It’s not every day that a cryptocurrency inventor sells all his coins, so a brazen move by Charlie Lee, Litecoin inventor, has taken the industry by surprise.

That’s it, I’m out!

Yesterday, on December 20, Lee announced on the Litecoin subreddit that he’d sold or donated all his LTC. Citing his powerful Twitter influencer status as a vehicle that is misconstrued as being used for personal gain, he stated that a conflict of interest led to his decision to part with an undisclosed amount of Litecoin, a small enough percentage of GDAX’s daily volume to not crash the market.

“Over the past year, I try to stay away from price related tweets, but it’s hard because price is such an important aspect of Litecoin growth. And whenever I tweet about Litecoin price or even just good or bad news, I get accused of doing it for personal benefit. Some people even think I short LTC! So in a sense, it is conflict of interest for me to hold LTC and tweet about it because I have so much influence. I have always refrained from buying/selling LTC before or after my major tweets, but this is something only I know. And there will always be a doubt on whether any of my actions were to further my own personal wealth above the success of Litecoin and crypto-currency in general.”

Lee added that his involvement with Litecoin had secured his finances, and so he no longer felt necessitated to tie his financial success to that of Litecoin.

What about Litecoin?

Lee stated in his announcement that, although he no longer owns LTC other than a few physical LTC as collectables, he’s not quitting the currency.

“I will still spend all my time working on Litecoin. When Litecoin succeeds, I will still be rewarded in lots of different ways, just not directly via ownership of coins. I now believe this is the best way for me to continue to oversee Litecoin’s growth.”

Regarding his act of jettisoning all his Litecoin holdings, he responds, “This is definitely a weird feeling, but also somehow refreshing.”

The markets interpreted the move as unusual, and most would echo the “weirdness” of Lee’s sentiment, while perhaps not the refreshment thereof.

Lee accused Market Watch of irresponsible journalism, feeling that their reporting slanted in the direction of the sale had come about as a result of Lee’s involvement in insider trading.

Reddit responds

Reddit was not pleased with the news. The outcry later urged Lee to add:

“UPDATE: I wrote the above before the recent Bcash on GDAX/Coinbase fiasco. As you can see, some people even think I’m pumping Bcash for my personal benefit. It seems like I just can’t win.”

r/user bloemy7 observed:

“Vitalik is handling all of this pretty well, isn’t anon and has sold parts of his ETH but definitely still holds a shit ton. Just doesn’t comment on the price. Think it’s doable too. While I think it’s an interesting move by Charlie, I don’t really understand why.”

r/user NefariousNaz responded:

“Real reason is that Charlie feels that he pumped the price enough with his media appearance and now wants to enjoy the fruit of his labor with a lower involvement.

Typically in finance, a founder selling out his stake is a very BAD indicator for his perception of future performance. I was planning on expanding my litecoin position prior to this even with Bitcoin Cash coming on coinbase, not anymore.”

But investors have not given up hope. Many are waiting for the dips so they can buy in low.

The future of Litecoin

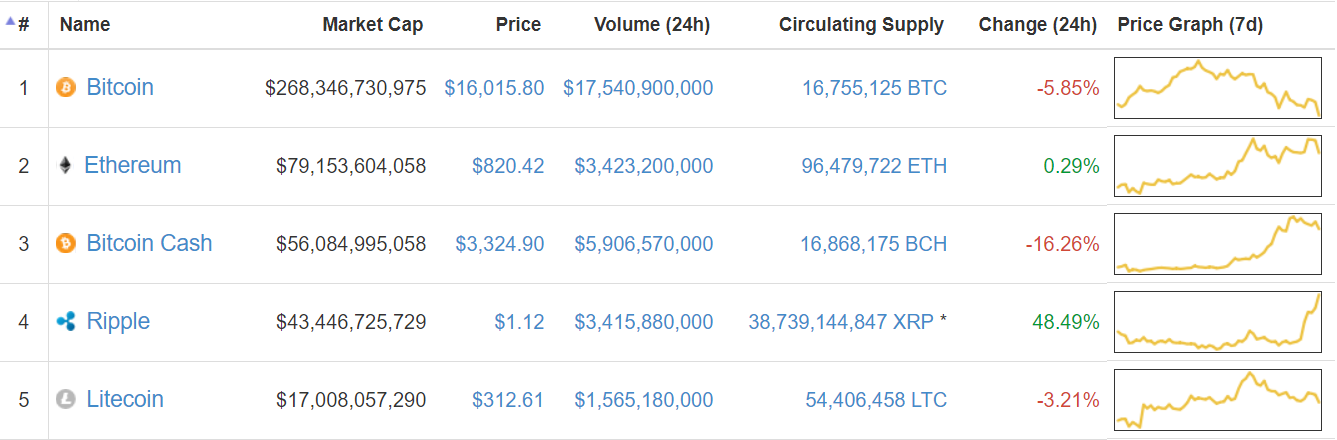

Litecoin is currently the 5th most popular cryptocurrency on the market, with a market cap of over US$17 billion.

Time will tell what Lee’s move will mean for the cryptocurrency. Litecoin, an early Bitcoin-fork, was founded by Lee in 2011 and has been hailed as a viable Bitcoin alternative for real-time currency use, due to its low transaction times.