Many traders don’t pay enough attention to the characteristics of a coin before they invest in it, nor do they consider timing of its purchase or exchange metrics. As a result, they lose huge sums when converting fiat money into cryptocurrency and expose themselves to hacker attacks and coin collapses.

But there are certain tricks of the trade, and being aware of them will help you to keep and multiply your money. We are going to tell you about those in this article.

Evaluating the Token

According to CoinMarketCap, today there are more than 2,000 different tokens available on the market, whose total capitalization exceeds $140 billion. How can you avoid mistakes and choose the token that will bring you profit? Check out the characteristics described below for some helpful guidelines in making the right decision.

For the record, sometimes the exchange itself can analyze tokens and publish the reviews on its website. Example is p2pb2b exchange. Here you can read their 3DCoin review. These materials can make the decision-making process a lot easier.

Fundamental Analysis

Find out what the cryptocurrency was created for and how it can make use of it. In order to be profitable, every project must solve some problem. If you read a whitepaper that seems to be mostly marketing tactics and smoke and mirrors instead of describing a practical, functional use case and the steps they’re taking to develop the tech, then it’s likely not a safe bet to invest your money in.

The company should offer technical solutions able to meet the needs of a large number of users. The better thought-out the technology is, the more robust its token and ecosystem will be. And while you study one company, you can filter out a lot of scam projects, too.

Financial Indicators

Trading Volume of the Cryptocurrency on Exchanges

This one shows how strong demand is for this token among traders. If trading volume is high, it means that many investors are interested in this coin.

