The bears have taken a firm hold of the crypto market, and the charts continue to wind sideways.

Since whatever happens next is highly speculative, many of us are taking this as an opportunity to burrow into whitepapers and Github activity logs. Fortunately, crypto morale hasn’t taken the same hit that prices have.

Bitcoin and Ethereum are starting to pick up steam again. There’s been some positive sentiment coming out of government agencies, and there are more startups than ever before operating in the industry.

However, finding the startups worthy of attention is like searching for a needle in a haystack, and in this haystack, finding a needle or two could be life changing.

So, in no particular order, here are 5 cryptocurrencies to keep your eye on this summer 2018.

Zcash ($ZEC)

Project Overview

Zcash is an established privacy-by-default cryptocurrency that set out to address some of Bitcoin’s shortcomings in Q4 2016.

With Zcash, users essentially have 3 sets of keys: a private key to access their funds, a spending key that obfuscates transactions, and a public viewing key to interact with outside parties.

Although Zcash wasn’t the first to capitalize on the privacy sector, they’ve given themselves a legitimate chance to own the privacy-focused market. Their technological development has received praise from the likes of Vitalik Buterin, and they’ve shown no signs of slowing down in 2018.

Why Watch Zcash?

From Sprout to Sapling

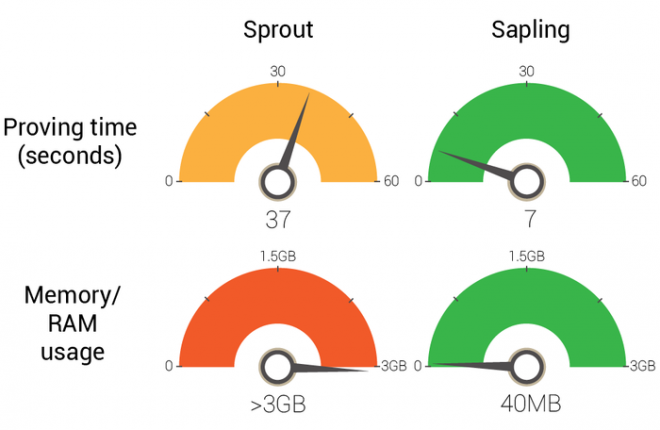

Sprout was announced as Zcash’s first developmental milestone roughly 1 month before ZEC was released on exchanges. Their initial software gave Zcash users a functional product, allowing the core team to focus on their second milestone: Sapling.

The Sapling protocol upgrade was originally set to release in September 2018, however its application has been delayed 6 weeks. A transitional upgrade called Overwinter was successfully launched at the end of June 2018, meant to prepare the Zcash protocol for future upgrades like Sapling.

The development team has done a great job hitting their milestones so far, and with tech products being notoriously difficult to launch, a 6-week delay is forgivable.

Sapling will bring significant improvements for transaction duration and memory usage, support for mobile wallets, and a “multi-party computation ceremony” called the Powers of Tau.

Coinbase Considers Zcash

Coinbase announced they’d be exploring 5 cryptocurrencies to add to their platform, with Zcash being their privacy-based pick. The assessment in and of itself is a meaningful step for all privacy coins, but integration with Coinbase would be a giant leap for the crypto industry at large.

Privacy coins are subject to increased risk when it comes to government regulation, and since Coinbase is on track to receive SEC registration, Zcash could break the regulatory barrier for privacy cryptos if Coinbase’s exploration leads to Zcash integration. The stars would have to align just right for this to happen, but that just makes ZEC an exciting token to watch.

ApolloX ($APXT)

Project Overview

ApolloX is a new platform for building blockchain ecommerce applications and services, and is seeking to disrupt the rent-seeking models currently dominating the ecommerce market. Websites like eBay take at least 10% of each sale, and Amazon is known to undercut sellers on their platform.

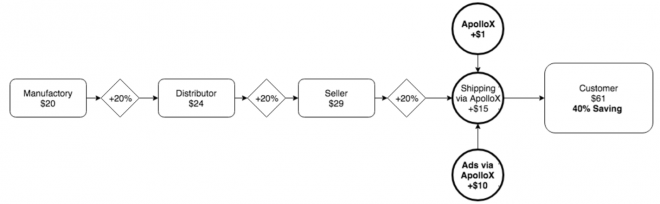

The 5 protocols being developed by ApolloX will decentralize trust, and reduce the inherent costs of advertising and delivering goods through a centralized platform. The ApolloX whitepaper anticipates a 40% cost reduction for consumers after all is said and done.

Why Watch ApolloX?

Aligned Incentives

Arguably the most interesting element of decentralized ecommerce is the alignment of buyer, seller, and platform. Traditionally, buyers and sellers interact in the name of convenience and profit, respectively.

