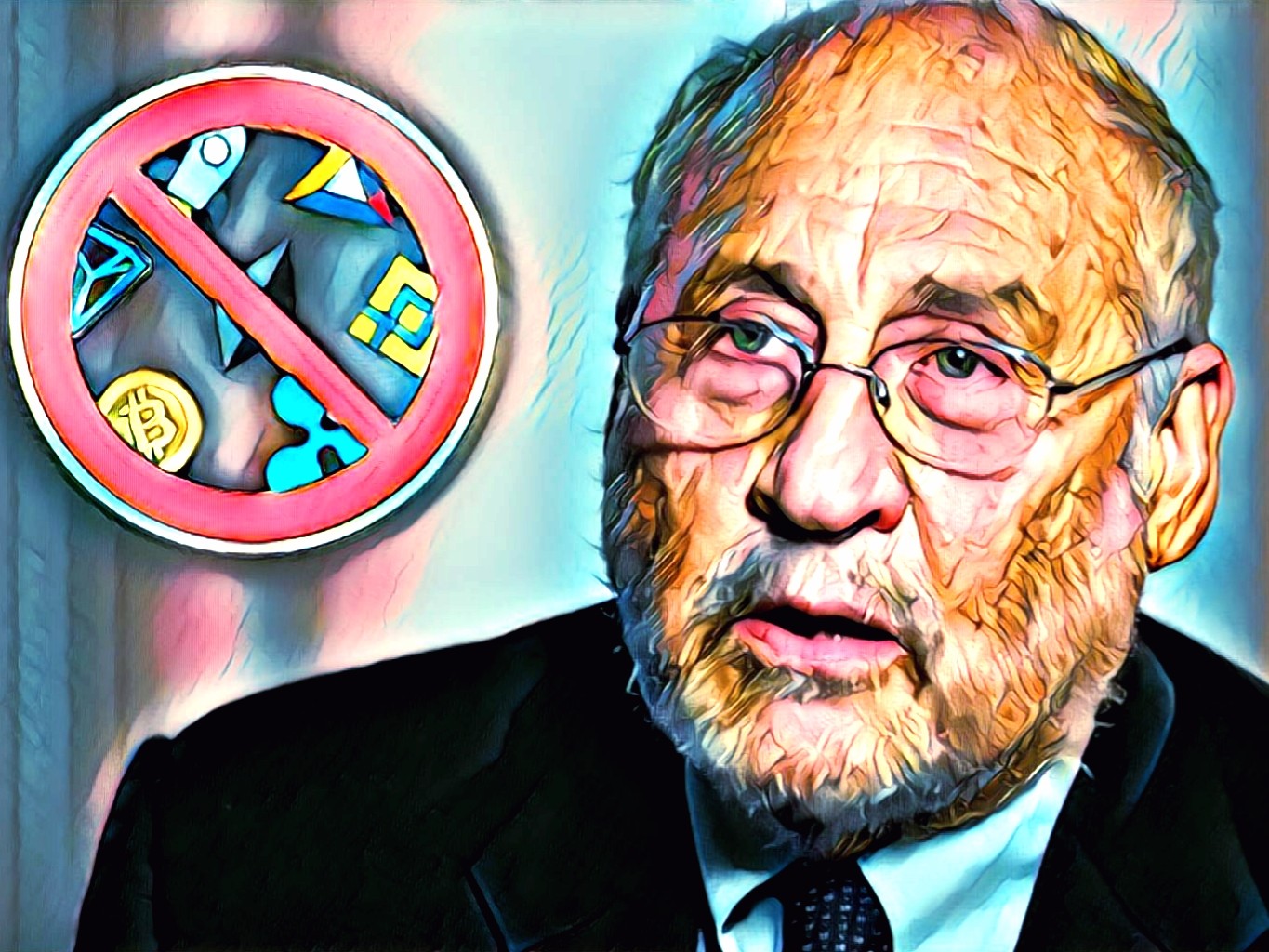

Nobel prize-winning economist, Joseph Stiglitz, speaking to CNBC, has made a strong remark against cryptocurrencies, saying that they should be shut down because they make transactions less transparent and enable illicit transactions.

Stiglitz, however, does favour the use of electronic payments,

I’ve been a great advocate of moving to an electronic payments mechanism. There are a lot of efficiencies. I think we can actually have a better regulated economy if we had all the data in real time, knowing what people are spending.

The argument that crypto can be used to fund illegal activities and launder money has been posed many times before, but there is no doubt that P2P transactions are far safer and more transparent than cash-based transactions, which remain the primary means for the funding of illegal activities.