Investing in cryptocurrencies is a time consuming process. In addition to all the research, you have create accounts on multiple exchanges, install a multitude of wallets, make sure you’re properly secured and on top of that, you have to keep track of the progress of every cryptocurrency in your portfolio. The founders of Iconomi understand this problem and came up with a solution: a user friendly cryptocurrency investment platform. Iconomi is built on the Ethereum blockchain and on this platform you can invest in portfolios that experts have assembled — the so called Digital Asset Arrays (DAAs).

The DAAs of Iconomi

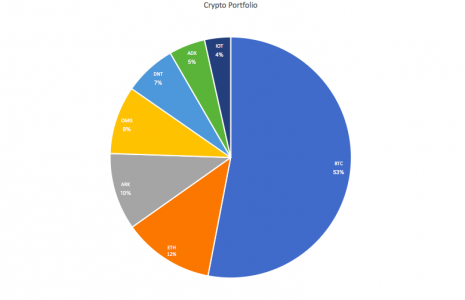

The Digital Assets Array of Iconomi are essentially a portfolio of cryptocurrencies. On the platform, the team behind Iconomi stresses the importance of diversification and a DAA does just that. A DAA aims to decrease the impact of the high fluctuations of cryptocurrencies by investing in a variety of different cryptocurrencies. Important to understand is that the market as a whole is quite volatile as well, just look at the China ban crash and the market uncertainty caused by the first major Bitcoin fork.

Iconomi is contracting third parties that will create and share their DAA on the platform and investors will be able to invest in them. If you see a DAA that you like and a manager you trust, you can buy into this DAA with either Bitcoin or Ethereum.

You pay a management fee set by the DAA manager for the time you’re invested in his or her DAA and in some cases you pay an entry and/or exit fee. Your portfolio will be updated and altered by the manager of the DAA and they will change the cryptocurrencies and relative distribution of the DAA based on their insights and analyses. You will be able to follow all the changes of the DAA, its daily returns and historic performance on the Iconomi platform.

Investing in these DAAs instead of doing all the work yourself saves investors a lot of time needed for both preparation and staying up to date with an entire portfolio. Moreover, you don’t have to buy all the different cryptos from a variety of exchanges, the DAA manager and Iconomi will do this for you. Iconomi will secure all the bought cryptocurrencies. This could be an advantage over securing your investments yourself, as cybercrime has been on the rise and individuals in possession of digital assets are prone to hacking. Most of the cyptocurrencies bought through Iconomi will be secured in cold storage, meaning that they will be put on multi signature, offline hardware wallets which are immune to hacking.

DAA managers

When investing in a DAA, you have to trust that the DAA managers will make the right decisions and work in your best interests to assure maximum profits. You can keep track of each manager’s historic returns and changes in the DAA, however, this does not guarantee trustworthiness. Iconomi safeguards the credibility of the DAA managers through a strict screening process, and not everyone is able to create a DAA.

The first 2 DAA’s are managed by Columbus Capital, an investment management firm from London. They created two Digital Asset Arrays, the Blockchain Index comprised of the more established cryptocurrencies and the Pinta, a high risk high return DAA. These two DAAs are just the beginning, and Iconomi held an open application for new DAA managers. Over 150 eager investors applied and on the 5th of October 2017, 12 new DAA managers were introduced on the platform.

Click here for an overview of Iconomi’s DAAs.

The Team

The Iconomi platform is supported and constantly improved by a large team with highly diverse specializations. Besides founding Iconomi, the CEO, Tim Zagar, is a leading strategic advisor for Cofoundit. Cofoundit is a venture capital investment company based on the blockchain and invests in blockchain projects.

Since Iconomi is a digital asset investment platform these two companies complement each other well, making Tim Zager a valuable player in the industry. Before these two companies, Tim Zagar co-founded Cashila, a company which provided Bitcoin payment gateways. Cashila was co-founded with Jani Valjavec, with whom he also created Iconomi, and together they liquidated Cashila to fully focus on Iconomi.