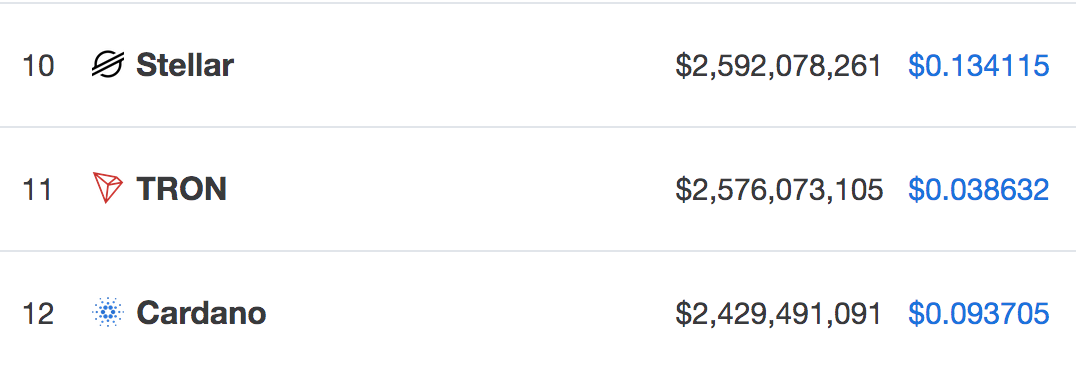

Tron has recently been overtaken by Stellar, losing the 11th position in market cap position as it sits around $16 million behind. Currently, Tron holds a $2.576 billion market cap value, with Stellar holding a $2.592 billion market cap value.

Both cryptocurrencies are practically neck and neck, and a slight move from either project could turn the tables. Cardano is also quickly entering the fold as it sits around $147 million behind Tron.

Source: CoinMarketCap

However, Tron has the advantage of being on a previous strong bull run. It surged by a total of 15% over the past 7 trading days, with a further price increase of 62% over the past 30. In comparison, Stellar has only managed to increase by a total of 35% over the past 30 days.

Let us continue to take a look at the TRX/USD market and highlight some potential areas of support and resistance moving forward.

Tron Price Analysis

TRX/USD – MEDIUM TERM – DAILY CHART

What Has Been Going On?

Analyzing the TRX/USD daily chart above, we can see that Tron managed to surge by a total of 65% from high to low in May 2019, and has continued to travel further higher in June 2019. As June 2019 started to trade, we can see that Tron managed to peak higher into resistance provided by a long-term bearish .382 Fibonacci Retracement level (drawn in red), priced at $0.039. The market has since fallen and is now trading at support around the $0.036 level.

The resistance between $0.039 and $0.04 will be significant moving forward.

Where Is the Resistance Above the Market?

Looking ahead, if the buyers can hold the current support at $0.036 and push the market higher, we can expect immediate significant resistance at the $0.039-$0.04 range. The resistance at $0.040 is further strengthened by a medium-termed 1.618 Fibonacci Extension level (drawn in blue).

If the bull can continue above $0.04, further higher resistance lies at $0.04153, $0.04363, $0.046, and $0.04798.

What If the Sellers Regain Control?

Alternatively, if the sellers continue beneath $0.036, further support below lies at $0.03390, $0.032, $0.03099, $0.030, $0.02940, and $0.02752.

Conclusion

Tron may have lost the 10th position to Stellar recently, but the two projects are still neck and neck in the rankings. Furthermore, Tron has the advantage of being on a stronger bullish run recently, relative to Stellar.

If the bulls can hold the $0.036 level and continue above $0.04, we can see Tron reclaiming the 10th position in the coming weeks ahead.