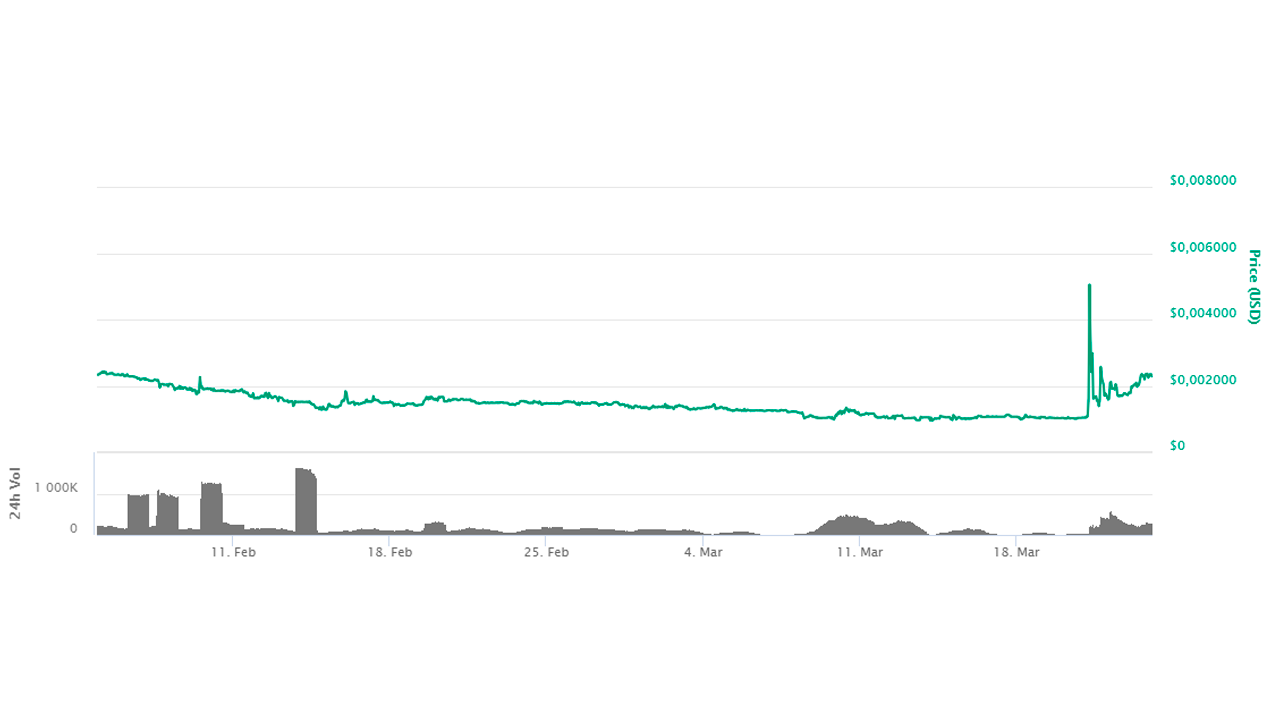

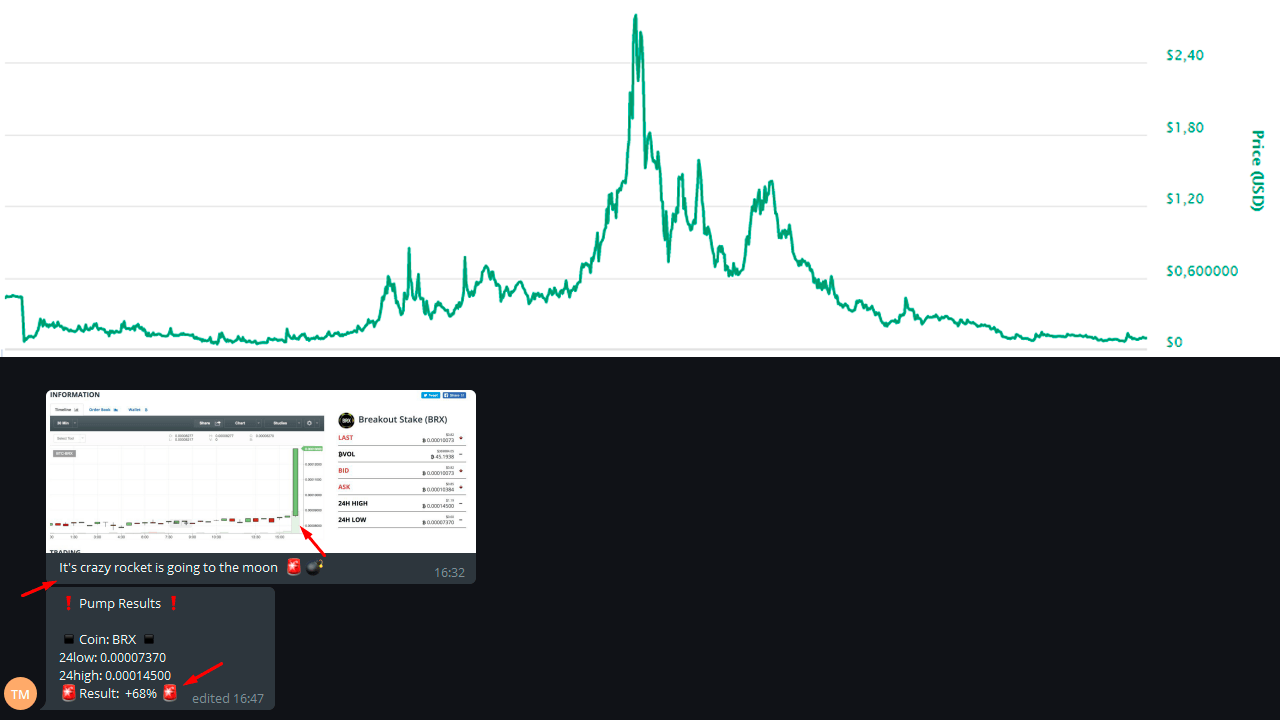

It can also be helpful to take a look at the growth/fall graph of the trading volume. It is possible that a coin might not be in high demand from investors, but its trading volume is artificially high because several dozen or hundred traders are buying up the project’s coins. Their purpose is clear: they want to pump the asset’s rate up, and then sell it back at higher price. For truly reliable projects, trading indicators should increase gradually, and any huge spike in price should be met with a critical eye.

The Coin Emission

The amount of tokens shows how much the cryptocurrency is valued. If a company issues 1 million tokens instead of 10, the coins will be 10 times more valuable, and the token rate will be much more difficult to manipulate. It’s even better when the coin has a limited emission, as was the case for Bitcoin, Litecoin, and Stellar. When the amount of coins is unlimited, there is a risk of inflation, which could cause a loss of the funds invested.

