As the entire cryptocurrency market continues to barrel sideways, ample time seems to be available for investors to dig into whitepapers, earn some extra fiat, and buy the dip.

The question of where your hard-earned money should go remains, and will continue to be answered differently depending what you’re looking for, and who you ask. The safest bet in one of the riskiest markets around is sussing out the projects that are solving “hair on fire” problems, then watching them all like a hawk.

Before jumping into this article, it’s only right to mention that in terms of long-term investments, all the truly useful ERC-20 tokens are going to be undervalued in the current bear market.

Also, since the advent of the Ethereum platform, creating your own cryptocurrency became significantly easier. This has led to, in my opinion, a large number of tokens that will end up being worthless in the not-so-distant future.

Bearing that in mind, here are 5 ERC-20 tokens that are currently undervalued, given their long-term potential.

Top Undervalued ERC-20 Tokens

0x Protocol (ZRX)

What is 0x Protocol?

The 0x protocol is an open-source, decentralized exchange (DEX) that’s been designed specifically for ERC-20 tokens to be traded on top of the Ethereum blockchain.

The most popular exchanges currently operating are centralized, so in efforts to remain true to pure blockchain principles, 0x is aiming to be the top DEX for ERC-20 tokens.

Founded in October 2016 by Will Warren and Amir Bandeali, the duo set out to create a future of tokenized finances that are able to be traded without the high fees and privacy concerns of centralized exchanges.

It’s also worth noting that the 0x protocol was designed to allow Ethereum-based dapps to easily offer an exchange function. At the same time, all dapps using the 0x protocol are directly connected, which in turn could increase ERC-20 token liquidity.

Why ZRX is Undervalued

No Gas Fees on Off-Chain Orders

Unlike other ERC-20 DEXs like IDEX and EtherDelta, the 0x protocol offers off-chain order books, which allows traders to avoid the gas fees required for buying, selling, placing orders, depositing, and withdrawing. While these fees are fairly low for long-term investors, they add up quickly for professional day traders.

In order to keep the order books off-chain, the 0x protocol relies on relayers, which broadcast the off-chain orders to the 0x network.

The relayers don’t execute the trades, but rather facilitate them by submitting the order to the network. Once the trade is complete, fees are paid in ZRX, 0x’s native token, and the transaction is written into Ethereum’s blockchain.

Since the 0x protocol uses a Proof-of-Stake consensus algorithm, the ZRX token can also be staked and used to vote for future developments of the platform.

Established Protocol Adoption

Use case and public adoption are the bread and butter of long-term crypto investments. That is, of course, if the usage continues steadily. The 0x protocol is off to a strong start, and is already live with more than 30 dapps and relayers using their solution.

Some of the more notable dapps and relayers are:

Dapps

Relayers

For a complete list of dapps and relayers that are, or will be using the 0x protocol, click here.

Coinbase Now Supports ZRX

Within 24 hours of the time of writing, Coinbase officially announced that ZRX will be the first Ethereum-based token to be supported by Coinbase Pro.

Coinbase has recently updated their token listing process, which was designed to greatly expand their offerings. Among the 5 tokens they began exploring in July 2018, ZRX was the first to make the cut.

Possibly Integrating New Chains

The 0x protocol has currently restricted their services to ERC-20 tokens, but that doesn’t mean they’ll be restricting the future of the platform to Ethereum. While focusing on ERC-20 tokens might be the best way to launch their DEX, the integration of other chains in the future is one decision that will be based on the staked voting power of ZRX token holders.

ZRX is priced at $0.737 at the time of writing, and is ranked 25 in terms of market cap.

IOST (IOST)

What is IOST?

IOST stands for Internet of Services Token, and they’re setting out to solve one of the most prominent problems within the crypto industry: scalability.

The IOST team managed to raise $40 million by the end of their ICO in early 2018. Despite the impressive technological problem they’re tackling, they’ve actually managed to stay ahead of their original roadmap by several months.

Co-founded by a team of 6, IOST has established their presence globally, with offices in China, Korea, Japan, Germany, Singapore, and the USA.

Their entire team has grown to include more than 50 blockchain experts, enabling a meeting of academic minds from Harvard, Princeton, Berkley, Uber, Google, and Morgan Stanley — just to name a few.

