After a parabolic increase over the past 90 trading days, which has seen Bitcoin break well above the $100 billion valuation and increase by over 100%, it is no suprise that the market has taken a little pause for a small correction.

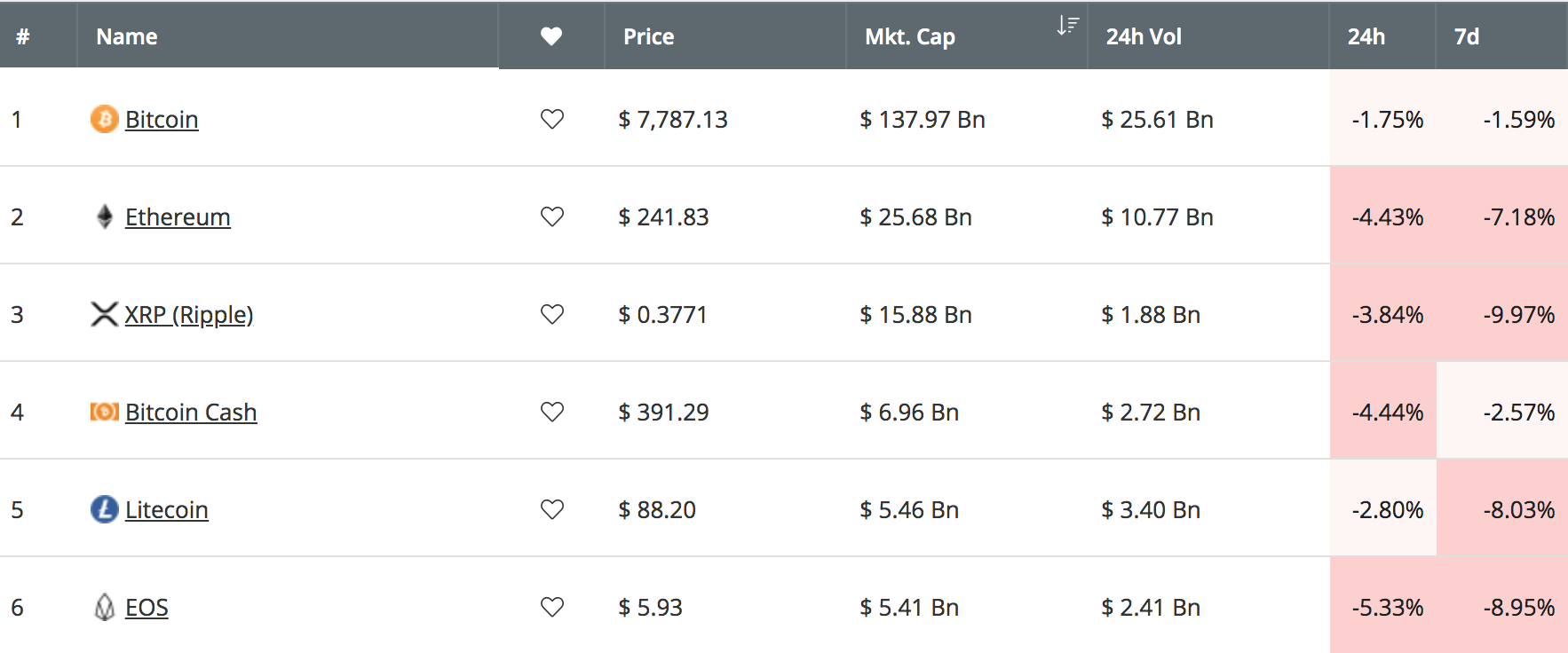

Over the past 7 trading days, Bitcoin has dropped back beneath the $8,000 level to trade around $7,787, and has brought the rest of the cryptocurrency market down with it. Over the past 7 trading days, 4 of the top 6 coins (excluding Bitcoin and Bitcoin Cash) have seen significant price corrections ranging between 7-9%.