Obvious exceptions here are the Ethereum and EOS platforms. These grew due to the fact that products they created were vital for the crypto-industry.

Liquidity

The more supporting exchanges a coin has, the higher its liquidity. It means that the asset is in high demand, and it’s easy to sell or buy it. A coin that’s only supported by a few minor exchanges will probably not have much of a chance for mass adoption, as the majority of investors will not have easy access to it.

Growth of the Token’s Price

Sometimes the rate can fall due to a bearish trend on the crypto-market. Also there can be pumps, when the token’s rate is being increased artificially by a group of traders. At this point, the graph might look very promising, forcing exchange users to buy the coin at a higher price from shrewd traders who bought it when it was much cheaper. Don’t let these fraudsters trick you, as every pump is followed by a dump, and soon the price for this token will be lower than ever.

The Cryptocurrency’s Volatility

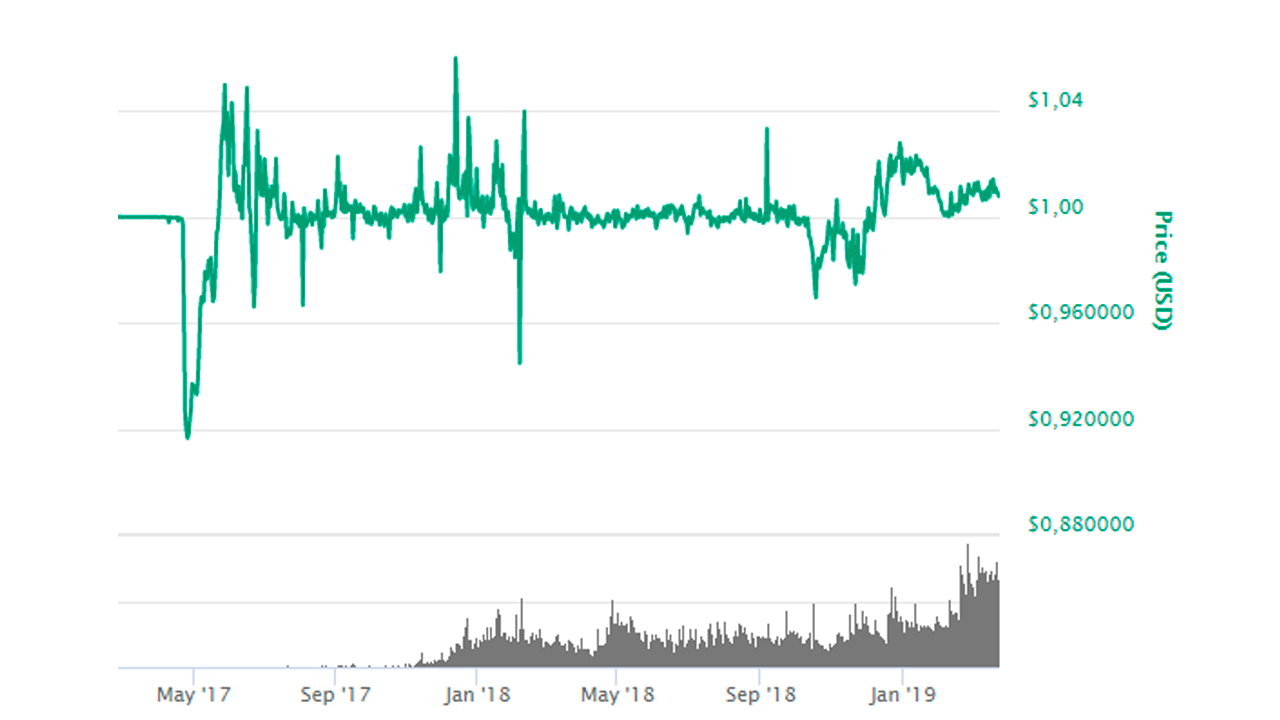

There are stablecoins assigned to fiat currencies – such as Tether (USDT), which is backed by the US dollar. The rate of a stablecoin barely changes at all, providing the fiat currency it’s tethered to is solid. But most tokens are very unstable, and often you will find that altcoins’ rates rise and fall according to how Bitcoin behaves.