Why IOST is Undervalued

Novel Consensus Algorithm

Aside from the impressive team that’s congregated around this project, what sets IOST apart from competitors like Zilliqa and EOS is the suite of software technology they’ve created to accomplish their end goal of secure, scalable blockchain solutions.

Commonly used consensus algorithms like Proof-of-Work (PoW) and Proof-of-Stake (PoS) have traditionally left gaps between where the market stands today, and a global mass adoption event. PoW blockchains like Bitcoin remain widely decentralized, but end up bulky and slow. PoS blockchains are typically much faster, but present the risk of centralization.

This lead IOST to a novel approach they call Proof-of-Believability (PoB). Simply put, there are 2 types of IOST nodes, Believable Nodes and Normal Nodes.

- Believable Nodes allow for fast transactions, and are constantly reviewed and given a “Believability Rating.”

- Normal Nodes are responsible for verifying each transaction made by Believable Nodes, as well as establishing Believability Ratings.

In order to support their PoB consensus algorithm, the IOST technical whitepaper outlines 4 more protocols that are designed to ensure the security and scalability of their network, most notably their Efficient Distributed Sharding (EDS) protocol.

It’s worth noting that IOST supports JavaScript, which has been the most popular programming language for the last 6 consecutive years, making it east for the largest population of coders in the world to experiment with blockchain.

For more details on their groundbreaking technology, be sure to read their whitepaper, and check out our article called What is IOST?

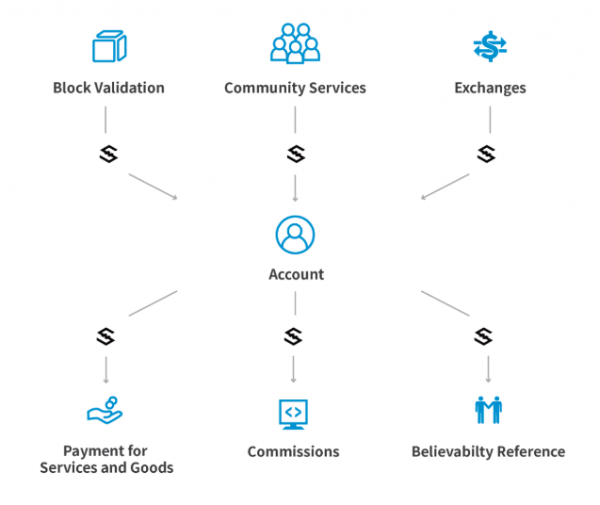

Strong Token Economics

When a blockchain startup has a token and finds success, it doesn’t automatically mean the price of their native token will rise as well. That’s why strong token economics and incentivized use of their native token is something for all investors to look for while doing their due diligence.

The IOST token has been woven into the ecosystem in a variety of ways. It can be used as a payment for goods and services purchased on the platform, or for commision and transaction fees within the ecosystem.

As previously detailed, the PoB system is IOST’s solution to the scalability problem. If they’re successful in solving this problem, their platform has the opportunity to be widely used.

Another role that the IOST token plays lies within the calculation of Believability Ratings, which makes the IOST token an integral part of their protocol, and could tie IOST’s price to its success.

The Team is Ahead of Schedule

IOST’s original roadmap, created after their early 2018 ICO, estimated their first public testnet would be released in Q1 2019. On October 1st, 2018, IOST officially announced the second iteration of their tesnet was now live.

Moreover, the originally scheduled release date for their public mainnet was during Q3 2019, which has now been pushed forward to Q1 2019.

Roadmaps aren’t supposed to be set in stone, which is usually in order to give startups extra time to navigate unexpected delays. The IOST team bucking the industry trend of delayed releases speaks volumes for their team’s ability to deliver on their vision.

IOST is priced at $0.011 at the time of writing, and is ranked 63rd in terms of market cap.

OmiseGo (OMG)

What is OmiseGo?

Founded in Bangkok, Thailand in 2013, Omise started out as a payment gateway for individuals and businesses across Asia. The company has since grown to list over 80 employees on their website, with offices in Thailand, Japan, Singapore, and Indonesia. In June 2017, Omise hosted an ICO event for their cryptocurrency, OmiseGo, where they raised $27 million.

Staying true to their slogan “Unbank the Banked,” the OmiseGo team has been working hard to allow anyone to send money anywhere in the world — without needing a bank account. Sending money across borders in Southeast Asia has become a slow, unreliable process, and there are many unbanked members of the population using cash as a primary means of payment.