Source: CoinCheckup

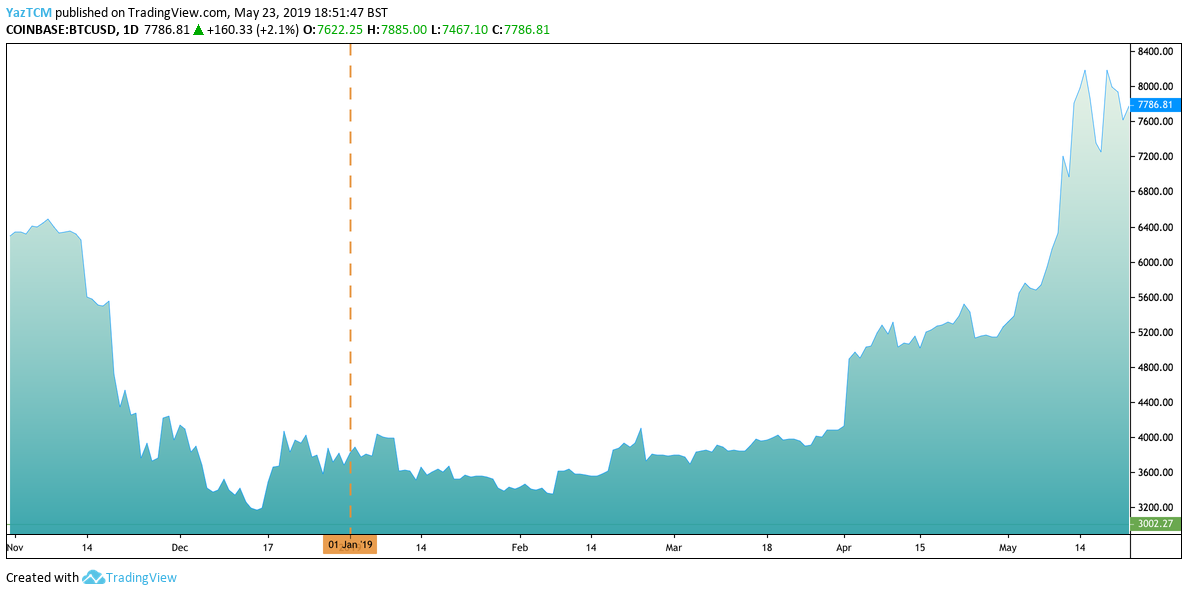

However, after taking a look at the BTC/USD graph below, it is still no surprise that Bitcoin rolled over at the $8,000 level and started to consolidate here.

The cryptocurrency had experienced a very long-term bearish market, dubbed “Crypto Winter,” since the beginning of 2018. After the final wave of capitulation during November 2018, Bitcoin started to find some form of stabilization and traded sideways for the first 3 months in 2019.

In April 2019, we saw the first bullish price increase as Bitcoin broke above the $4,200 resistance level and climbed toward $5,200. This price surge then continued during May as Bitcoin managed to reach a high of around $8,200.

The primary reason that a market may consolidate is caused by traders who are taking profits. Bitcoin managed to increase by a total of 145% from the low to high in 2019, so it is no surprise to see traders clocking in profits at some point.

However, when markets consolidate, if the market does not break beneath the initial structure support set-out in the consolidation, it allows for those who wish to sell to exit the market, while those who wish to remain in can continue to hold through the consolidation. However, if price action drops beneath the initial structure support set out during the consolidation, in Bitcoin’s case the $7,250 level, it could spark a fresh wave of selling as other traders choose to book profits before the market continues further lower.

Consolidation is generally regarded as a period of indecision within the markets, and this is reflected with the fact that the RSI for Bitcoin is now trading close to the 50 level. However, the Stochastic RSI shows that a bounce higher could be imminent, and a bullish crossover signal is forming in oversold conditions. Get up to date with the latest price action for Bitcoin here.

Conclusion

At the end of the day, markets cannot continue to go up higher forever. The higher they go up, the longer the downtrend will be. Looking at Bitcoin as an example, the market surged significantly toward the end of 2017 and start of 2018, but the downtrend has lasted well over a year now.

However, this short period of consolidation is a natural formation within markets as traders bank profits, and is nothing to be too worried about unless Bitcoin falls beneath the consolidation support level.