High volatility can be good for you if you are a short-term investor. In that case, you buy tokens of a project and sell them back in a few minutes. Many people manage to make a small fortune with such operations. On the contrary, if you are a holder (a long-term investor) – you’d better choose a stable cryptocurrency, because these ones are more likely to bring a good return in the long term.

Social Indicators

Even if you’ve found a company that creates a useful product, and its token shows good financial indicators, there is a final piece of due diligence to complete before you buy in. First, you have to research and get a feel for the attitude society gives to the project, and check out the news about the company in the media, such as blogs, news sites, and social media.

The company’s accounts in social networks – primarily Reddit and Twitter – can tell you if it has a good rapport with the investors. Look at what people write in the project profile and how high their activity is. Is the CEO communicative and reliable to their followers? Is the community happy with how the project is progressing in terms of their roadmap and milestones? If all followers of the account are bots, it means the project itself is most likely to be fraudulent.

Another thing that shows how important it is for the company to develop their product is developers’ attentiveness to marketing. In order to see how scrupulous the creators are when it comes to promotion, check out how often they update their account, and how many articles about the product you can find in Google search results. Also, see if the developers attend cryptocurrency conferences and if they’re holding meetings with the investors.

A good PR strategy can help the project to grow tremendously, and marketing campaigns can be cyclical. Precisely at a time when the project is being actively advertised, an investor can make a profit out of it.

The Company’s Features

In addition to the above-mentioned criteria, there are other features that can drive the token price up.

Ability To Mine Cryptocurrency

This one attracts many crypto-enthusiasts who earn money by maintaining the work of the blockchain project. Mining allows the project to develop faster, given that highly specialized specialists start talking about it. Also, the presence of miners will make the work of the network itself and the token price more stable.

Correlation With Major Cryptocurrencies

This means that, whenever the value of a large coin – let’s say Bitcoin – drops, the price for a small project token follows it. Of course, there are currencies independent from the market leaders, which allows them to show growth during an overall collapse. Investors willingly buy this kind of coins, because the use of such tokens allows you to diversify your crypto portfolio and hedge against market-wide catastrophe.

Anonymity

The first thing you need to understand is that this criterion can be important for many legitimate reasons, despite privacy coins getting a bad rap for being used by criminals. These also may be ordinary investors who prefer to have their transactions anonymous and untraceable. While federal institutions are still trying to figure out how to regulate them, privacy coins such as ZCash and Monero have become extremely popular.

Choosing the Right Time for Purchase

The Cryptocurrency’s Listing Announcement

When news hits that a new token will soon be listed on an exchange, word is sent out to all users of the cryptoplatform. It is also likely that the coin itself will make an announcement, as being picked up on an exchange is exciting news. This encourages interest in the coin to a variety of different investors, and hence increases its value.

This is what happened a while ago on the p2pb2b exchange. A similar case allowed one of the users to increase his capital by 507%, by closely following a particular coin’s listing announcements and picking the right time to put money in it.

Day or Night

It’s best to buy cryptocurrency during the active phase of trading: this way it will have the highest possible number of offers. If it’s designed for the Western market, active trading will most likely to be held in the daytime (New York time), and if it’s the Eastern market, it will be the nighttime.

