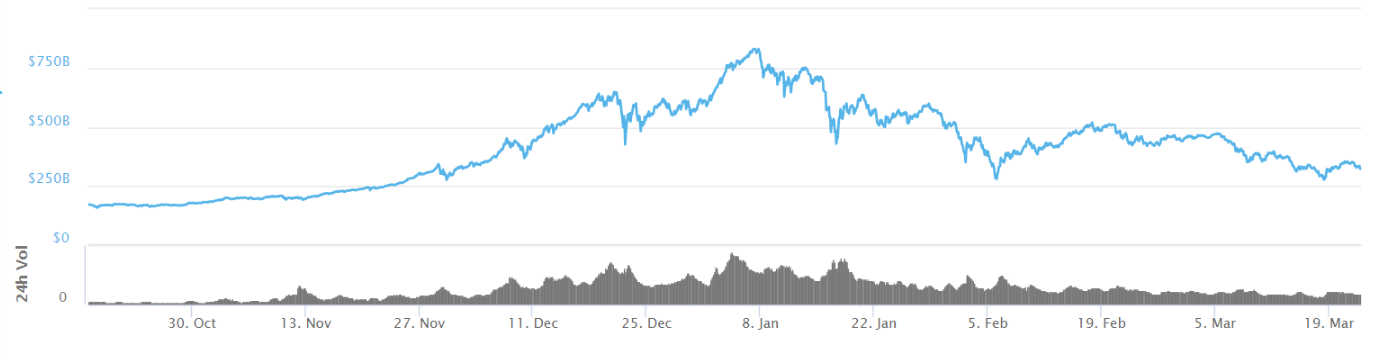

The crypto market has been dreadful during the first quarter of 2018. Coins have been bleeding out and have seen losses up to 90%, while the total market capitalization is bottoming out at around $250 billion coming all the way from its peak of about $830 billion.

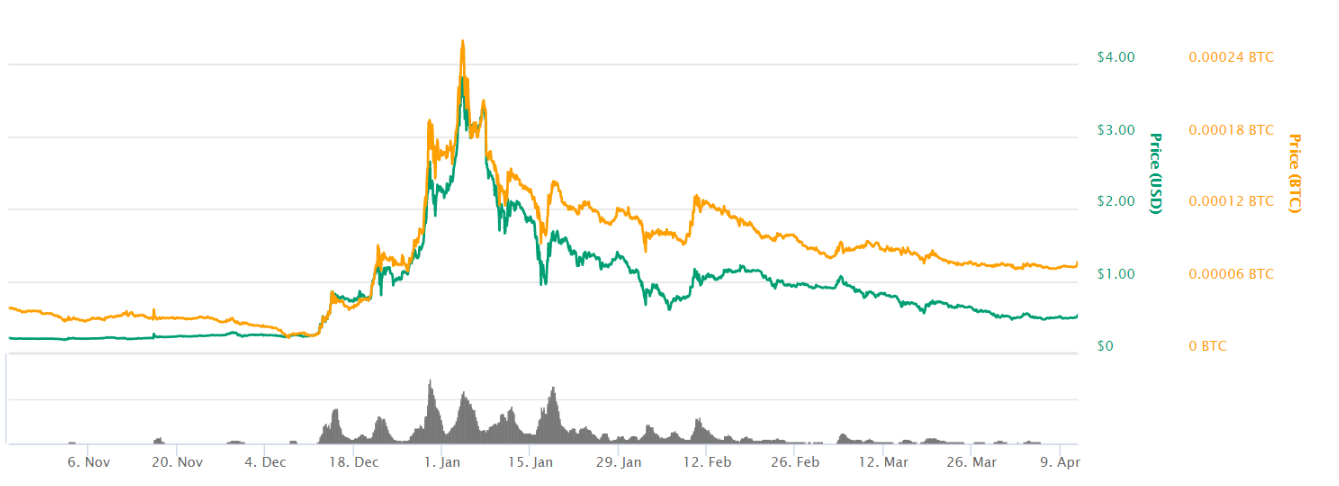

The chart below is that of Ripple, one of the altcoins taken down hard by the bears. The way Ripple’s graph looks like from about mid-December is how most altcoin graphs currently look.

Luckily, there were some cryptocurrencies that weren’t completely destroyed by the bears—or even managed to grow in value.

