Crypto exchanges are a crucial part of the crypto ecosystem. They present the infrastructure to exchange cryptocurrencies for other cryptocurrencies and fiat. The rate and frequency at which cryptocurrencies change hands is important to the industry, as any ecosystem ought to be monitored for healthy growth.

In a previous article, we reported on the impact of wash trading on exchange volumes released by crypto exchanges.

While wash trading, the act of selling at a loss and rebuying internally to artificially inflate daily trade volume, is illegal in the U.S., this regulation has not yet been applied to the crypto market. As such, organizations like Blockchain Transparency Institute have been calling out discrepancies in the data released by exchanges.

In their latest release, Blockchain Transparency Institute uncovered specific trades and trading pairs that show evidence of wash trading. This data results from activities such as monitoring order books, analysis of volume data points, interviews with market makers and high-frequency traders, and an updated algorithm to track these data.

Wash Trading Pairs and Exchanges

Blockchain Transparency Institute (BTI) began reporting on suspected wash trading going on in the crypto market in August 2018. Presently, the Institute expresses confidence in the data it has acquired concerning crypto exchanges, as they have spent 3 months perfecting their algorithms.

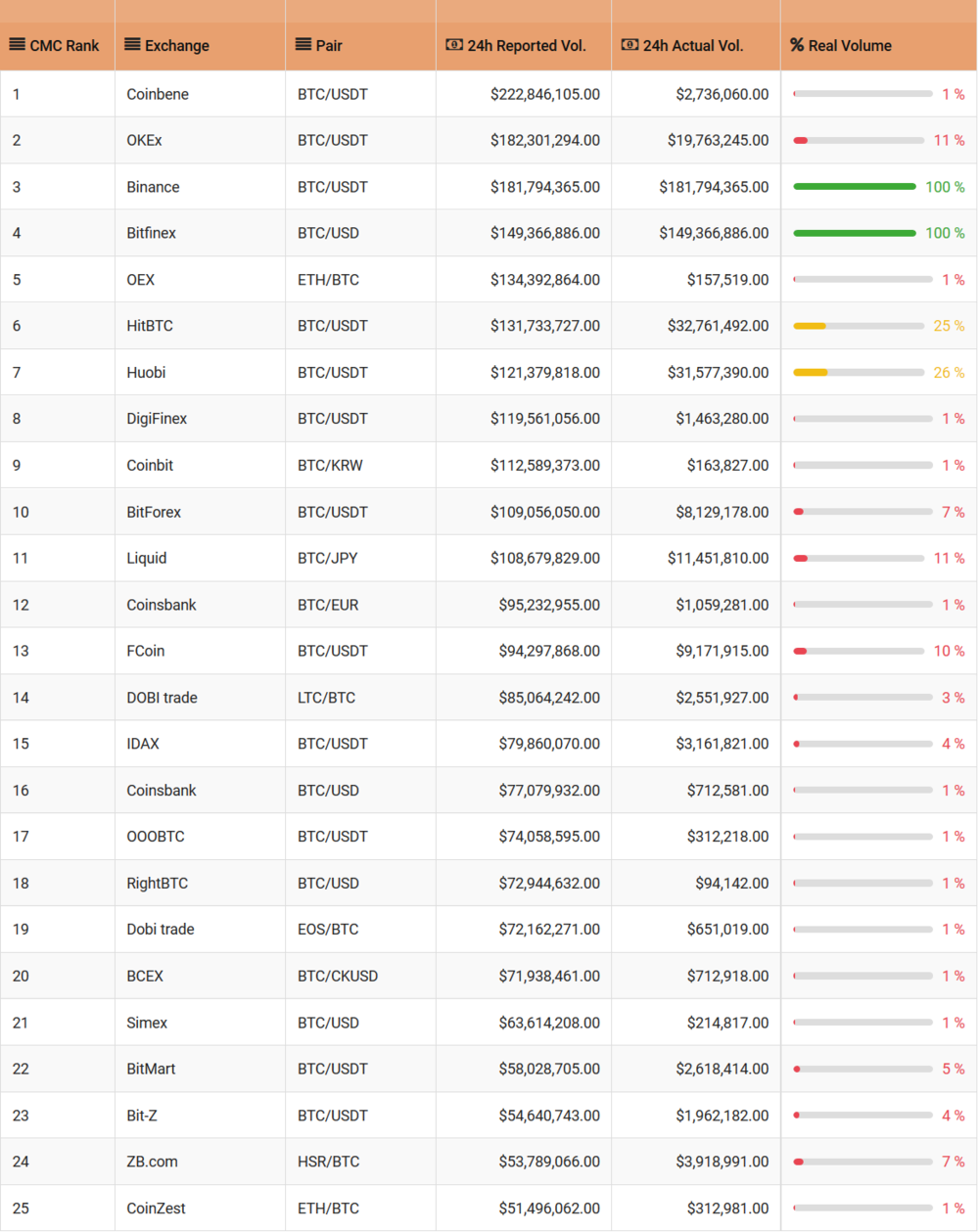

According to the data collected, over 80% of the top 25 BTC pairs on Coinmarketcap is wash traded.

Most of these pairs have an actual volume of less than 1% of the volume reported on Coinmarketcap. Of the top 25 BTC pairs crypto exchanges, only 2 were discovered not to be wash trading their volume: Binance and Bitfinex.

OKEx was discovered by the BTI algorithm to be engaged in wash trading, with an estimated 89% of their BTC/USDT trade volume wash traded. However, their adjusted trade volume will still keep them among the top 10 crypto exchanges by volume.

Huobi is another exchange reported to have wash trading, responsible for about 74% of the BTC/USDT trade volume. HitBTC was also reported to be wash trading about 75% of their BTC/USDT trade volume.

Wash trading was also observed in other leading trading pairs in both Huobi and HitBTC.

Wash-traded coins and tokens appear to vary each month on Bithumb. BTI reports wash trading in cryptocurrencies such as Monero, Dash, Bitcoin Gold, and Zcash on Bithumb.

The list below shows the Coinmarketcap trade volume for the top 25 BTC pairs and the BTI adjusted volume.

The Impact of Wash Trading on the Crypto Industry