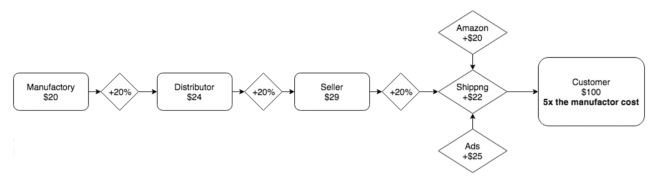

The platform itself has an agenda of its own, seeking to maximize profits on every single transaction. As with most centralized systems, this agenda can lead to user dissatisfaction. Sellers are forced to raise their prices for minimal profits, and buyers end up paying the cost.

There are typically 5 actors in the ecommerce supply chain: Manufacturer, Distributor, Seller, Logistics, and Buyer. Aside from the Buyer, each actor is seeking profit.

As a centralized platform, Amazon is able to charge listing and advertising fees. Having systematic power allows them to retain customer contact and behavioral information. They can then sell that information to other sellers. Amazon is also known to target best-selling items, then undercut third-party merchants. Since they don’t have to pay their own fees, it’s simple to execute.

A decentralized option could curtail the profit-seeking departments of centralized ecommerce, offering a series of digital protocols that require a fraction of the capital to operate.

The ApolloX Roadmap

ApolloBox is an ecommerce website that connects small merchants from around the globe. TheApolloBox.com was created in 2015, and grew quickly to exceed $1 million in monthly sales by November 2017. A month later, The ApolloX foundation was created to explore the application of blockchain technology in the ecommerce market.

The ApolloX team has proven to be successful in the ecommerce industry, and in May 2018 they integrated the ApolloX Token with the ApolloBox app. At the time of this writing, there’s a bounty program currently in its first week, set to last until the end of September 2018.

While the project is in its beginning stages, the ApolloX front-end beta version is set to release in October 2018. The back-end infrastructure will run on distributed nodes, and the alpha version is set to release before 2019.

The ApolloX Foundation is targeting 2020 for the full release of their decentralized service. If this project interests you, be on the lookout for their front-end beta version. How the team handles their formative years serves as one indicator for future success. Their success—and integration with—TheApolloBox serves as another.

While it’s too early to tell how well this crypto will perform in the coming months, it might be good to have this early-stage project on your radar.

EOS ($EOS)

Project Overview

While a handful of cryptos have been nicknamed the “Ethereum killer,” it seems to have stuck with EOS.

EOS is a smart contract platform that was created by the founder of Bitshares and Steemit, Dan Larimer. Larimer is also credited with the creation of the Delegated Proof of Stake algorithm (DPoS) and Graphene software platform.

Whether or not EOS will “kill” Ethereum is impossible to say, but there are legitimate reasons to invest in EOS despite the growing pains the company has experienced during their mainnet launch.

Why Watch EOS?

June Mainnet Launch

Summer 2018 was an important time for EOS. Their year-long ICO event came to a successful end in June, requiring the ERC-20 token holders to register their wallets for a token swap.

After a delay in their official launch, voting was held to elect the 21 EOS block producers, and the platform went live.

Airdrops Everywhere

While ICOs have been all the rage recently, airdrops have become a popular way for new blockchain businesses to increase awareness. With the massive capital acquired from their ICO event, EOS is able to fund the companies building dapps on their platform, and many of those companies are doing airdrops.

This is great news for EOS holders. Since the basic requirement for participation in the airdrops is to hold EOS tokens in a registered wallet, EOS tokens become more valuable. The more you hold, the more airdropped tokens you’ll receive. One of the more notable airdrops set to release this year is HireVibes. You can stay up-to-date on airdrops by clicking here.

Blockchain Activity

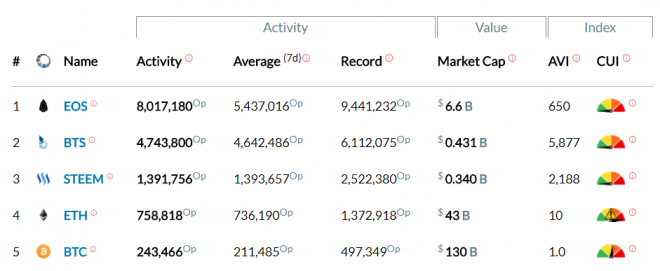

There’s an interesting chart on a website called Block’tivity. The website provides a unique perspective of crypto market value, one they claim is more accurate than looking at marketcap numbers. They argue that the best indication of value is how much it’s being used by people.

Snapshot taken August 1st, 2018.

The activity section breaks down the overall activity of a blockchain, counting not only transactions, but all other operations as well. The main activity column measures activity in the last 24 hours. There’s also a 7-day average column, and a column for record activity.

Perhaps one of the most interesting columns is the Capacity Utilization Index (CUI), which represents how much of a blockchain’s total capacity is currently being used. All 3 of Larimer’s projects claim the top of the list, followed by the top cryptos measured by marketcap—Bitcoin and Ethereum.

At the time of writing this article, Ethereum’s capacity is maxed out at 100%, with more than 32,000 unconfirmed transactions.

