While the term ICO has become popular enough to be common in the wider world beyond the cryptocurrency community, the term STO, or Securities Token Offering, is a much less common variant. This may be partly because many coins want to avoid being perceived as a security, for all the tax burdens and regulations that securities must conform to.

The most obvious example of the fear of being classified as a security is epitomized by Ripple Labs, makers of the XRP token, who are currently being subjected to a class action lawsuit that claims they are a security, and thus have responsibilities to people who bought their coin.

While fighting in court to maintain that XRP tokens are not a security, Ripple Labs is simultaneously making a concerted marketing effort to make clear in the minds of the broader public that XRP is just a coin, with no implications of a stake in the company issuing them.

Beyond the penalties of losing one particular lawsuit, they fear that if XRP is synonymous with Ripple, their token will have much less utility and value as a security.

However, while a lot of groups would rather avoid the costs and rules imposed by being declared a security, it’s clearly been established that ICOs are a way for companies to raise significant funds more rapidly than traditional stock issuance.

If a company could do that while also being SEC-compliant, then it might be possible to get the best of all worlds. This is where Polymath steps in, offering a service that helps provide the legal advice and process to help tokens be used as fully legally compliant securities. They have also launched POLY, an ERC-20 standard token that assists in providing a basic framework of a securities token for others to build on.

What Does Polymath Do?

It’s really the company, Polymath, where one finds the differences that might make it a contender in the cryptocurrency space, and not in any particular technical aspect of their coin, POLY. POLY conforms to all the features available to any other ERC-20 token, and all one really needs to know about them is that there will be a maximum of 1 billion of them issued.

This lack of any differentiators on a technical level is reflected in Polymath’s whitepaper, the first half of which reads more like a history textbook, starting with The Bubble Act of 1720 and explaining the evolution of securities all the way up to the invention of the blockchain.

The second half of the Polymath whitepaper then explains the process of creating and issuing POLY tokens, using hypothetical case studies. Unlike many whitepapers which often lean on mathematical proofs to convey an air of legitimacy, the Polymath white paper is all about usage.

The lack of complicated mathematical formulas to justify some theoretical technological advantage should not be taken as a criticism, though. It merely highlights a difference.

Essentially, Polymath is offering a service, and the question of their value needs to focus on whether or not that service meets a need.

Polymath’s purpose is to bridge the gap between the lucrative capital of the ICO market with regulation-bound financial securities. To bring this new form of investment to traditional financial instruments, the platform must nurture an ecosystem that goes comprises of more than just security – or in this case, token – issuers and investors, as we’ll see shortly.

In the traditional model, it is necessary for issuers to register with regulatory bodies, undergo an extensive underwriting process and integrate KYC norms before it can turn to the public for investment.

The ICO model operates a little differently – in most cases, KYC requirements are ignored. However, Polymath wants businesses to meet all jurisdictional laws and, for that, legal obligations must be followed.

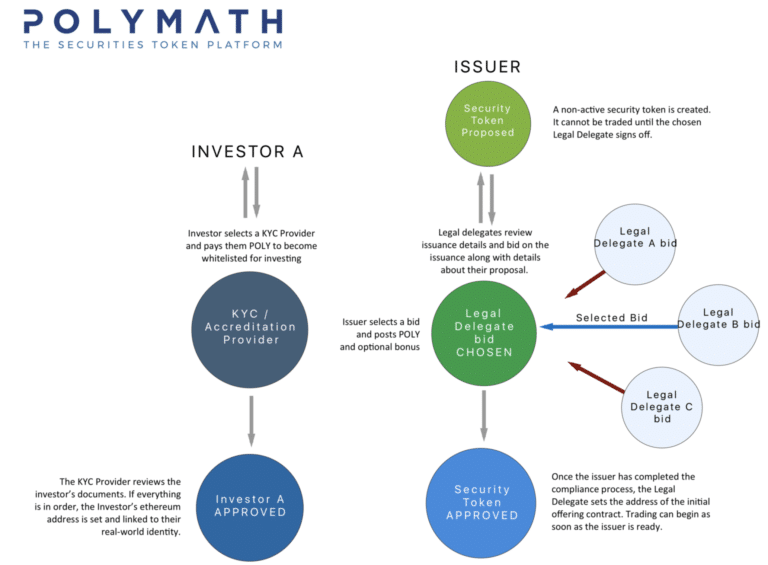

To facilitate this, they have positioned legal delegates as an especially important stakeholder in the ecosystem — they are responsible for guiding token issuers through the compliance processes. From the investors’ side, KYC providers will validate the identity of participants to ensure they are accredited for certain investments.

