Atomic swaps can theoretically accomplish everything a DEX can do.

2018 could also see the introduction of value-added services to help both retail and institutional investors.

There are several barriers preventing the “normies” and the institutional investors from participating in the crypto space. Purchasing and storing crypto assets is not nearly user-friendly or secure enough for the less technically-savvy among us. In 2018, we’ll likely see an influx of services to step in and remedy these problems.

Robinhood has roughly 3 million users and is offering commission-free trading on both BTC and ETH. They’re rolling out their crypto services slowly, but the demand is enormous as we’ve already seen more than 1 million people sign up with them.

We also have full-scale financial services platforms such as CoinMetro launching ICOs in 2018. Besides offering a typical trading platform, CoinMetro also plans to add value-added services such as crypto ETFs and managed funds. Services like crypto ETFs mimic traditional financial products which will reduce friction for new investors.

We’re also seeing new exchanges pop up with fiat-to-altcoin gateways. This is an important step for the ecosystem.

My Opinion:

Decentralized exchanges are not ready for mass adoption which makes holding native exchange tokens (BNB, KCS, etc) lucrative in the short/mid term. However, when you take a long-term view, centralized native exchange tokens come with significant risk.

The exchange landscape will make dramatic changes over the next couple years and the future is unknown. Will decentralized exchange protocols see mass adoption? Will atomic swaps take over? Will new “full service” exchange platforms win the new investor market? Or will centralized exchanges such as Binance evolve and protect their market share?

Exchanges turn a massive profit and whoever wins the space in 2018 will be rewarded handsomely. That being said, there are too many unknowns to make predictions with any degree of confidence. Personally, I would only invest in a few key players and keep position sizes small to minimize risk.

Conclusion

Although the future is impossible to predict, we can optimize our portfolios to minimize risk and maximize returns by studying trends.

Here is a recap of the trends I’m watching in 2018:

- #1 Platforms are (still) king: Focus on infrastructure instead of dapps

- #2 ICO landscape will evolve: Proceed with caution, understand the presale process, and you will be rewarded

- #3 Scalability is the top focus: Study Lightning Network and invest where you see the most promise

- #4 Security tokens will disrupt traditional finance: Invest in infrastructure that will power the tokenized world

- #5 Access to crypto will improve dramatically: Invest in exchanges/services but keep position sizes small due to high risk profile.

What trends are you keeping an eye on in 2018? Let’s discuss in the comments below.