ShapeShift CEO, Erik Voorhees seems to think that Bitcoin will act as a good hedge against traditional financial assets, tweeting that that there has never been a global recession during the lifetime of bitcoin, and cherishing its hedging potential,

There has never been a global recession since Bitcoin was created. Next time it happens, there is an escape hatch. https://t.co/XmwcCcuSU9

— Erik Voorhees (@ErikVoorhees) April 16, 2019

Voorhees has previously been quite forthright on the view that bitcoin will see individuals through a recession, tweeting late last year,

When the next severe global recession hits, it will turn into a debt crisis… money will be printed to an extreme, and it is not Bitcoin but the dollar to which you should wave goodbye.

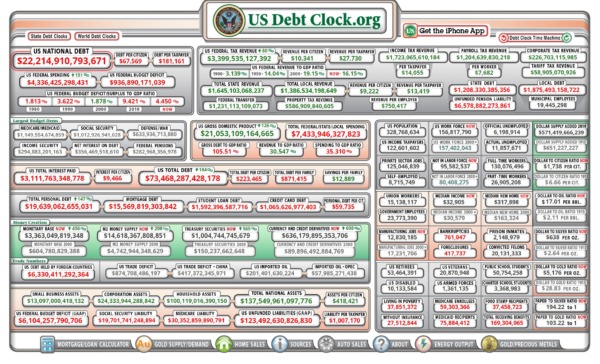

The national debt of the United States exceeds a staggering $21 trillion, with student and credit card loan debts alone exceeding $1.5 trillion and $1 trillion respectively. Such figures have American citizens and experts worried that another major recession may be on the verge of occuring. Should fiat value slump in the next 5 to 10 years, it would make sense for investors to migrate to decentralized and deflationary digital currencies like bitcoin, at least as a way of mitigating any potential damage from a recession.

For many cryptocurrency investors, the idea is not to make quick money betting on the volatility of the market – rather, it’s a way to hedge against any potential calamities in the global economy.

Bitcoin to the Rescue in Times of Recession?

Some economists and analysts have been predicting that the world is heading towards a recession that it is not prepared for, with dire consequences for the global economy. The idea of bitcoin acting as a reserve currency and store of value in the event of a global recession has been a recurring theme in the growth of bitcoin and cryptocurrencies, and even the likes of PayPal director Wences Casares has said that it would be sensible for investors to apportion 1% of their portfolio towards bitcoin.