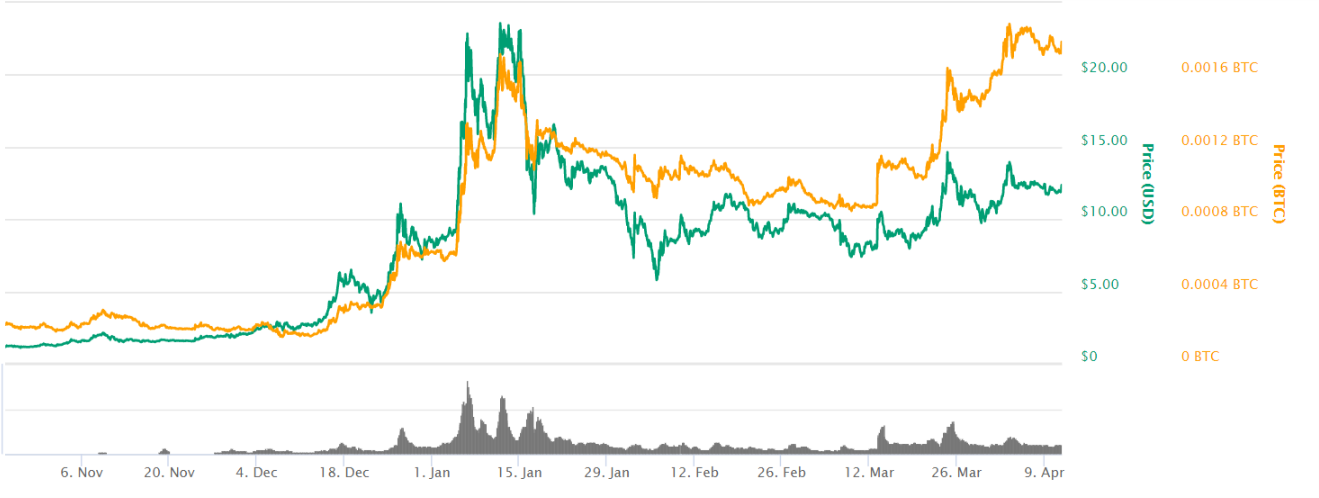

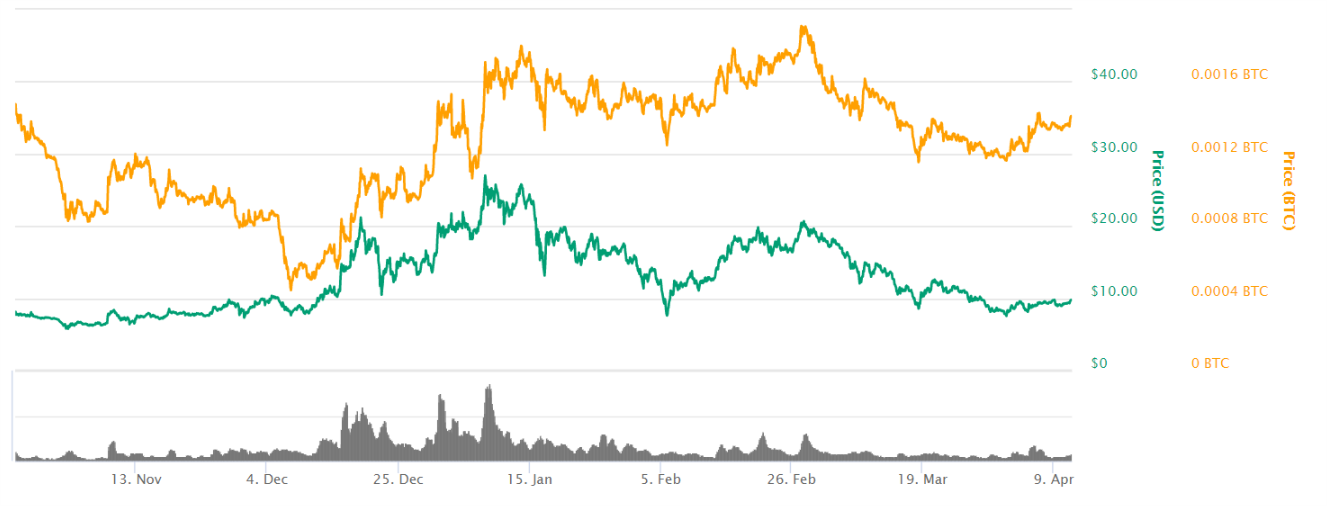

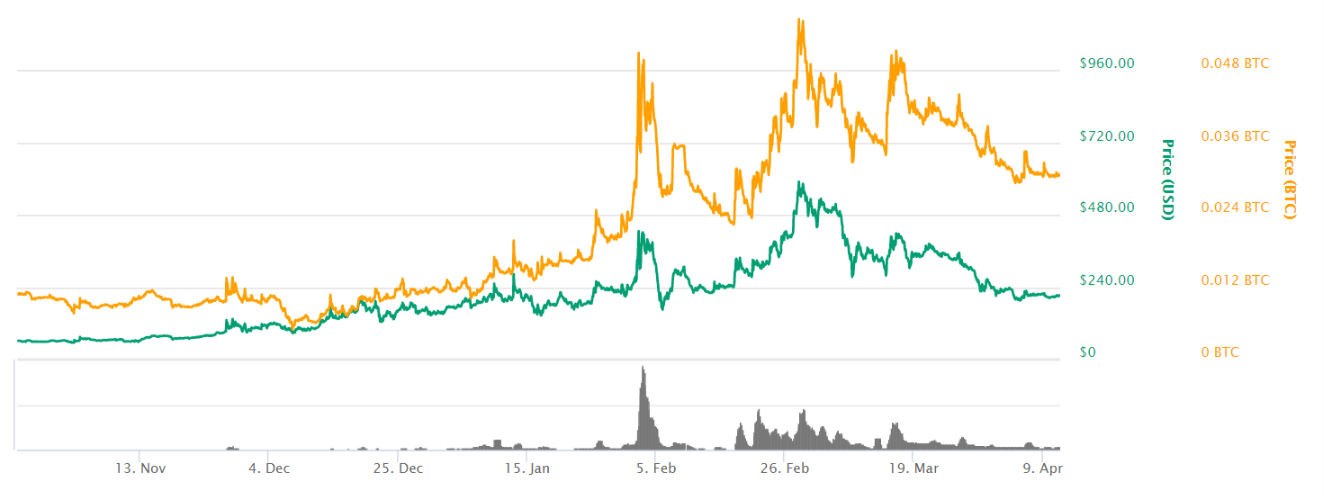

In the graphs for the following cryptocurrencies, the green line is the USD value, which is related to the money pulling out of the coin and the market. The orange line represents the Bitcoin comparative, which indicates whether a cryptocurrency managed to maintain its value against the king of crypto.

Since Bitcoin dominance has doubled during this bear market, coins that have been able to maintain a steady Bitcoin comparative have outperformed almost all altcoins.

Binance Coin (BNB)

The Binance exchange has been taking over the crypto exchange market by storm.

Binance has had a wild ride over the last few months. There were several occasions that gave rise to panic, especially a supposed hack around February 8 and again a month later on March 8. This was professionally solved by the Binance team and panic was kept to a minimum thanks to transparent communication over social media by the CEO Changpeng Zhao (CZ). Binance continued business as usual and CZ continued to build trust through transparency and direct responses to incidents that occurred.

This has given the exchange an incredibly solid and trustworthy reputation, which is reflected in the bounce after the FUD. While there were attacks on the exchange, Binance managed to contain the threats. As a response, the company went on the offence, starting with the offering of bounties to prevent potential hacks.

On March 23, Binance announced a move to Malta in response to Japanese regulatory pressure. Matla has become a go-to country for crypto-related companies and has set up a blockchain-friendly regulatory infrastructure.

The biggest announcement has been the introduction of a second Binance exchange in mid-March that will be decentralized. In the words of CZ:

Binance was growing too quickly, and too busy to start anything else. So, all we could do is, to just start one more Binance.

This has major implications for the BNB token, as the new exchange will have its own blockchain with a native cryptocurrency, likely the already existing BNB token. This shapeshift poses an incredibly complex problem, but once solved, the BNB token will have at least double the demand.

OmiseGo (OMG)

We previously looked at OMG’s highly promising roadmap—and it seems investors have as well. Even though the cryptocurrency did lose some of its USD value, the drop was mild relative to other cryptocurrencies, indicated by its relatively steady Bitcoin comparative. The OMG team kicked off Q2 with an April’s fool stating that OMG would fork/spoon. It turned out that this wasn’t a joke at all and that OMG holders are eligible for new Cosmos tokens. Click here for a full explanation.