To assist with the technical procedures of launching a token, developers will also play a critical role in the ecosystem by creating and analyzing the initial contracts for the tokens.

The ecosystem formed by these 5 stakeholders – investors, issuers, legal delegates, KYC providers and developers – are worked into a solution that is effectively a marketplace where issuers and investors, who are the primary stakeholders, are supported by legal delegates, KYC providers and developers who facilitate the token investment process.

The latter 3 have an economic incentive to contribute to network. As legal delegates bid to help approve non-active security tokens and KYC providers verify investor credentials, they expect to see the token value rise.

Assuming many companies succeed with this model, which will raise the value of the POLY token overall, there could be a robust pool of legal advisors vying for attention from token issuers within the Polymath system.

With this platform, securities can be rapidly tokenized and businesses can be eased into the process of raising capital through ICOs. They would receive capital more quickly, from a larger pool of investors and avoid going through onerous processes of traditional capital raising.

The Polymath Team

Polymath was founded in 2017 and has had one round of funding via ICO that earned them 58.7 million US dollars. There is no indication that they’ve had any institutional or angel investors of significance.

The Polymath team consists of about 18 people, with a mix of technical and business developers. The company was founded by Trevor Koverko and Chris Housser, who are the CEO and COO respectively.

Koverko has extensive experience in finance and digital currency, having worked at Digital Assets International and Lumenix. Housser is graduate of law and has worked as an associate at Bennett Best Burn, where he practised law relating to securities, litigation and employment.

It’s notable that their list of advisors is almost an equal amount of people, with 16 listed on their website. This gives a strong impression that Polymath is well connected and supported by like-minded people in the industry.

Given that their business model is all about trying to link advisors to companies, it makes a lot of sense that they would emphasize their own robust network.

Their list of advisors contains a who’s who list of crypto brand names, such as:

- Chairman of Factom, David Johnston

- CEO of Jaxx, Anthony Di Iorio

- Bitcoin Foundation’s Bruce Fenton

- CEO of ShapeShift, Erik Voorhees

- Co-Founder of Ethereum, Steven Nerayoff

- Chief Information Security Officer at ShapeShift, Michael Perklin

Competitors and Challenges

Other companies have recognized the potential market for securities-compliant blockchains, such as Harbor and Swarm Fund. However, while every company aspires to be the top player in their field, this is a market where a player would not have to be number one to reap huge returns.

If tokenized securities become a commonplace methodology for companies to raise funds, then there would be room for not only these three players but many more to be very profitable.

Whether or not Polymath has a particular advantage over Harbor or Swarm Fund or others remains to be seen, as they all offer similar KYC approaches to securities compliance — the differences will only be made apparent in the testing ground of the marketplace.

Nonetheless, there’s no reason to assume it’s a zero sum game, and so Polymath’s fate is largely in its own hands, less so at the mercy of competitors.

How to Purchase and Store POLY

Polymath’s POLY tokens can be bought on selected exchanges such as Huobi, Bittrex, and Kucoin, and stored on ERC-20 compatible wallets, such as a Ledger or Jaxx.

Tokens created for STOs using the Polymath system requires complying with their ST20 standard, which is an emulation of Ethereum’s ERC-20 standard, but with KYC built in. KYC is facilitated by companies integrated into the process, such as IdentityMind and Agrello.

Since tokens issued on the POLY platform are securities, you will get voting rights and other privileges similar, if not identical, to owning shares. You cannot exercise those rights if it is not known who you are, so you may find the standard for identifying yourself before purchasing such tokens more stringent than buying other coins.

Conclusion

Polymath definitely serves a need in the marketplace: a way for companies to benefit from the rapid issuance of tokens while remaining compliant with regulations. The potential market for this kind of application could be enormous.

The challenge they face is fostering a robust network of legal advisors to participate in their “Github of legal counsel,” and establishing their brand as the go-to platform for issuing securities.

Getting listed on stock market in order to be publicly traded can be an expensive and time consuming process, which may exclude smaller companies who could benefit from issuing stock, but can not afford to undertake that journey. Polymath lowers the barriers to entry by providing legal assistance that is compensated in terms of token ownership. This makes it both cheaper to acquire SEC compliance, and also motivates legal counsel to want to see the tokens grow in value.

In this light, it may be that Polymath’s success will be contingent on being associated with a breakout company that uses their POLY token to issue securities and then becomes a success in whatever field they are in. After such an event, others will be more likely to emulate that kind of success by following in their footsteps and tokenizing their securities on Polymath.

Related: The SelfKey and Polymath Partnership: KYC and Securities Can Prosper on the Blockchain