Successful integration of the OmiseGo platform would allow for simple monetary exchange, while tapping the unbanked into the online global economy.

Why OMG is Undervalued

Their Target Demographic is Large and Tech Savvy

Operating in multiple South East Asian countries allows OmiseGo to expand into a rapidly growing economy. According to WorldBank, as of 2018, only 27% of South East Asians had bank accounts despite there being a massive workforce and educated population.

While most have been forced to stash their fiat at home, with the explosion of cheap smartphones and the advent of payment apps that can be “topped up” (add funds to your account with cash at a store), the unbanked have found their way around bank accounts.

As someone who lives in Southeast Asia, I’ve seen QR codes at plenty of cash registers. The gap between fiat and crypto looks much smaller from this angle.

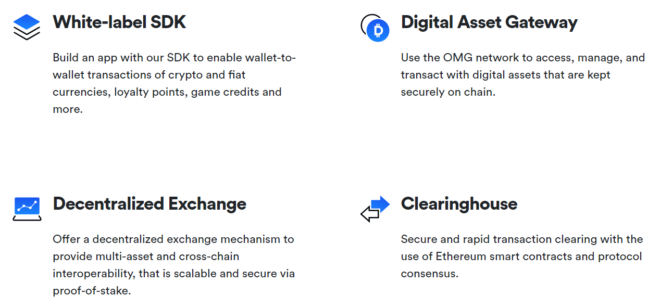

Integrated Platform Features

Once complete, the OmiseGo platform will offer a wide array of services for their users. Even though they’re focusing on the end user, they’re building a system that provides other tech companies a platform to operate on top of. Focusing on the wholesale side of blockchain technology gives OMG an opportunity to scale quickly.

Software Development Kits (SDK) — Although their slogan is somewhat combative, OmiseGo does plan to work with existing financial institutions alongside other crypto projects moving forward. This has led them to create white label SDK, which allows crypto wallet providers to connect to the OMG network. This enables their users to trade both crypto and fiat assets, as well as top up with debit cards, credit cards, and designated ATMs.

Decentralized Exchange (DEX) — Right now, if you’re able to use Coinbase, it’s fairly easy to get involved in cryptocurrencies. The problem is, Coinbase is a centralized exchange, which directly contradicts the principles of blockchain technology.

This has given OmiseGo, and many others, the opportunity to build decentralized exchanges. While at first it might seem a bit overambitious to include, the OmiseGo DEX would likely serve the entire network regularly, allowing OmiseGo users to tap into an in-house exchange that allows for trading both Bitcoin and Ethereum assets.

Furthermore, as part of the Proof-of-Stake network, staked OMG will validate DEX transactions. With incentive to hold OMG, less of the asset is available, encouraging an increase in demand, and therefore, price.

OMG is priced at $3.07 at the time of writing, and is ranked 24th in terms of market cap.

WaltonChain (WTC)

What is WaltonChain?

The Chinese-Korean company was founded in November 2016 with the intent to solve the centralization problem found within the growing Internet of Things (IoT). Under a centralized structure, the autonomous exchange of information between objects cannot take place unless they’re a part of the same network.

By using a combination of blockchain databases and Radio-Frequency Identification (RFID) mechanisms, Waltonchain is building what they describe as the Value Internet of Things (VIoT). Just like humans are being globally connected with distributed ledger technology, so too will our vehicles, cell phones, and refrigerators.

With a decentralized network, manufacturers will be able to completely track their supply chain, trace their sources, and authenticate products. By doing so, the safety and transparency of manufactured products can be measured and improved, while latent consumer needs can be identified and served with greater ease.

Why WTC is Undervalued

IoT Industry Leaders

RFID chips are used to transmit data, and they’ve been in the market for quite some time. You can find them in hotel key cards, in the fast lane of highway tolls, or implanted into global supply chains.

One of the biggest problems preventing the interconnection of our electronic devices with RFID technology is that the RFID chips currently in production are too expensive, and not secure enough to integrate with blockchain tech.

This has led the WaltonChain team to manufacture their own patented technology, which allows them to source inexpensive, more secure, and more powerful chips in-house. By infusing blockchain principles within the manufacturing process, each chip is unique and foolproof, complete with their own set of public and private keys.

