While cryptocurrencies across the board lost tremendous value in 2018, some of these coins saw substantial increases in development. In certain cases — particularly during an extended bear market like we’ve been seeing — this can be a far more valuable metric to judging a project than its price.

After all, the majority of cryptocurrencies are down over 90% from their all-time highs in 2017, so how could you possibly judge the quality of their projects by price?

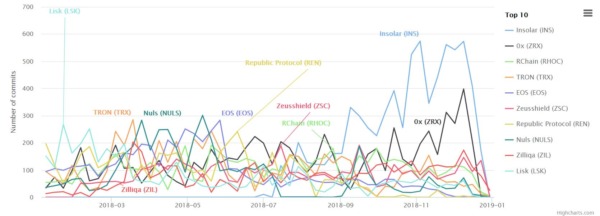

One way of gauging a cryptocurrency’s development is by checking the project’s GitHub activity. An excellent resource for doing this is a website called CryptoMiso, which measures GitHub activity and provides various useful statistics on the number of commits a project receives.

Measuring GitHub Activity

According to analytics provided by CryptoMiso, Cardano (ADA) was the #1 cryptocurrency project in terms of total repository commits at the beginning of 2018. However, now that 2018 has come to an end, other projects have overtaken Cardano in terms of having the most commits.

The leading blockchain platform with the most commits in 2018 is Insolar (INS) with 7,289 commits. This is followed by 0x (7,098), Rchain (5,584), Tron (5,399), Eos (4,823), Zuesshield (4,362), Nuls (4,258), Republic (4,321), Zilliqa (4027), and Lisk (3,981).

You might notice that Ethereum (ETH) didn’t make the list and that’s only because CryptoMiso doesn’t include commits from Solidity, Mist, Ethereumj, and many others that would bring its number of commits much higher than the 989 commits shown.

Refining Measured Github Activity

While simply looking at the number of GitHub commits a project has is worthwhile, there are a number of other factors worth considering when analyzing and judging a cryptocurrency project.

For instance, a data website called CoinCodeCap tracks all of the GitHub implementations per project. This provides a far better representation of the productiveness or usefulness of the GitHub commits submitted.

Using CoinCodeCap, the data compiled here reveals that Cardano (ADA) has over 45,000 commits throughout all of its repositories, and they consist of 16 different programming languages.

Therefore, while Cardano didn’t make it to the top 10 when analyzing the total number of commits, it’s #1 if you take the number of GitHub implementations into consideration. The next projects following Cardano using this metric include: Augur, 0x, Ethereum, Lisk, Status, Tron, Komodo, SkyCoin, and Waves.

Just like in the previous top 10 list, where cryptocurrency GitHub data is showcased, Bitcoin is not among the top 10. Bitcoin has 3,269 commits which have been implemented, and Bitcoin Cash has just 988 commits among implementations.

However, just like CryptoMiso, CoinCodeCap’s data has some issues as well. Some of the commit implementations are simply website changes and other infrastructure-related code changes, rather than important protocol enhancements.

Conclusion

Therefore, the number of Github commits and implementations a project has doesn’t necessarily mean one project is better than the other. It is simply one measurement people can use to gauge activity and keep up with developments throughout the year.

However, having very little repository action could be a red flag to supporters, as it may signal the cryptocurrency project has lost support from developers and is not making any progress. Therefore, the metrics provided by CryptoMiso and CoinCodeCap are best used to identify dying or slow-moving projects rather than identifying top crypto projects.

All in all, crypto project-tracking sites like the ones mentioned here are simply another analysis tool, much like metrics that track price, trading volume, transaction volume, market capitalization, and so on.

What do you think about the statistics provided by CryptoMiso and CoinCodeCap? Do you think they’re more important than other statistics like market cap and number of transactions? Let us know what you think in the comment section below.