Meanwhile, EOS is running at 0.66% of its capacity, and plans to make it easy for projects running on Ethereum to switch to the EOS platform. If timing is everything, EOS might take off soon.

Traxia ($TMT)

Project Overview

Traxia is a new project aiming to increase cash flow for small- and medium-sized enterprises (SMEs) by tokenizing unpaid invoices, which are then traded in a decentralized marketplace. This allows them to be purchased by a wider variety of investors instead of relying on local banks.

The process is commonly known as factoring in trade finance, and it’s about to be improved with blockchain technology. Large enterprises typically have good credit and healthy cash flow, but SME growth is stunted by the liabilities of empty invoices.

Why Watch Traxia?

Fintech is Massive

The current bear market is a huge buy signal for many crypto believers. Traxia has followed the downward trend from $0.055 at ICO price to $0.016 at the time of this writing. The market cap is roughly $7 million. To add context, Traxia’s largest competitor is Populous, which boasts a marketcap of $207 million right now.

If we set aside the massive $43 trillion in accounts receivable during any given day, and focus solely on the $3 trillion (7%) banks are currently financing, we can estimate a conservative value of dapps in trade finance as it stands today.

- Populous market cap = $200 million

- Traxia market cap = $7 million

- Total decentralized marketcap = $207 million

- Total centralized marketcap = $3 trillion

The total decentralized share is 0.0069% of the centralized market share. If the decentralized market is able to finance what banks currently finance, the total decentralized market cap would multiply by roughly 14,500. If the ratios between Traxia and Populous remain the same, the price of one TMT would be $232.

Disrupting the banking system with cryptocurrency is a tall order, but blockchain technology was built for creating innovative fintech solutions. Considering banks currently refuse to finance SME invoices due to lack of liquidity and credit history, while staring at an untouched $40 trillion, the incentive for banks to upgrade is there.

Cardano and Emurgo

Whether Traxia sticks around is impossible to say, especially since it’s still an early-stage project. And whether that’s good or bad news for investors is yet to be determined. That being said, Traxia was the first ICO built on top of Cardano, and they’ve partnered with the blockchain incubators and investors at Emurgo.

Emurgo is responsible for integrating new businesses onto the Cardano blockchain, and since this is Cardano’s first ICO, Emurgo is totally focused on the project’s success. If you decide to keep an eye on Traxia, be sure to keep one on Cardano and Emurgo as well.

NEO ($NEO)

Project Overview

NEO, originally known as AntShares, was rebranded after the Greek prefix “νεο,” which means “new” and “young.” NEO was created to digitize assets with smart contracts using blockchain technology.

(Fun fact: both NEO and EOS derive their names from Greek mythology, and both their nicknames involve their biggest competitor, Ethereum.)

Although NEO is commonly referred to as “China’s Ethereum,” China’s Ministry of Industry and Information Technology recently published their list of top smart contract cryptocurrencies, and NEO came in fourth place. The winner: Ethereum… for now.

Why Watch NEO?

Popular Languages, More Developers

NEO may have been taken down a notch by Chinese authorities, but the platform has distinct advantages over Ethereum. One of those advantages is the availability of popular programming languages integrated into the NEO network.

Ethereum requires its developers to learn an entirely new language called Solidity, limiting the amount of developers able to work on the Ethereum Virtual Machine. Meanwhile, NEO allows its smart contracts to be written on some of the most popular languages, including C#, Python, and Javascript.

It’s worth noting these are the same languages Solidity is based on, so veteran coders should be able to onboard relatively quick.

NEO 3.0 Upgrade

On July 10, 2018, NEO co-founder and core developer Erik Zhang published a blog post detailing the improvements being implemented with the release of NEO 3.0—their latest platform upgrade.

Zhang had this to say about NEO 3.0:

NEO 3.0 will be an entirely new version of the NEO platform, built for large scale enterprise use cases. It will provide higher TPS and stability, expanded APIs for smart contracts, optimized economic and pricing models, and much more. Most importantly, we will entirely redesign NEO’s core modules.

The NEO developers welcome community discussion and suggestions on their proposals, which can be found on Github. NEO 3.0 has a current due date of December 31, 2018.

Passive Income

Although it’s nothing new, NEO holders earn passive income relative to the amount of tokens their official wallet holds.

NEO holders are awarded GAS, which is the token used to pay for NEO transactions. This means that as long as there are transactions on the NEO blockchain, GAS will hold its value. To get an idea of how much passive income you can expect to earn, consider NEO’s current price and check out the GAS calculator.

Wrap-Up

With all the crypto projects happening right now, there are a ton of good coins to watch—and even more to steer clear of. That being said, a general disclaimer is in order.

Zcash, NEO, and EOS were listed because they have long-term potential, and were specifically chosen for their recent fundamental developments. The others were selected as possible moonshots getting ready to launch now.

The cryptomarket requires due diligence. Fortunes have been made, and life savings have been lost. As always, don’t invest more than you’re willing to lose.

What do you think about these picks for Summer 2018? Are there any projects you would’ve liked to see on this list?