The purpose of wash trading is to inflate the trade volume data. This leads to a false assumption by traders and crypto projects about the number of users and the liquidity on the exchange.

This misinformation is particularly useful in luring crypto projects to list their coins and tokens on these exchanges at expensive prices.

BTI estimates that the average amount spent by a crypto project to list on these exchanges in 2018 is over $50k. This amounts to about $100 million wiped out from the crypto industry in listing fees.

Hence, wash trading is essentially a scheme to get away with exorbitant listing fees, to the detriment of the actual tokens.

Wash trading is reported to be carried out by bots, and BTI has discovered various bot strategies for inflating exchange trade volume numbers. These exchanges then make between $500,000 to $1 million a year just collecting listing fees.

However, genuine exchanges, such as Binance, are observed to have fair listing fees ranging from a flat fee of 2 to 75 BTC.

A full list compiled by BTI, known as the Exchange Advisory List, contains information of crypto exchanges reported to be engaging in wash trading. This list contains 57 exchanges that are over 80-99% of their volumes. Crypto projects are advised to proceed with caution when considering listing on these exchanges.

BTI also made a list of trusted crypto exchanges who don’t inflate their trade volume (dated December 2018).

Conclusion

The crypto industry is at a critical stage in growth.

Currently, regulators seem to be justified in their concerns with the processes and transactions that take place within the industry. Even though the idea of blockchains is based on decentralization and transparency, a few actors within the industry still lack these qualities.

Centralized exchanges have often been under fire for hacks and unfavorable terms for users (e.g. not paying NEO holders the GAS that they’re entitled to). However, decentralized exchanges have yet to show real momentum, as lack of liquidity plagues many of them.

Wash trading discredits the crypto industry and prevents users, projects, and institutions from getting an accurate impression of the market. BTI looks to continue their efforts in 2019 against manipulation and theft in the industry. This includes an Initial Investor Security Report, scheduled to be released in 2019, to provide traders with information about exchange security measures.

There are some key crypto developments in 2019 to look forward to, and with increased awareness and the introduction of regulations, there will be better transparency among centralized crypto exchanges as well.