By keeping hardware production and blockchain development in-house, WaltonChain is giving themselves a competitive advantage against competitors using outsourced hardware. In fact, in June 2018, the initial iteration of their RFID chips were being mass produced.

Significant Partnerships in a Growing Industry

While WaltonChain hasn’t had the marketing success as other supply chain cryptos (like VeChain for example), they have positioned themselves well within their surrounding environments.

Over the last couple years, the WaltonChain team has established high-level partnerships throughout Asia. For example, they’re currently partnered with the massive e-commerce company Alibaba, and are currently working on projects with the Chinese government.

All these partnerships are being made within the IoT industry, which is predicted to see serious growth within the next decade. It’s difficult to put a number on where IoT will go in the near future in terms of price and usage, although many have tried. It’s easy to see the common theme among IoT reports: they expect more devices to be connected, and more money to be involved in the coming years.

WTC is priced at $2.99 at the time of writing, and is ranked 56th in terms of market cap.

Basic Attention Token (BAT)

What is Basic Attention Token?

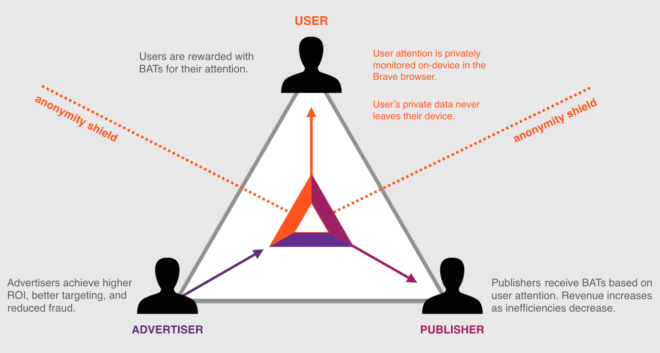

Basic Attention Token was created to give users the ability to use the internet for free — without sacrificing their personal information and attention. The token itself would be exchanged among content producers, consumers, and advertisers, creating a mutually beneficial relationship between them.

As it currently stands, there is an interconnected relationship between publishers, advertisers, and users of websites like Facebook and YouTube.

The advertiser pays the publisher (and the platform) a fee to advertise their goods and services. The platform collects the user information in order to target advertisements, which allows them to charge advertisers more money. The user gets to consume the content free of charge, but is required to pay attention and give away their privacy.

The current system works, but it has its disadvantages. Since the platform facilitating all of this is centralized, content producer and consumer attention/data is constantly being mined and sold to advertisers in order to turn a profit.

By introducing a decentralized reward mechanism complete with “anonymity shields,” users are rewarded for their attention, publishers are rewarded for their viewership, and advertisers are able to target their audience better.

Why BAT is Undervalued

Their Web Browser is Fantastic

The entire BAT concept is facilitated by use of the Brave Browser. Brave is a free, open-source web browser that automatically blocks advertisements and cookies. By eliminating unwanted data from your load times, Brave is twice as fast as Chrome, and up to 8 times faster than mobile web browsers.

Since the launch of their first iteration in January 2016, the Brave Browser has been downloaded more than 10 million times in the Google Play Store alone, and boasts over 4 million active users.

In 2009, Internet Explorer accounted for 65% of web browser usage. Less than 10 years later, they’ve basically switched places with Google Chrome, and now only see about 2.8% of web browser usage.

The switch from Internet Explorer to Google Chrome was a clear decision for myself, and many others, simply because it was faster. Since Brave makes it easy to import bookmarks and passwords from other popular web browsers, the switch is quick and painless.

You can try Brave today by clicking here.

The BAT Team Knows Their Stuff

After raising $35 million dollars during their 30-second ICO in summer 2017, the team got to work implementing their strategy. It is definitely worth noting that the founder, strategist, and visionary for this project is extremely suited for the job.

Brendan Eich is the creator of JavaScript, which is the most popular programming language in 2018, a title that’s been maintained for the last 6 consecutive years. To add to that, he’s also the co-founder of Mozilla, and their web browser, Firefox.

BAT is priced at $0.176 at the time of writing, and is ranked 45th in terms of market cap.

Disclaimer: This is not intended to be financial advice. These projects are complex, and as always, remember to do your own research before making any investments.