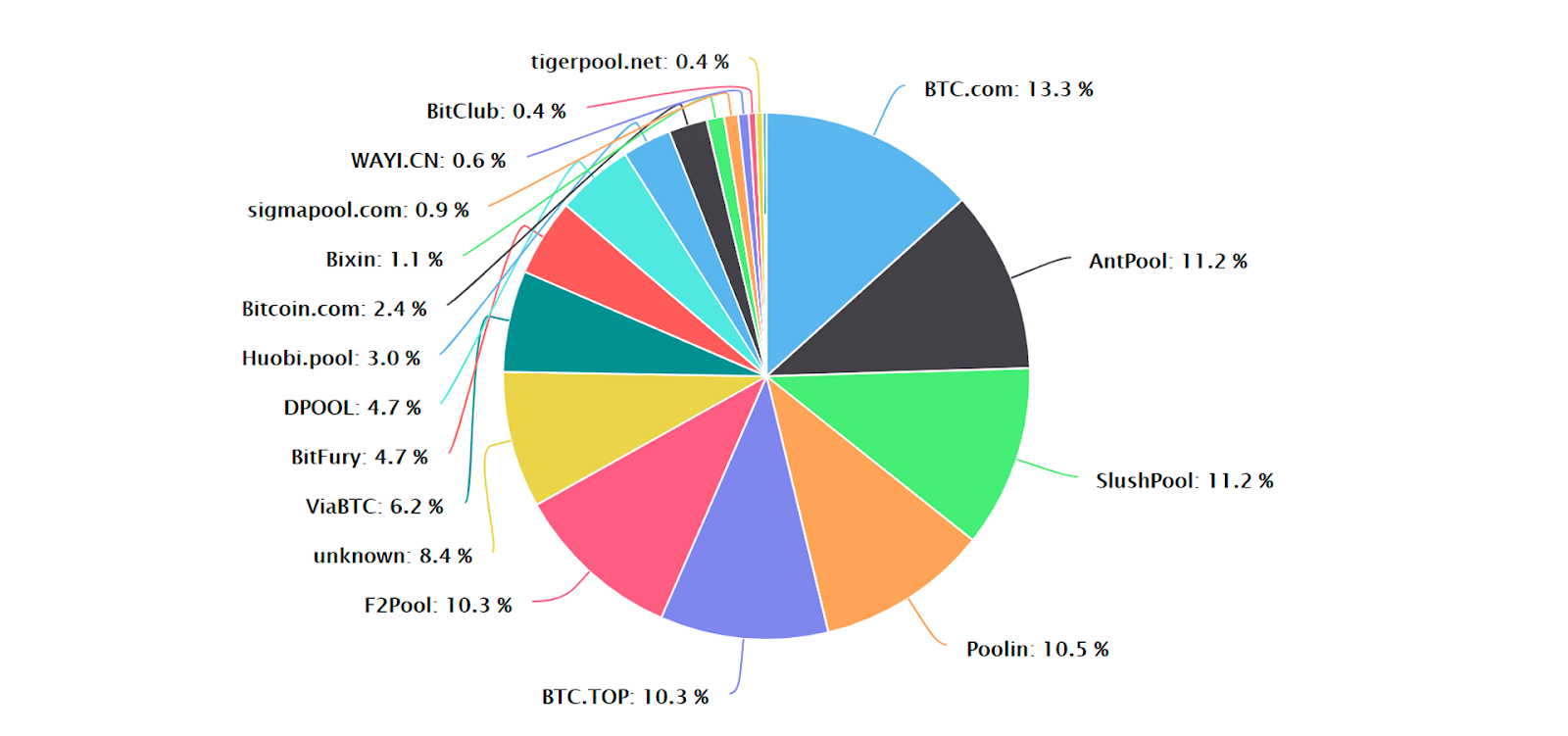

The graph below shows that more than 80% of the total hashrate of the largest cryptocurrency network Bitcoin belongs to Chinese mining pools, which reflects the influence of this country in the crypto world.

Chinese pools mine over 80% of Bitcoin network units. Image Source: https://btc.com/stats/pool?percent_mode=latest#pool-history

What If the Rate Drops?

When the price for the token starts going down, traders often start panicking and selling it at smaller and smaller prices. If you are confident in this coin, it would be a shame not to take advantage of the situation. The crypto market is notoriously unstable, so even the token rate of a very good project can sometimes fall. That is why the main rules of trading here are: don’t panic, and take advantage of the overall hysteria.

Performance Indicators of the Exchange

The process of choosing the trading platform should be taken very seriously. Now, exchanges can differ in a few parameters.

Fee Amount

Can reach 0.5% from the transaction amount. The average is 0.2%.