Ethereum founder Vitalik Buterin already indicated that he thinks OmiseGo has the best token model in the crypto space thus far. This led to the OMG network being the first application that will start employing the Plasma scaling solution, designed to solve the scaling issues of OMG’s main platform, Ethereum.

OmiseGo made a giant move by signing a partnership with ShinhanCard, an affiliate of the second biggest bank in South Korea. The largest bank of SK denied cryptocurrency transactions, so this announcement is a double win, indicating that regulatory scares are mostly off the table in South Korea and that banks are willing to cooperate with crypto-issuing companies.

DigixDAO (DGD)

Being the first major Ethereum-based Decentralized Autonomous Organization (DAO), DigixDAO managed to attract a lot of attention to its project committed to tokenizing gold.

How could the price rise when it’s pegged to gold? Well, DigixDAO (DGD) is the main token of the DigixDAO platform and holders will be able to claim quarterly rewards gained from the transaction fees of DigixGold. DigixGold (DGX) is the token that is pegged to gold and represents gold ownership. DGD tokens are also used to pledge on DigixDAO proposals, an essential mechanism for running a DAO.

DigixDAO is included here because it really began rallying while almost everything else was experiencing heavy losses. Even though DGD also profited from the market craze, it surprisingly started taking off during the end of January, although nothing of real significance was announced—just this developers’ update.

The second spike coincided with another dev update, but it is hardly likely that these updates caused millions of dollars in volume. What are more likely reasons for DigixDAO’s bear market diversion could be organic growth in awareness of the DAO they’re creating, and the gold-backed asset launch.

After the peak on March 1, the price did drop significantly. Even the release of its DGX market couldn’t turn the tide, indicating that it was overbought during its huge upward movement. This inflated spike could have occured because traders were looking for a crypto going up while the rest was dropping.

Conclusion

It has been rough for all of us crypto investors lately, but even during red days there remains some green to be found. BNB, OMG and DGD managed to maintain their value or even grow while the entire market was getting hammered. Whether this indicates that these coins will shoot up further once the market turns bullish again remains to be seen.