MakerDAO’s DAI stablecoin – Ethereum’s blockchain-based decentralized stablecoin solution that’s pegged 1:1 to the US dollar and collateralized by Ether (ETH) – may be reducing the coin’s stability fee by 2% to make the fee 17.5% per year.

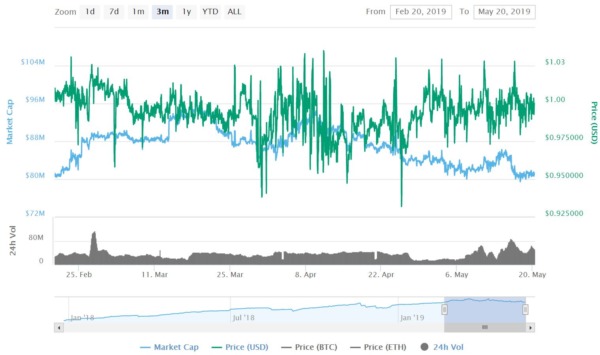

The Maker Foundation released a blog post announcing the vote for the Dai stability fee on May 17. The proposed fee reduction is an attempt to improve the token’s peg to the US dollar, as the DAI has fluctuated both above and below the $1.00 mark in recent months.

MakerDAO’s Stability Fee

The MakerDAO stability fee is a charge imposed by Maker participants when they create a CDP and generate Dai stablecoin loans. The stability fee is accrued over time as an annual percentage yield that needs to be paid by the CDP users when they withdraw their collateralized ETH.

The stability fee can only be paid in Maker (MKR), and the MKR is immediately burned after it has been paid off. While this process may seem confusing, it is necessary to bring stability to Dai stablecoin.

Earlier this year in March, Maker participants voted to raise the stability fee to 3.5% and then again to 7.5% per year. Following this, the fee was further increased in April when it was voted to increase the fee another 4%, bringing the fee to 11.5%.

Since then, a series of further votes brought Maker’s stability fee up to 19.5% in May. Since this increase, the Dai stablecoin has remained fairly stable and even above $1, following volatile spurts to the downside in April. However, a fee decrease of 2% is being predicted to provide even more stability to Dai around $1.00.

MakerDAO: Most Popular DeFi Application on Ethereum

The MakerDAO project is one of, if not the most popular decentralized finance (DeFi) application on the Ethereum blockchain protocol to date. According to the crypto analytics platform DeFi Pulse, it holds over $460 million worth of Ether (ETH) and is by far the most successful crypto lending application.

Moreover, MakerDAO is poised to be valued far higher soon, as millions of dollars worth of other cryptocurrencies will be introduced to the application in a new upgrade, introducing what’s called “multi-collateral DAI.”

Therefore, once Maker solves their stability issues and introduces multi-collateral DAI, we can expect the price of MakerDAO to increase significantly as a result of more widespread use. At the time of writing, MakerDAO is trading at $654, up 33% from the beginning of the year.

What do you think of MakerDAO? Will the project maintain its position as the #1 DeFi project? Let us know what you think in the comment section below.