Security

You can find information about security measures on the exchange website. See what standards it meets, what shares it keeps in cold and hot wallets. Remember that cold wallets are much harder to hack. For instance, p2pb2b exchange stores 96% of all cryptocurrencies on a hardware wallet and is protected with compliance to OWASP TOP 10 standards.

Also you shouldn’t forget about the obvious means of security. You would be surprised to find out how many people don’t use, for example, 2-factor authentication. That’s the reason why most hacker attacks today are still successful. According to RBC, every 20% of 720 victims used a password shorter than 8 symbols for their authorization.

When considering investing in an exchange, check to see if it has ever been hacked before. For example, several million dollars of cryptocurrency were stolen twice from the BitHumb platform. Shockingly, after the first attack, many traders continued to store their crypto in the compromised exchange, and were condemned to lose all their money once again.

Number of Trading Pairs

Usually the same token can be placed on different platforms at once, and the most popular ones, of course, are placed on all platforms. In this case, you want to choose the exchange that offers the best terms:

- the lowest price for a coin;

- the smallest commission fee;

- convenient ways to deposit/withdraw your funds.

Remember that you don’t have to use only one platform for trading. After all, even the perfect exchange can be surpassed by another ones under certain conditions.

Deposit and Withdrawal of Funds

Many exchanges allow you to top up your balance only in cryptocurrency. For traders, it means losing considerable sums of money on fees just for topping up their BTC balance. So far, converting dollars or euros into cryptocurrencies is still quite difficult. Even among large platforms, only Okex, Huobi, p2pb2b, HitBTC, and ZB.COM support top-ups in US dollars.

Trading Volume

This indicator reflects the number of people using the exchange, and more traders means more offers. But it doesn’t mean you have to simply choose the one with the highest trading volume. Basically, any exchange from Coinmarketcap.com top 20 will meet all the necessary requirements.

IEO Availability

Another important advantage for a trading platform is the ability to raise money for start-up projects. IEO is a fundraising process meant to replace the obsolete ICO. Each token sold is backed by financial securities, which make the coin a real digital asset. And fundraising on the exchange guarantees the safety of contributors’ money: to get to the platform, a startup first needs to undergo a serious verification procedure, which is carried out by specialists of the exchange. Once the money is collected, they start to sell the coin on the same trading platform where the fundraising took place. So far, IEOs are available only on 2 major exchanges: Binance and p2pb2b.

Amount of Investment

You should bear in mind that even if you are absolutely sure about the project, you should never invest all your money in it. Invest only as much as you are not afraid to lose. As you should’ve learned by now, coins are not always stable or predictable.

Take care about diversification of your crypto portfolio. Try to buy coins from various project categories. This way, even when the AI market is stagnated, you will be able to raise revenue from, let’s say, agricultural projects.

If you find a project that you consider a promising one, don’t rush into investing your own money in it. It’s very likely for such a coin to have pitfalls. One example is Sirin Labs, a company that raised $158 million. The project was intended for blockchain-based smartphones production, but it was never launched. The price for their tokens then dropped from $3.44 to $0.33.

Conclusion

In order to make a comprehensive assessment of the potential cryptocurrency, you will have to take into account all the above-mentioned factors. Thus, a good token should have a high liquidity and trading volume ─ these ones reflect the demand for the coin and its popularity. Of course, technical parameters, such as emission, which basically shows us the value of cryptocurrency, are equally important. The token’s volatility and its correlation with large cryptocurrencies prove that the coin is independent from the market and will probably retain its value.

Before you invest money in it, it’s also worth studying the company from the inside. Find out who is in charge of the project and look at the leading developers’ CVs on LinkedIn. There was no and never will be such a project that can grow without proper PR strategy, which means that a huge amount of money must have been spent to promote the brand.

Take into account social indicators too. To continue its growth, any coin needs public awareness. Analyze social media accounts of the project and comments people write about it on specialized forums.

Another vital thing is to pick the trading platform you will buy tokens from. When it comes to this, you should consider the exchange’s fee amount, the number of trading pairs, along with the ways of funds depositing and security measures.